Bill Of Sale Kansas With Payment Plan

Description

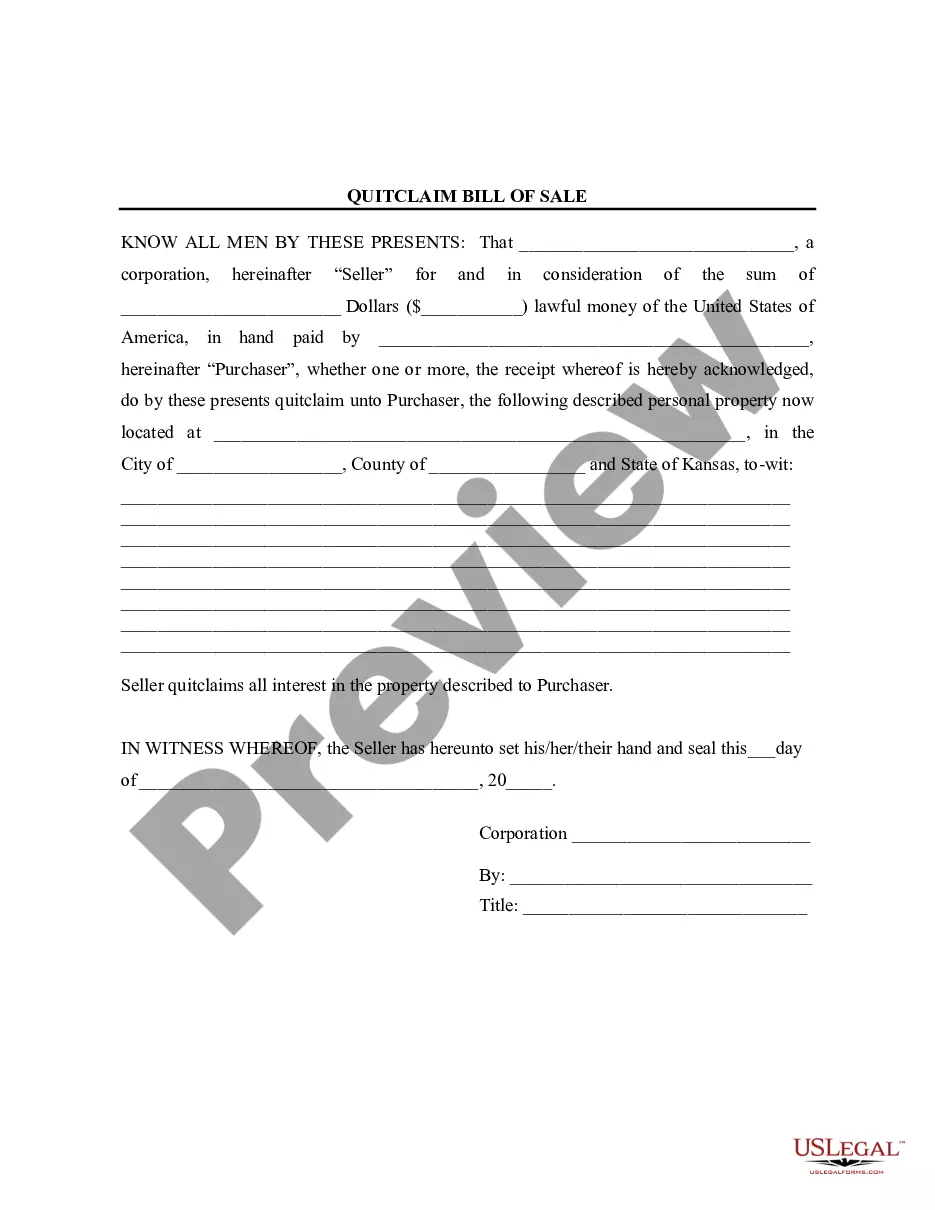

How to fill out Kansas Bill Of Sale Without Warranty By Corporate Seller?

How to locate professional legal documents that adhere to your state's regulations and prepare the Bill of Sale for Kansas with a Payment Plan without consulting an attorney.

Numerous online services offer templates to address various legal scenarios and requirements. However, it might require time to identify which of the available samples meet both your needs and legal standards.

US Legal Forms is a reliable service that assists you in finding official documents crafted according to the latest state law updates, saving you money on legal services.

If you do not possess an account with US Legal Forms, follow the steps below: Review the webpage you have opened and ensure that the form meets your requirements. To do this, utilize the form description and preview options if accessible. Search for another template in the header that lists your state if necessary. Press the Buy Now button once you find the appropriate document. Choose the most suitable pricing plan, then Log In or set up an account. Select the payment method (by credit card or via PayPal). Modify the file type for your Bill of Sale for Kansas with Payment Plan and click Download. The obtained templates are yours to keep: you can always return to them in the My documents tab of your account. Subscribe to our library and prepare legal documents independently like a seasoned legal professional!

- US Legal Forms is not just an ordinary online library.

- It features over 85,000 verified templates for diverse business and personal situations.

- All documents are categorized by field and state, facilitating a faster and more convenient search process.

- Moreover, it comes with robust tools for PDF editing and electronic signatures, allowing users with a Premium subscription to easily complete their paperwork online.

- It requires minimal effort and time to obtain the needed documents.

- If you have an account, Log In and verify that your subscription is active.

- Download the Bill of Sale for Kansas with Payment Plan by clicking the respective button next to the file name.

Form popularity

FAQ

Here in Kansas, buying a car is subject to sales tax. However, when you trade in your old car, the amount you get is deducted from the total purchase price. You will only have to pay sales tax on the difference between the two.

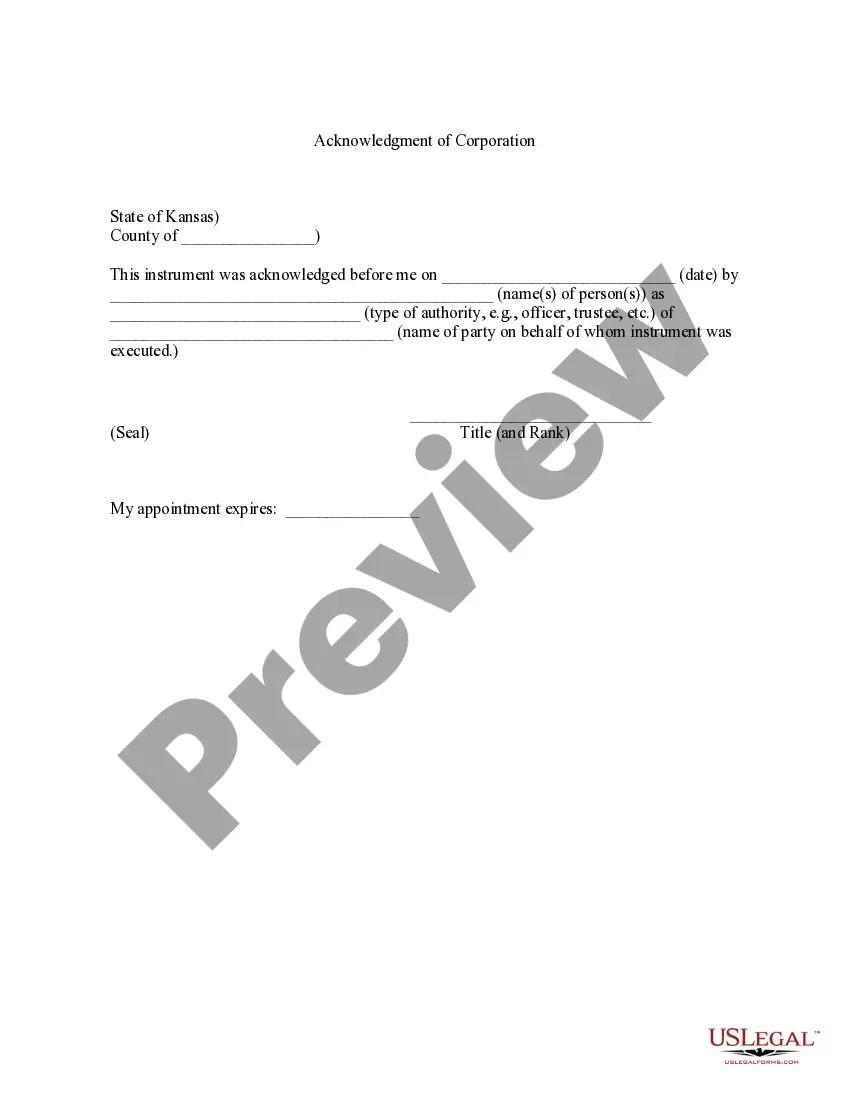

In general, Kansas does not require bills of sale, title assignments, and applications to be notarized. However, it has the right to request notarization in unusual circumstances, such as if document information is incomplete or questionable.

You have three options for filing and paying your Kansas sales tax:File online File online at the Kansas Department of Revenue.File by mail You can use Form ST-16 for single jurisdiction filers or Form ST-36 for multiple jurisdiction filers and file and pay through the mail.More items...

Get the Payment Plan Request for INDIVIDUAL INCOME (CM-15) here.Pay Plan Request Forms can be faxed to the Collections Department at: 1-785-291-3616.Pay Plan Request Forms can be emailed to: kdorkstaxpayplanrequest@ks.gov.

A payment plan is an agreement with the IRS to pay the taxes you owe within an extended timeframe. You should request a payment plan if you believe you will be able to pay your taxes in full within the extended time frame. If you qualify for a short-term payment plan you will not be liable for a user fee.