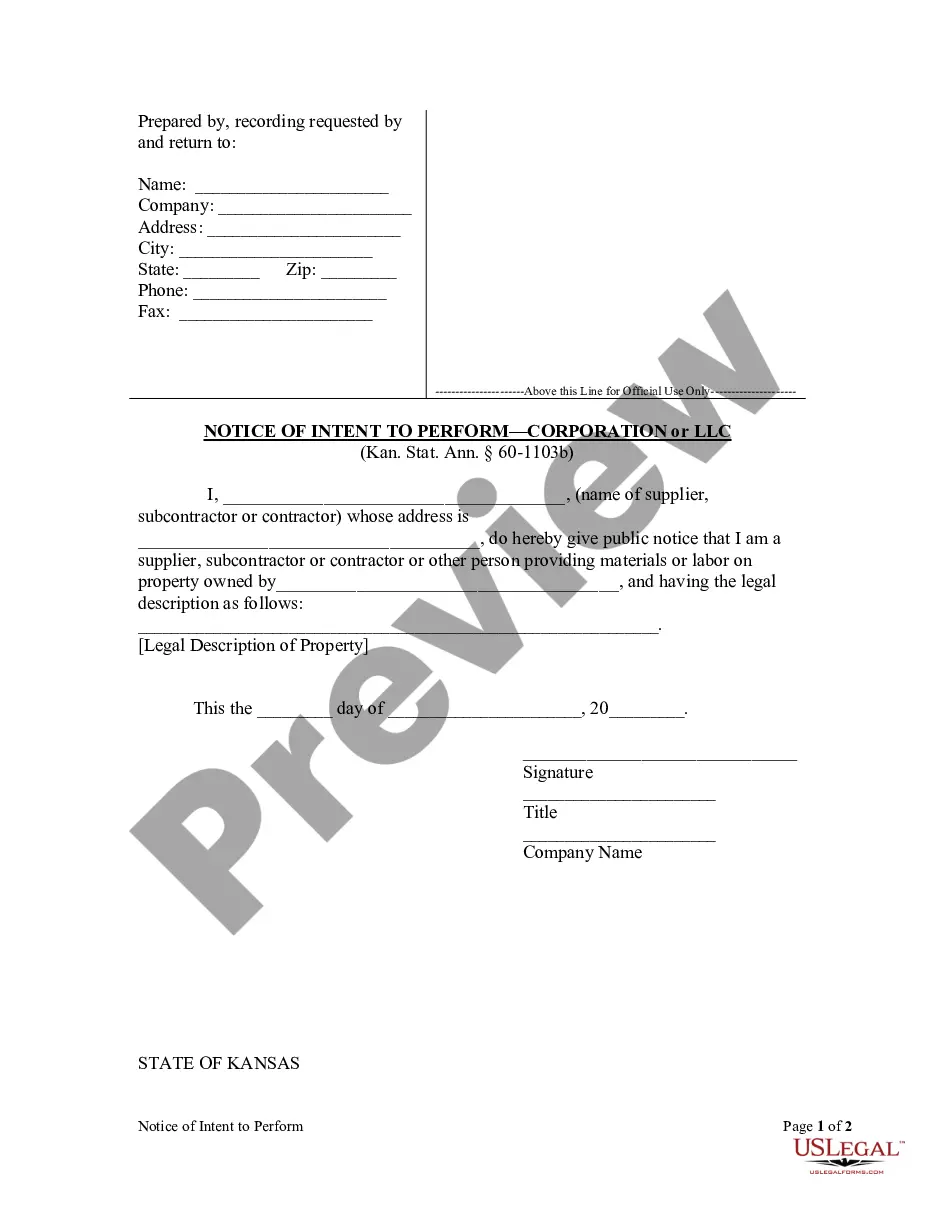

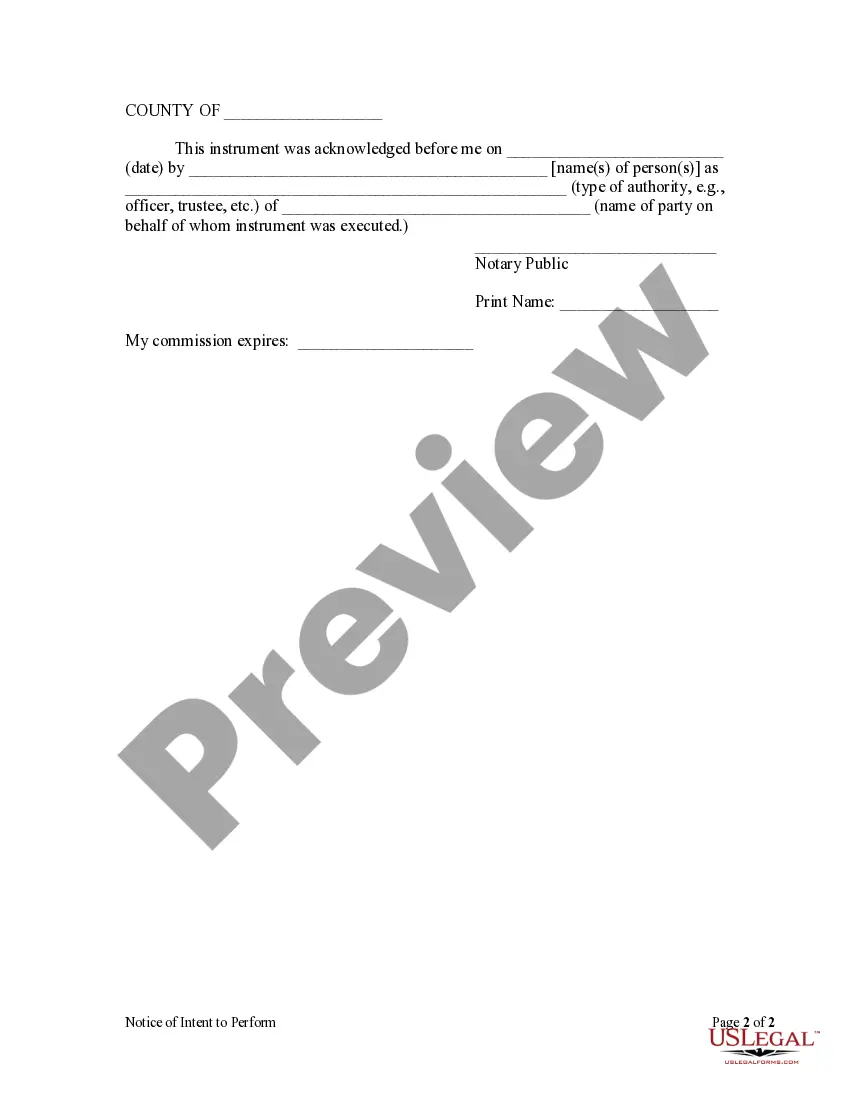

Kansas law provides a form with which a subcontractor may claim a lien for labor and/or materials provided to new residential property. This Notice of Intent to Provide is filed in the office of the clerk of the district court of the county where the property is located. After the lien claimant is paid in full, the lien claimant is required to also file a form releasing the previous Notice and waiving any lien.

Kansas Corporation For Business

Description

How to fill out Kansas Notice Of Intent To Perform By Corporation Or LLC?

- Access your US Legal Forms account. If you're a returning user, log in and ensure your subscription is active before downloading the required form template.

- Preview the form description carefully. Confirm that it meets your specific needs and complies with Kansas laws.

- Search for additional templates if necessary. Use the Search tab to find alternate forms and select the one that best fits your requirements.

- Proceed to purchase your document. Click the Buy Now button, select your subscription plan, and register an account for full access.

- Complete your purchase by entering your payment information, either through credit card or PayPal.

- Download your form. Save it to your device for completion and access it anytime via the My Forms section in your account.

By following these steps, you can efficiently create and manage your Kansas corporation. US Legal Forms not only provides a robust selection of forms but also access to premium experts who can assist with form completion, ensuring that your documents are precise and legally sound.

Start your journey today by visiting US Legal Forms and empower your business endeavors!

Form popularity

FAQ

To start an S Corporation in Kansas, you must first incorporate your business at the state level. This includes choosing a unique name, submitting the necessary articles of incorporation, and filing for S Corporation status with the IRS. Using a service like US Legal Forms can ease the process by providing templates and guidance tailored to forming a Kansas corporation for business.

Setting up a sole proprietorship in Kansas is quite straightforward. You simply need to register your business name and ensure compliance with local permits and licenses. This approach to a Kansas corporation for business allows for complete control, but it also means bearing all risks and liabilities, which is an essential factor to consider.

While you do not need an accountant to set up an S Corporation, having one can simplify the process. A Kansas corporation for business requires adherence to legal and financial regulations that can be intricate. Utilizing the expertise of an accountant may help prevent costly mistakes and ensure that everything complies with local laws.

Yes, you can set up an S Corporation yourself, especially if you are familiar with the process. However, a Kansas corporation for business often involves specific forms, filings, and compliance with state regulations. Considering the details and potential complexities, you may find it helpful to use a reliable platform like US Legal Forms to guide you through the process smoothly.

To set up an S Corp in Kansas, you first need to establish your Kansas corporation for business by filing the Articles of Incorporation. After that, you must apply for S Corporation status by filing Form 2553 with the IRS, ensuring you meet the eligibility requirements. It's also wise to consult with a tax professional or use services like USLegal Forms to help with the process and ensure compliance with local laws.

Starting a Kansas corporation for business requires a few essential components. You need a business name that adheres to state guidelines, and you must also decide on the business structure. Furthermore, having initial funding and a marketing strategy will help establish your business. Consider seeking legal advice to navigate state requirements effectively.

Starting a Kansas corporation for business involves several key documents. You will need to file Articles of Incorporation with the Kansas Secretary of State. Moreover, you'll want to create bylaws for your corporation, and potentially file for an Employer Identification Number (EIN) from the IRS for tax purposes. Utilizing platforms like USLegal Forms can simplify the documentation process significantly.

To start a Kansas corporation for business, you need to develop a solid business plan. This plan outlines your goals and strategies. Additionally, you must choose a unique business name that complies with state regulations. Finally, secure any necessary licenses or permits based on your specific industry.

Starting a corporation in Kansas involves several key steps. First, you must choose a business name that aligns with Kansas regulations, ensuring that it's unique and not in use by another entity. Next, file the Articles of Incorporation with the Kansas Secretary of State, which officially establishes your corporation. Consider using uslegalforms to navigate through this process efficiently, as it offers resources tailored for those looking to establish a Kansas corporation for business.

No, you do not need to form an LLC to create a corporation in Kansas. Corporations can stand alone and operate independently, but an LLC serves as an alternative structure that some choose for its procedural simplicity. When establishing a Kansas corporation for business, decide on the best legal structure by weighing the benefits of each. It's essential to consult resources like uslegalforms to understand your options fully.