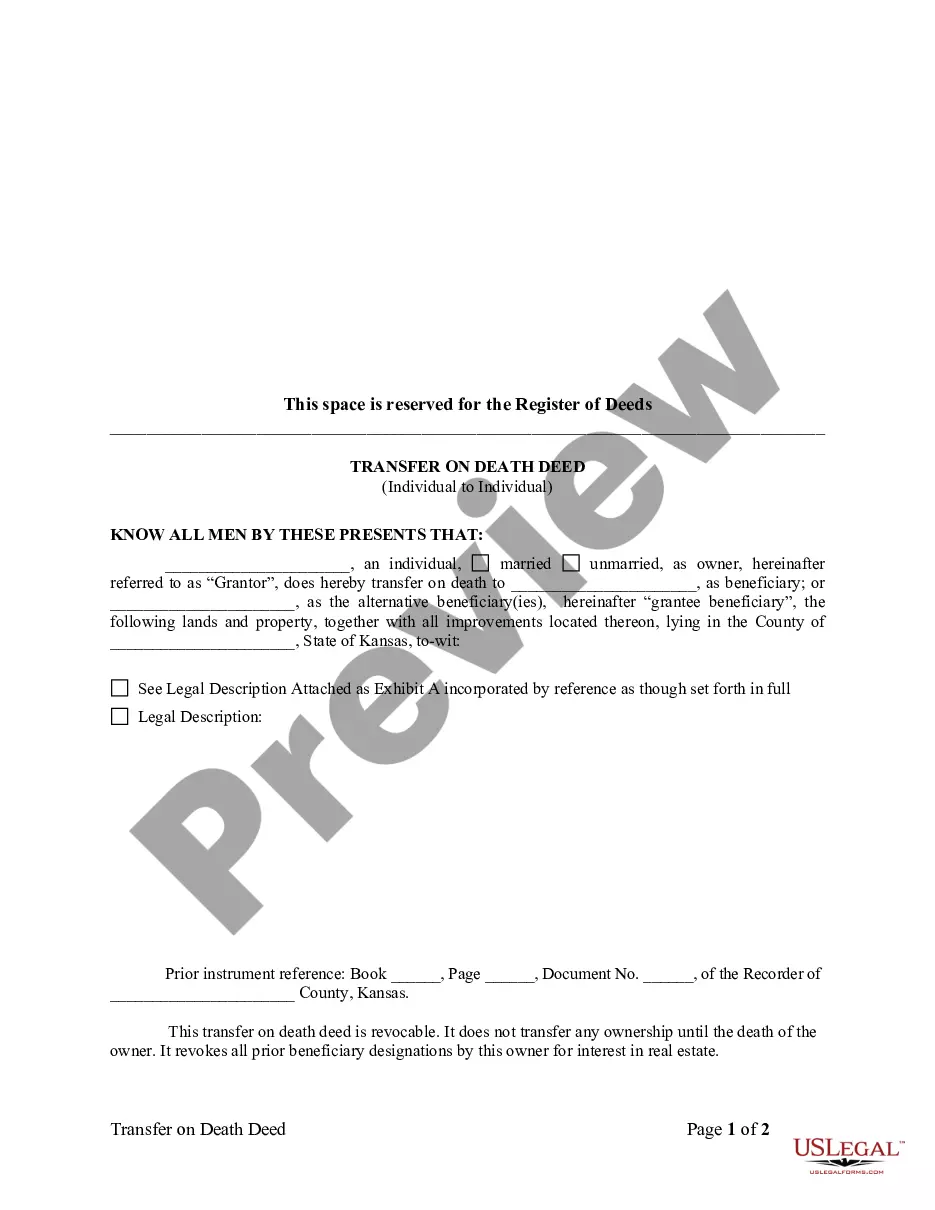

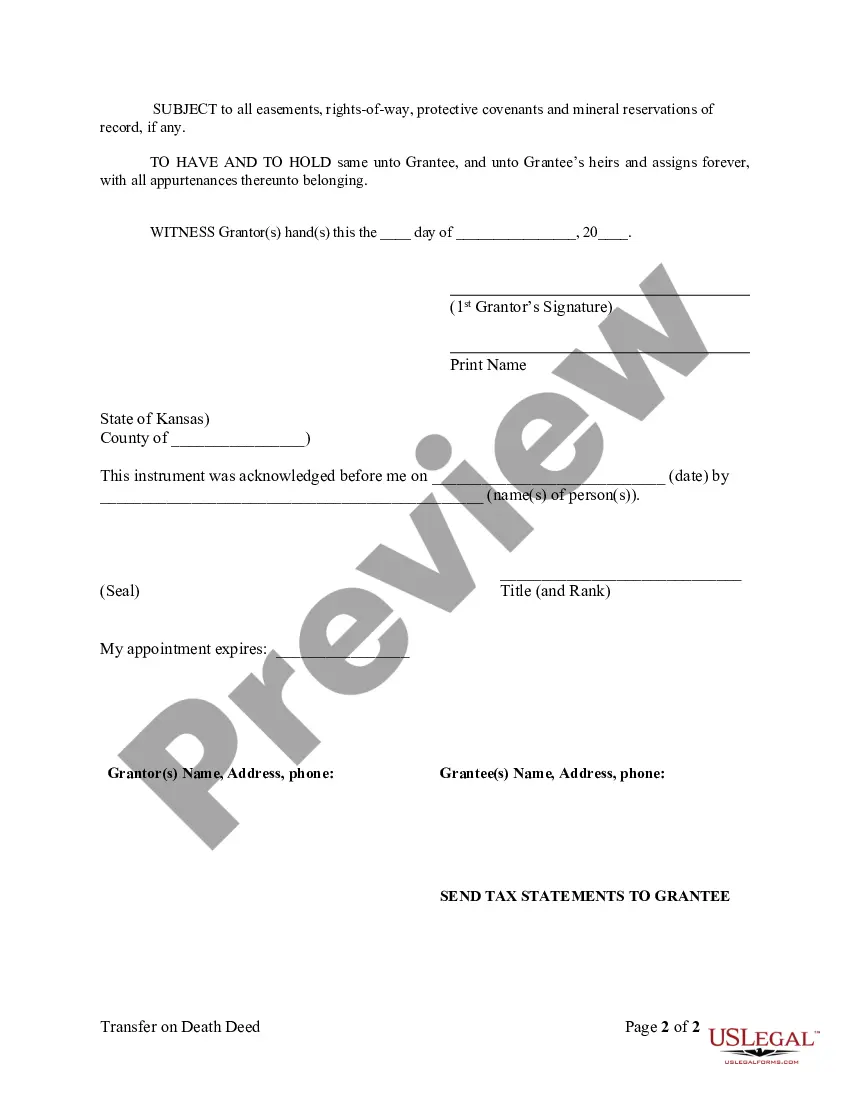

Kansas Transfer On Death Deed Form With Beneficiaries

Description

How to fill out Kansas Transfer On Death Deed Or TOD - Beneficiary Deed For Individual To Individual?

Utilizing legal templates that adhere to federal and state regulations is crucial, and the web provides countless alternatives to select from.

However, what’s the purpose of spending your time searching for the appropriate Kansas Transfer On Death Deed Form With Beneficiaries example online when the US Legal Forms digital library already compiles such templates in one location.

US Legal Forms stands as the largest online legal repository featuring more than 85,000 customizable templates created by attorneys for all professional and personal situations.

View the template using the Preview feature or through the textual description to confirm it suits your requirements. Search for another example using the search tool located at the top of the page if needed. Click Buy Now once you’ve found the appropriate form and choose a subscription plan. Create an account or Log In and complete the payment using PayPal or a credit card. Select the format for your Kansas Transfer On Death Deed Form With Beneficiaries and download it. All templates available via US Legal Forms are reusable. To re-download and complete previously saved forms, access the My documents tab in your account. Experience the most comprehensive and user-friendly legal documentation service!

- They are straightforward to navigate, with all documents organized by state and intended use.

- Our specialists remain current with legislative changes, ensuring that your form is always updated and compliant when acquiring a Kansas Transfer On Death Deed Form With Beneficiaries from our site.

- Getting a Kansas Transfer On Death Deed Form With Beneficiaries is simple and efficient for both existing and new users.

- If you already possess an account with an active subscription, Log In and save your required document sample in the correct format.

- If you're new to our site, follow the instructions below.

Form popularity

FAQ

Steps to Obtaining a Child Care License Visit the Child Care Licensing Page and Complete the New Provider Training. ... Apply for the Child Care License. ... Submit Background Check Form and Fingerprints. ... Create a Utah ID. ... Log into Your Child Care Licensing Portal. ... Obtain and Complete the Following: ... Onsite Inspection with Licensor.

You need to be licensed as a licensed family child care provider in Utah if you provide care: In the home where you reside. In the absence of the child's parent. For five to 16 unrelated children.

Care in the home of the provider. A license or certificate is not required for care provided in the home of the provider for less than four hours per day, or for fewer than five children in the home at one time.

13 to 24 months: one staff for up to four children () ? 2 years: one staff for up to seven children () ? 3 years: one staff for up to 12 children () ? 4 years: one staff for up to 15 children () ? 5 to 13 years: one staff for up to 20 children () ? During naptime, higher ratios are permitted for ...

Utah Admin. Code 381-100-10 TABLE 1Age GroupCaregiver-to-Child ratioMaximum Group Size0-11 Months - Infant12-17 Months -- Younger Toddler18-23 Months -- Older Toddler04 more rows

Care for up to 8 children with 1 caregiver including no more than 2 children under age 2; OR care for up to 6 children with 1 caregiver including no more than 3 children under age 2; OR care for up to 16 children with 2 caregivers including no more than 4 children under age 2.