Kansas Form Certificate For Pensioners

Description

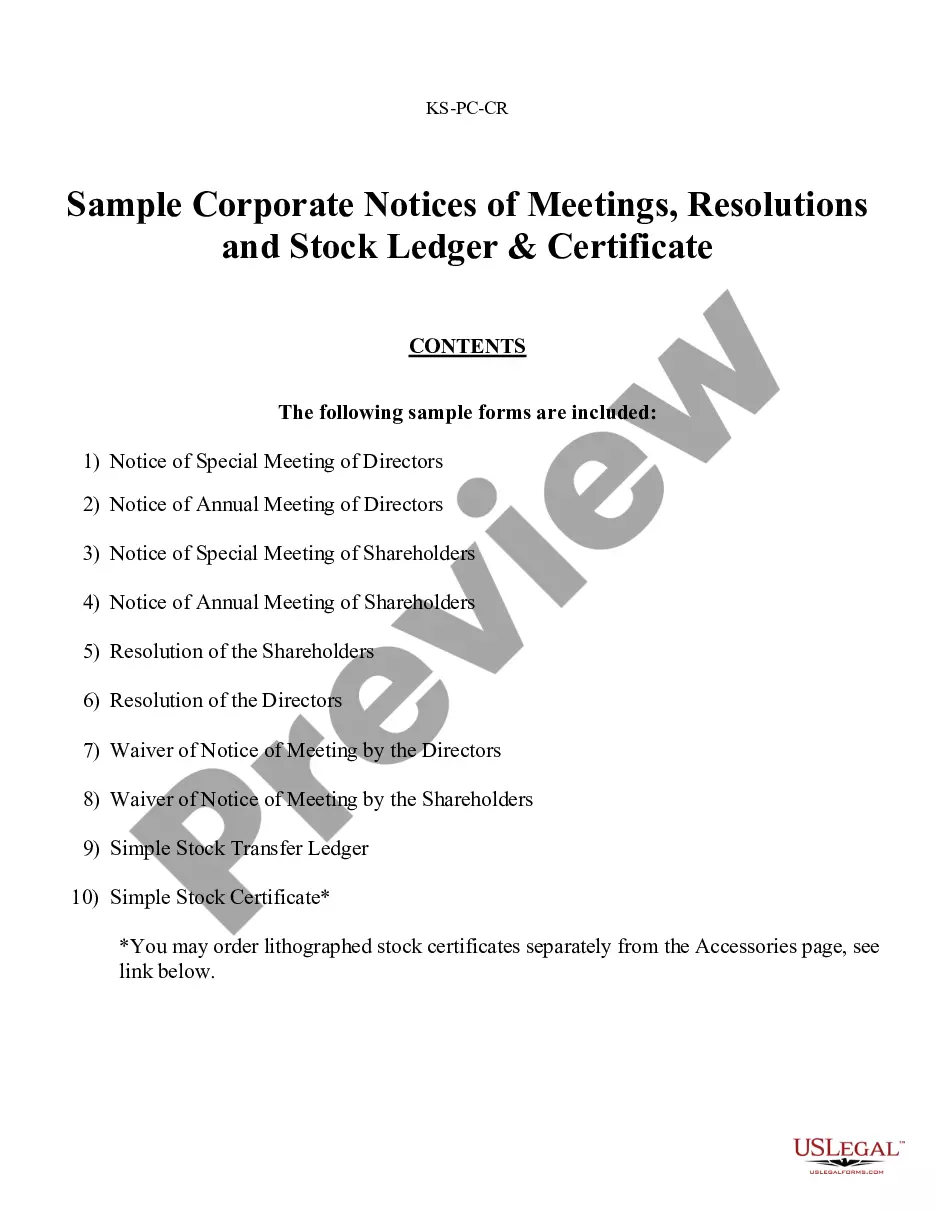

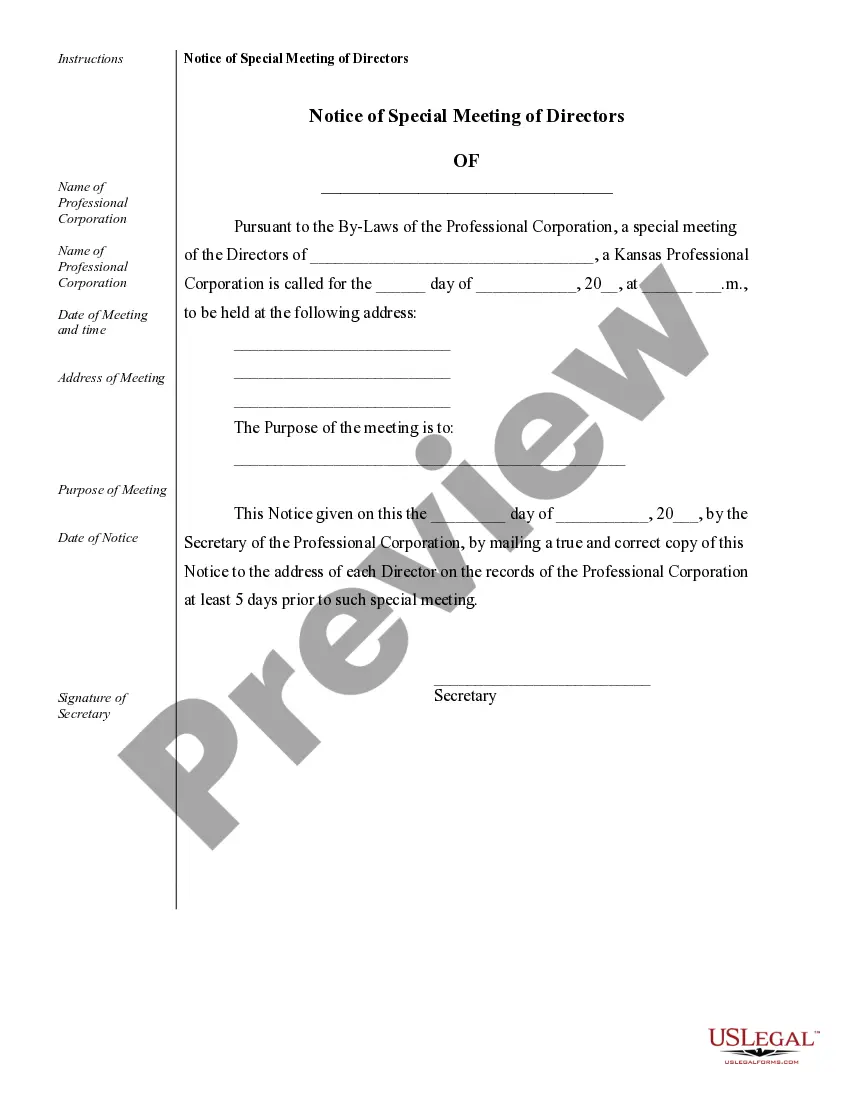

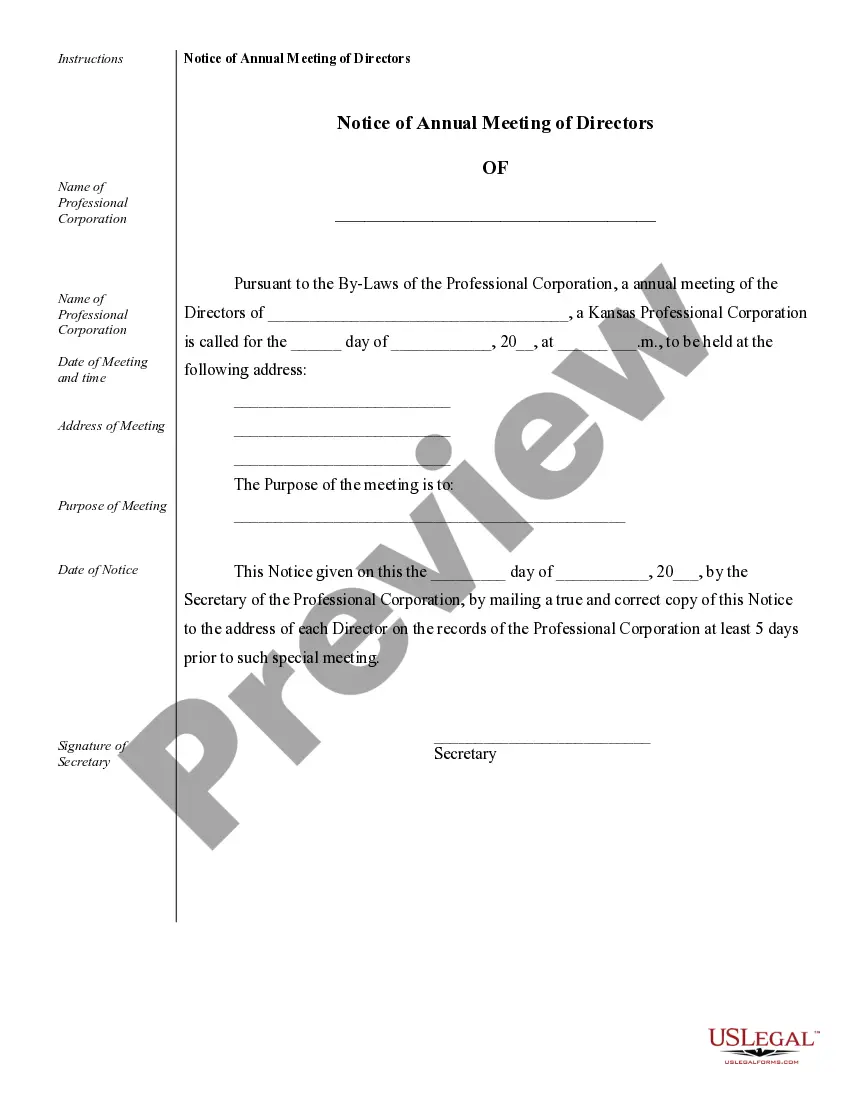

How to fill out Sample Corporate Records For A Kansas Professional Corporation?

Accurately prepared formal documents are one of the crucial safeguards for preventing issues and legal disputes, yet acquiring them without the assistance of an attorney may require time.

Whether you need to swiftly locate a current Kansas Form Certificate For Pensioners or any other forms for employment, personal, or business purposes, US Legal Forms is always available to assist.

The procedure is even simpler for current users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button next to the desired file. Additionally, you can revisit the Kansas Form Certificate For Pensioners at any time, as all documents previously obtained on the platform remain accessible within the My documents section of your profile. Save both time and money on preparing official documents. Explore US Legal Forms today!

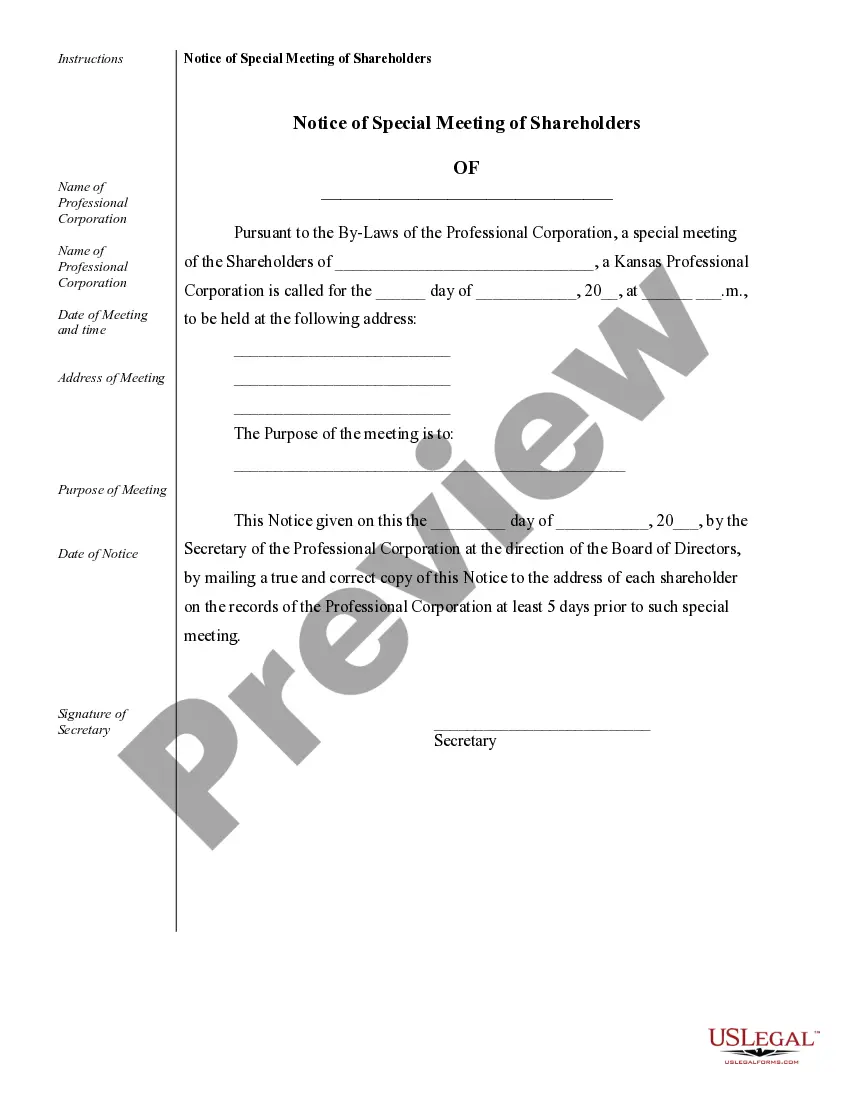

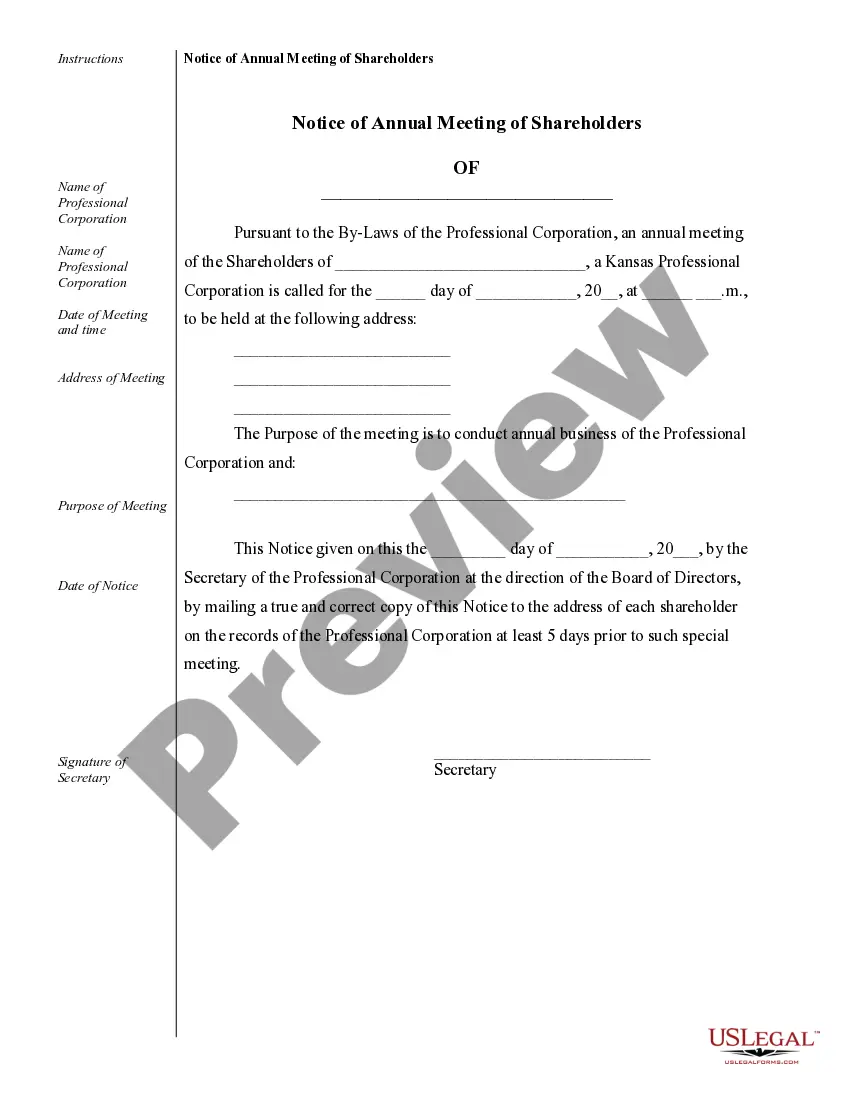

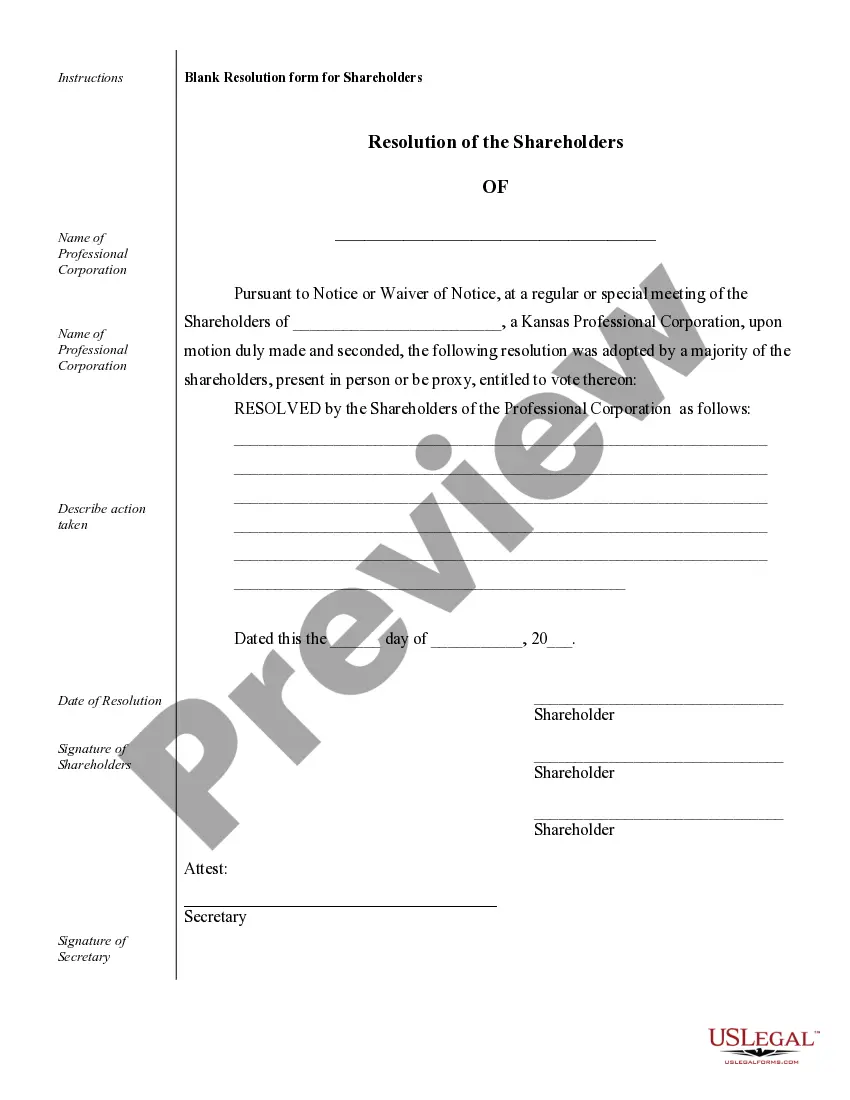

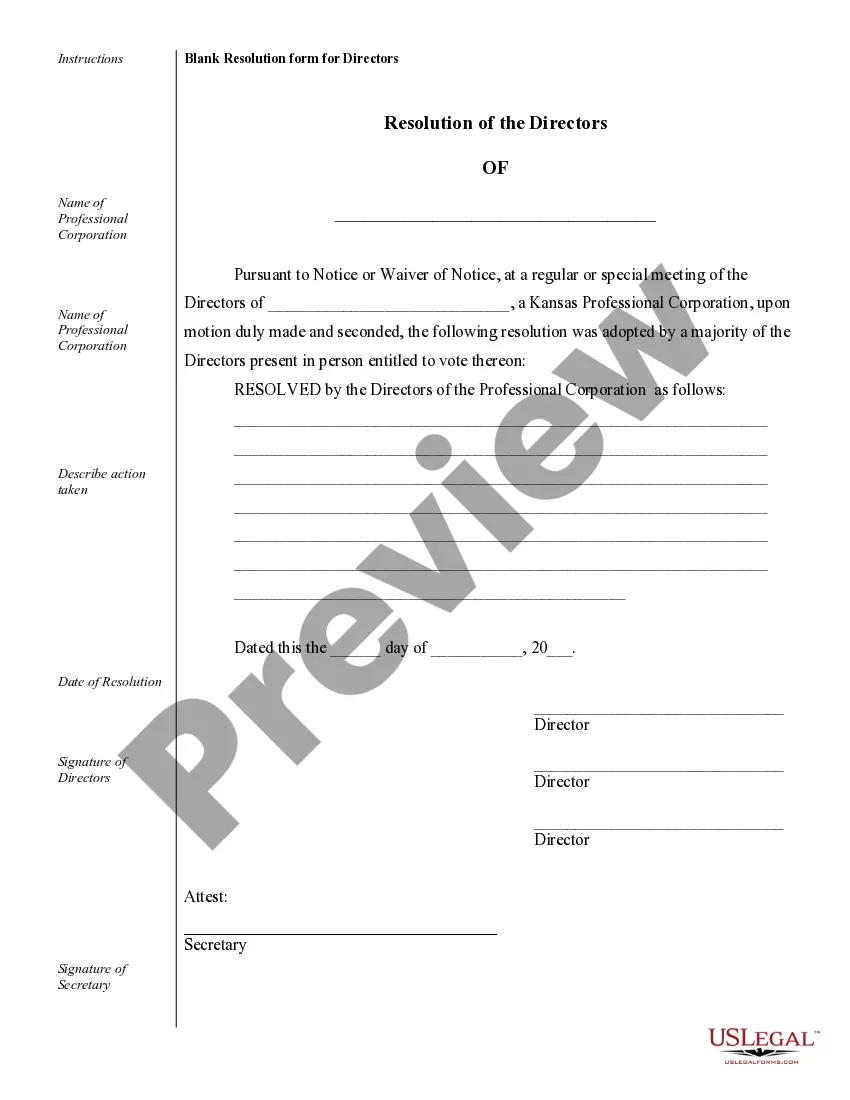

- Verify that the form aligns with your needs and location by reviewing the description and preview.

- Search for an alternative template (if necessary) using the Search bar in the header of the page.

- Click Buy Now once you find the relevant form.

- Choose the pricing option, sign in to your account or create a new one.

- Select your preferred payment method to acquire the subscription plan (via a credit card or PayPal).

- Choose the file format, either PDF or DOCX, for your Kansas Form Certificate For Pensioners.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

Yes, KPERS contributions are typically made on a pre-tax basis, meaning you can reduce your taxable income while saving for retirement. This approach allows your investment to grow tax-deferred until withdrawal. Understanding the benefits of pre-tax contributions can help you maximize your retirement savings. If you need to file for your benefits or access necessary forms, the Kansas form certificate for pensioners is key, and uslegalforms is here to provide you with the tools needed.

Yes, KPERS death benefits may be subject to taxation. The taxable amount depends on various factors, such as the beneficiary and the type of benefit received. It's important to consult a tax professional to understand the implications fully and ensure compliance with tax regulations. For further queries and detailed documentation, the Kansas form certificate for pensioners can be an essential resource, and uslegalforms is available to assist you with related forms.

Determining when you can retire with KPERS involves understanding your eligibility based on your age and years of service. Generally, you need to meet a specific combination of age and service time to qualify for retirement benefits. The Kansas form certificate for pensioners can provide clarity on your retirement options and benefits. For personalized assistance and resources, explore uslegalforms to guide you through your retirement planning.

To pull out KPERS, you need to complete the Kansas form certificate for pensioners. This form allows you to request your benefits and provides necessary details regarding your service credit and contributions. It's essential to follow the instructions carefully to ensure a smooth withdrawal process. If you need assistance, uslegalforms offers user-friendly templates and guidance to help you complete this task.

Kansas does not tax certain federal pensions for seniors, providing a notable advantage for retirees. This means that many pensioners can retain more of their income, allowing for better financial planning and stability during retirement. To navigate any potential complexities related to tax liabilities, it is helpful to refer to the Kansas form certificate for pensioners. This resource can guide you in understanding how these laws specifically apply to your situation.

In Kansas, seniors can benefit from a tax break that reduces their tax burden significantly. Specifically, the state offers a special property tax exemption for individuals aged 65 and older. This exemption can provide substantial financial relief, helping pensioners manage their expenses more effectively. For those seeking to understand the specifics, utilizing the Kansas form certificate for pensioners can simplify the application process.

KPERS generally offers a solid retirement plan for many Kansas public employees, providing a reliable source of income after years of service. Its defined benefit structure ensures that you receive predictable monthly payments based on your career. Many find the stability and peace of mind it provides to be advantageous. If you are considering the Kansas form certificate for pensioners, exploring your options and understanding the benefits is essential, making the uslegalforms platform a valuable resource for your retirement planning.

When you retire, KPERS typically pays you a monthly pension based on your salary, years of service, and the retirement plan you are enrolled in. You can choose between a lifetime benefit or a one-time payout, depending on your financial needs. Using the Kansas form certificate for pensioners helps you to navigate these choices, ensuring you receive the benefits you have earned. For ease of understanding, consider tools available on the uslegalforms platform that guide you through the retirement process.

Yes, you can collect both KPERS and Social Security benefits; however, your KPERS benefit may be affected by your Social Security earnings. This interaction occurs because certain public employment can influence your Social Security benefits. It is wise to understand how these programs intersect, especially if you are looking into the Kansas form certificate for pensioners. For detailed resources on this matter, check out the information available on the uslegalforms platform.

To retire with the Kansas Public Employees Retirement System (KPERS), you typically need a minimum of 85 points. Points are calculated by adding your age and years of service together. This system encourages more service years, as longer tenures lead to better benefits. The Kansas form certificate for pensioners can help you understand how your service years translate into retirement benefits.