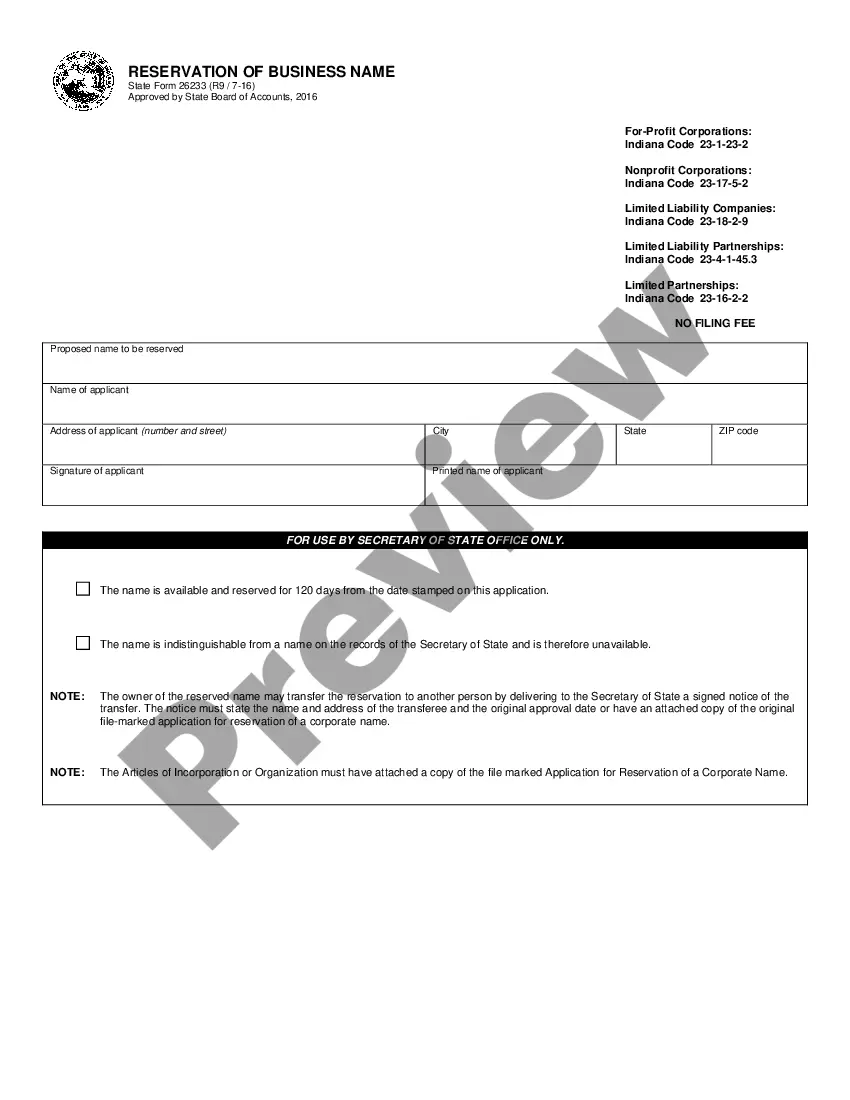

File this form to reserve a Limited Liability Company name.

Indiana Application Llc Withdrawal

Description

How to fill out Indiana Application Llc Withdrawal?

There's no longer a necessity to waste time searching for legal documents to comply with your local state regulations.

US Legal Forms has gathered all of them in a single location and made their access straightforward.

Our platform offers over 85k templates for various business and individual legal situations categorized by state and usage area.

Completing legal documents under federal and state regulations is quick and simple with our platform. Try US Legal Forms today to keep your paperwork organized!

- All forms are properly drafted and validated for accuracy.

- This ensures you can trust that you're obtaining an up-to-date Indiana Application Llc Withdrawal.

- If you are acquainted with our platform and possess an account, you must verify that your subscription is active before acquiring any templates.

- Log In to your account, choose the document, and click Download.

- You can also revisit all previously obtained documentation when necessary by accessing the My documents tab in your profile.

- If you've never utilized our platform before, the process will involve a few additional steps to complete.

- Here’s how new users can find the Indiana Application Llc Withdrawal in our library.

- Carefully examine the page content to ensure it contains the sample you require.

Form popularity

FAQ

To remove a member from your LLC in Indiana, start by reviewing your operating agreement for the specific process. Typically, you need to document the decision and submit it to the Secretary of State along with the Indiana application for LLC withdrawal if you're closing the entity. Consider involving uslegalforms to guide you through the requirements and ensure compliance with state laws, making the transition smoother.

Yes, you can close your LLC yourself in Indiana by submitting the necessary Indiana application for LLC withdrawal forms. It is important to follow the correct procedures, including notifying creditors and settling any pending obligations. While you can handle this independently, using a platform such as uslegalforms can help you navigate the process seamlessly and avoid potential pitfalls.

To shut down your LLC in Indiana, you need to file the Indiana application for LLC withdrawal with the Secretary of State. This process involves completing a form and ensuring your business has no outstanding debts or taxes. Once your application is approved, you will receive confirmation that your LLC is officially closed. Engaging a service like uslegalforms can simplify this process and ensure all requirements are met efficiently.

Yes, Indiana requires LLCs to file an annual report to keep your business in good standing. Failing to submit this report can result in penalties or even administrative dissolution of your LLC. If you decide to dissolve your LLC instead, the obligation to file reports ceases once the Indiana application LLC withdrawal is approved. It is essential to stay compliant with state requirements to maintain your LLC’s status.

Dissolving an LLC refers to the official process of ending the business operation, while terminating often refers to the end of the business's legal existence. In Indiana, when you complete the Indiana application LLC withdrawal, you are dissolving your LLC, which involves filing necessary paperwork and paying any fees. Termination is more about the consequences of that dissolution, such as no longer being able to do business or own assets under that name. Understanding this distinction helps clarify your responsibilities and options in managing your LLC.

Deciding whether to dissolve your LLC or keep it inactive depends on your business goals. If you foresee reopening in the future, you may choose to leave it inactive; however, this can lead to ongoing fees and potential legal complications. On the other hand, if you want to close your business for good, you should file an Indiana application LLC withdrawal to avoid future obligations. Evaluate your situation to make the best decision for your business.

To dissolve your LLC in Indiana, you need to file the appropriate forms with the Indiana Secretary of State. Start by completing the Indiana application LLC withdrawal form, which allows you to officially terminate your business entity. Be sure to settle any debts and obligations your LLC has before filing. Lastly, once your application is approved, your LLC will no longer be recognized as a legal entity.

Voluntarily removing a member from an LLC involves following the specific procedures in your operating agreement or state law. Generally, this requires a formal agreement among the members and may include a buyout of the departing member's interest. Additionally, understanding the implications for the Indiana application LLC withdrawal is critical to ensure legality and proper documentation. US Legal Forms can help you navigate this process with the right forms and guidance.

To kick someone out of an LLC, you typically need to follow the procedures outlined in your operating agreement. This process often involves a vote by the remaining members. It's important to document the reasons and ensure compliance with state laws, particularly concerning the Indiana application LLC withdrawal. If you need assistance, US Legal Forms can provide the necessary resources and templates to streamline this process.

The IRS does not have a specific form exclusively designed to remove a partner from an LLC. However, you need to update your LLC’s tax reporting forms, such as the 1065, to reflect any changes in members. It's important to properly document the transaction to maintain compliance. Using uslegalforms can help you understand the right steps to take during your Indiana application LLC withdrawal.