Kansas Corporation For Sale

Description

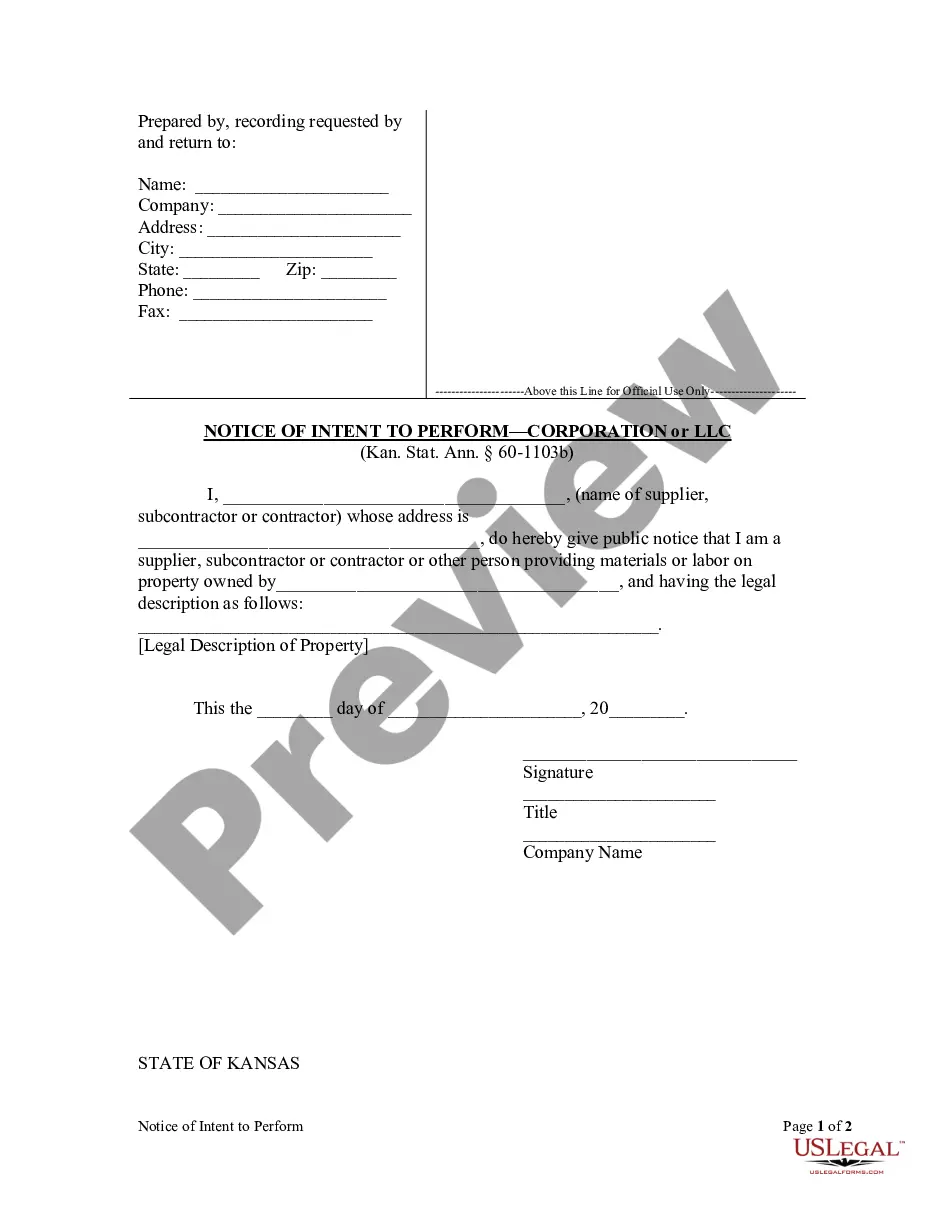

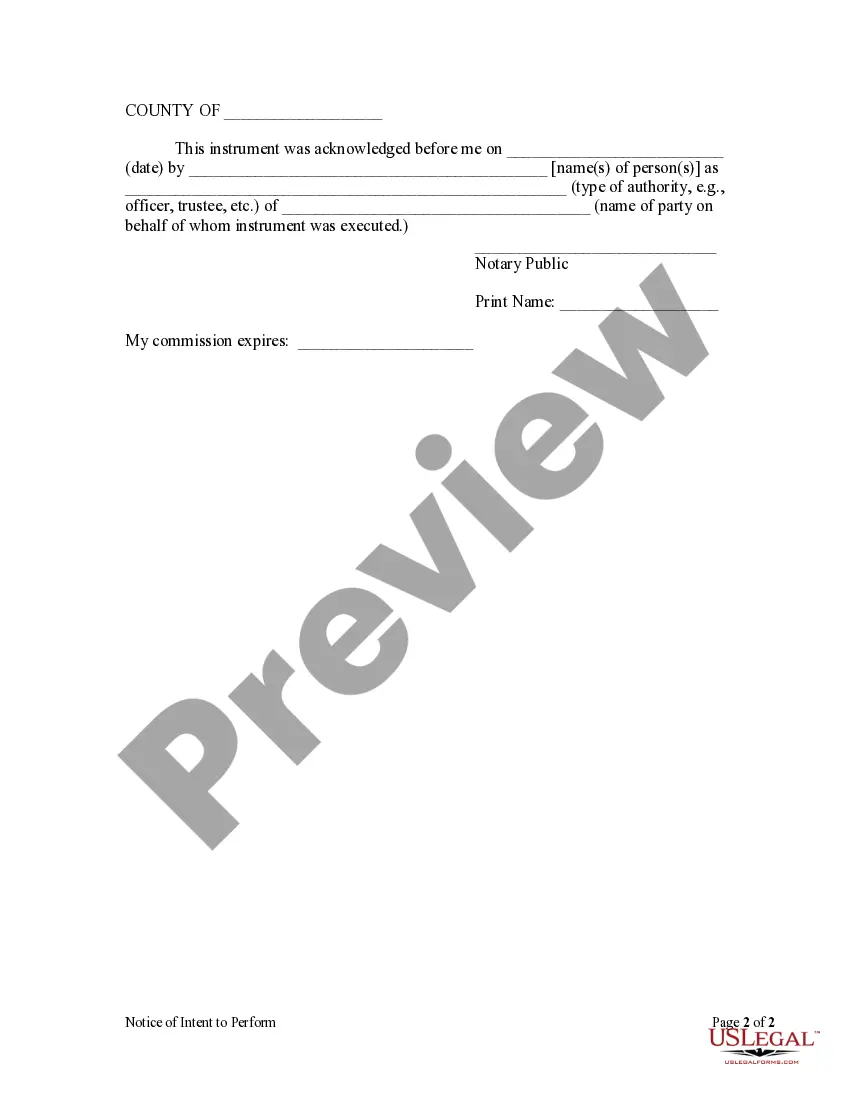

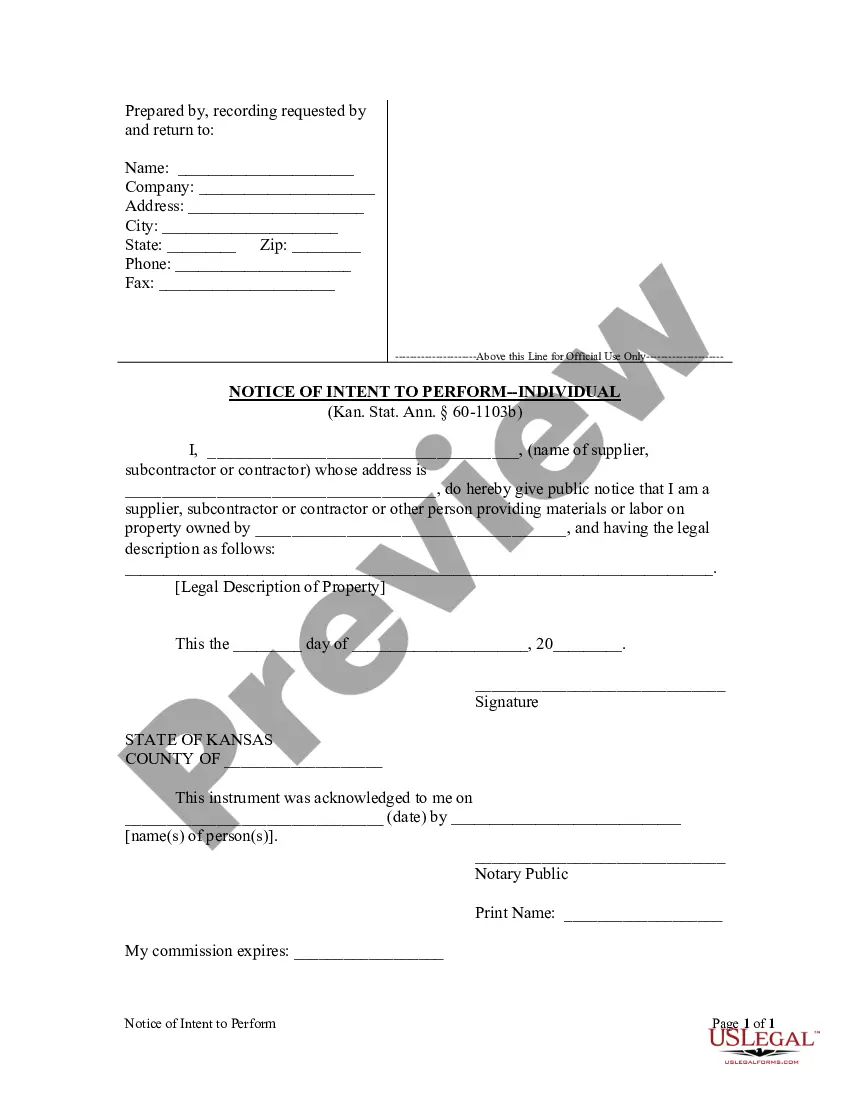

How to fill out Kansas Notice Of Intent To Perform By Corporation Or LLC?

- Verify your subscription status. If you've used US Legal Forms before, log into your account to ensure your subscription is active. If not, renew it according to your selected payment plan.

- Browse the available templates. Utilize the Preview mode and read the form descriptions to confirm you've selected the correct document for your needs.

- Search for alternate templates if necessary. If the first choice doesn't meet your requirements, use the Search tab to find additional options.

- Purchase the document. Click the Buy Now button, choose your preferred subscription plan, and register an account to unlock access to the extensive library.

- Complete your payment. Enter your credit card information or opt for PayPal to complete the purchase process.

- Download your legal form. Save the template to your device and access it anytime through the My Forms section of your profile.

By following these straightforward steps, you can efficiently obtain the legal documentation you need for a Kansas corporation sale. This service empowers users with a vast library of over 85,000 forms to ensure you find the right template.

Get started with US Legal Forms today and ensure your legal documents are accurate and compliant. Don't hesitate, take action now!

Form popularity

FAQ

Forming a Kansas corporation for sale can involve various costs, but it does not have to break the bank. Expenses may include state filing fees, legal fees, and other administrative costs. However, platforms like US Legal Forms can simplify the process, offering affordable solutions that help you navigate the complexities of forming a corporation. By utilizing our services, you can keep these costs manageable while ensuring that your Kansas corporation is set up for success.

Dissolving a corporation in Kansas involves several steps to ensure a legal closure. First, you'll need to hold a meeting with the board of directors to approve the dissolution. Then, you must file a Certificate of Dissolution with the Kansas Secretary of State, alongside settling any outstanding debts and obligations of the corporation. By following these steps, you can successfully conclude your Kansas corporation for sale.

To close a corporation in Kansas, you need to file Articles of Dissolution with the Secretary of State. This process is essential, especially if you decide to take a Kansas corporation for sale off the market. Always settle outstanding debts and taxes before filing to avoid complications.

The sales tax rate in Kansas is currently 6.5%, which applies to most goods and services. If you acquire a Kansas corporation for sale, understanding sales tax obligations will be crucial for compliance. Additionally, local jurisdictions may add their own sales tax, so always check the total rate applicable to your specific location.

Not all partnerships must file Forms K-2 and K-3. These forms are specifically required for partnerships that have international activities or foreign partners. If your partnership or Kansas corporation for sale falls into this category, you will need to file accordingly, keeping track of any international income and expenses.

Any individual or entity earning income in Kansas must file a Kansas tax return. That includes those who own a Kansas corporation for sale, as the income generated will be subject to state taxes. It's crucial to understand your filing requirements to ensure compliance and minimize tax liabilities.

A partnership in Kansas must file a partnership return if it has income, deductions, or certain credits. This requirement applies to partnerships, regardless of structure, including any Kansas corporation for sale. All partners must report their individual share of income and comply with state tax obligations to avoid penalties.

Yes, Kansas does require nonresident partners to have withholding for state taxes. When you are considering a Kansas corporation for sale, it's essential to understand that any nonresident partner will have taxes withheld on their share of the partnership income. This withholding is typically reported on the partnership's return, ensuring compliance with Kansas tax laws.