Form A Limited Liability Company With The Ability To Establish Series

Description

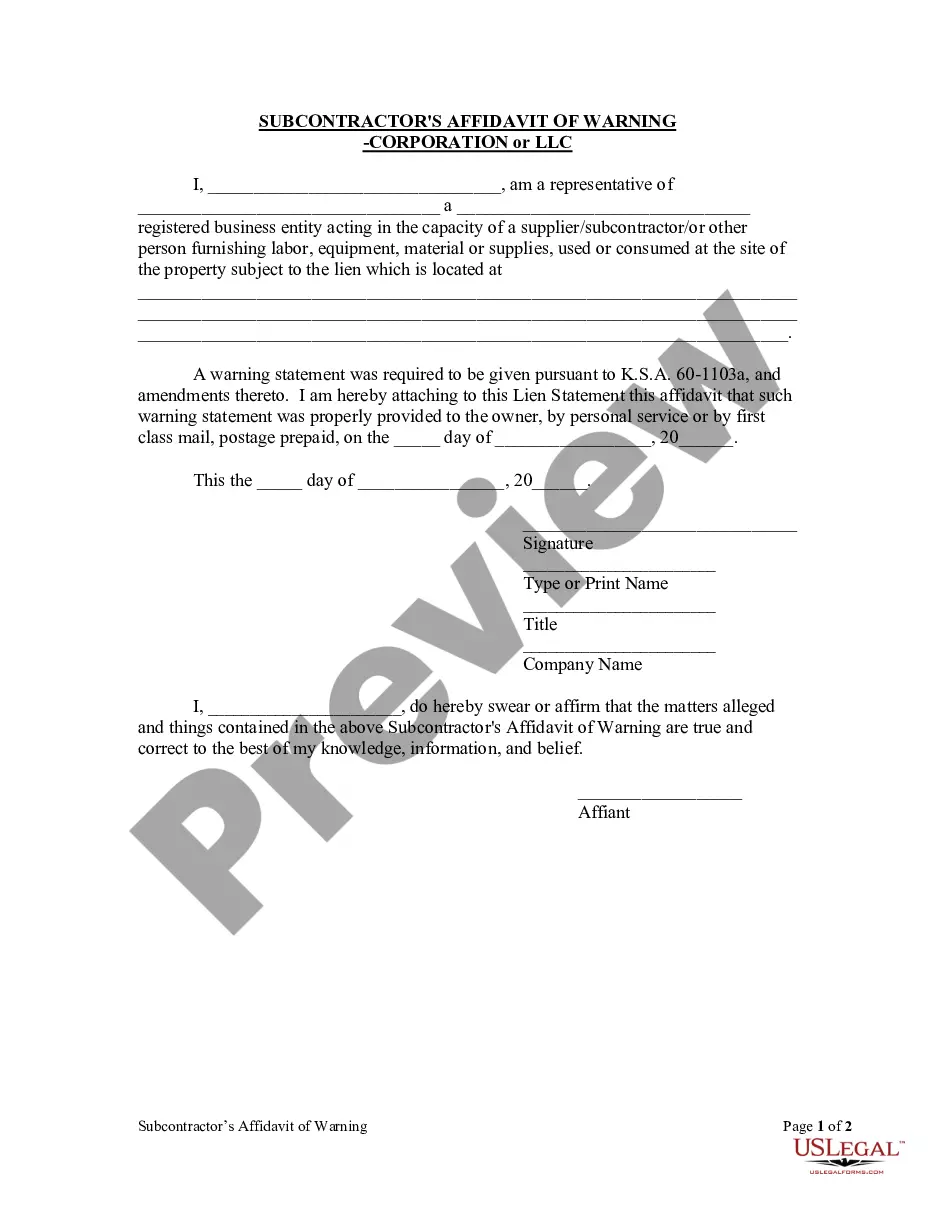

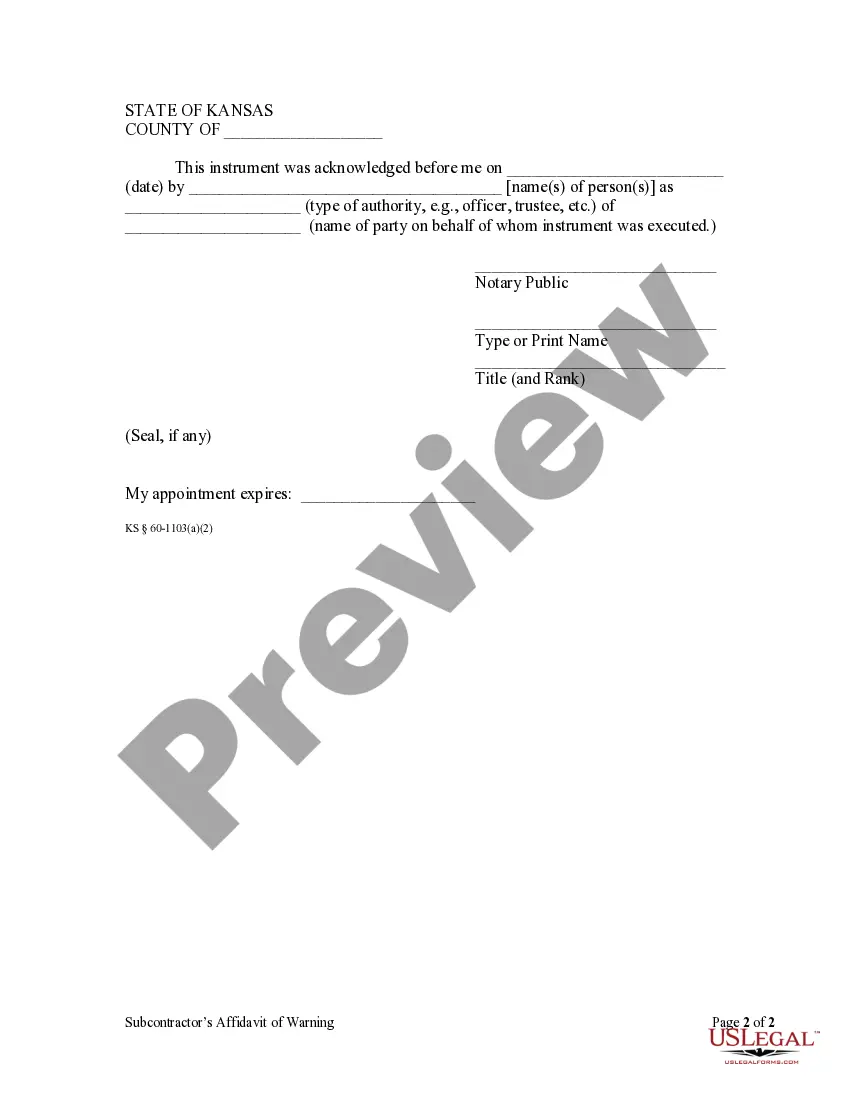

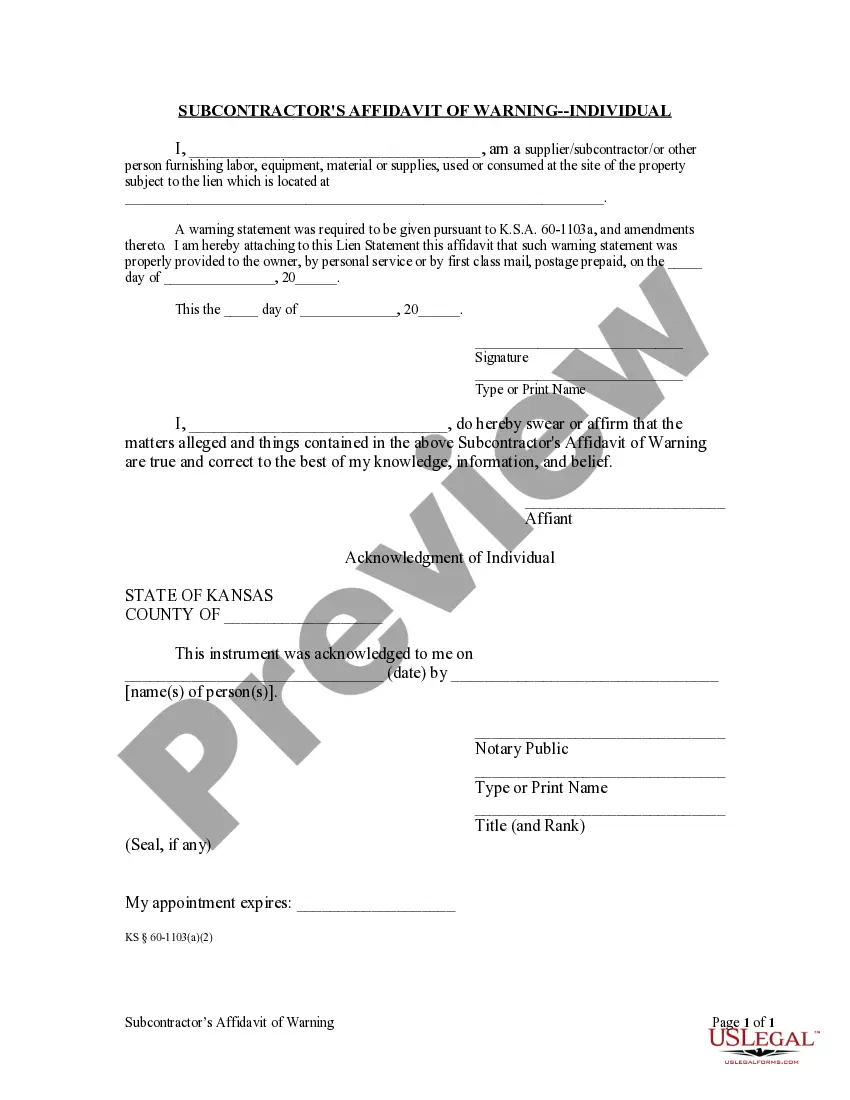

How to fill out Kansas Subcontractor's Affidavit Of Warning By Corporation Or LLC?

- Access your US Legal Forms account. If you’re an existing user, log in to retrieve your previous documents or templates directly. Ensure your subscription is active; if not, consider renewing it based on your plan.

- Review the available templates. For first-time users, explore the Preview mode to find a form that aligns with your state’s requirements. Verify that the chosen template meets your specific business needs.

- Search for alternatives if necessary. Should any discrepancies arise, utilize the search function to locate the correct form template.

- Purchase the selected document. Click on 'Buy Now' and opt for a subscription plan that suits you. You need to create an account to gain full access to the library.

- Complete your transaction. Enter your payment details or utilize PayPal to secure your subscription.

- Download your document. Save the template directly to your device and access it anytime through the 'My Forms' section in your profile for future use.

In conclusion, US Legal Forms empowers you to navigate the legal landscape with ease and confidence. Their robust collection of over 85,000 forms ensures you find what suits your needs.

Start your journey today and take advantage of their resources to build your LLC with ease!

Form popularity

FAQ

To convert an existing LLC to a series LLC, you must follow your state's legal requirements, which generally involve amending your original operating agreement and filing necessary paperwork. It’s important to ensure that your new structure allows you to effectively form a limited liability company with the ability to establish series. Engaging legal services can help make this transition smooth and compliant.

An LLC with the ability to establish series is a special type of limited liability company that allows for the creation of multiple series, each with its own assets and liabilities. This structure provides flexibility and can help protect individual series from the liabilities of others. By forming a limited liability company with the ability to establish series, business owners can efficiently manage risks and operations.

Yes, if you operate multiple LLCs, you need a separate EIN for each entity. This requirement applies even if the LLCs have similar names or purposes. When you form a limited liability company with the ability to establish series, each series should ideally have its own EIN to streamline tax reporting and compliance.

Yes, you can use the same EIN for multiple 'doing business as' (DBA) names if they fall under the same limited liability company. However, it is crucial to maintain proper records and ensure that each DBA is distinct in its operations. If you wish to form a limited liability company with the ability to establish series for each DBA, consider obtaining separate EINs for better financial clarity.

Each series in a series LLC may be required to file its own tax returns, depending on how it's structured and whether it has its own income. This means that if you form a limited liability company with the ability to establish series, you must be aware of the tax obligations for each series. Consulting a tax professional can help you navigate these requirements.

Generally, yes. Each series within a series LLC requires its own Employer Identification Number (EIN) if it has employees or needs to file tax returns separately. By obtaining an EIN for each series, you can effectively manage tax liabilities and simplify financial management when you form a limited liability company with the ability to establish series.

Yes, each series within a series LLC should maintain separate bank accounts. This separation helps ensure that each series maintains its own assets and liabilities, which is essential for protecting the liability shield provided by forming a limited liability company with the ability to establish series. Using separate accounts also simplifies accounting and tax reporting for each series.

Yes, an LLC can establish a series, which is one of the primary features of a Series LLC. Each series can operate independently, holding its own assets and liabilities while being part of the parent LLC. This flexibility allows business owners to manage various operations without the need for multiple LLCs. If you are interested in forming a limited liability company with the ability to establish series, consider consulting USLegalForms for expert guidance.

The main advantage of a Series LLC is its ability to protect assets by separating liabilities across different series. This structure allows business owners to manage multiple ventures under a single legal entity. Additionally, each series can have its own assets and operations, streamlining management and reducing overall costs. It's a strategic choice for entrepreneurs looking to diversify their investments.

To make your LLC a Series LLC, start by checking your state's laws regarding Series LLC formation. Next, amend your existing operating agreement to include provisions for creating series within your LLC. Finally, file the necessary documentation with your state authorities. Platforms like USLegalForms can assist you in this process, ensuring compliance and proper setup.