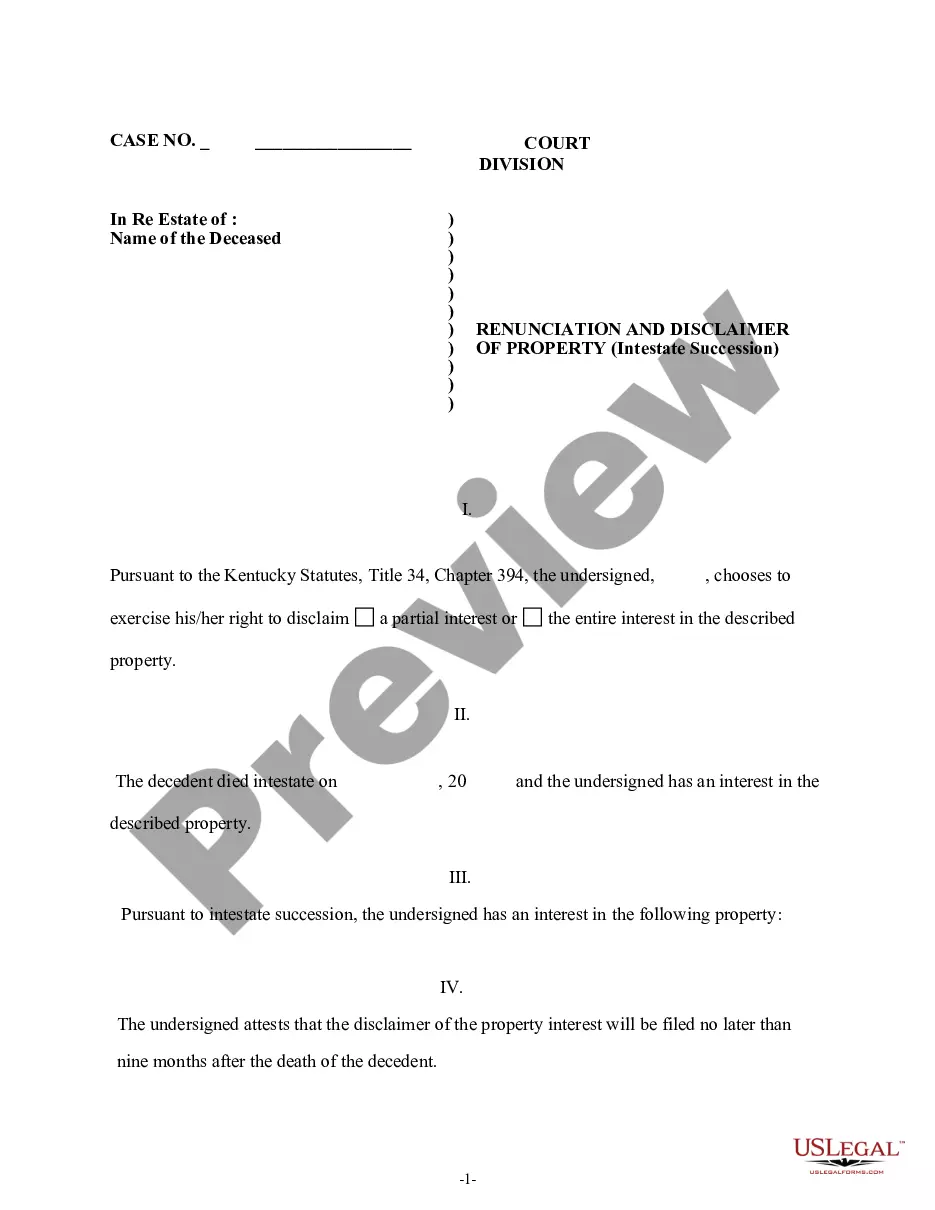

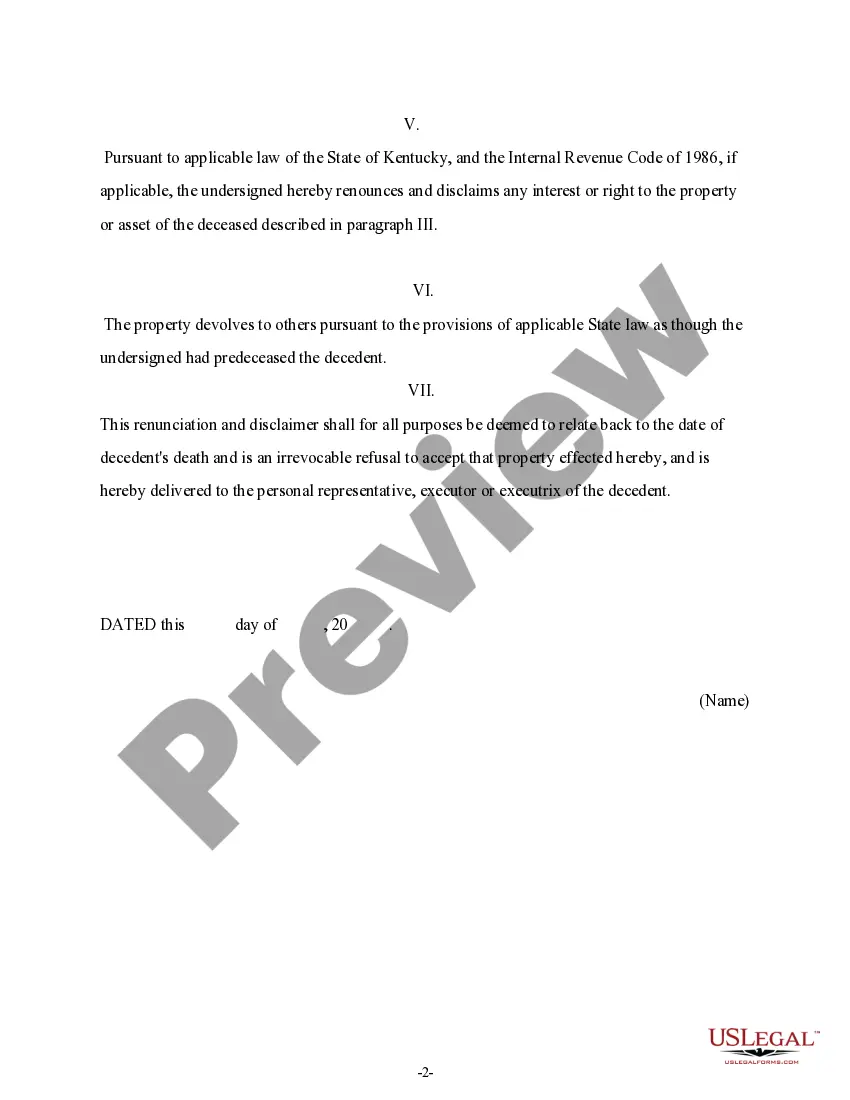

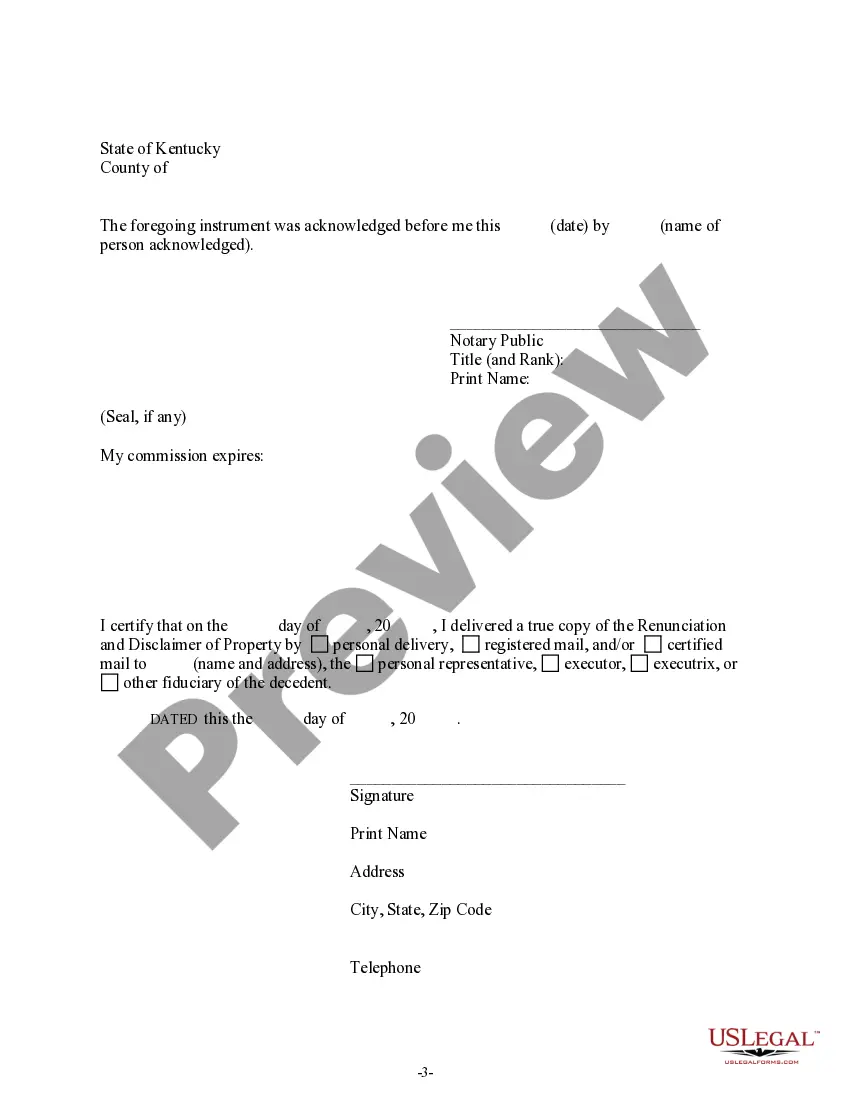

This form is a Renunciation and Disclaimer of Property acquired by Intestate Succession. The decedent died intestate (without a will) and the beneficiary gained an interest in the described property. However, pursuant to the Kentucky Statutes, Title 34, Chapter 394, the beneficiary has chosen to disclaim a portion of or the entire interest in the described property. The beneficiary attests to the fact that the disclaimer will be filed no later than nine months after the death of the decedent in order to secure the validity of the disclaimer. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Kentucky Intestate Succession Formula

Description

How to fill out Kentucky Renunciation And Disclaimer Of Property Received By Intestate Succession?

Using legal templates that comply with federal and regional laws is essential, and the internet offers many options to pick from. But what’s the point in wasting time looking for the correctly drafted Kentucky Intestate Succession Formula sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the greatest online legal library with over 85,000 fillable templates drafted by attorneys for any business and personal situation. They are simple to browse with all files arranged by state and purpose of use. Our professionals keep up with legislative updates, so you can always be sure your paperwork is up to date and compliant when acquiring a Kentucky Intestate Succession Formula from our website.

Obtaining a Kentucky Intestate Succession Formula is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the preferred format. If you are new to our website, follow the instructions below:

- Analyze the template using the Preview option or through the text outline to make certain it fits your needs.

- Locate another sample using the search function at the top of the page if necessary.

- Click Buy Now when you’ve found the right form and choose a subscription plan.

- Register for an account or sign in and make a payment with PayPal or a credit card.

- Choose the right format for your Kentucky Intestate Succession Formula and download it.

All documents you locate through US Legal Forms are reusable. To re-download and complete previously obtained forms, open the My Forms tab in your profile. Benefit from the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

In Kentucky, if you die without a will, your spouse will inherit property from you under a law called "dower and curtesy." Usually, this means that your spouse inherits 1/2 of your intestate property. The rest of your property passes to your descendants, parents, or siblings.

In an intestate situation, the surviving spouse receives all of the community property and a portion of the separate property based on a predetermined formula set out in probate law. If the decedent was not married but has children, then the children will inherit everything equally.

If you are married, childless, and your parents are living, your spouse gets one-half of your property and your parents get the other half. If you are unmarried and have no children, your parents inherit everything.

Unlike most other states, Kentucky utilizes the ?dower and curtesy? inheritance structure. If a spouse dies without a will, the spouse receives the dower share, but not the entire estate. Because of these laws, you'll want to consider a will to designate how you want your assets distributed, despite being married.

Is Probate Necessary? Probate is not always necessary, but it may be desirable to prevent problems and fraud. In Kentucky, estates with greater than $30,000 in probate assets are typically subject to probate and must be administered through the probate courts.