Kansas Corporation Withdrawal

Description

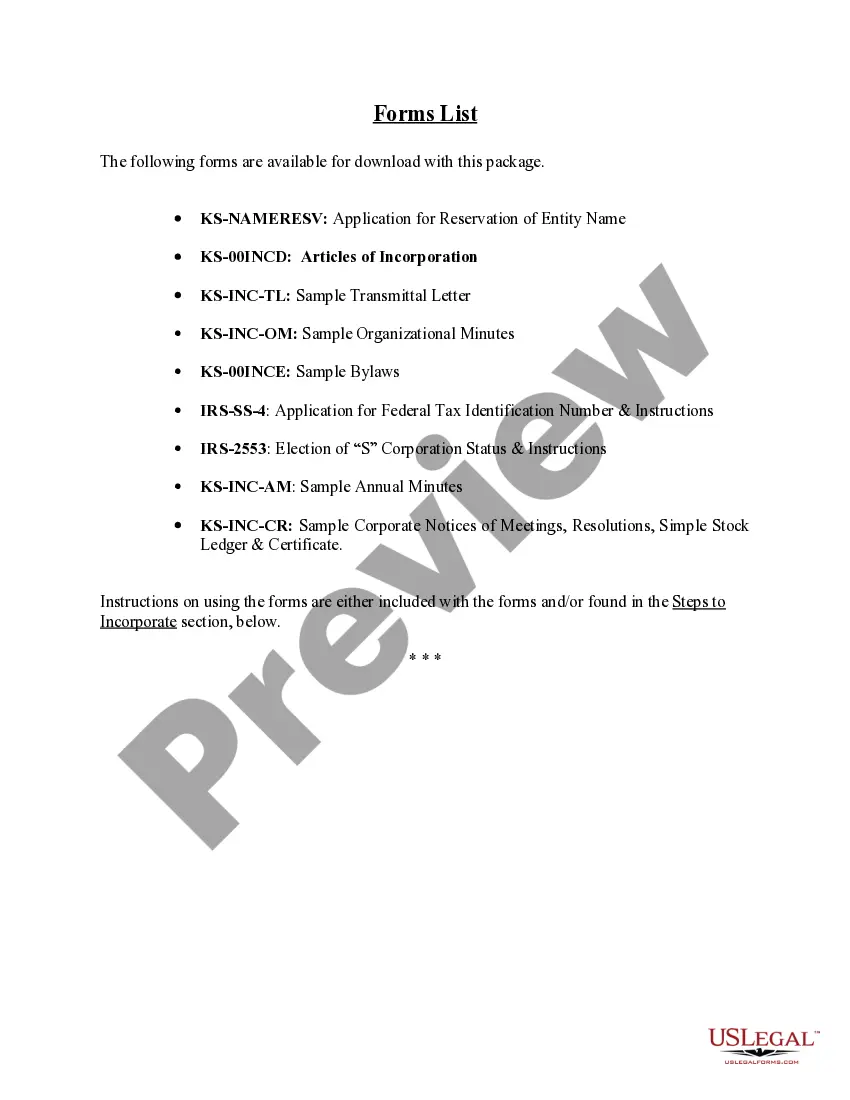

How to fill out Kansas Business Incorporation Package To Incorporate Corporation?

Securing a reliable source for obtaining the latest and most pertinent legal templates is a significant part of navigating bureaucracy.

Finding the appropriate legal documents requires accuracy and careful consideration, making it essential to obtain samples of Kansas Corporation Withdrawal exclusively from trustworthy sources, such as US Legal Forms. An incorrect template can squander your time and delay your current situation.

After obtaining the form on your device, you can either edit it using the editor provided or print it out to complete it manually. Eliminate the hassle associated with your legal paperwork. Explore the extensive US Legal Forms catalog where you can locate legal templates, evaluate their applicability to your circumstances, and download them without delay.

- Utilize the catalog navigation or search bar to find your template.

- Access the form’s details to ensure it meets the standards of your state and locality.

- Preview the form, if available, to confirm it is the one you need.

- Return to the search to find the correct template if the Kansas Corporation Withdrawal does not meet your criteria.

- If you are confident about the form’s suitability, download it.

- As a registered customer, click Log in to verify your identity and access the templates you’ve selected in My documents.

- If you don’t have a profile yet, click Buy now to obtain the form.

- Select the pricing option that caters to your requirements.

- Proceed with the registration to finalize your purchase.

- Complete your purchase by selecting a payment option (credit card or PayPal).

- Choose the file format for downloading Kansas Corporation Withdrawal.

Form popularity

FAQ

These are examples of the benefits that survivors may receive: Surviving spouse, full retirement age or older ? 100% of the deceased worker's benefit amount. Surviving spouse, age 60 ? through full retirement age ? 71½ to 99% of the deceased worker's basic amount.

Today, you can apply for retirement, disability, and Medicare benefits online, check the status of an application or appeal, request a replacement Social Security card (in most areas), print a benefit verification letter, and more ? from anywhere and from any of your devices!

You must have worked and paid Social Security taxes in five of the last 10 years. If you also get a pension from a job where you didn't pay Social Security taxes (e.g., a civil service or teacher's pension), your Social Security benefit might be reduced.

Have you heard about the Social Security $16,728 yearly bonus? There's really no ?bonus? that retirees can collect. The Social Security Administration (SSA) uses a specific formula based on your lifetime earnings to determine your benefit amount.

If you're getting Social Security retirement benefits, some members of your family may also qualify to receive benefits on your record. If they qualify, your ex-spouse, spouse, or child may receive a monthly payment of up to one-half of your retirement benefit amount.

You must have worked and paid Social Security taxes in five of the last 10 years. If you also get a pension from a job where you didn't pay Social Security taxes (e.g., a civil service or teacher's pension), your Social Security benefit might be reduced.

General information for recording statements on the SSA-795. Use an SSA-795 whenever a signed statement is required or desirable, except when we request some other form or questionnaire or we can readily adapt for the statement. Prepare an SSA-795 using the claimant's own words whenever possible.

If you will reach full retirement age in 2023, the limit on your earnings for the months before full retirement age is $56,520. Starting with the month you reach full retirement age, there is no limit on how much you can earn and still receive your benefits.