Open Trust Account Bank

Description

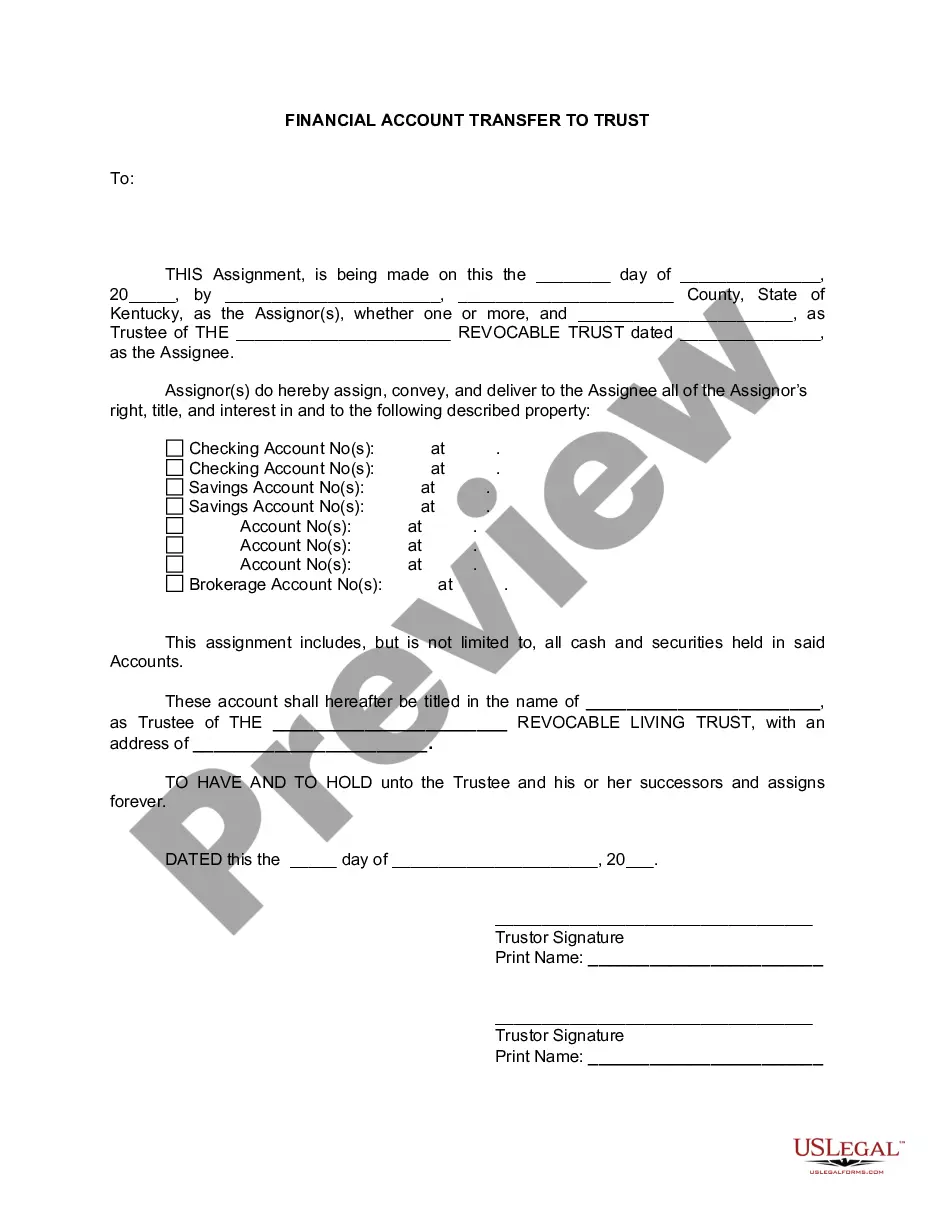

How to fill out Kentucky Financial Account Transfer To Living Trust?

- For returning users, log in to your account and check if your subscription is active. Click the Download button to retrieve your desired form template.

- If you're a new user, start by browsing the form descriptions in the Preview mode. Confirm that the selected form aligns with your needs and complies with local regulations.

- If necessary, use the Search feature to locate a different template that fits your requirements better. Once you find the correct one, move on.

- Click the Buy Now option to select a subscription plan that works for you. Create an account to gain access to the extensive library of forms.

- Complete your purchase by entering your payment information, either via credit card or PayPal.

- Download the form to your device for easy access. You can find it later in the My Forms section.

In conclusion, using US Legal Forms simplifies the process of accessing legal templates, allowing you to focus on what truly matters. Their vast collection of forms and expert support ensures your documents are accurate and compliant.

Start your journey today with US Legal Forms to confidently open your trust account bank.

Form popularity

FAQ

To open a bank account for a trust, first gather all necessary documentation, including the trust agreement and the tax identification number for the trust. Next, visit your preferred bank or credit union, as some may have specific requirements for trust accounts. Once there, an account representative can guide you through the application process to open a trust account bank. If you need assistance, consider using US Legal Forms, which provides helpful resources and documentation to make this process more straightforward.

The best type of bank account for a trust is generally a dedicated trust account. This type of account typically offers benefits such as specialized reporting and tailored services for managing trust funds. Consider accounts that provide easy online access, low transaction fees, and investment flexibility. A platform like UsLegalForms can guide you through selecting the ideal account for your trust's needs.

Choosing the best bank for a trust account depends on your specific needs, including investment options and customer service. It's advisable to look for banks that offer expertise in trust management and competitive features. Research bank options and read reviews to find institutions that align with your trust goals. Platforms like UsLegalForms can assist you in understanding the specifics of setting up a trust account.

Yes, you can open a bank account under a trust, and it is often recommended for managing trust assets effectively. Having a specific account for the trust allows for better organization and tracking of funds. When you directly associate the account with the trust's name, you reinforce the separation from personal funds. This setup also helps beneficiaries easily access information about trust finances.

Yes, you usually need an Employer Identification Number (EIN) to open a bank account for a trust. The EIN serves as the trust's tax identification number, which is crucial for managing taxes related to the trust. Additionally, having an EIN can help streamline the account opening process. Remember to gather all required documentation to facilitate your bank visit.

The best bank account for a trust typically offers features like low fees, good interest rates, and online banking capabilities. Look for banks with a solid reputation in trust management. Moreover, review the services they offer specifically for trust accounts, as these can vary significantly. It's beneficial to compare options to ensure you find the right fit.

Yes, you can open a bank account for a trust. Each trust has its unique model, and opening a trust account can help manage the trust's finances easily. By establishing a dedicated account, you maintain separation between trust assets and personal assets, which simplifies accounting and tax reporting. It’s a wise choice to explore banks that specialize in trust accounts.

To put a bank account in the name of a trust, you must first create a trust and have a trustee appointed. After this, visit your bank with the trust's documentation, including the trust agreement and the Social Security number of the trust. The bank will guide you through the process of transferring the account ownership into the name of the trust, ensuring funds are properly managed.

An example of a trust account at a bank is an irrevocable trust account, where the trust’s assets cannot be withdrawn or modified without the consent of the beneficiaries. Such accounts often serve to manage assets for minors or for specific purposes, ensuring the assets are used responsibly. By opening a trust account bank, you maintain control over funds while meeting your beneficiaries' needs.

A trust account typically refers to a bank account established in the name of a trust, holding assets for beneficiaries. This account is separate from personal or business accounts, providing dedicated management of funds as per the trust's terms. Opening a trust account bank allows for clearer financial management and protection of assets.