Agreement Release Mortgagors With No Money

State:

Indiana

Control #:

IN-ED1014

Format:

Word;

PDF;

Rich Text

Instant download

Description

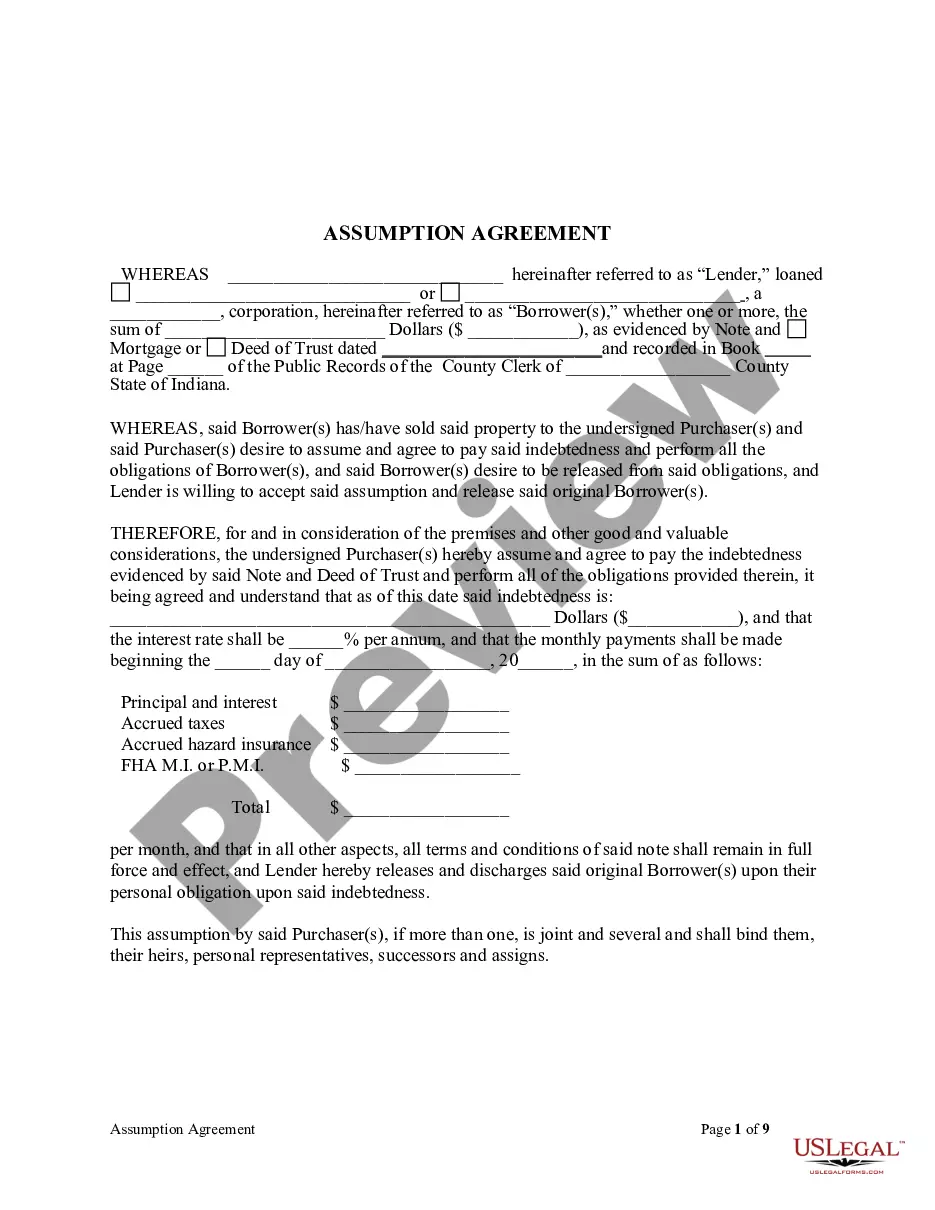

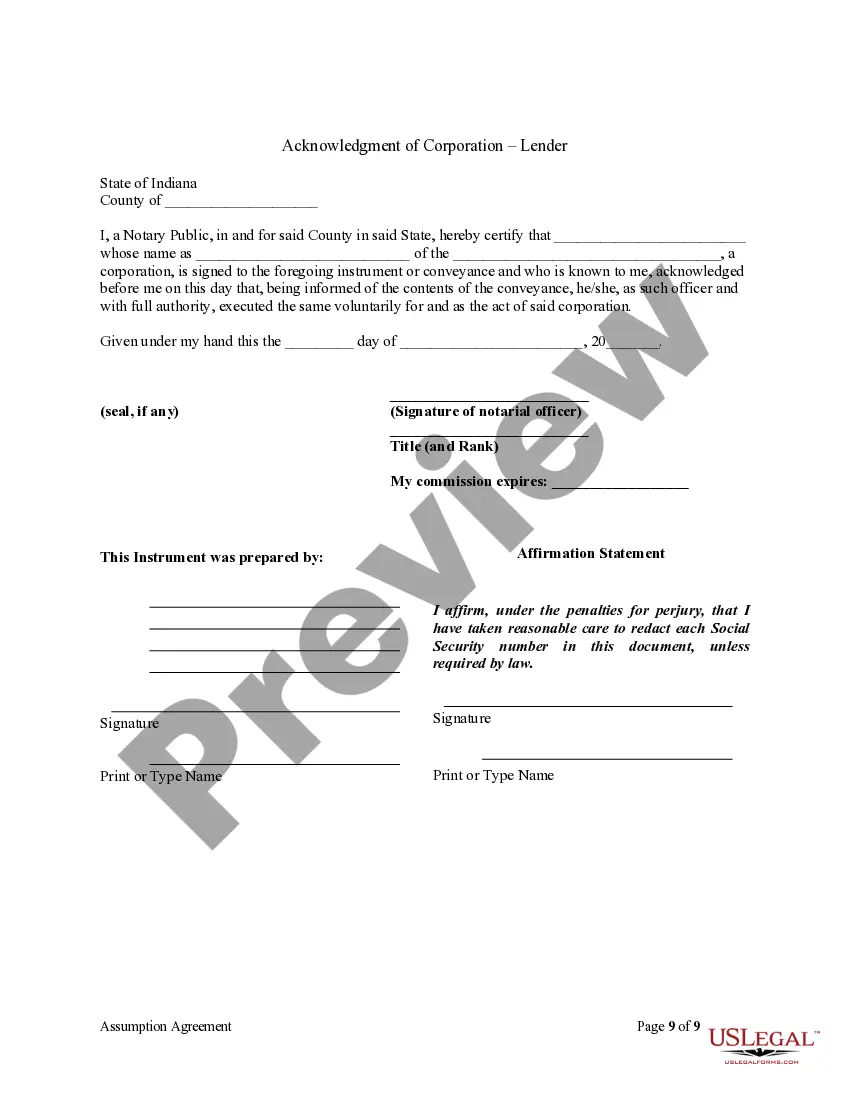

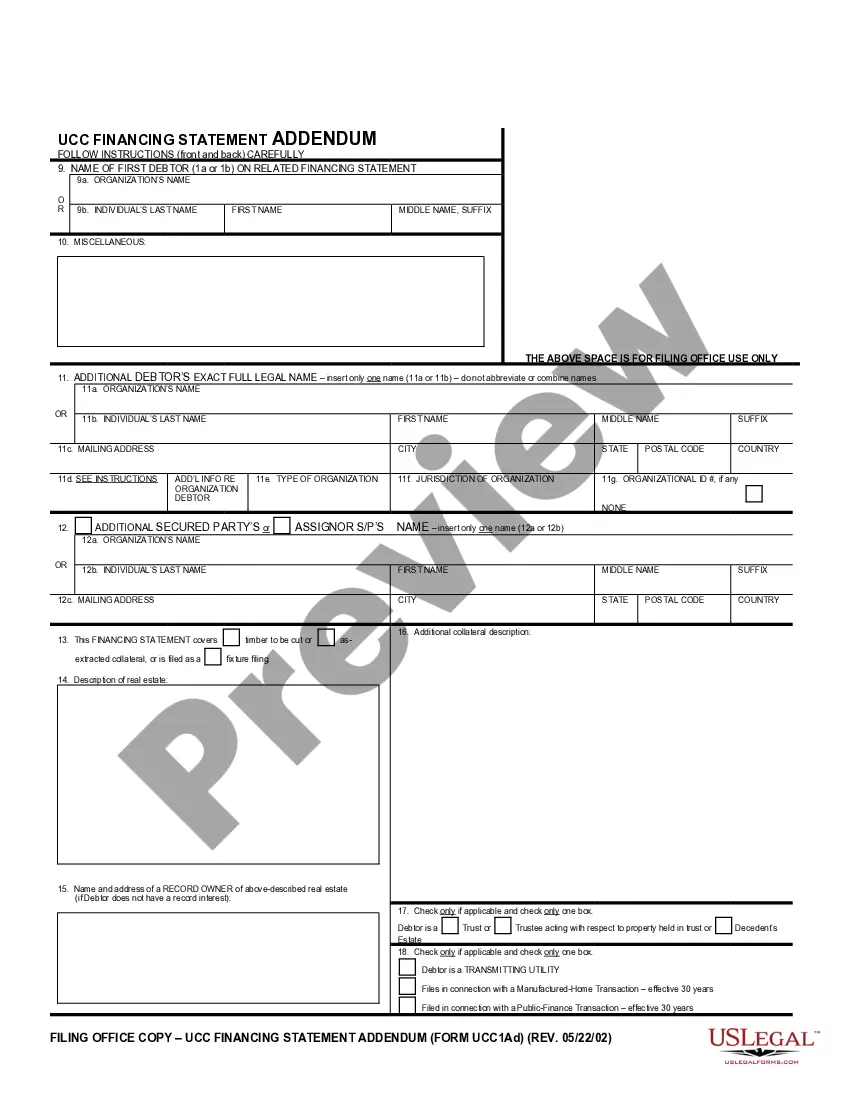

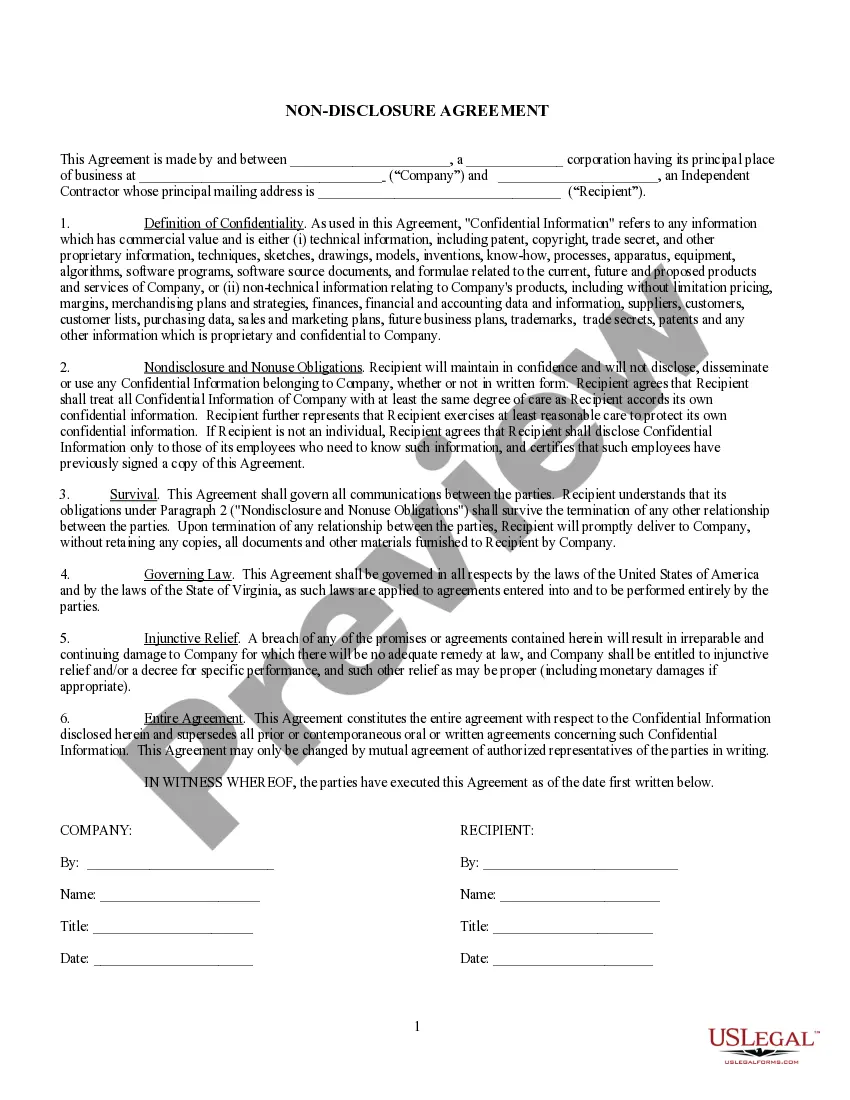

The Agreement Release Mortgagors With No Money is a legal document that facilitates the transfer of mortgage obligations from original borrowers to new purchasers without any monetary compensation. This form is essential for lenders, borrowers, and purchasers to formalize the assumption of a mortgage while releasing the original borrowers from their obligations. Key features include detailed sections outlining the terms of the mortgage, such as the indebtedness amount, interest rate, and monthly payments. Filling out this form requires clarity regarding the roles of all parties involved, alongside detailed acknowledgment sections to be completed by notaries public. The document is primarily used by attorneys, paralegals, and legal assistants within real estate transactions, ensuring protection for clients while navigating the assumption of loan responsibilities. Properly executed, this form helps prevent disputes related to financial obligations and provides clear documentation for all parties involved. It is also useful for corporate borrowers and lenders to streamline the transfer process in transactions involving larger real estate operations.

Free preview

How to fill out Indiana Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

- If you're a returning user, log in to your account and select the desired form. Ensure your subscription is up to date; renew if necessary.

- For first-time users, start by reviewing the Preview mode and form description to confirm it meets your requirements and complies with your local laws.

- If the selected template isn't suitable, use the Search bar to find an appropriate form that matches your needs.

- Once you find the right document, click on 'Buy Now' and choose a subscription plan that fits your budget. You’ll need to create an account to access the extensive library.

- Complete your purchase by entering your payment details or using PayPal to subscribe.

- Download the selected form to your device for completion, and find it later in your account section under My Forms.

US Legal Forms empowers individuals and attorneys to effectively manage legal documentation with a vast library of over 85,000 editable templates.

Don't let legal complexities hold you back. Get started with US Legal Forms today and ensure your legal documents are professional and precise!