Ccdf Income Guidelines Indiana 2022 Withholding

Description

How to fill out Indiana Child Care Services Package?

Locating a reliable source to obtain the latest and suitable legal templates is a significant part of navigating bureaucracy.

Acquiring the appropriate legal documents requires accuracy and meticulousness, which is why it's crucial to source Ccdf Income Guidelines Indiana 2022 Withholding only from trustworthy providers, such as US Legal Forms. An incorrect template can squander your time and delay your circumstances.

Once you have the form on your device, you can edit it using the editor or print it and fill it out manually. Eliminate the inconvenience associated with your legal documents. Explore the comprehensive library of US Legal Forms to discover legal templates, verify their suitability for your situation, and download them immediately.

- Utilize the library navigation or search bar to find your template.

- Examine the form's summary to determine if it aligns with the stipulations of your state and locality.

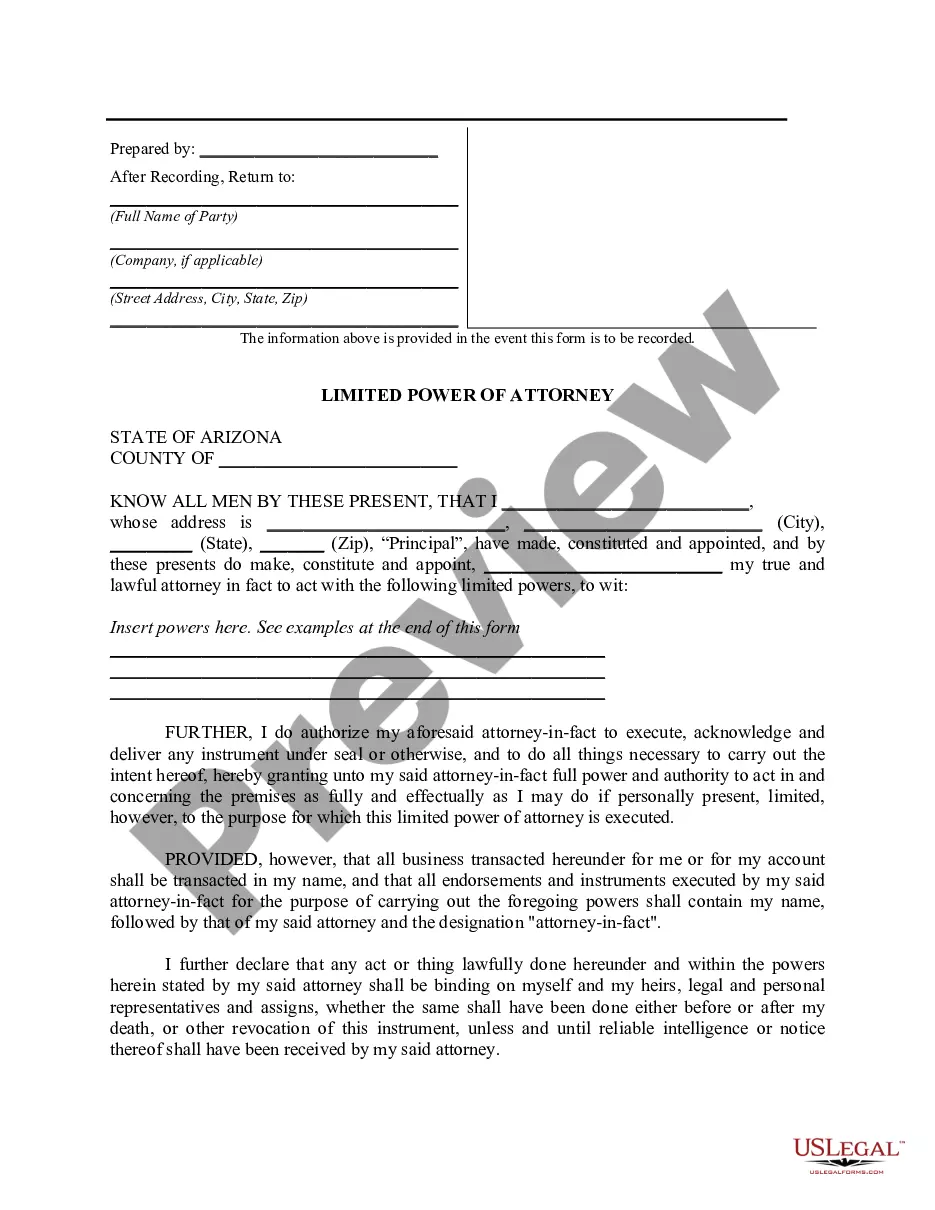

- Review the form preview, if accessible, to ensure it is indeed the template you need.

- Return to your search and find the suitable document if the Ccdf Income Guidelines Indiana 2022 Withholding does not fulfill your criteria.

- Once you are confident about the form's applicability, download it.

- If you are a registered user, click Log in to verify your identity and access your chosen templates in My documents.

- If you do not possess an account yet, click Buy now to acquire the template.

- Choose the pricing plan that suits your requirements.

- Proceed to the enrollment process to complete your purchase.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading Ccdf Income Guidelines Indiana 2022 Withholding.

Form popularity

FAQ

A short form mortgage shall set forth the date on which it is executed, the names of the parties thereto, the amount of the indebtedness secured or to be secured thereby, the description of the real property mortgaged as security for the indebtedness, and a statement incorporating by reference the general provisions, ...

A mortgage note is a legal document that sets out all the terms of the mortgage between a borrower and their lending institution. It includes terms such as: The total amount of the home loan. The down payment amount. Whether monthly or bimonthly payments are required.

A Master Form is a central document where all necessary data can be inputted and can be used to generate multiple copies.

This collateral can take many different forms, but the most common type is real estate. Other security instruments include things like vehicles, jewelry, art, and even patents or copyrights. Basically, anything of value that can be used as collateral can be considered a security instrument.

Fannie Mae is a leading source of mortgage financing in the United States. We don't originate mortgage loans or lend money directly to borrowers. Instead, we purchase mortgage loans made by lenders, who are then able to use those funds to offer mortgage loans to more people.

Definition of 'Master Mortgage' The Master Mortgage is a document created when a property is purchased for the first time. It is filed in the public land records and its purpose is to keep track of the initial mortgage and of any liens that might be associated with the property.