Ky Trust With 401k

Description

How to fill out Kentucky Living Trust For Individual, Who Is Single, Divorced Or Widow (or Widower) With Children?

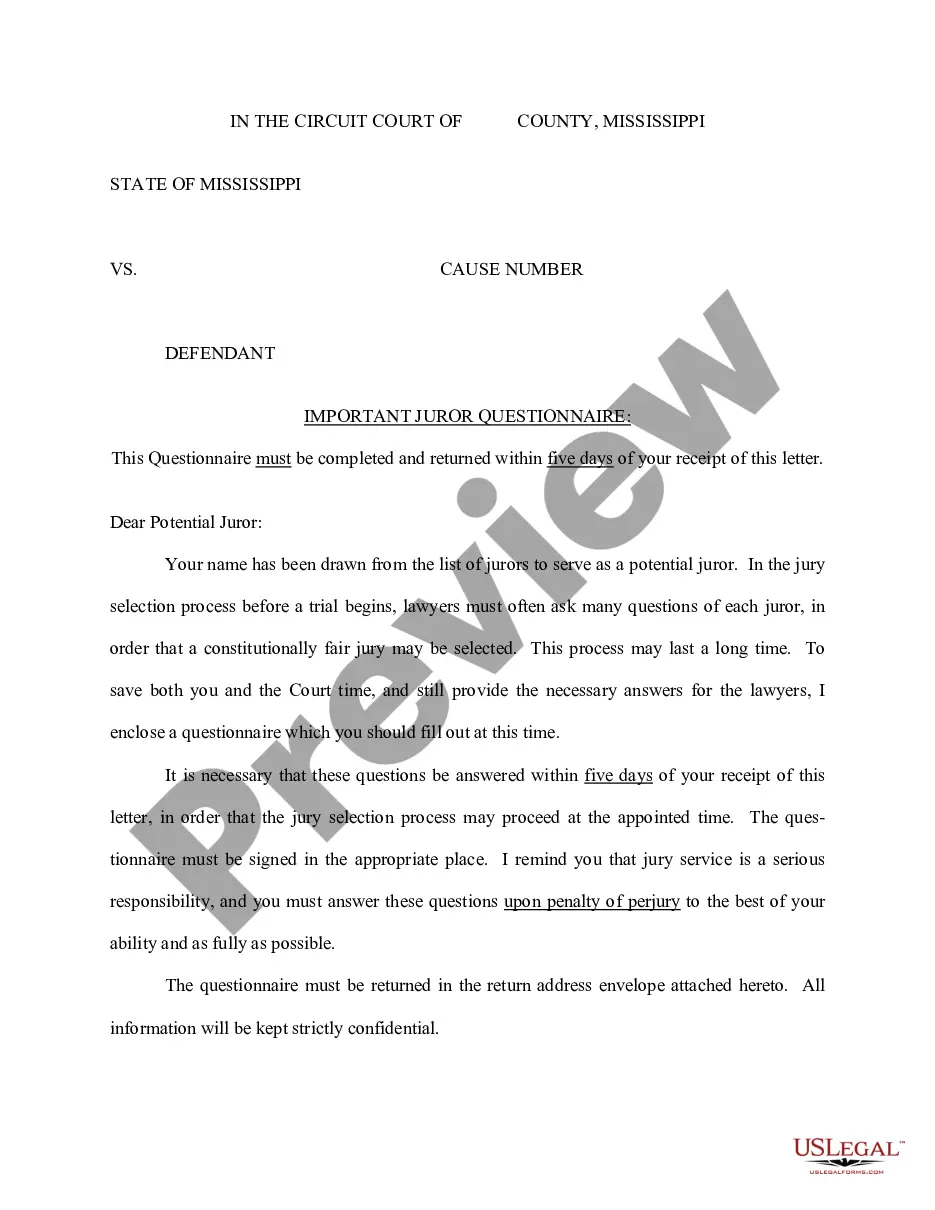

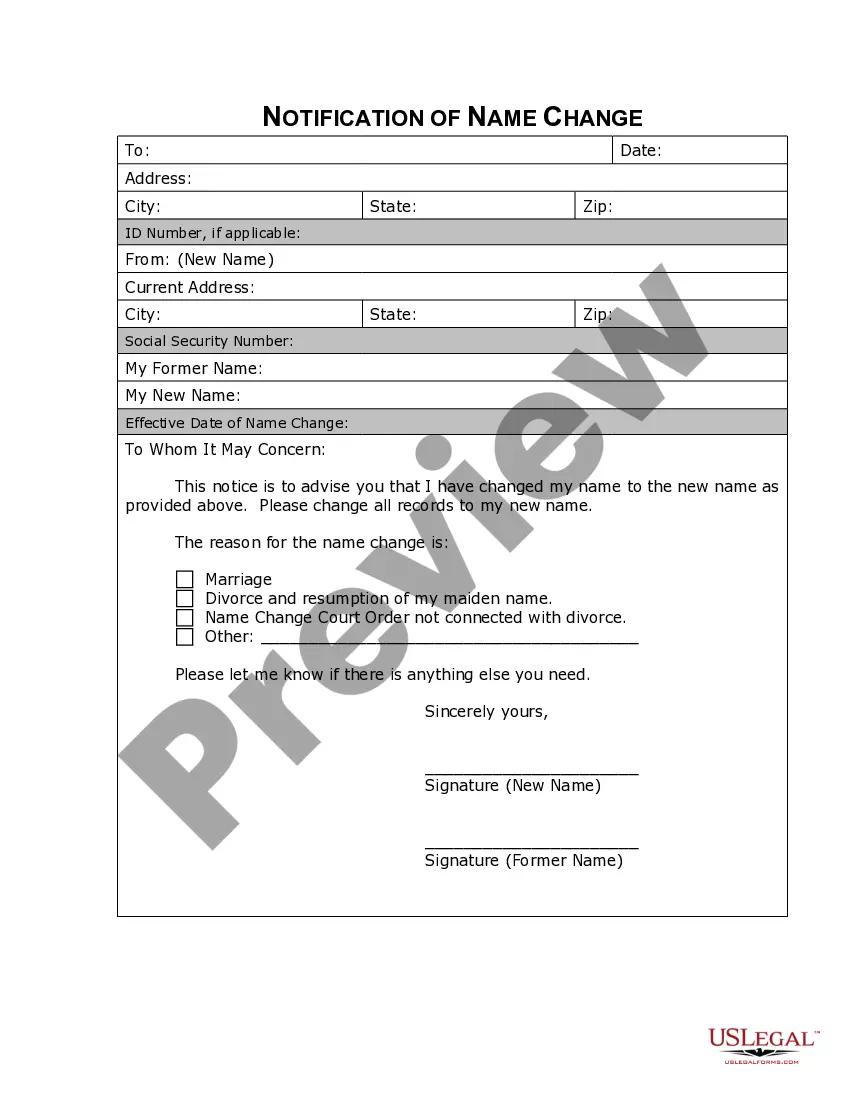

The Ky Trust With 401k displayed on this site is a versatile legal template crafted by experienced attorneys in compliance with federal and local laws.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal experts with more than 85,000 validated, state-specific documents for any business and personal scenario. It’s the quickest, easiest, and most trustworthy method to acquire the documents you require, as the service assures the utmost level of data protection and anti-virus safety.

Select the format you desire for your Ky Trust With 401k (PDF, DOCX, RTF) and store the document on your device. Complete and sign the forms. Print the template to fill it in by hand. Alternatively, use an online multifunctional PDF editor to swiftly and correctly complete and sign your document with a valid signature.

- Search for the document you require and examine it.

- Browse the sample you looked for and view it or review the form details to confirm it meets your needs. If it does not, use the search feature to find the appropriate one. Click Buy Now once you’ve identified the template you seek.

- Enroll and Log In.

- Choose the pricing option that best fits you and establish an account. Utilize PayPal or a credit card for quick payment. If you already possess an account, Log In and check your subscription to proceed.

- Obtain the editable template.

Form popularity

FAQ

How to buy a franchise, step by step Be sure about your reasoning. ... Research which franchises you may want to own. ... Begin the application process. ... Set up your ?discovery day? meeting. ... Apply for financing. ... Review and return your franchise paperwork very carefully. ... Buy or rent a location. ... Get training and support.

While a franchisor may be happy to take someone into the franchise who has no previous experience of running a business, there still need to be levels of capability. It is probable that, in a white collar franchise, it will look for someone who has a form of experience in a white collar role.

How much does it cost to start your own franchise? Franchise startup costs can be as low as $10,000 or as high as $5 million, with the majority falling somewhere between $100,000 and $300,000. The price all depends on the industry, location and type of franchise.

These legal documents, along with the operating manuals, staffing, training programs, and marketing initiatives, are your main investments in the franchise system. The two primary documents you'll create are the Franchise Agreement and the Franchise Disclosure Document (FDD).

Here are 10 fundamental provisions outlined in some form or fashion in every franchise agreement: Location/territory. ... Operations. ... Training and ongoing support. ... Duration. ... Franchise fee/investment. ... Royalties/ongoing fees. ... Trademark/patent/signage. ... Advertising/marketing.

How much does it cost to start your own franchise? Franchise startup costs can be as low as $10,000 or as high as $5 million, with the majority falling somewhere between $100,000 and $300,000. The price all depends on the industry, location and type of franchise.

For a franchise to be legally binding, it must follow a set of federal and state rules and regulations including: The franchisor must provide a disclosure document, referred to as an FDD which discloses the 23 prescribed pieces of information the franchisee must be made aware of.