Unearnedfees

Description

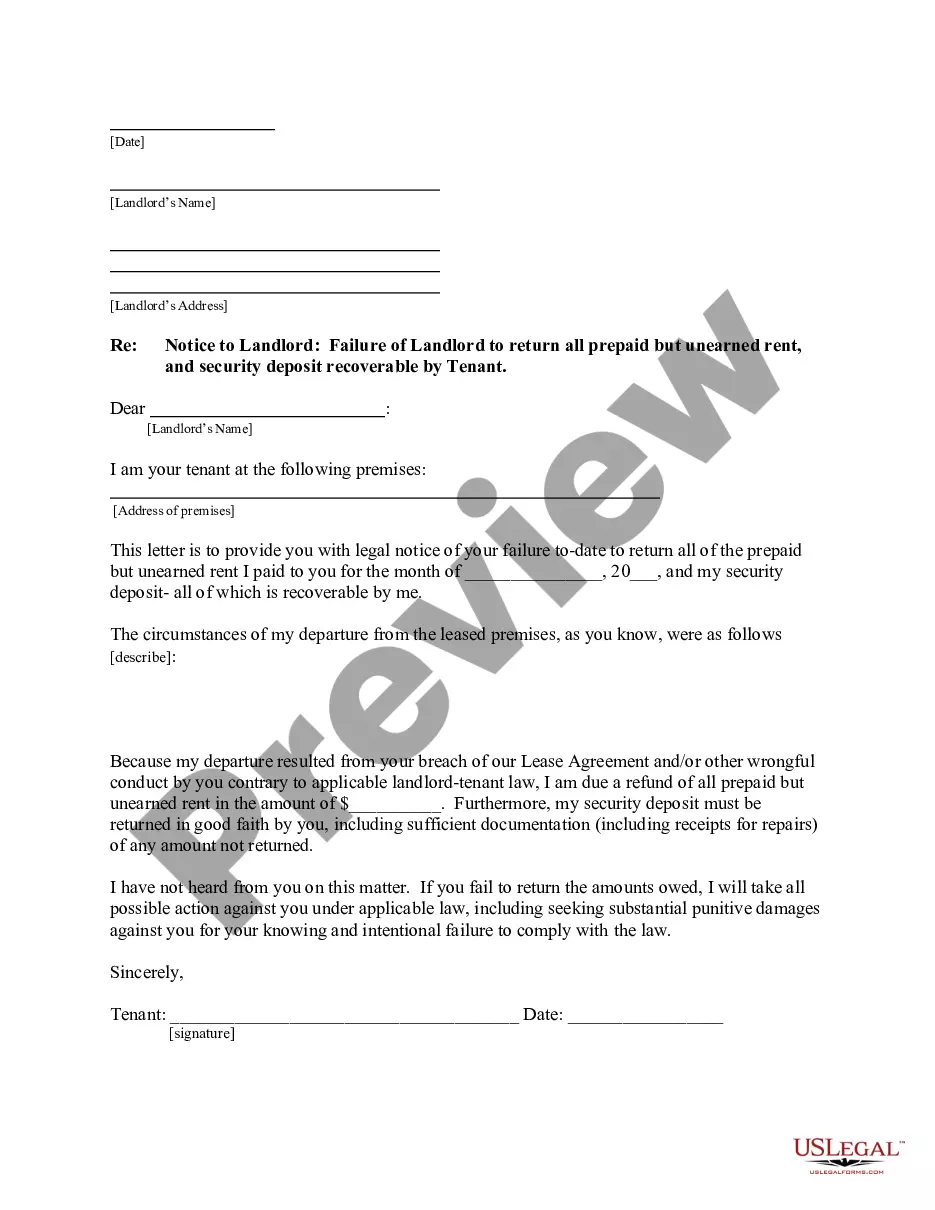

How to fill out Indiana Letter From Tenant To Landlord For Failure Of Landlord To Return All Prepaid And Unearned Rent And Security Recoverable By Tenant?

- If you are returning to US Legal Forms, log in to your account and download the form you need. Ensure that your subscription remains active; otherwise, renew it based on your payment plan.

- For first-time users, start by reviewing the Preview mode and form description to verify that the selected template aligns with your requirements and complies with local jurisdiction laws.

- If you encounter any discrepancies or need a different template, use the Search tab at the top to find the right form and proceed with it if suitable.

- Once you have selected your document, click the Buy Now button and select your desired subscription plan to gain access to the extensive form library.

- Complete your purchase by entering your payment information, whether through credit card or PayPal, ensuring secure transactions.

- Download your form and save the template onto your device. You can access your documents anytime through the My Forms menu in your profile.

In conclusion, US Legal Forms not only provides a comprehensive collection of templates but also gives users access to premium experts to assist with document completion. This makes it easier to navigate unearnedfees and legal documentation accurately and efficiently.

Start your journey with US Legal Forms today and ensure your legal needs are met with confidence!

Form popularity

FAQ

Unearned fees are indeed classified as current assets. This means they are payments received in advance for services that will be delivered in the near future. As a business, when you receive unearned fees, these funds remain on your balance sheet until the services are performed. Thus, it is crucial to account for these amounts correctly, as they affect your liquidity and financial position.

Recording unearned revenue involves two main steps. Initially, you record the payment in a liability account labeled 'Unearned Revenue.' Upon providing the service, you then adjust the entries to recognize it as earned income. Keeping track of unearned fees properly is essential for accurate financial management.

To record unearned revenue, you start by creating a liability account in your accounting system. When you receive payment upfront, you credit the unearned revenue account. Once you deliver the product or service, you will debit this account and credit the revenue account. Tools like US Legal Forms provide templates that help streamline this process.

Yes, unearned revenue appears on a balance sheet as a liability. It indicates that a company has received payment for services not yet rendered. This entry is crucial for transparency in financial reporting. By accurately recording unearned fees, you ensure compliance and trust with stakeholders.

An adjustment entry for unearned fees refers to the accounting action taken to recognize revenue that was previously recorded as unearned. When services are performed, you will move the amount from unearned fees to earned revenue. This adjustment maintains accurate financial statements. Using platforms like US Legal Forms can simplify tracking and recording these adjustments.

Unearned fees appear on the balance sheet as liabilities under current liabilities. They represent an obligation to deliver a service in the future. Accurate tracking of these fees is crucial for financial reporting and overall business health. Services like those provided by USLegalForms can guide you in better managing these entries.

Accounting for unearned fees requires recognizing them as liabilities until the service is complete. When you receive payment without delivering the service, you record it as unearned revenue in your accounting system. As you begin to deliver the service, you can then recognize this revenue. This approach ensures your financial statements reflect your obligations accurately.

Calculating unearned income focuses on the total payments received for services not yet rendered. It includes items like advance subscriptions or deposits. To find this figure, identify all received payments with no associated service delivered. By doing so, you can clearly see the amount classified as unearned fees.

The accounting entry for unearned revenue involves recognizing a liability on the balance sheet. When a business receives payment before delivering a service, it records this as unearned revenue. This entry reflects the obligation to provide the service in the future. As you fulfill the service, you will debit the unearned revenue and credit revenue.

To show unearned income, you can present documentation like bank statements, tax forms, or financial summaries reflecting this income type. Having clear records available is crucial for reporting purposes. If you seek more detailed guidance on showcasing unearned fees, consider resources like US Legal Forms for tailored support.