Kansas Pacific

Description

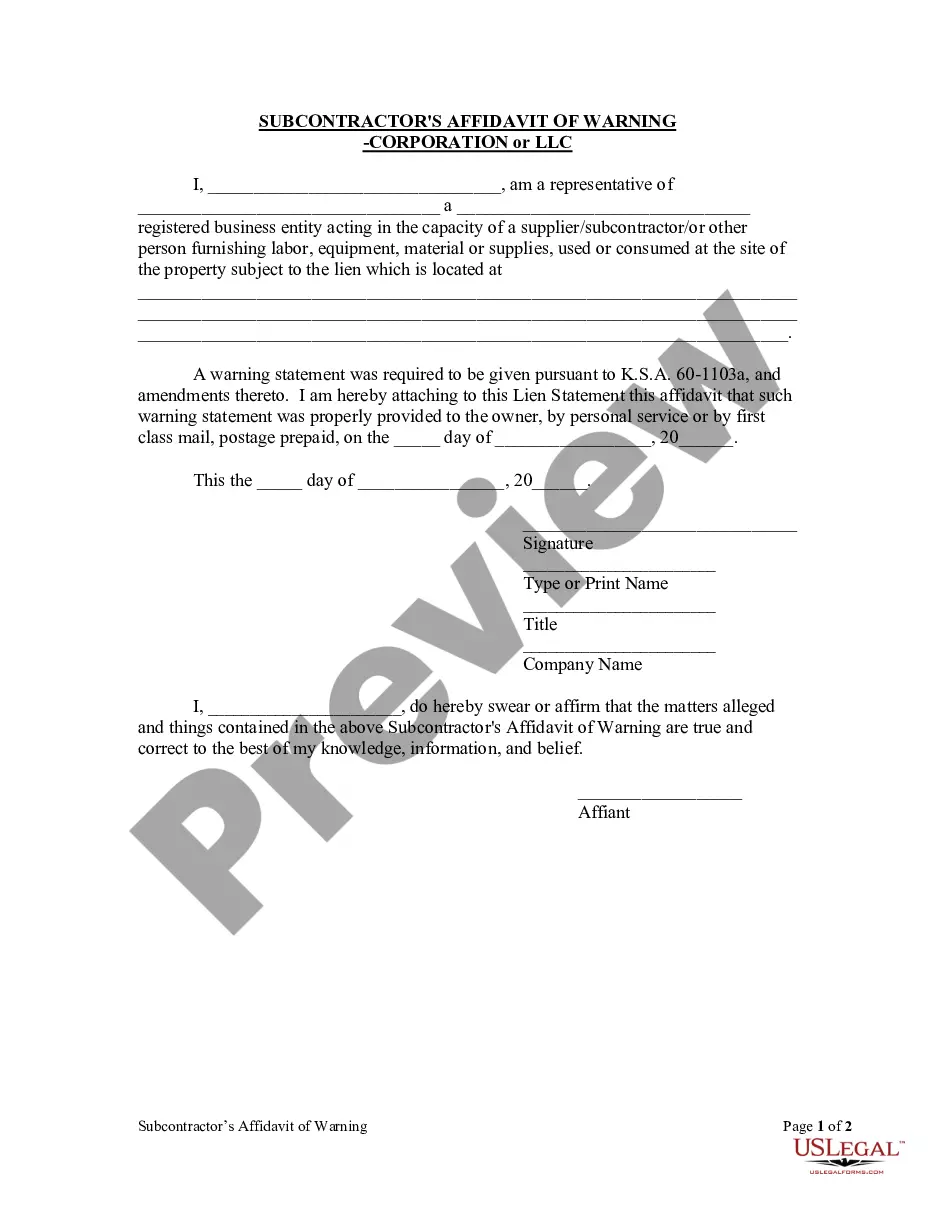

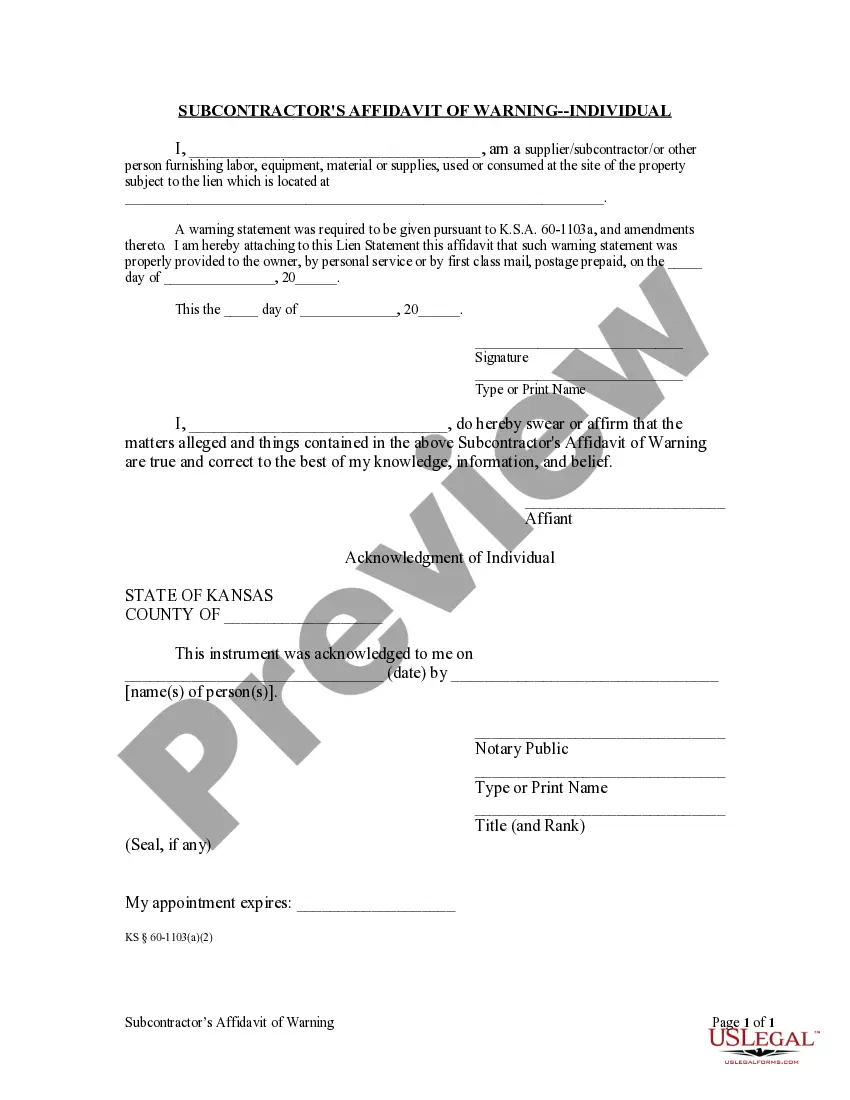

How to fill out Kansas Subcontractor's Affidavit Of Warning - Individual?

- If you're a returning user, log in to your account and check the validity of your subscription before downloading your desired form. Ensure your subscription remains active to continue benefiting from our services.

- For first-time users, begin by exploring the extensive form library. Use the Preview mode to check descriptions, ensuring the selected forms meet your specific requirements and jurisdictional norms.

- If the form you need isn't available, utilize the Search feature to find an alternative that aligns with your needs. Once identified, proceed to the next step.

- Select the Purchase option by clicking the Buy Now button, where you can choose a subscription plan suitable for your needs. Creating an account is necessary to access the full resources of the library.

- Complete your purchase by entering your payment method, either through a credit card or via PayPal, to finalize your subscription and gain access.

- After payment, download the selected form to your device so you can begin filling it out. You can revisit the My Forms section in your profile whenever you need access to your documents.

Utilizing US Legal Forms provides individuals and attorneys with a robust collection of legal templates designed to make the document preparation process straightforward. With premium expert guidance available, achieving accuracy and compliance has never been easier.

Start securing your legal documents today with US Legal Forms and experience the ease and efficiency of our services. Register now and ensure your forms are ready to go!

Form popularity

FAQ

The Pacific Railroad, primarily known as the Kansas Pacific, stretched from the eastern part of Kansas into Colorado. This railroad facilitated the movement of goods and settlers into the western territories. By learning more about the route of the Kansas Pacific, you can gain insight into the historical significance of railroads in shaping the American frontier.

Kansas is home to several historic railroads, including the Atchison, Topeka and Santa Fe Railway, and the Missouri Pacific Railroad. These old railroads, alongside the Kansas Pacific, played crucial roles in connecting communities and boosting trade in the state. Understanding these railroads helps us appreciate the history and growth of transportation in Kansas.

Yes, the Kansas Pacific Railroad was an essential part of America's westward expansion. Established in the 1860s, it connected Kansas with eastern markets and significantly contributed to the development of the region. The Kansas Pacific played a vital role in transporting goods and people, shaping the economy and landscape of Kansas.

If you earn income that is subject to Kansas taxation, you must file a Kansas income tax return. This includes both residents and non-residents earning income in the state. For more tailored advice, look towards the US Legal Forms resources related to Kansas Pacific, which may expedite your filing process.

Yes, if you live or work in a city that imposes a local tax, you typically need to file a city tax return. This can vary based on your municipality, so it’s essential to check local regulations. Finding information about Kansas Pacific can assist you in understanding your local tax obligations effectively.

If you reside or work in Kansas City, you are likely required to file a Kansas City return, regardless of your overall tax status. Staying informed about your obligations ensures compliance and can save you from potential fines in the future. Resources related to Kansas Pacific can help clarify your requirements in this area.

Yes, Kansas allows taxpayers to file amended returns electronically. This can simplify the process and help you receive any refunds you may be entitled to more quickly. For assistance, you might explore the US Legal Forms platform, which can provide resources related to Kansas Pacific, including step-by-step guidance on filing amended returns.

Certain individuals, such as military personnel stationed in Kansas City or non-residents who earn income outside the city, may be exempt from the Kansas City earnings tax. If you qualify for any exemptions, ensure you gather the necessary documentation to support your claim. Understanding Kansas Pacific guidelines can help you navigate these exemptions effectively.

Yes, if you are a resident of Kansas or earn income sourced from Kansas, you are required to file a Kansas tax return. It's essential to keep track of your income and any deductions you may qualify for, as this can affect your overall tax liability. For detailed guidance, examine resources related to Kansas Pacific, which may help streamline the filing process.

If you reside in Missouri or earn income from Missouri sources, you generally need to file a state tax return. However, if you live in Kansas but work in Missouri, your Kansas income tax obligations may still apply. Consider consulting with a tax professional to clarify your situation regarding Kansas Pacific.