Ky Trust With 501c

Description

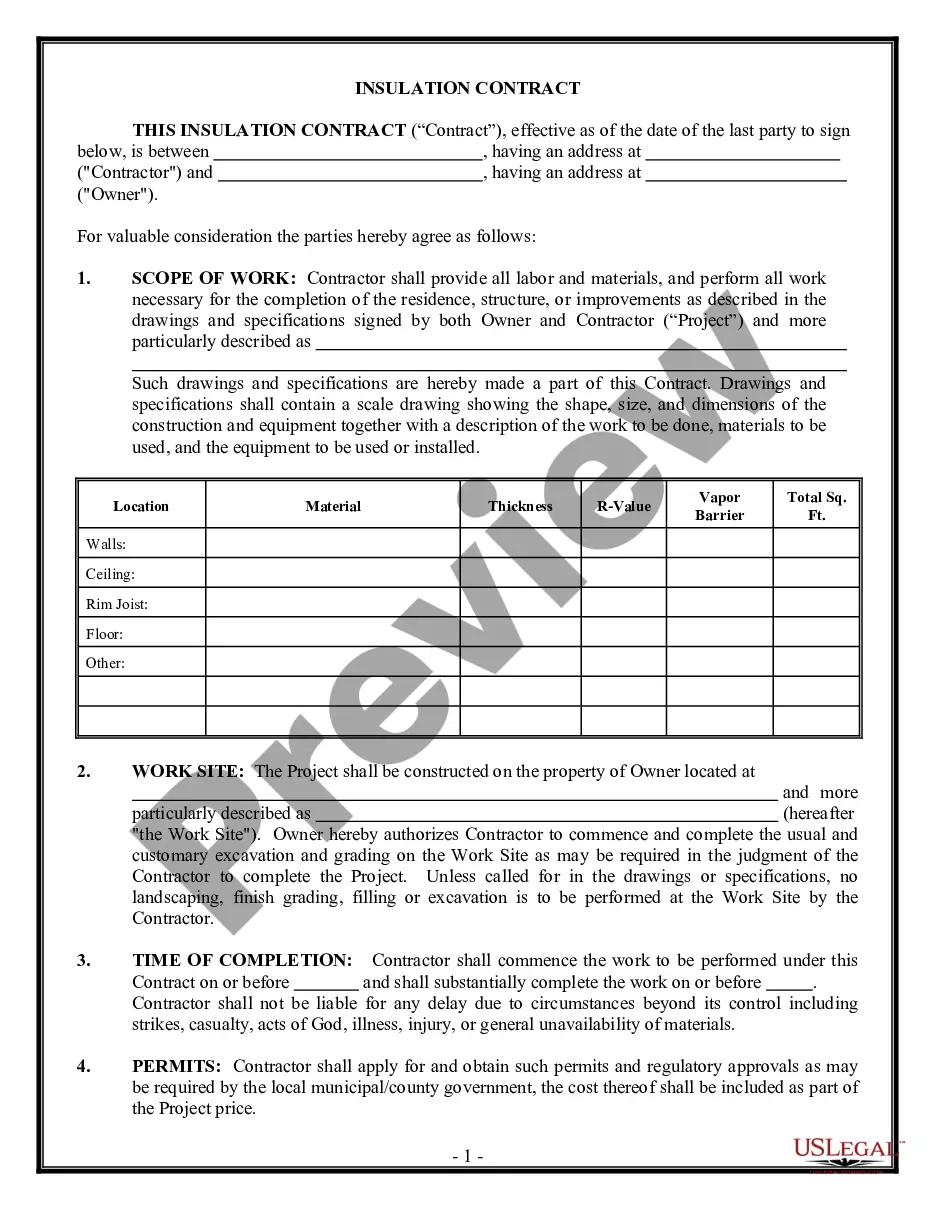

How to fill out Kentucky Living Trust For Individual, Who Is Single, Divorced Or Widow (or Widower) With Children?

Identifying a reliable location to find the latest and suitable legal templates is a significant part of navigating bureaucracy.

Acquiring the correct legal documentation requires precision and attention to detail, which highlights the necessity of obtaining Ky Trust With 501c samples solely from trustworthy sources, such as US Legal Forms. An incorrect template could consume your time and delay your situation.

Once you have the form on your device, you can edit it using the editor or print it to fill in manually. Simplify the complexities associated with your legal documents. Explore the vast catalog of US Legal Forms to locate legal samples, review their applicability to your situation, and download them immediately.

- Utilize the catalog browsing or search bar to find your template.

- Examine the form’s description to determine if it meets the criteria of your state and locality.

- View the form preview, if available, to confirm the form is the one you need.

- Return to your search to locate the right document if the Ky Trust With 501c does not satisfy your criteria.

- When you are certain of the form’s relevance, download it.

- If you are a registered user, click Log in to verify and access your selected templates in My documents.

- If you haven't created an account, click Buy now to acquire the template.

- Choose the subscription plan that aligns with your needs.

- Proceed to the registration to complete your order.

- Finish your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading Ky Trust With 501c.

Form popularity

FAQ

How To Start A Nonprofit In Kentucky Choose your Kentucky nonprofit filing option. File the KY nonprofit articles of incorporation. Get a Federal EIN from the IRS. Adopt your nonprofit's bylaws. Apply for federal and/or state tax exemptions. Apply for any required business licenses. Open a bank account for your KY nonprofit.

Costs of starting a new nonprofit in Kentucky Articles of Incorporation: $8. 501(c): $275 or $600 IRS fee.

The Form 990 shall be filed with the Attorney General each year in which contributors are solicited in the Commonwealth at the same time the form is filed with the Internal Revenue Service.

501(c)(3) organizations are commonly referred to as charitable organizations. Their primary purpose is to serve the public interest by engaging in activities such as religious, educational, scientific, or charitable work.

To apply for recognition by the IRS of exempt status under IRC Section 501(c)(3), you must use either Form 1023 or Form 1023-EZ. All organizations seeking exemption under IRC Section 501(c)(3) can use Form 1023, but certain small organizations can apply using the shorter Form 1023-EZ.