Modelo De Poder Para Custodia Y Cuidado Personal Forzado

Description

How to fill out Indiana General Power Of Attorney For Care And Custody Of Child Or Children?

Utilizing legal templates that comply with federal and local laws is essential, and the web provides a plethora of options to select from.

However, what's the advantage of spending time searching for the appropriately drafted Modelo De Poder Para Custodia Y Cuidado Personal Forzado sample online when the US Legal Forms digital library already consolidates such templates in one location.

US Legal Forms is the largest online legal repository with over 85,000 fillable templates prepared by attorneys for various business and personal situations.

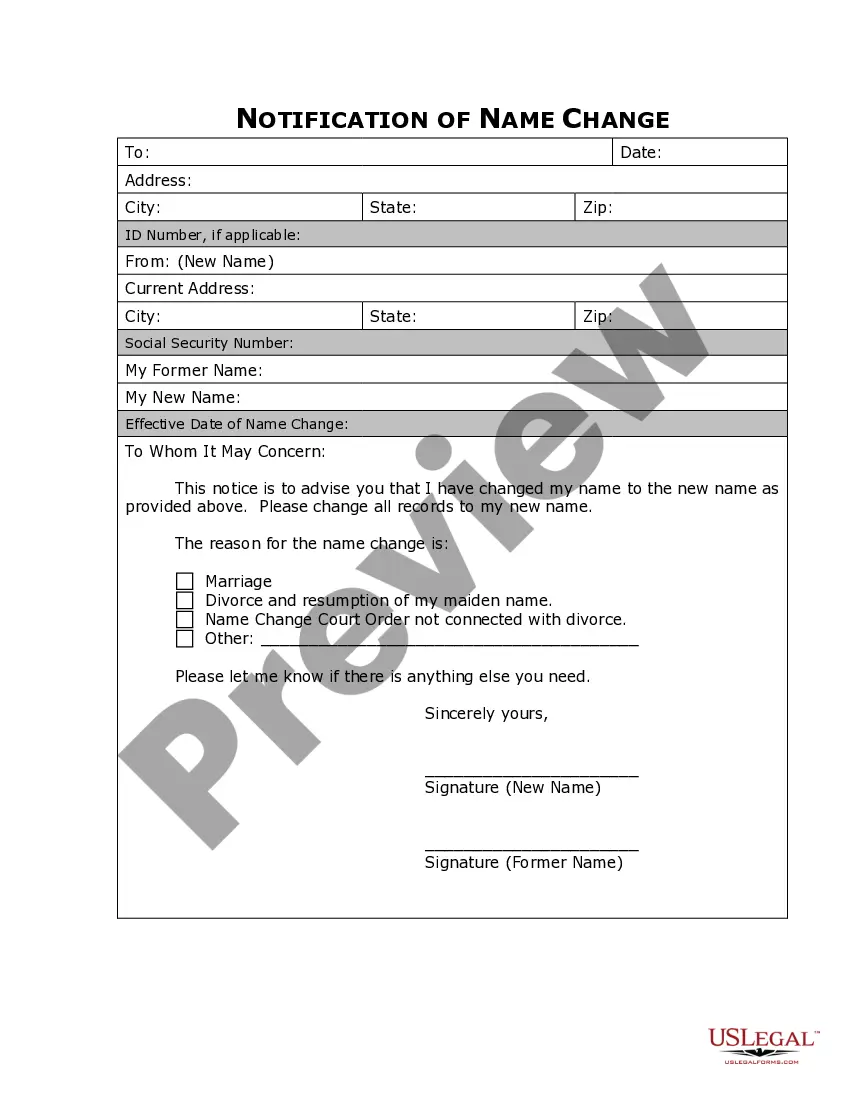

Examine the template using the Preview option or through the text description to confirm it meets your requirements.

- They are user-friendly, with all documents organized by state and intended usage.

- Our experts keep abreast of legal updates, so you can rest assured your form is current and compliant when obtaining a Modelo De Poder Para Custodia Y Cuidado Personal Forzado from our site.

- Acquiring a Modelo De Poder Para Custodia Y Cuidado Personal Forzado is quick and easy for both existing and new users.

- If you possess an account with an active subscription, Log In and save the document sample you require in your chosen format.

- If you are unfamiliar with our site, adhere to the steps outlined below.

Form popularity

FAQ

A loan agreement is: A borrower's written promise to repay a sum of money, or principal, to the lender. A document that outlines the terms of a loan, including a repayment plan, between a lender and a borrower.

Entering a debt agreement can affect your ability to obtain future credit. Your details may appear on a credit reporting agency's records for up to 5 years, or longer in some cases.

When writing a debt settlement agreement letter, it is essential to be clear and concise. Make sure to include all the necessary information, such as the debt owed, the settlement amount, the terms of the agreement, and the date. Include the contact information of both parties in the letter.

Steps to negotiate your debt Work with a credit counselor. Enroll in a debt management program. Try various debt payment strategies like the snowball method. Ask the creditor for a payment deferment. Ask for a lower interest rate. Consider a debt consolidation loan.

An individual voluntary arrangement (IVA) is a formal and legally binding agreement between you and your creditors to pay back your debts over a period of time.

?Offering 25%-50% of the total debt as a lump sum payment may be acceptable. The actual percentage may vary depending on the circumstances of the borrower as well as the prevailing practices of that particular collection agency.? One benefit of negotiating settlement terms is likely to reduce stress.

When drafting a debt settlement agreement, it is essential to include the following: Necessary information about the loan agreement. The contact information of both parties. The date of the agreement. The terms of the agreement. The amount of debt.