Assumption Release Mortgagors For Sale Of Property

Description

How to fill out Indiana Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

- If you are an existing user, log in to your account. Verify that your subscription is current, and download the relevant form template directly onto your device by clicking the Download button.

- For first-time users, start by browsing the extensive form library. Use the Preview mode to review form descriptions and ensure you select the one that meets your jurisdictional requirements.

- If your initial search doesn't yield the correct template, utilize the Search tab at the top of the page to locate the appropriate document tailored to your needs.

- Once you find the right form, click on the Buy Now button and choose a subscription plan. Registration is required to access the library.

- Complete your purchase by entering your credit card details or using PayPal. Ensure your payment goes through successfully to access the form.

- After payment, download your document and store it on your device. You can also find it later in the My Forms section of your profile.

With US Legal Forms, you gain access to a robust collection of over 85,000 legal templates, which empowers you to efficiently manage your legal documentation. Furthermore, users can consult with premium experts to ensure their forms are completed accurately and in compliance with legal standards.

Don't let legal documentation overwhelm you. Start your journey with US Legal Forms today and take control of your legal needs with ease!

Form popularity

FAQ

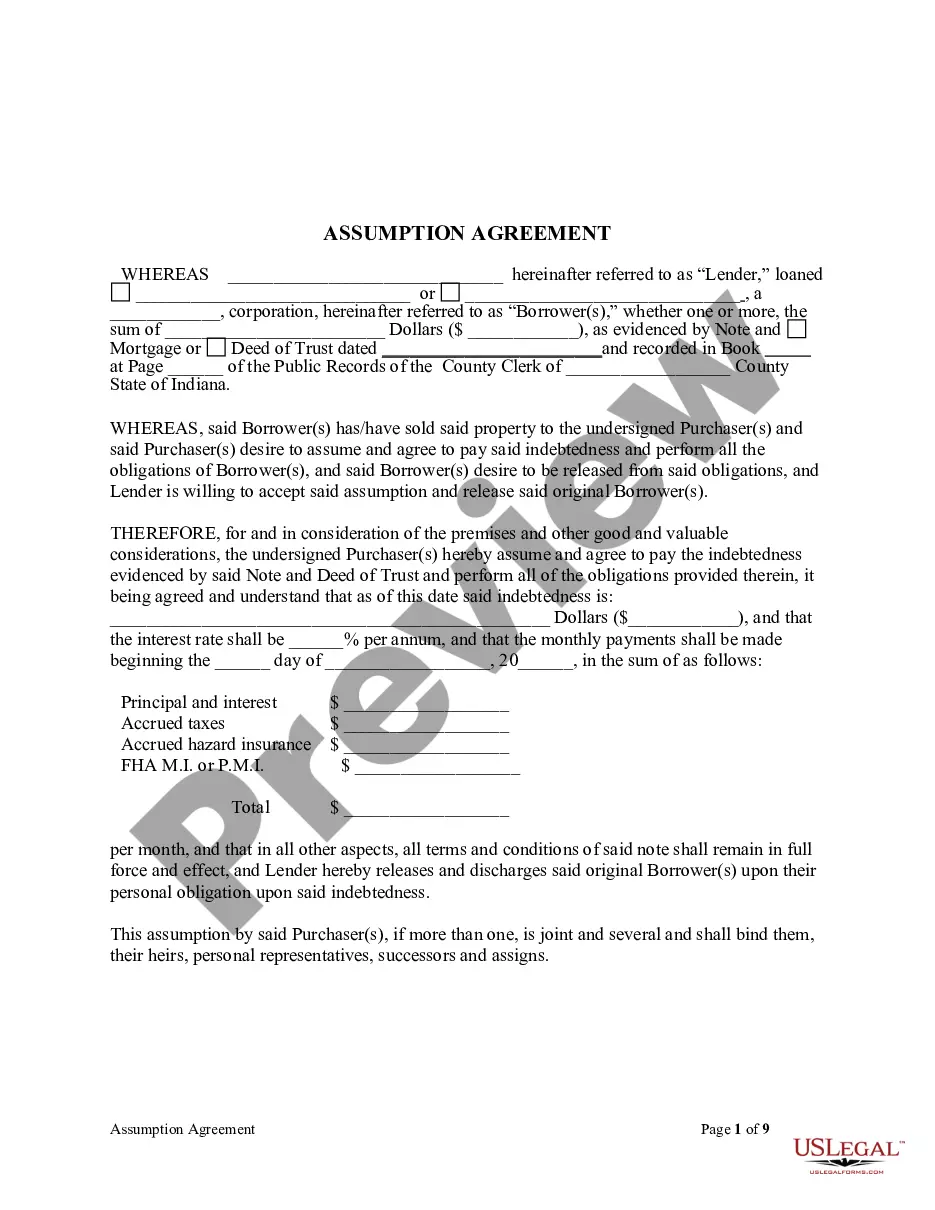

An assumption in the sale of mortgaged property allows the buyer to take over the seller's mortgage. This process often includes an assumption release for mortgagors, which frees the seller from future liabilities related to the mortgage. It's important for both parties to understand the terms and implications of this arrangement to ensure a smooth transaction. By exploring platforms like USLegalForms, you can access resources and forms essential to navigate the assumption release mortgagors for sale of property.

The difficulty of assuming a mortgage can vary based on the lender's requirements and the specific terms of the mortgage. In many cases, buyers must be pre-approved or meet certain financial criteria to take over the existing mortgage. While it may seem challenging, utilizing platforms like uslegalforms can simplify the process of navigating assumption release mortgagors for sale of property. Proper guidance and resources can help make the assumption relatively straightforward.

One downside of assuming a mortgage can be the potential for higher interest rates than what the current market offers. Additionally, buyers must qualify under the lender's terms, which can involve stringent financial scrutiny. Furthermore, if not managed well, the assumption release mortgagors for sale of property could lead to complications in negotiations regarding the sale. It is essential to weigh these factors carefully.

Assuming a mortgage means that the buyer agrees to take on the seller's mortgage liability during the property sale. For example, if a homebuyer purchases a house and assumes the existing mortgage of $150,000, they will take over the mortgage payments and the terms of that mortgage. This transaction highlights the importance of the assumption release mortgagors for sale of property, which can lead to smoother transitions during ownership changes.

A mortgage assumption occurs when a buyer takes over the existing mortgage of the seller, effectively stepping into their shoes. For instance, if the seller has a mortgage with a balance of $200,000, the buyer can agree to continue making those payments. This process often requires the lender's approval to ensure the buyer can meet the repayment obligations. Understanding how assumption release mortgagors for sale of property works can bring advantages in certain real estate transactions.

The catch with assumable mortgages often lies in the buyer's qualifications. Lenders may require the buyer to meet specific financial criteria, which can complicate the process. Additionally, sellers might remain liable for the mortgage even after transferring it, unless specific releases are obtained. Therefore, understanding assumption release mortgagors for sale of property is crucial to prevent any potential pitfalls.

Yes, an assumable mortgage can indeed benefit the seller. It allows them to showcase a more flexible selling option, which can draw in buyers who want to avoid the hassle of new financing. Moreover, it can lead to quicker sales and a smoother transition, mitigating some of the stress involved with selling. Utilizing assumption release mortgagors for sale of property can be a beneficial tactic in such scenarios.

An assumable mortgage can have downsides for both buyers and sellers. For sellers, they may find that they need to negotiate terms that may lead to them accepting less than their property's market value. Additionally, if the original mortgage has a high interest rate, a buyer may not find it appealing. Therefore, understanding the implications of assumption release mortgagors for sale of property is essential.

Begin your search for houses with assumable mortgages by utilizing online real estate platforms that filter listings based on mortgage type. Websites, social media groups, and local real estate agents can also provide insights on available properties. Keep in mind that assumption release mortgagors for sale of property often attract savvy buyers, so staying informed can enhance your search. Take advantage of resources like uslegalforms to navigate this process effectively.

To obtain a mortgage assumption, start by reviewing your current mortgage agreement for eligibility. Then, contact your lender to discuss the necessary steps for transferring the mortgage. Engage with a real estate agent familiar with assumption release mortgagors for sale of property, as they can provide valuable insights and resources. By following these steps, you can streamline the process and ensure a smooth transition.