Kansas 60 Lien Withholding

Description

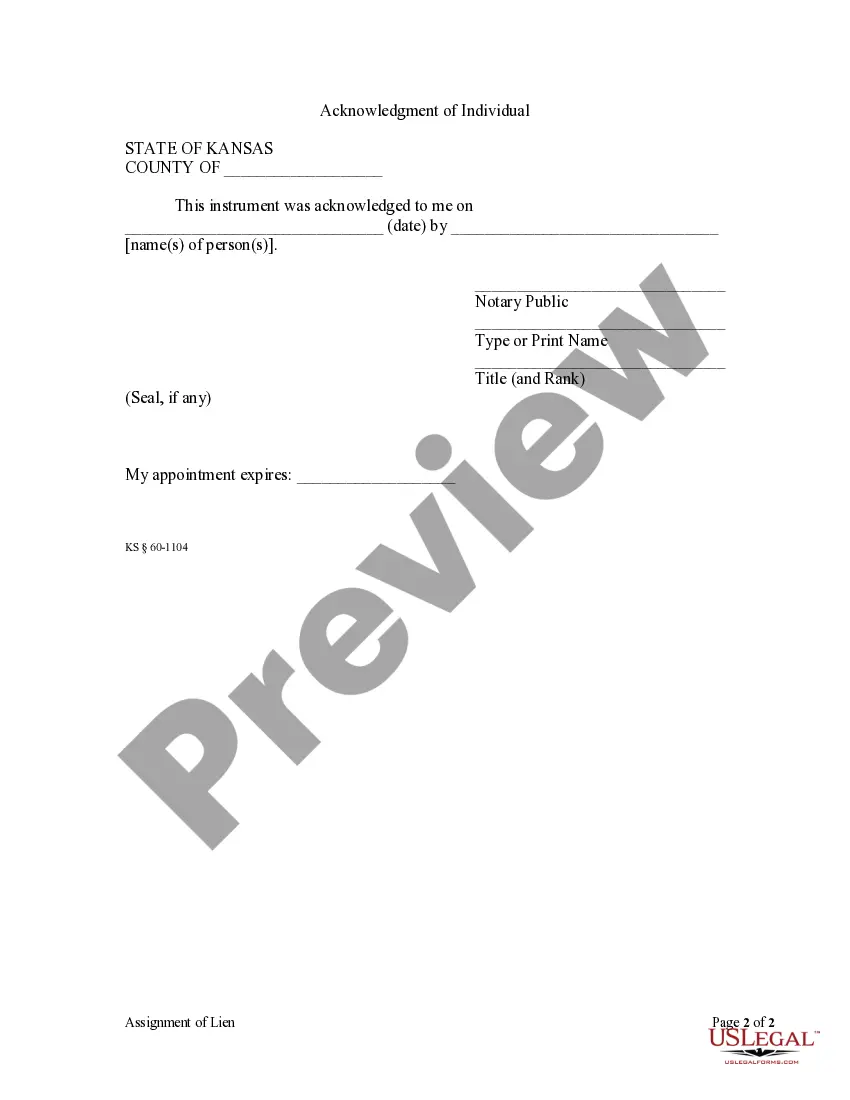

How to fill out Kansas Assignment Of Lien - Individual?

- Log in to your account on US Legal Forms if you're a returning user. Check that your subscription is active; if necessary, renew it based on your selected payment plan.

- For new users, start by browsing the extensive library of over 85,000 legal forms. Use the search function to locate the Kansas 60 lien withholding template that meets your needs and local jurisdiction requirements.

- Once you've verified the document's adequacy in Preview mode, proceed to purchase. Click the 'Buy Now' button and select your desired subscription plan.

- Complete the purchase by entering your payment details or through your PayPal account to gain immediate access.

- After payment, download the Kansas 60 lien withholding form and save it on your device. You can find it any time in the 'My Forms' section of your profile.

US Legal Forms not only streamlines your document retrieval process but also ensures you benefit from a comprehensive legal library. Whether you need a specific form or consult with legal experts, this platform empowers your legal journey.

Don’t hesitate to leverage the resources available through US Legal Forms. Start today and experience the convenience of obtaining your Kansas 60 lien withholding document efficiently.

Form popularity

FAQ

To obtain a 60-day tag in Kansas, begin by completing the application form available through your local county treasurer's office. You'll need to provide necessary documentation, such as proof of ownership and identification. After submitting your application, you will receive your temporary tag, which is crucial during the period of 'Kansas 60 lien withholding' or until your permanent registration is finalized.

In Kansas, a lien is typically valid for five years from the date of filing, but it can be renewed before expiration. This duration is crucial for both debtors and creditors to understand, as it affects the enforceability of the lien. After five years, if not renewed, the lien may be released, allowing the property owner greater freedom. Staying informed about Kansas 60 lien withholding ensures you can protect your interests effectively.

To put a lien on property in Kansas, you must file a lien statement with the county clerk's office. This document should include details about the debt and the involved parties. After filing, the lien is officially recorded, making it enforceable under Kansas law. Using USLegalForms can streamline this process by providing the necessary templates and guidance for Kansas 60 lien withholding.

In Kansas, a contractor may still file a lien even if a formal contract does not exist. This situation is often addressed through the Kansas 60 lien withholding law, which provides guidelines for lien claims based on the work completed. However, it is essential for the contractor to prove that they have provided valuable services or materials that benefit the property. If you are unsure about the lien process, US Legal Forms can help you navigate this effectively.

The discovery rule in Kansas refers to the legal principle that the time limits for filing a lawsuit or a lien only begin when the injured party discovers, or reasonably should have discovered, the damage or wrong. This rule can play a significant role in cases concerning Kansas 60 lien withholding, impacting how long individuals have to assert their rights. It's vital to understand how this rule applies to your situation, and consulting with a knowledgeable professional can provide clarity.

A notice of intent to file a lien informs property owners that a contractor or supplier intends to seek a lien if the owed payment is not made. This notice serves as a warning and is part of the process under Kansas 60 lien withholding, helping property owners understand their obligations. Sending this notice can often prompt payment and avoid legal complications. Utilizing tools on UsLegalForms can assist in drafting this notice correctly.

A contractor in Kansas typically has six months from the date of the last work performed or material supplied to file a lien. This time frame is essential to ensure that the rights under Kansas 60 lien withholding are not forfeited. It's important for contractors to keep accurate records of their work and payments to avoid missing this deadline. Leaning on platforms like UsLegalForms can simplify the filing process and provide the necessary documentation.

In Kansas, disorderly conduct is considered a misdemeanor offense, which can include a variety of actions disturbing the peace. The penalties for disorderly conduct may include fines and potential jail time, depending on the severity of the behavior. If charges arise, it's crucial to understand how they can affect financial matters, like liens under Kansas 60 lien withholding. A legal expert can provide clarity on navigating these issues.

The statute 60 1101 in Kansas addresses the rules and regulations governing liens against property. Specifically, it outlines how individuals or businesses can claim a right to payment owed for services or materials provided. Understanding this statute is essential for any property owner, contractor, or supplier dealing with Kansas 60 lien withholding issues. It ensures that all parties follow proper procedures to enforce their rights.