Power Of Attorney With

Description

How to fill out Indiana General Durable Power Of Attorney For Property And Finances Or Financial Effective Immediately?

Creating legal documents from the ground up can frequently feel somewhat daunting.

Certain situations may require extensive research and substantial financial investment.

If you’re seeking a more direct and economical method of preparing Power Of Attorney With or any other documents without the hassle, US Legal Forms is always accessible to you.

Our online repository of over 85,000 current legal documents encompasses nearly every dimension of your financial, legal, and personal matters.

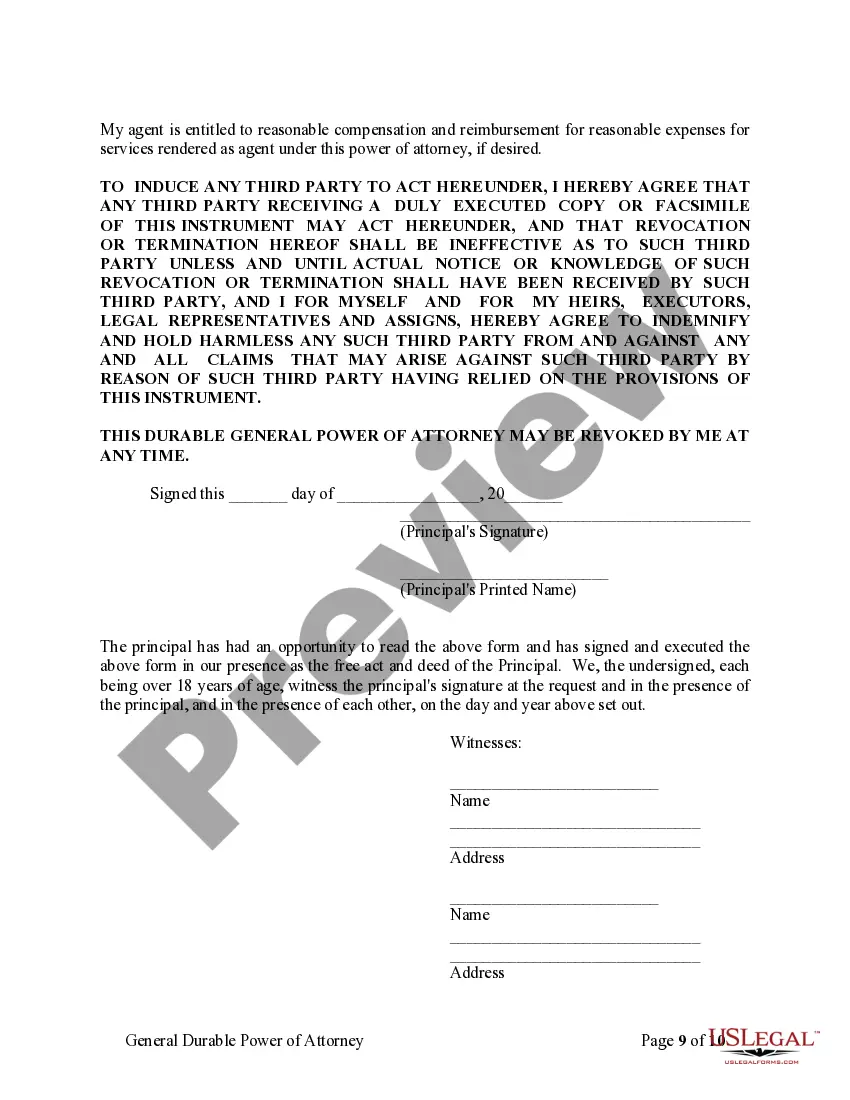

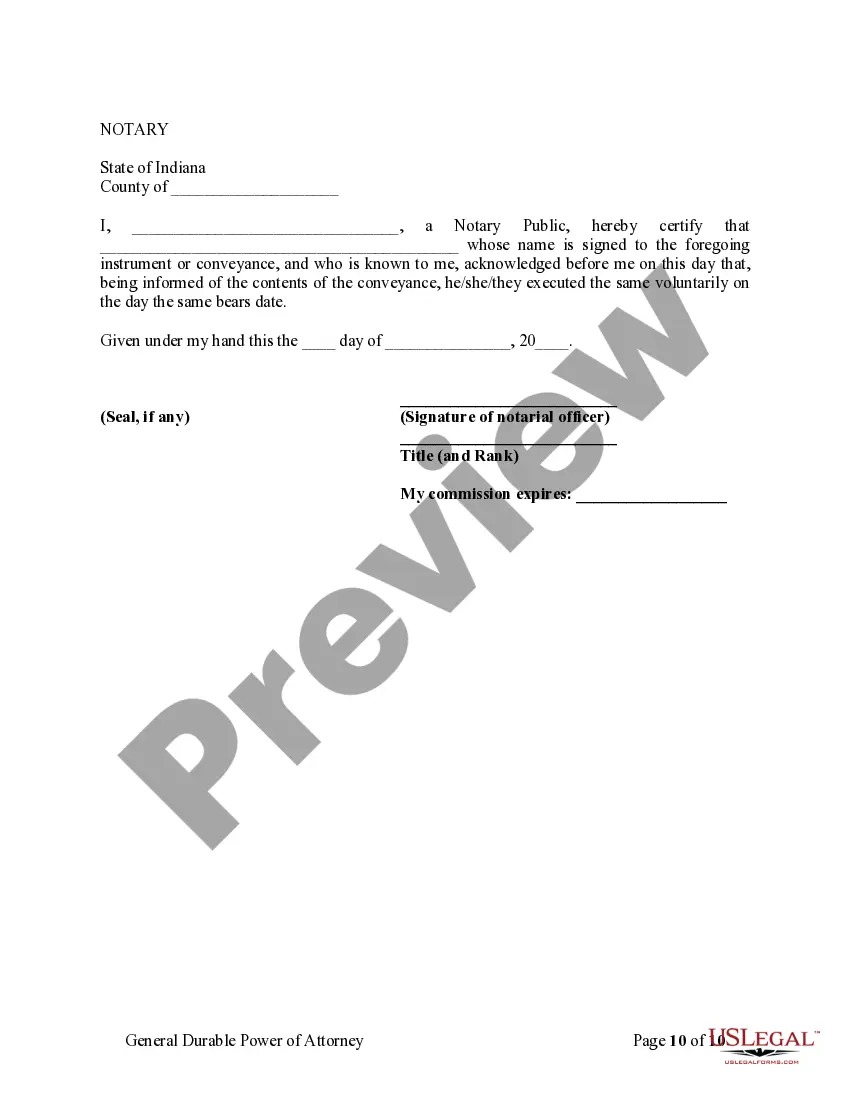

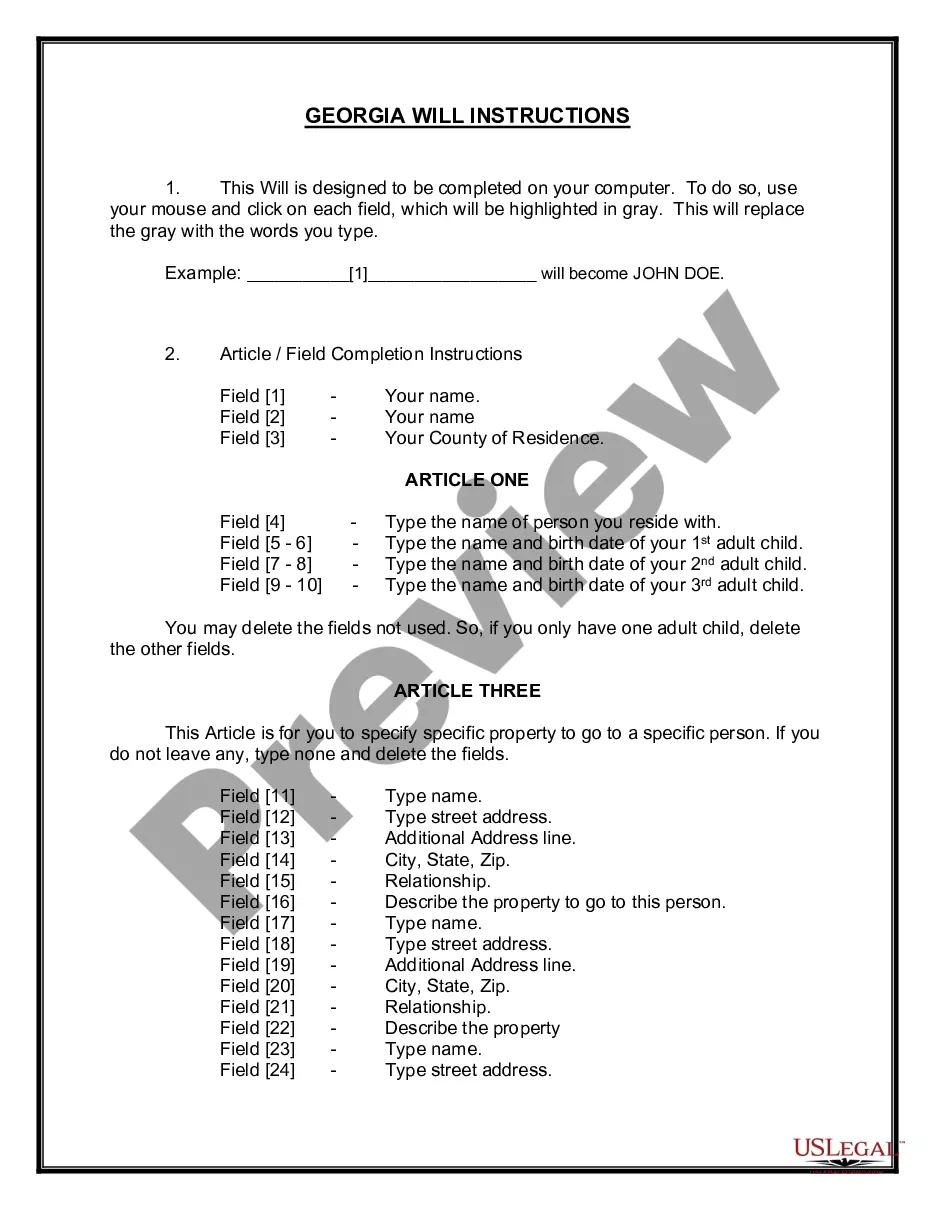

Review the document preview and descriptions to ensure you have located the correct form.

- With just a few clicks, you can swiftly obtain state- and county-specific forms meticulously crafted for you by our legal specialists.

- Utilize our website whenever you require dependable and trustworthy services to easily locate and acquire the Power Of Attorney With.

- If you're familiar with our website and have already created an account, simply Log In, find the template, and download it immediately or re-download it anytime in the My documents section.

- Don’t have an account? No worries. Setting it up takes minimal effort and time to browse the catalog.

- But before diving straight into downloading Power Of Attorney With, consider these tips.

Form popularity

FAQ

A power of attorney (POA) is an authority imposed on an agent by the principal allowing the said agent to make decisions on his/her behalf. The agent can receive limited or absolute authority to act on the principal's behalf on decisions relating to health, property, or finances.

___________ do hereby nominate, appoint constitute and appoint Sri./Smt______________________ S/o. /W/o. aged about _____ years residing at ______________________as my true and lawful power of attorney holder to do the following acts, deeds and things on my behalf and in my name in respect of the schedule property.

1. The Power of Attorney is to be executed on a non-judicial stamp paper of the requisite value as per the stamp duty prevalent in the respective state. 2. Each page of the Power of Attorney is to be signed and wherever the blanks are filled in initialed by the Grantor (all applicants to the loan).

You can write a POA in two forms: general or limited. A general power of attorney allows the agent to make a wide range of decisions. This is your best option if you want to maximize the person's freedom to handle your assets and manage your care.

Things to Include In POA For Property Grantor Details- The name, age, address and occupation of the person who grants the power (Grantor) should be mentioned first. Attorney Details- The name, age, father's name, address and occupation of the person to whom the power is granted (Attorney) should be described next.