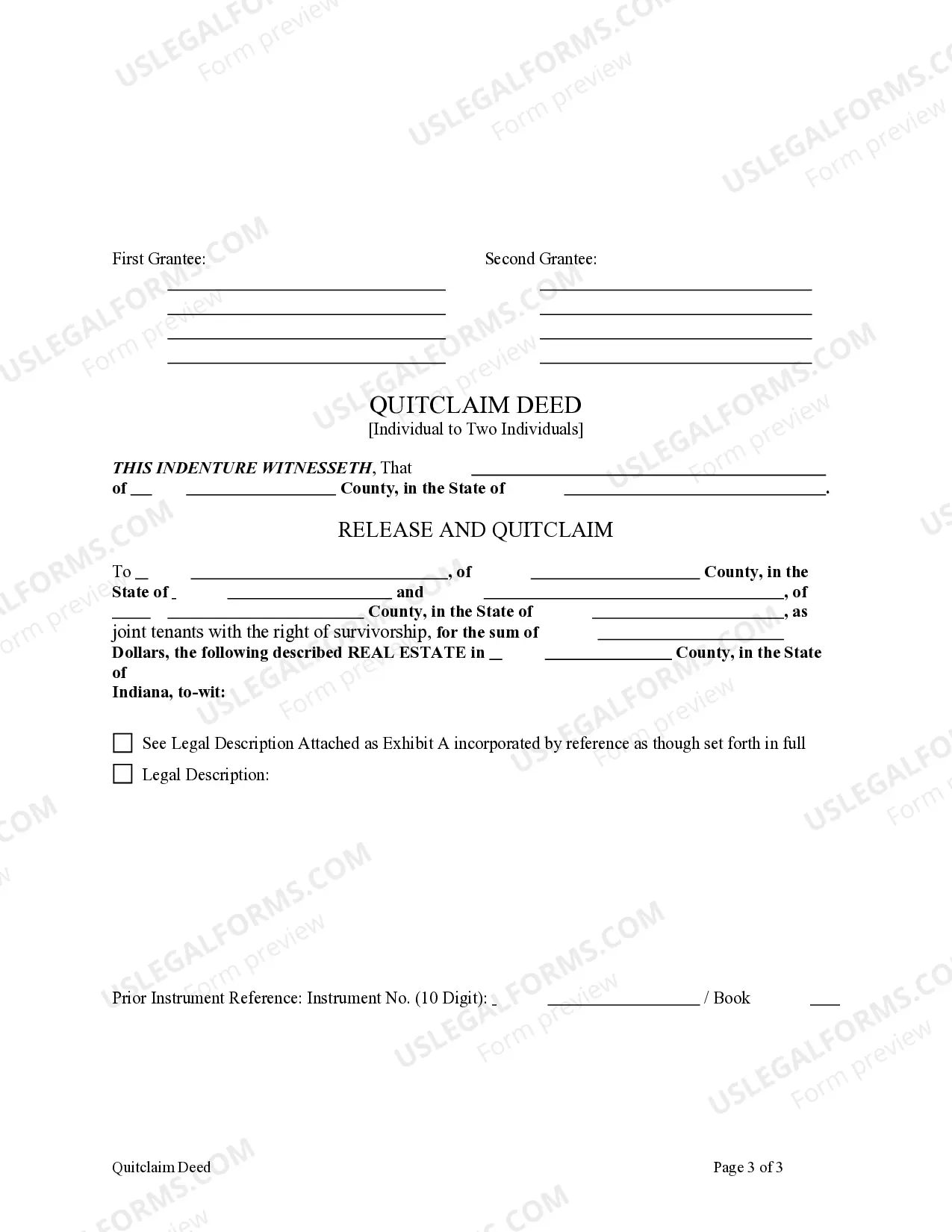

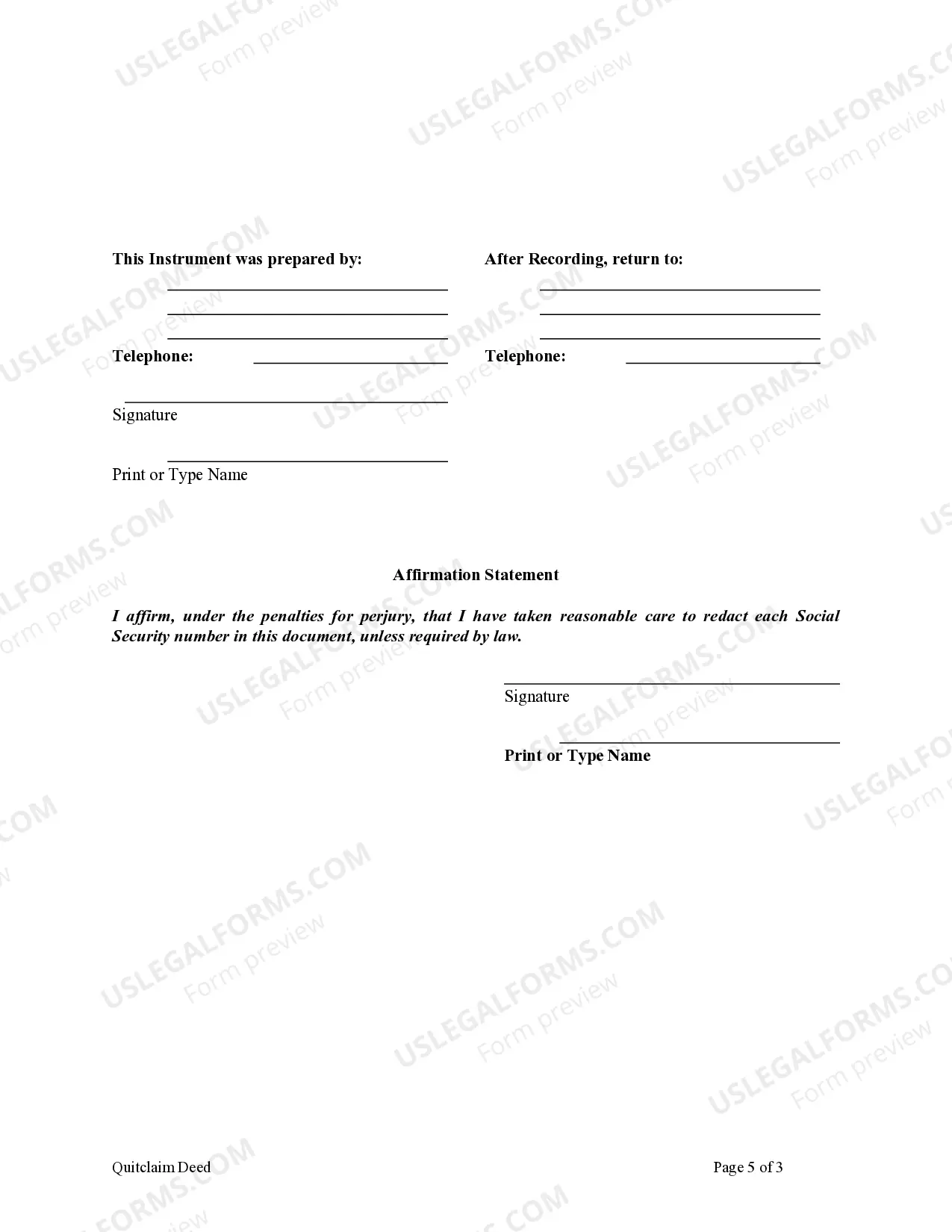

This form is a Quitclaim Deed where the grantor is an individual and the grantees are two individuals holding title as joint tenants.

Joint Tenants Form With Full Rights Of Survivorship

Description

Form popularity

FAQ

You do not necessarily need a lawyer to add someone to a deed, but it can be beneficial. Using a joint tenants form with full rights of survivorship allows you to add a person without legal assistance. However, consulting a lawyer can help ensure that all paperwork is completed correctly and that you understand any legal implications.

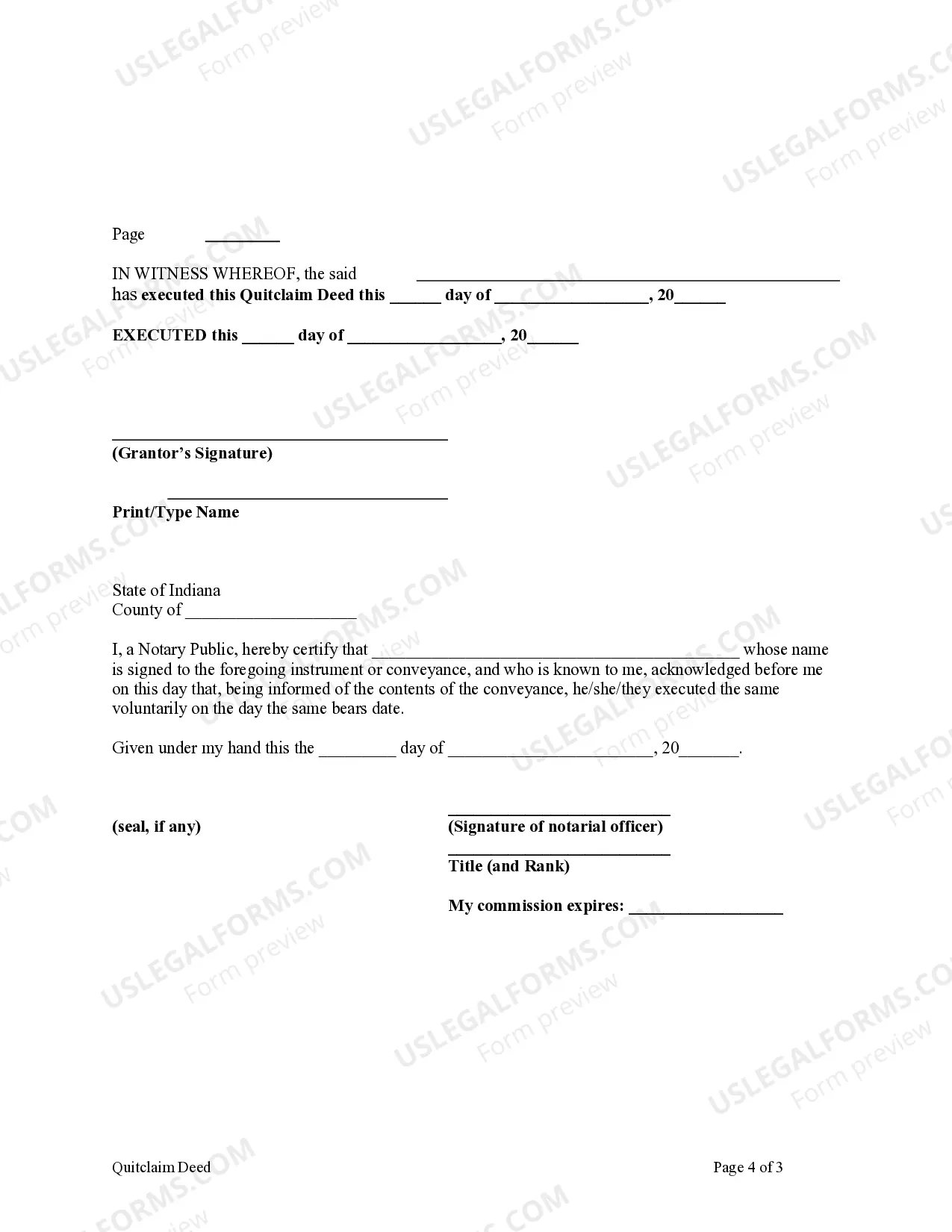

To obtain a survivorship deed, you can use a joint tenants form with full rights of survivorship available through platforms like US Legal Forms. The process generally involves completing the form, having it signed by all parties, and filing it with your local county clerk. It is essential to ensure that all legal requirements are met to establish proper ownership.

While the right of survivorship offers benefits, it also has drawbacks. One significant disadvantage is that it limits the transfer of ownership since both joint tenants must agree to changes. If one owner wishes to sell their share, they cannot do so without the other owner's consent, which can create complications and prevent flexibility in managing the property.

Yes, a survivorship deed, which utilizes a joint tenants form with full rights of survivorship, typically takes priority over a will. When the property owner passes away, the surviving joint tenant automatically receives full ownership of the property. This means that the property does not go through probate, and the terms of the will do not affect the ownership transfer.

The step-up basis for joint tenants with right of survivorship is similar to the process seen in other joint ownership formats. It allows the surviving owner to inherit the deceased's share of the property at its current market value. This adjustment helps minimize capital gains tax for the survivor upon later selling the property. By using a joint tenants form with full rights of survivorship, property owners can ensure a smooth transition and financial advantage during estate transfers.

Generally, assets in a joint account do not automatically receive a step-up in basis unless they are specifically designated as joint tenants with full rights of survivorship. In such cases, only the deceased owner's portion of the account is eligible for the step-up in basis. Understanding these distinctions is crucial for effective estate planning. If you need guidance on forming a joint account correctly, a joint tenants form with full rights of survivorship can simplify the process.

Yes, a surviving spouse typically receives a full step-up in basis for the jointly owned property when the other spouse passes away. This step-up applies to the deceased spouse's share of the property, allowing the surviving spouse to benefit from a higher tax basis. This change can significantly reduce taxation on any future sale of the property. When considering options, a joint tenants form with full rights of survivorship is an effective strategy for couples.

The step-up basis for joint tenants with rights of survivorship refers to the increase in the value of an asset upon an owner's passing. Under this arrangement, only the deceased tenant's share of the property receives the step-up in basis. This means that the surviving tenant retains a higher basis for tax purposes, minimizing potential capital gains taxes if the property is sold later. Utilizing a joint tenants form with full rights of survivorship can be beneficial for estate planning.

To file a joint tenancy with full rights of survivorship, start by preparing a deed that outlines this ownership arrangement. You can utilize services like US Legal Forms to access customizable templates to create a compliant document. Once completed, sign and have the deed notarized, then record it with your local land office to make your joint tenants form legally effective. This process ensures your property rights are clearly established and recognized.

The terms 'joint tenancy' and 'joint with survivorship' generally refer to the same legal structure where co-owners hold the property equally. However, 'joint tenancy' encompasses the broader concept, while 'with right of survivorship' specifically highlights the automatic transfer of ownership to the surviving tenant upon death. If you want to establish a joint tenants form with full rights of survivorship, ensure the agreement clearly reflects this intent to avoid any future confusion.