Quitclaim Deed Kansas Without Consideration

Description

How to fill out Quitclaim Deed Kansas Without Consideration?

Navigating the complexities of official paperwork and templates can be challenging, particularly for those who do not engage in such activities professionally.

Choosing the appropriate template for a Quitclaim Deed Kansas Without Consideration can be tedious, as it must be accurate and valid to the last detail.

Nevertheless, you will spend significantly less time selecting a suitable template from a trusted resource.

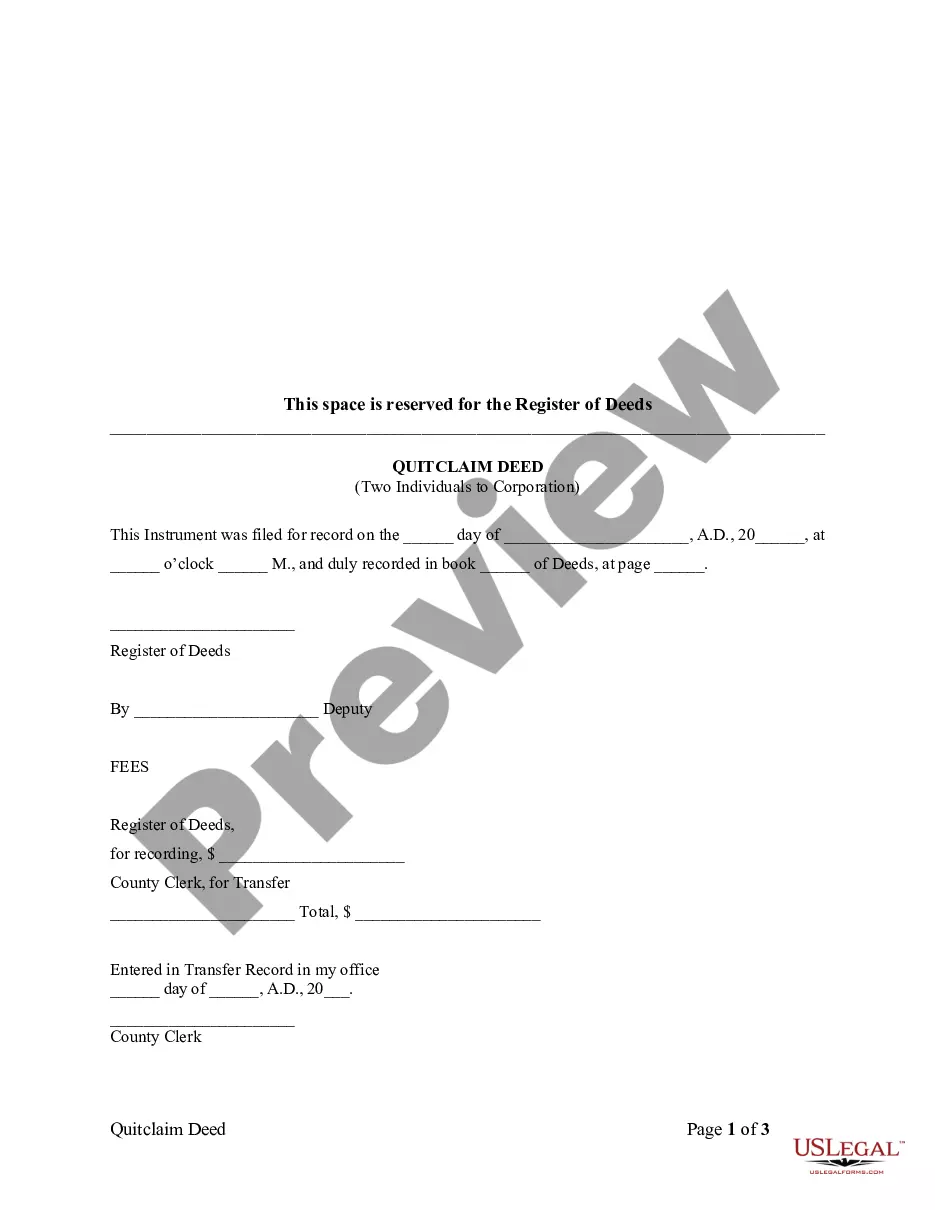

Obtain the correct form in a few simple steps: Enter the document name in the search bar, locate the appropriate Quitclaim Deed Kansas Without Consideration in the list, review the sample’s outline or view its preview, if the template meets your requirements, click Buy Now, choose your subscription plan, use your email to create a password for registering at US Legal Forms, select a payment method via credit card or PayPal, and save the template document on your device in your preferred format. US Legal Forms will save you a great deal of time verifying if the form you discovered online meets your requirements. Set up an account and gain unlimited access to all the templates you need.

- US Legal Forms acts as a platform that streamlines the process of locating the right forms online.

- US Legal Forms serves as a central hub where you can find the latest samples of forms, verify their usage, and download these samples to complete them.

- It houses a collection of over 85K forms that span various professional fields.

- When searching for a Quitclaim Deed Kansas Without Consideration, you won't have to worry about its legitimacy since all the forms are certified.

- Creating an account at US Legal Forms will guarantee that all the needed samples are within your reach.

- You can retain them in your history or add them to the My documents catalog.

- Access your saved forms from any device by clicking Log In on the library site.

- If you do not have an account yet, you can still search for the template you require.

Form popularity

FAQ

After signing a quitclaim deed in California, a spouse may lose their claim to the property if they willingly relinquished their rights. However, the specifics can vary based on the circumstances surrounding the deed and any agreements made between the spouses. It’s advisable to seek guidance from professionals familiar with laws regarding quitclaim deed kansas without consideration, as they can navigate these complex issues effectively.

A deed without consideration may still be legally binding, depending on the circumstances and state laws. In many cases, a quitclaim deed kansas without consideration allows one party to gift property to another without monetary exchange. However, it is essential to consult legal advice to ensure that the deed is valid and enforceable.

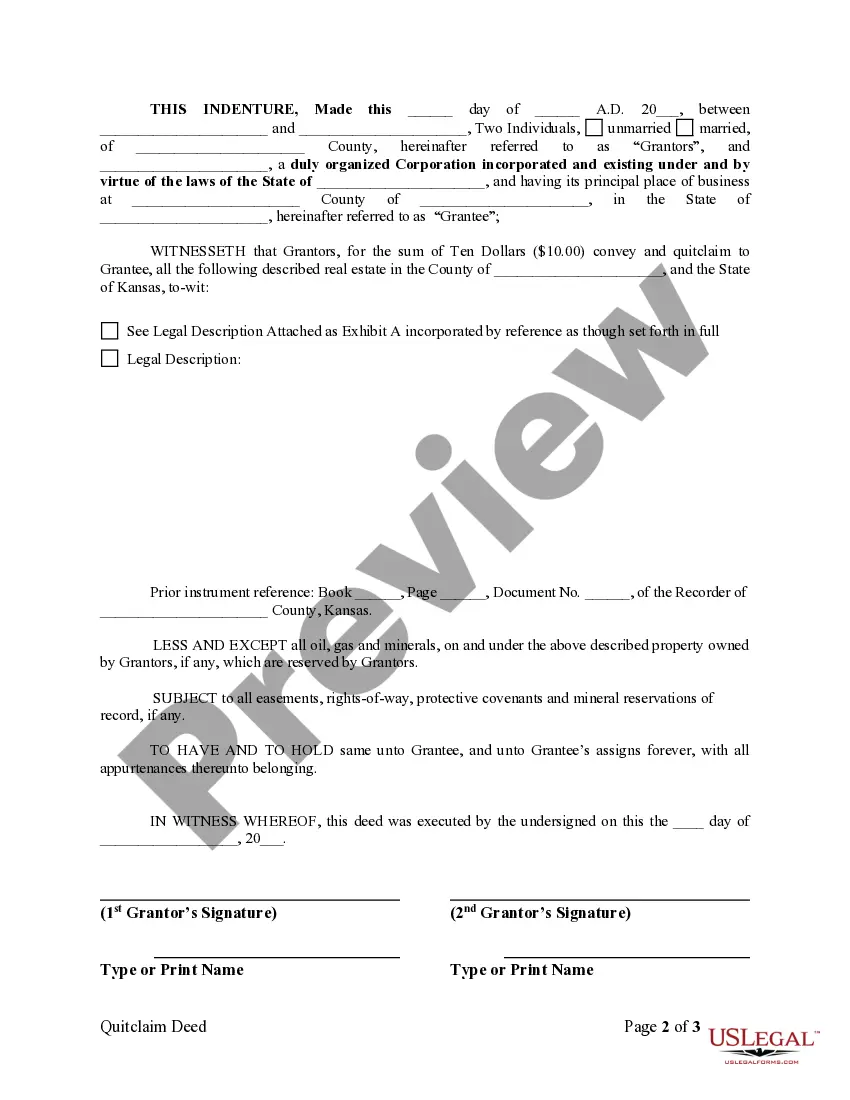

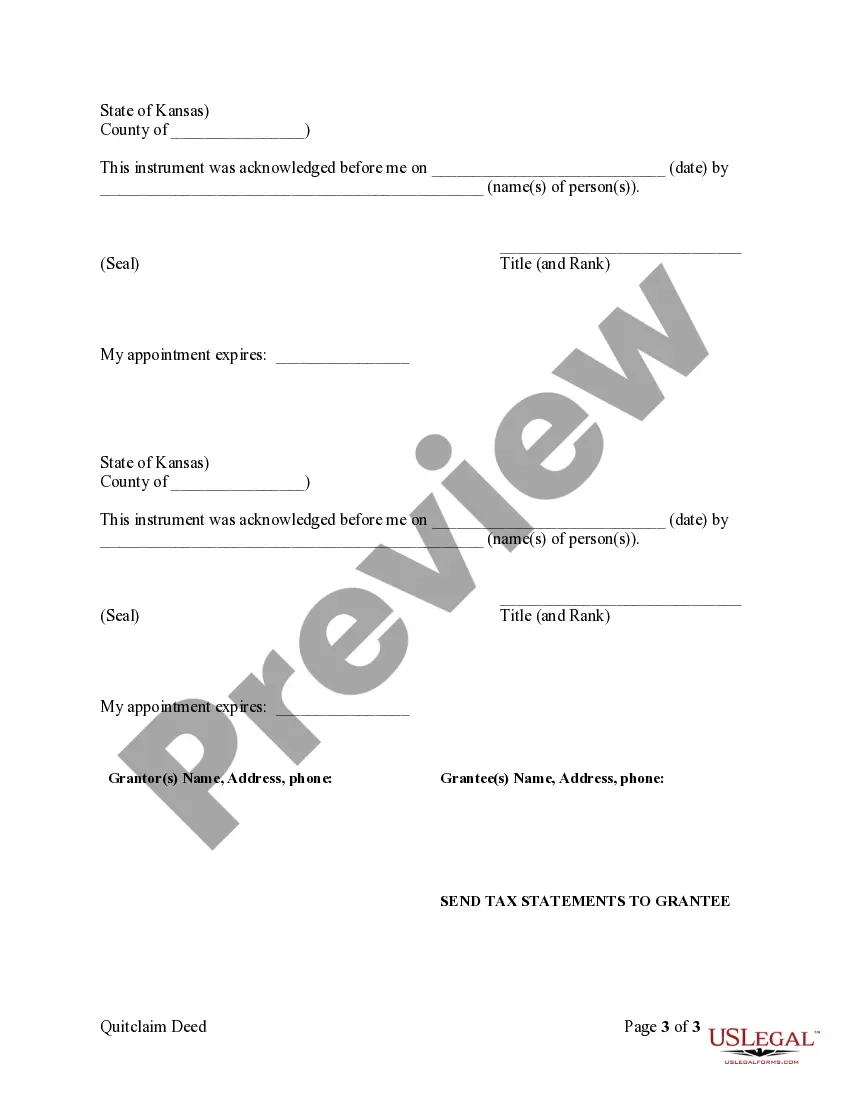

To create a quitclaim deed in Kansas, you typically need the original quitclaim deed form, a legal description of the property, and the names of the grantor and grantee. Additional documents, such as a notary acknowledgment, may also be required based on local regulations. For ease of use, consider exploring US Legal Forms, which provides packaged forms to assist in preparing these documents efficiently.

Several factors can void a quitclaim deed in Kansas, such as fraud, lack of proper execution, or failure to meet state requirements for filing. If the document is not properly recorded after being executed, it may also be considered void. Therefore, ensure you follow the correct procedures when filing to maintain the validity of a quitclaim deed without consideration.

A quitclaim deed in Kansas transfers any ownership interest the grantor has in a property without guaranteeing clear title. This means that the buyer receives whatever rights the seller possesses, which can include partial ownership or none at all. For a smooth transaction, ensure that both parties understand the implications of a quitclaim deed, especially if it involves transferring property without consideration.

In Kansas, a quitclaim deed must include the names of the parties involved, a legal description of the property, and the date of transfer. It should also be signed by the grantor, and ideally, notarized to ensure its validity. This document helps all parties involved understand the transfer process of property rights without consideration.

You can file a quitclaim deed in Kansas without a lawyer by utilizing online resources, such as templates and instructions. Platforms like US Legal Forms offer user-friendly templates that guide you through each step of the process. This way, you can complete the required forms accurately. Once you have filled out the quitclaim deed, you can file it with the appropriate county office.

If a quitclaim deed is not recorded in California, it may lead to complications regarding ownership claims. The lack of recording can leave your rights vulnerable, as the deed may not provide legal protection against competing claims. Even though Kansas laws may differ, ensuring your quitclaim deed is recorded protects your interests and provides clarity in ownership matters.

Yes, $0.00 can be a valid consideration when filing a quitclaim deed in Kansas. This means you can transfer property without any payment, which is permissible in many situations. Utilizing a quitclaim deed without consideration allows individuals to achieve straightforward property transfers without the need for financial exchanges, making it a convenient option.

The primary beneficiaries of a quitclaim deed are often family members and individuals involved in transactions where the relationship means trust. In Kansas, utilizing a quitclaim deed without consideration allows for seamless transfers, especially among relatives or friends who want to avoid the complications associated with traditional sales. It also helps simplify estate planning and management by clarifying ownership.