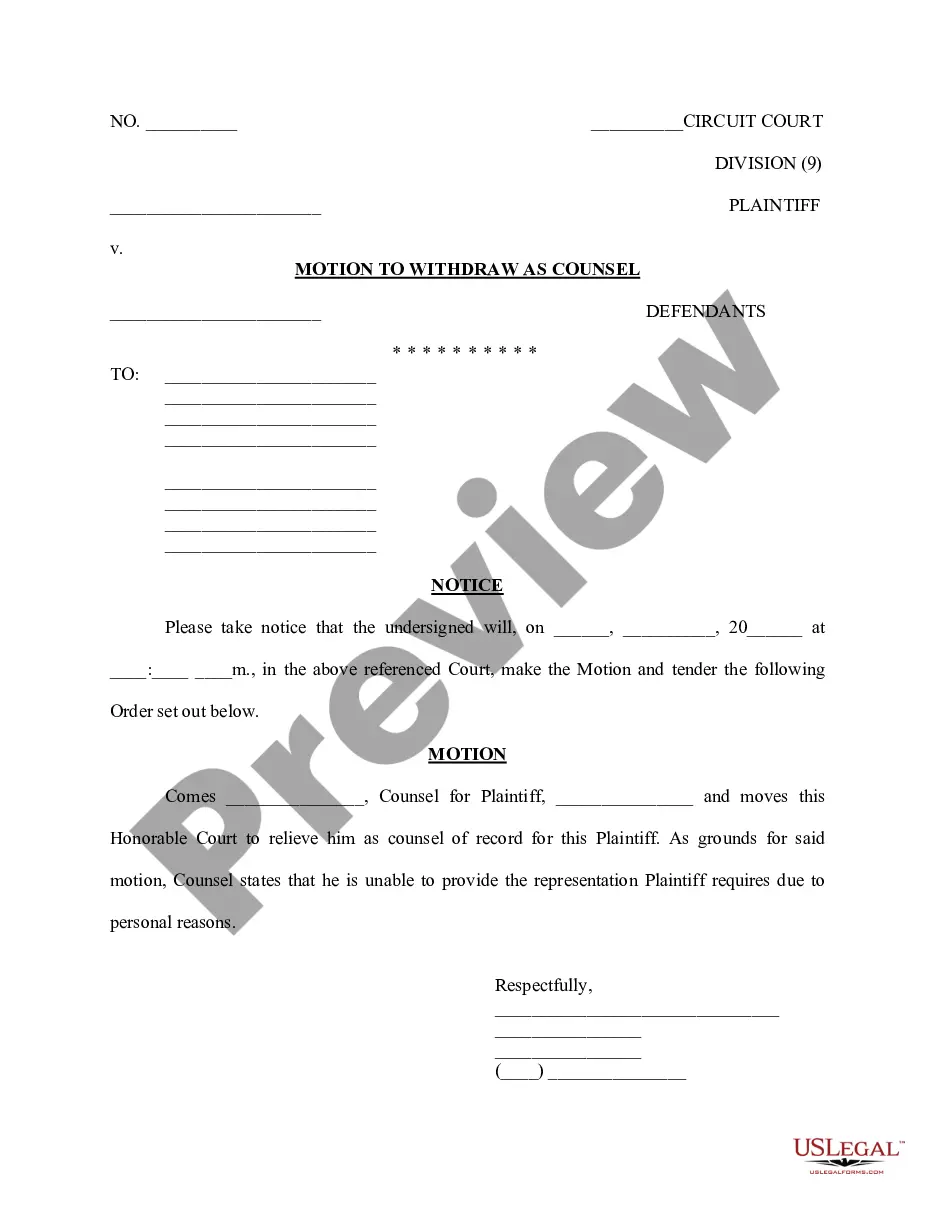

Motion To Withdraw As Counsel Sample For Divorce

Description

How to fill out Kentucky Motion To Withdraw As Counsel?

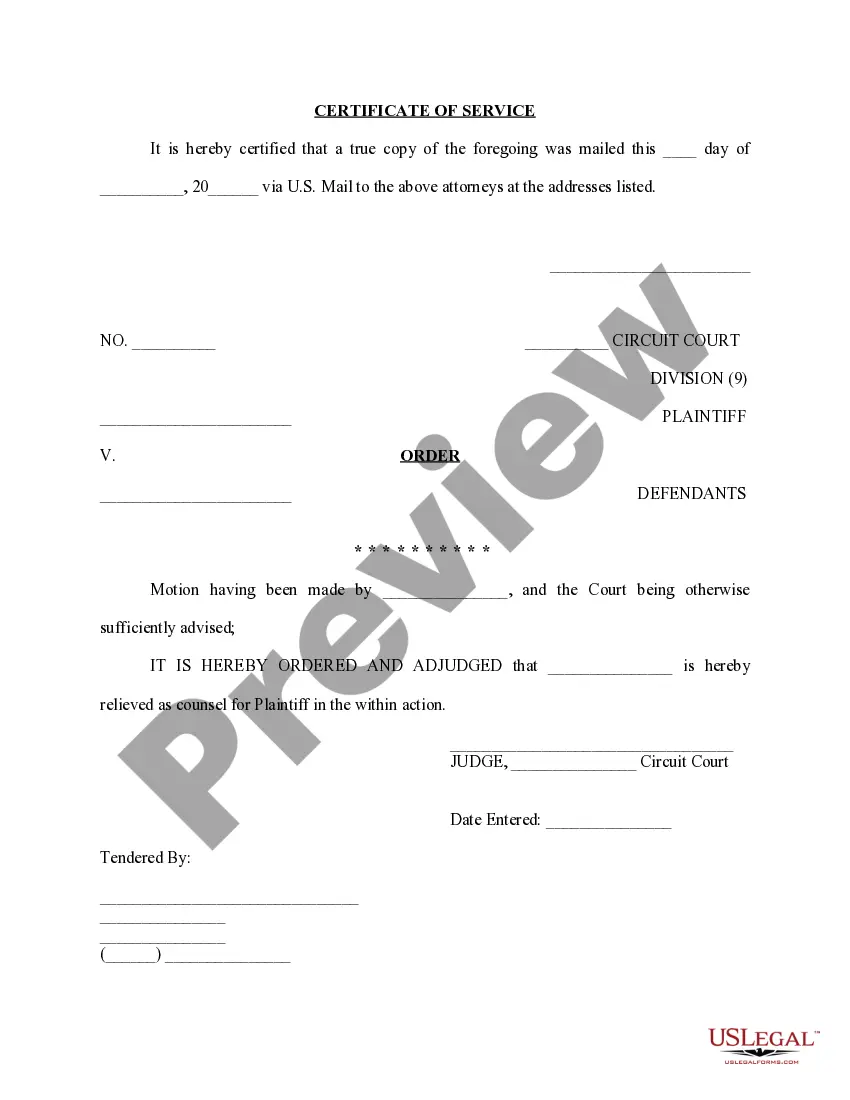

The Request To Withdraw As Legal Representation Example For Divorce presented on this site is a reusable legal template created by qualified attorneys adhering to national and local laws.

For over 25 years, US Legal Forms has offered individuals, entities, and legal experts more than 85,000 authenticated, state-specific documents for various business and personal needs. It’s the fastest, most direct, and most trustworthy method to acquire the documentation you require, as the service ensures bank-level data protection and anti-virus safeguards.

Choose the format you prefer for your Request To Withdraw As Legal Representation Example For Divorce (PDF, DOCX, RTF) and download the template to your device.

- Seek out the document you need and examine it.

- Browse through the file you searched and inspect it or review the form description to verify it meets your needs. If it doesn't, use the search function to find the appropriate one. Click Buy Now after you have located the template you want.

- Register and Log In.

- Select the subscription plan that fits you and create an account. Utilize PayPal or a credit card for swift payment. If you already possess an account, Log In and verify your subscription to continue.

- Obtain the editable template.

Form popularity

FAQ

Irrevocable Trusts Using an irrevocable trust allows you to minimize estate tax, protect assets from creditors and provide for family members who are under 18 years old, financially dependent, or who may have special needs.

Idaho Statutes Duty to register trusts. The trustee of a trust having its principal place of administration in this state shall register the trust in the court of this state at the principal place of administration.

How much money is needed to set up a trust? There isn't a clear cut rule on how much money you need to set up a trust, but if you have $100,000 or more and own real estate, you might benefit from a trust.

Ultimately, the question is not whether it is better to have a will or a trust, but if you should have a trust in addition to a will. If you die without having a valid will or trust in place, the courts will determine how your assets are distributed.

A Idaho trust typically costs anywhere between $1,150 and $3,950. At Snug, any member can create a Power of Attorney and Health Care Directive for free. A Will costs $195 and a Trust costs $500. For many families, this is a great option to get you fully covered and save some money while doing it.

To create a living trust in Idaho, you create and then sign a declaration of trust in front of a notary. You then transfer ownership of assets into the trust to fund it. At this point it becomes effective. A revocable living trust offers a variety of benefits that may appeal to you and fill your needs.

To create a living trust in Idaho, you create and then sign a declaration of trust in front of a notary. You then transfer ownership of assets into the trust to fund it. At this point it becomes effective. A revocable living trust offers a variety of benefits that may appeal to you and fill your needs.

How to Write ( Fill Out ) a Living Trust Form Step 1: Fill out the grantor information. ... Step 2: Indicate the purpose of the trust. ... Step 3: Include trustee information. ... Step 4: List beneficiaries and make specific gifts. ... Step 5: Sign and notarize the completed document.