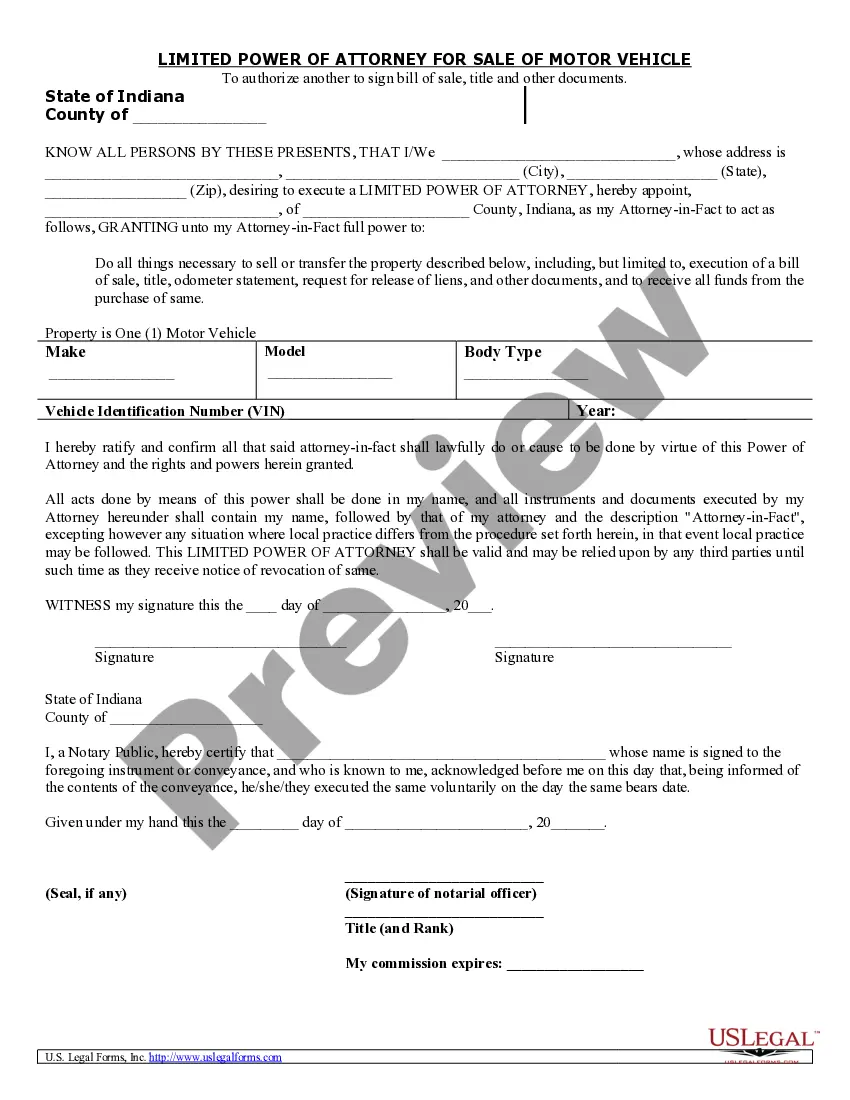

This is a limited power of attorney authorizing your agent to execute a bill of sale, title and other documents in connection with the sale of a motor vehicle. This form contains a state specific acknowledgment. This form allows your agent to do all things necessary to sell or transfer property, including the execution of a bill of sale, title, odometer statement, request for release of liens and other documents and to receive all funds from the purchase of the same.

Indiana Bmv Power Of Attorney Withholding

Description

How to fill out Indiana Power Of Attorney For Sale Of Motor Vehicle?

Individuals often connect legal documents with something intricate that only an expert can handle.

In some respect, this is accurate, as creating the Indiana Bmv Power Of Attorney Withholding necessitates considerable understanding of subject matter criteria, including state and local statutes.

However, with US Legal Forms, the process has become simpler: pre-prepared legal templates for every life and business scenario specific to state laws are compiled in a single online repository and are now accessible to all.

Select the format for your document and click Download. You can print your document or upload it to an online editor for a quicker fill-in. All templates in our collection are reusable: once purchased, they remain saved in your profile. You can access them anytime via the My documents tab. Discover all benefits of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 current forms categorized by state and area of utilization, making it quick to search for Indiana Bmv Power Of Attorney Withholding or any other specific example.

- Previously registered users with an active subscription must Log In to their account and click Download to access the form.

- New users to the site will need to first create an account and subscribe before they can store any documentation.

- Here is the step-by-step guide on how to obtain the Indiana Bmv Power Of Attorney Withholding.

- Examine the content of the page carefully to ensure it fulfills your requirements.

- Review the form description or verify it using the Preview option.

- Search for an alternative template via the Search field in the header if the previous one does not meet your criteria.

- Click Buy Now when you find the appropriate Indiana Bmv Power Of Attorney Withholding.

- Choose a subscription plan that aligns with your needs and financial limitations.

- Create an account or Log In to proceed to the payment page.

- Complete your subscription payment using PayPal or with your credit card.

Form popularity

FAQ

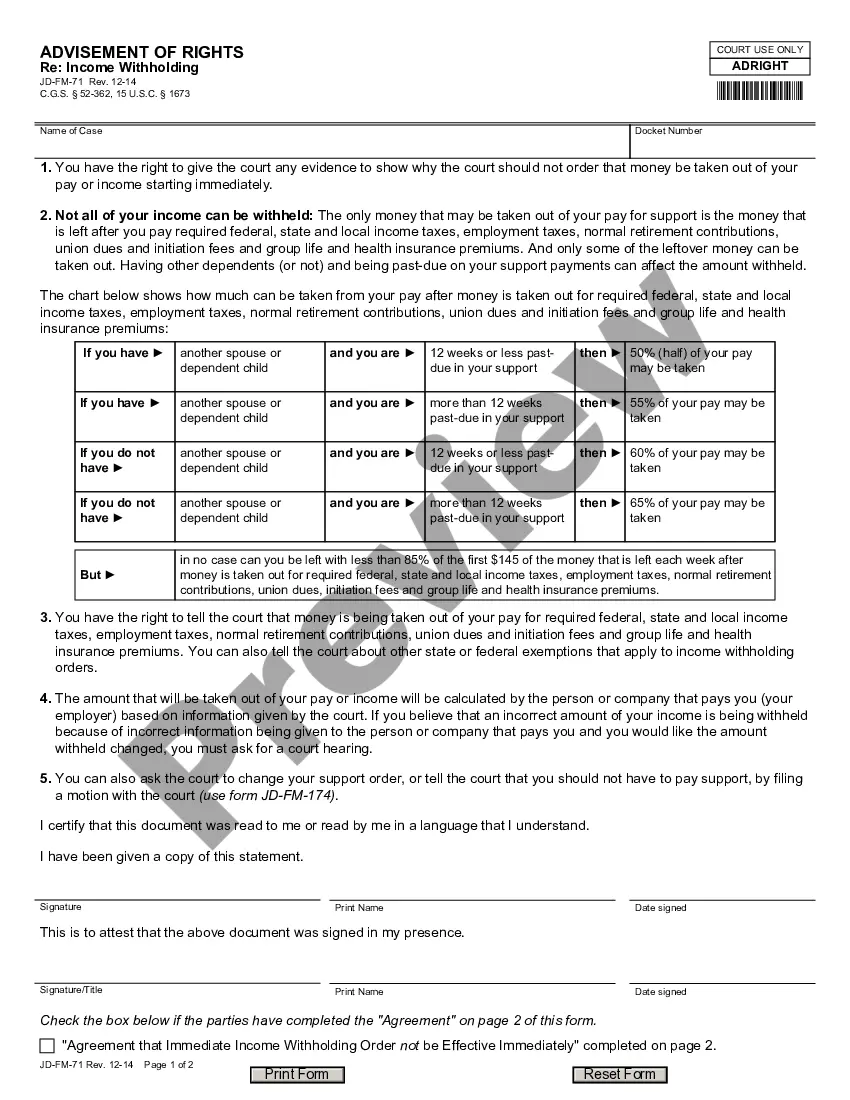

The WH-3 (Annual Withholding Reconciliation Form) is a reconciliation form for the amount of state and county income taxes withheld throughout the year. All employers must file the WH-3 by January 31 each year.

To register for withholding for Indiana, the business must have an Employer Identification Number (EIN) from the federal government. In addition, the employer should look at Departmental Notice #1 that details the withholding rates for each of Indiana's 92 counties.

The WH-1 is the Indiana Withholding Tax Form and is required for any business that is withholding taxes from its employees. When completed correctly, this form ensures that a business's withholding taxes by county are reported accurately and timely.

Indiana POA RequirementsBe in writing.Name an attorney in fact.Give the attorney in fact the power to act on behalf of the principal.Be signed by the principal or at the principal's direction by another individual in the presence of a notary public.

The Indiana Power of Attorney Act sets out four requirements for a valid power of attorney: (1) it must be in writing; (2) it must name the attorney in fact; (3) it must give the attorney in fact the power to act on behalf of the principal; and (4) it must be signed by the principal in the presence of a notary public.