Kansas 60 Lien With Title

Description

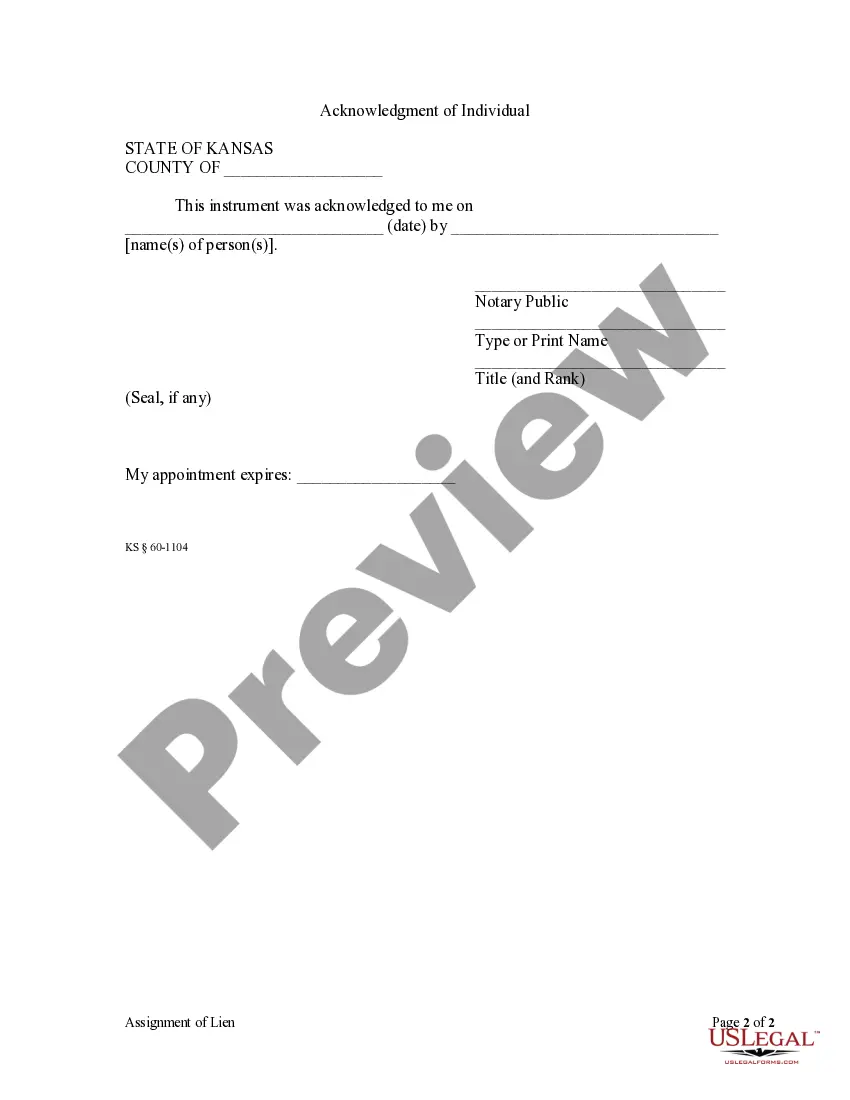

How to fill out Kansas Assignment Of Lien - Individual?

- If you're a returning user, simply log in to access your account. Download the necessary form template by clicking the Download button. Ensure your subscription is current; renew if needed.

- For first-time users, begin by browsing through the available forms and check the preview option to verify that it aligns with your needs and local regulations.

- If adjustments are necessary, utilize the Search tab to find the right template that meets your requirements.

- Once you identify the suitable form, click on the Buy Now button to choose your subscription plan. You will need to create an account to tap into the extensive library.

- Proceed with your payment by entering your credit card details or using your PayPal account to finalize the subscription.

- After purchasing, download your form. It will be saved on your device, and you can access it anytime via the My Forms section.

By following these steps, you can efficiently obtain your Kansas 60 lien with title.

Get started today with US Legal Forms to streamline your legal documentation process!

Form popularity

FAQ

To put a lien on a title, you need to fill out the appropriate forms and submit them along with any required fees to your state’s vehicle registration office. This process legally attaches the lien to the vehicle, protecting your interests as a creditor. Understanding the specific steps for a Kansas 60 lien with title is vital to ensure the lien is enforceable. Using platforms like USLegalForms can simplify the filing process and help avoid common errors.

In Kansas, a contractor can file a lien without a formal contract, but this can complicate the process. If the contractor provided work or materials, they may still have grounds for a lien based on implied or verbal agreements. However, a Kansas 60 lien with title helps solidify the claim and enforce legal rights. To navigate this situation effectively, consider utilizing resources available on USLegalForms.

To put a lien on a title, you must submit the necessary documentation to the appropriate state agency, such as the Department of Motor Vehicles. This paperwork typically includes details about the debt and the parties involved. For a Kansas 60 lien with title, ensuring that your forms are accurately filled out is critical to avoid any delays. Seek assistance from a service like USLegalForms to guide you through this process.

To file a lien on a property in Kansas, you must first prepare a lien statement that outlines the debt owed. After drafting this document, you can file it with the county clerk's office in the county where the property is located. Utilizing a Kansas 60 lien with title can facilitate this process, ensuring your legal rights are properly documented. Consider using platforms like USLegalForms to help you prepare the necessary paperwork.

Yes, it is possible for someone to put a lien on your car without your knowledge, especially if they have a legal claim against you. Typically, creditors such as banks or contractors may file a lien if they believe it is warranted. If you're concerned about a Kansas 60 lien with title, regularly check your vehicle's title history to stay informed. This proactive approach helps you discover any liens before they become problematic.

In Illinois, any creditor with a legal claim against an individual or entity can file a lien. This includes contractors, suppliers, and employees owed wages. If you're seeking to file a Kansas 60 lien with title, understanding your rights is essential. Make sure to follow the correct legal procedures to protect your interests.

Selling a car with a lien in Kansas requires a few important steps to ensure a smooth transaction. First, contact your lender to understand the payoff amount and request a lien release document. You can negotiate with the buyer and complete the transfer once the lien is settled. Platforms like US Legal Forms can assist you in handling the paperwork involved in clearing your Kansas 60 lien with title, making the process simpler for both you and the buyer.

Filling out the back of a Kansas car title involves providing specific information about the buyer and seller. Begin by entering the seller's name and address in the designated fields, then sign and date the title. Next, the buyer should fill in their name and address, and sign as well. Completing this process accurately is crucial to avoid complications when addressing any Kansas 60 lien with title concerns.

In Kansas, contractors generally have six months from the completion of the project to file a lien. This time frame is important for securing rights to collect for provided services. If you are a contractor or homeowner dealing with a Kansas 60 lien with title, understanding this timeline can help you take timely action.

In Kansas, the penalty for disorderly conduct can include a fine or potential jail time. The severity of the punishment often depends on the circumstances of the act. Being informed about local laws, such as penalties related to disorderly conduct, can help prevent complications that may interfere with property matters, including the implications of a Kansas 60 lien with title.