Amendment Living Trust With The Bank

Description

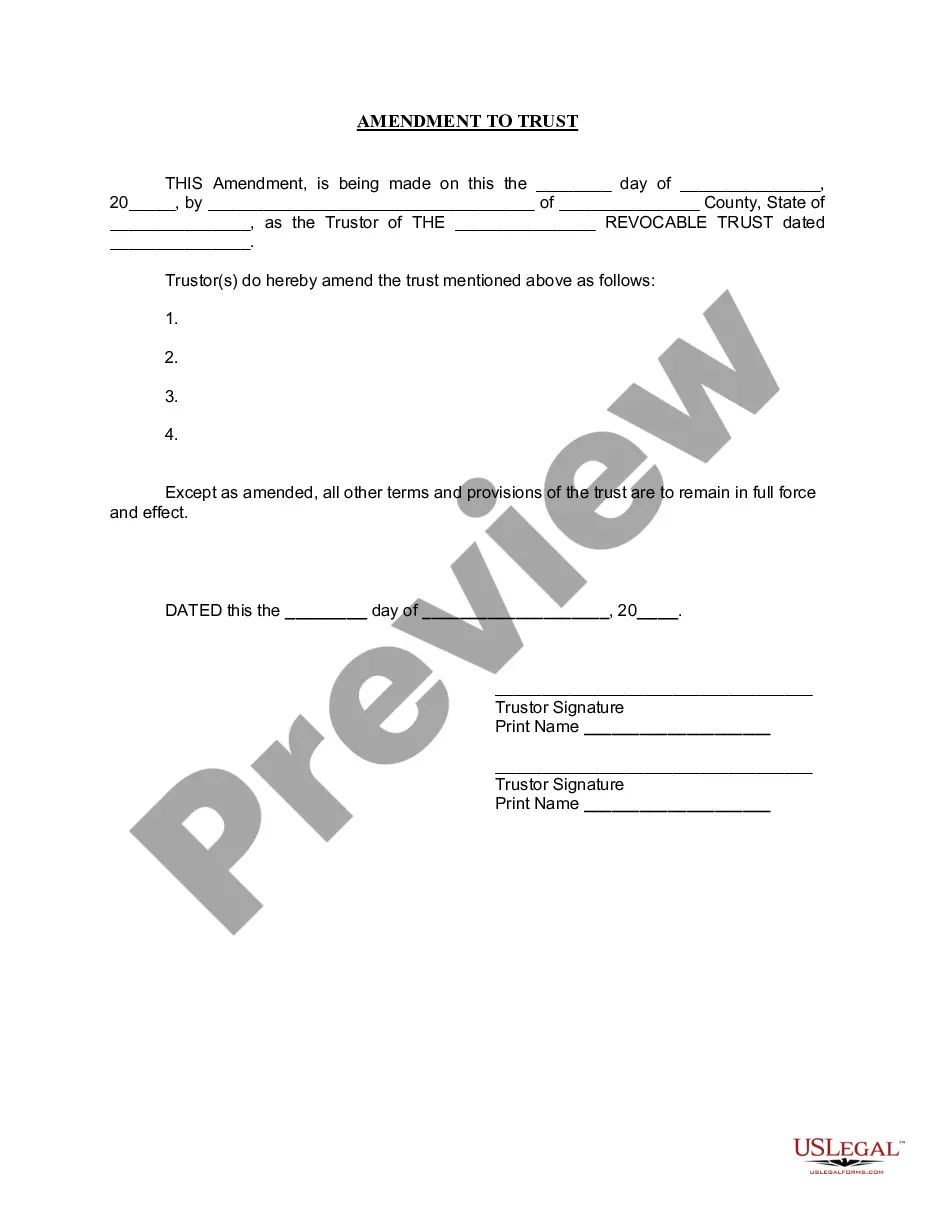

How to fill out Kentucky Amendment To Living Trust?

- If you are a returning user, log in to your account and download the required form template by clicking the Download button. Verify that your subscription is active.

- For first-time users, start by checking the form preview and description. Confirm that it is the right template for your needs and aligns with your local jurisdiction's regulations.

- If necessary, search for an alternative template using the Search tab above. If the current form does not meet your needs, find the correct one before proceeding.

- Proceed to purchase your document. Click the Buy Now button and select a subscription plan that fits your needs. You’ll need to create an account for full access.

- Complete your transaction by entering your credit card information or opting for PayPal checkout.

- Download your form to save it on your device. Access it anytime from the My Forms section in your profile.

In summary, with the extensive resources offered by US Legal Forms, drafting an amendment living trust with the bank becomes a straightforward task. Their robust collection of over 85,000 legal forms ensures you find the right document.

Empower yourself today by utilizing US Legal Forms for all your legal documentation needs!

Form popularity

FAQ

Deciding whether to place your bank account in a living trust involves weighing the benefits and drawbacks. A living trust can facilitate the transfer of assets, avoiding probate, but some accounts may require direct access for management. It's wise to assess your financial needs and consult with legal experts to determine if creating an amendment living trust with the bank is the right choice for you.

Writing an amendment to a living trust is straightforward. Start by clearly stating your intention to amend the trust, and specify the changes you wish to implement. Additionally, make sure to sign and date the amendment, and consider having it notarized for additional validation. Platforms like US Legal Forms can provide templates and guidance to simplify this process.

When considering an amendment living trust with the bank, avoid putting accounts that require immediate access for day-to-day expenses, such as checking accounts. Additionally, certain types of retirement accounts and some insurance policies may not benefit from being placed in a trust. It's important to consult with a financial advisor to ensure you make the right choices for your unique situation.

While you can make changes to an amendment living trust with the bank without a lawyer, consulting one can provide peace of mind. Legal advice can help you avoid potential pitfalls, especially if your situation is complex. Platforms like uslegalforms offer resources that can guide you through the amendment process, ensuring every detail is correctly addressed. This can empower you to manage your trust confidently.

To write an amendment to an amendment living trust with the bank, you must clearly state your intentions and specify which parts of the trust you wish to change. It's important to outline the date and details of the original trust and include signatures from you and your witnesses. Uslegalforms offers templates and guidelines that make this process easy and efficient. This support can ensure your amendments meet all legal standards.

Changing an amendment living trust with the bank is straightforward, provided you follow the correct procedures. While some might think it is complex, making updates just requires clarity on the legal requirements. Utilizing tools available on platforms like uslegalforms can simplify the process and guide you through any necessary amendments. This way, you can manage your trust effectively without unnecessary stress.

Including bank accounts in an amendment living trust with the bank can simplify the management of your assets. By doing so, you make it easier for your successor trustee to access funds after your passing. This can help avoid probate and ensure your beneficiaries receive their inheritance smoothly. Consider updating your trust documents to reflect these changes for a seamless transition.

Whether your parents should put their assets in a trust largely depends on their financial goals and family situation. A trust can provide benefits such as avoiding probate and ensuring a smooth transition of assets to beneficiaries. However, they must also consider the implications of amending a living trust with the bank to keep it aligned with any changes in their circumstances.

A common mistake parents make is failing to fund the trust properly. Even if the trust document is well drafted, it must include the assets to function effectively. Additionally, neglecting to revisit and amend a living trust with the bank after life changes can leave the trust outdated and unbeneficial for heirs.

To amend a living trust, you typically need to draft a document outlining the changes you wish to make. This amendment then must be signed and dated by you. However, if your living trust includes a bank as a trustee, you should check with them regarding specific procedures for amending the trust, ensuring compliance with their policies.