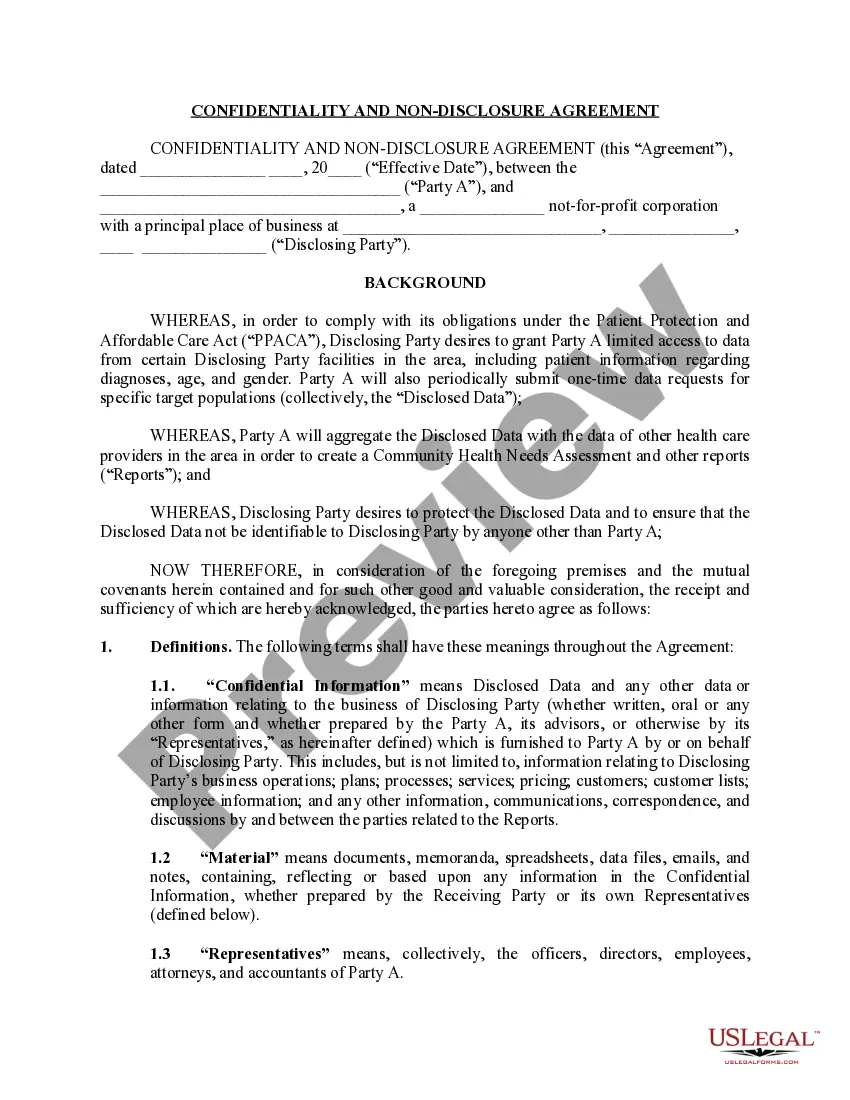

Non Marital Agreement With Us Citizen

Description

How to fill out Kansas Non-Marital Cohabitation Living Together Agreement?

- If you have a US Legal Forms account, log in and download your desired form by clicking 'Download'. Ensure your subscription is active; if it’s expired, renew according to your payment plan.

- For first-time users, start by reviewing the Preview mode and description of the non marital agreement. Verify it aligns with your local jurisdiction.

- If you encounter any discrepancies, utilize the Search tab to find a more suitable template.

- Once you’ve determined the correct form, click 'Buy Now' and select a subscription plan that fits your needs. Create an account to access the forms library.

- Complete your purchase by providing payment details, either via credit card or PayPal.

- After your purchase, download the document to your device. You can access it anytime through the My Forms section of your account.

By leveraging US Legal Forms, you ensure that your non marital agreement is thorough and compliant with legal standards. This platform not only simplifies the document creation process but also connects you with premium legal experts for guidance.

Start your legal journey today and secure your non marital agreement with ease. Visit US Legal Forms to explore your options!

Form popularity

FAQ

Yes, there are disadvantages to filing taxes as married but separately. You may miss out on certain tax benefits like credits and deductions available to joint filers. Additionally, if you're navigating a non marital agreement with a US citizen, it is crucial to understand how your filing methods might influence your legal status. For personalized assistance, consider platforms like uslegalforms to help you make informed decisions.

Filing as married but separately can raise eyebrows during the immigration process. It might lead immigration officials to question your relationship's authenticity. If you are establishing a non marital agreement with a US citizen, ensure your filing reflects the genuine nature of your relationship. Clarity and proper documentation are essential to prevent misunderstandings.

If you are married to a non U.S. citizen, you typically have the option to file jointly or separately. Filing separately may simplify your tax situation but could limit credits and deductions. When considering a non marital agreement with a US citizen, it is essential to evaluate your tax implications and ensure compliance with IRS rules. Utilizing a platform like uslegalforms can offer guidance in navigating this process.

The act of filing taxes as married but separately does not inherently affect your green card status. However, it can create complications if immigration authorities question the legitimacy of your marriage. A non marital agreement with a US citizen may provide necessary legal protection, but proper tax filings should demonstrate your genuine relationship. It's advisable to seek professional advice to navigate these concerns effectively.

Filing taxes as married but separately can raise potential concerns during an immigration review. Immigration officials might scrutinize your relationship to ensure it is genuine and not solely for obtaining benefits. If you are involved in a non marital agreement with a US citizen, this filing status could lead to a deeper examination of your partnership. Thus, transparency and clarity when filing taxes is crucial.

Filing taxes as married but separately does not directly affect your citizenship status. However, it can raise questions during the immigration process about your relationship with your spouse. If you are considering a non marital agreement with a US citizen, it's vital to understand how your tax filing status can impact your overall application. Consulting with an immigration expert in conjunction with tax advice is beneficial in this situation.

Yes, it is possible to be deported even if married to a U.S. citizen. If a non-citizen entered the country illegally or has a serious criminal record, they may face deportation regardless of their marital status. Thus, it's crucial to maintain clear immigration documentation and legal status. Consulting resources like US Legal Forms can help you draft a non marital agreement with a US citizen to safeguard your interests.

No, marrying a U.S. citizen does not automatically grant citizenship. The non-citizen spouse still needs to go through the green card application process. This journey includes demonstrating the marriage's legitimacy and fulfilling residency requirements. A non marital agreement with a US citizen can provide clarity on rights and needs during this period.

When a non-immigrant marries a U.S. citizen, they can shift toward permanent residency. The U.S. citizen spouse can sponsor the non-immigrant for a green card. This process typically involves submitting an application to U.S. Citizenship and Immigration Services. Additionally, a non marital agreement with a US citizen can outline important terms and responsibilities during this transition.

Yes, an immigrant can stay in the US if they marry a citizen. This marriage allows the immigrant to apply for a green card, which grants them legal residency. However, it's important to follow the proper legal channels and paperwork. A non marital agreement with a US citizen can also help clarify expectations and protect both parties.