Kansas Probate Testate Beneficiary Notices Form

Description

Form popularity

FAQ

Yes, Kansas does allow for a small estate affidavit, which can simplify the process for estates valued under a certain threshold. This affidavit enables heirs to collect assets without going through the full probate procedure. Utilizing the Kansas probate testate beneficiary notices form along with the small estate affidavit can help ensure all beneficiaries receive their due notice and facilitate smoother asset distribution. This approach is an efficient option for managing smaller estates in Kansas.

Yes, it is possible to avoid probate in Kansas using certain strategies, such as establishing trusts, designating beneficiaries on accounts, or holding property jointly with rights of survivorship. These alternatives can streamline the transfer of assets without going through the probate process. However, it's wise to use the Kansas probate testate beneficiary notices form to inform beneficiaries about estate matters, ensuring they are aware of their rights. Consulting with a legal professional can assist in navigating these options effectively.

Yes, in Kansas, wills typically need to be probated to ensure their validity and to facilitate the distribution of assets. This legal process involves the court reviewing the will and overseeing the allocation of assets according to the document's terms. The Kansas probate testate beneficiary notices form plays a crucial role in notifying beneficiaries about the probate process. Therefore, it's vital to understand this requirement to secure your estate's intentions.

If a will is not filed in Kansas, the deceased's estate may end up in intestacy, meaning it will be subject to state laws regarding asset distribution. This occurs if there is no legally recognized will available. Without the Kansas probate testate beneficiary notices form, heirs may experience delays and uncertainties in receiving their inheritance. Thus, it is essential to have a will properly filed to ensure a smooth transition of assets.

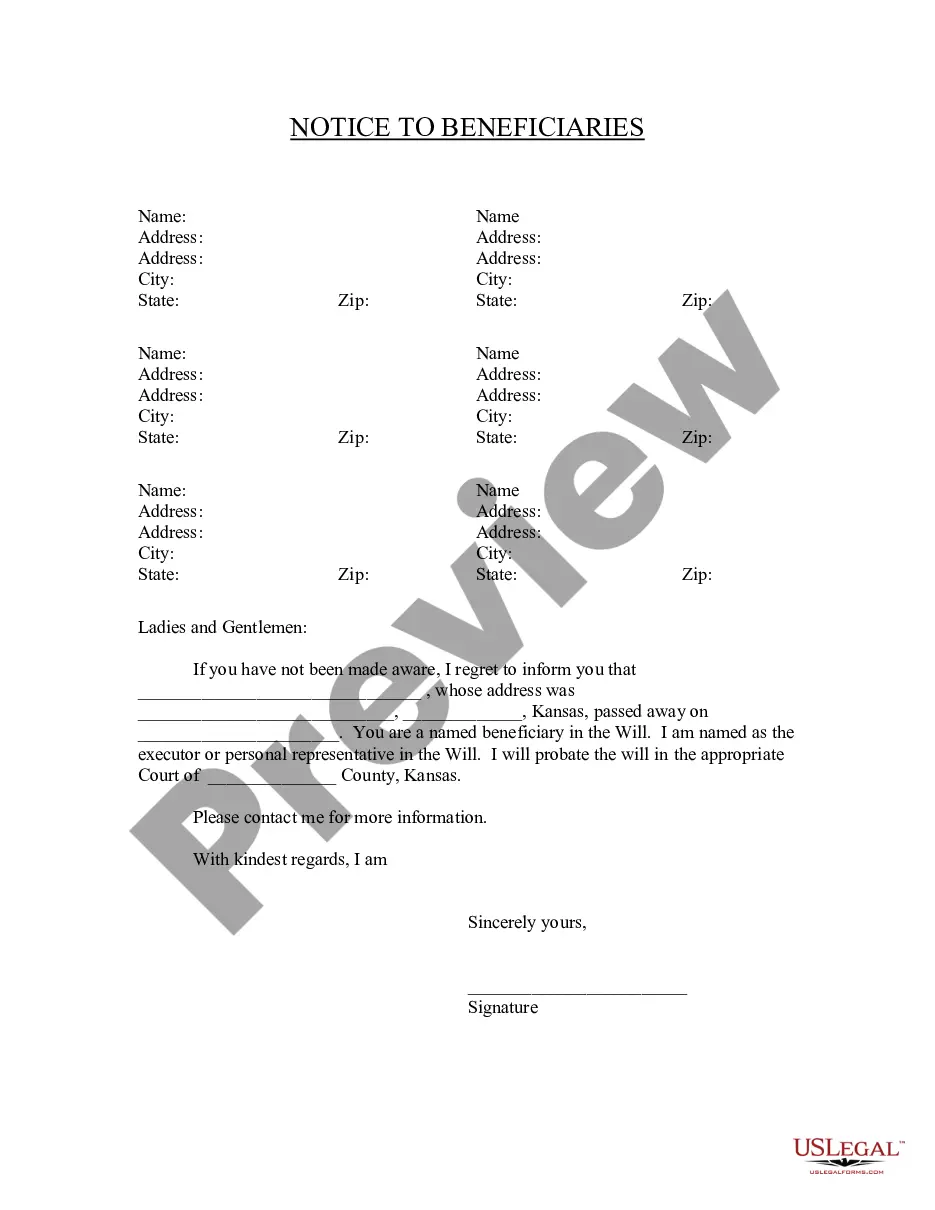

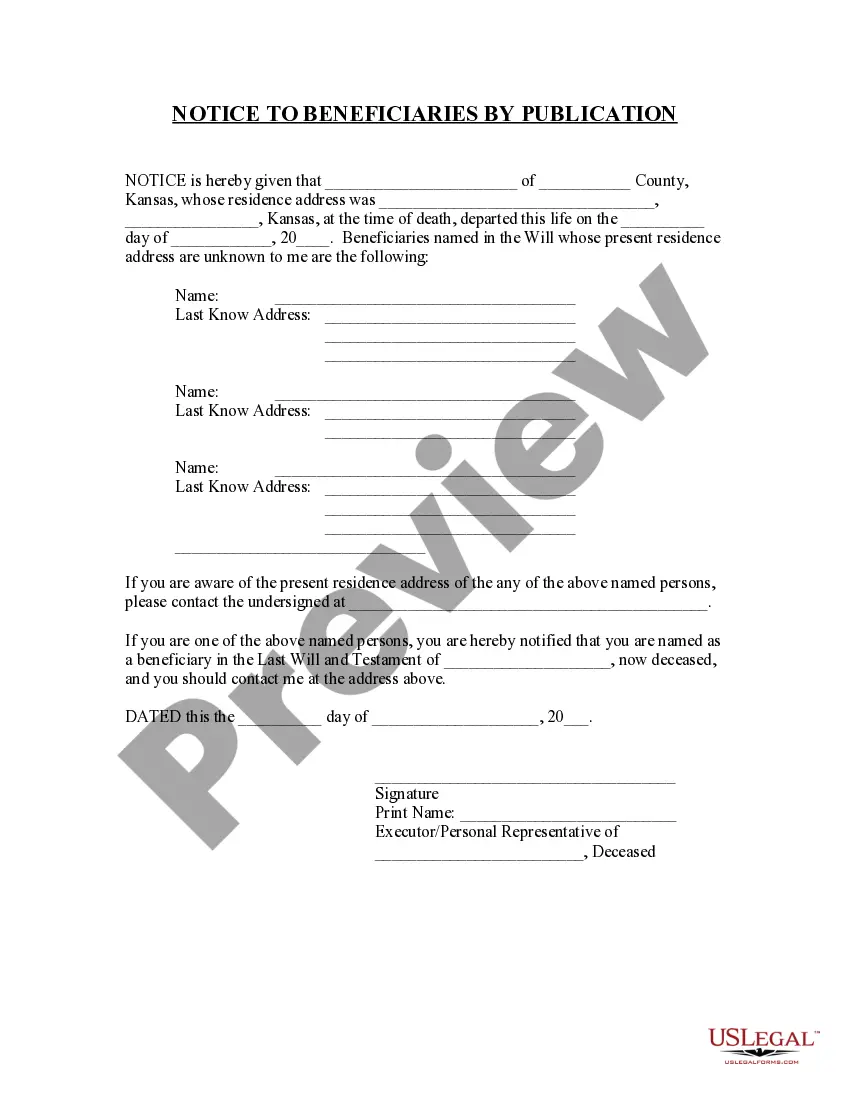

To initiate the probate process in Kansas, you must file the will, if one exists, along with the Kansas probate testate beneficiary notices form in the appropriate district court. Make sure to gather all necessary documents and information about the estate. If you need further assistance, consider using uslegalforms to guide you through the process efficiently.

In Kansas, a spouse does not automatically inherit all assets. Instead, the inheritance depends on other surviving heirs and the nature of the property. Understanding the will's provisions is crucial, and if probate is needed, you'll require the Kansas probate testate beneficiary notices form.

In Kansas, you can avoid probate by utilizing strategies like setting up a living trust, naming beneficiaries on accounts, or co-owning property. These methods keep assets out of the probate system. If you need guidance in creating these documents, the uslegalforms platform can assist you in ensuring everything is in order to bypass the Kansas probate testate beneficiary notices form.

One effective way to avoid probate is to reduce the size of your estate below the Kansas threshold of $40,000. You can do this by using joint ownership, beneficiary designations, or creating a living trust. These strategies can help streamline the transfer of your assets without needing a Kansas probate testate beneficiary notices form.

Not all wills need to go through probate in Kansas. If the estate is below the $40,000 threshold, or if the assets are held in a trust, you may avoid probate entirely. However, it is essential to file the appropriate Kansas probate testate beneficiary notices form if probate is required.

The threshold for probate in Kansas is set at $40,000 for property that is solely owned by the deceased. This means any estate valued at more than this amount will require probate proceedings. Remember, you will need a Kansas probate testate beneficiary notices form to proceed if your estate exceeds this limit.