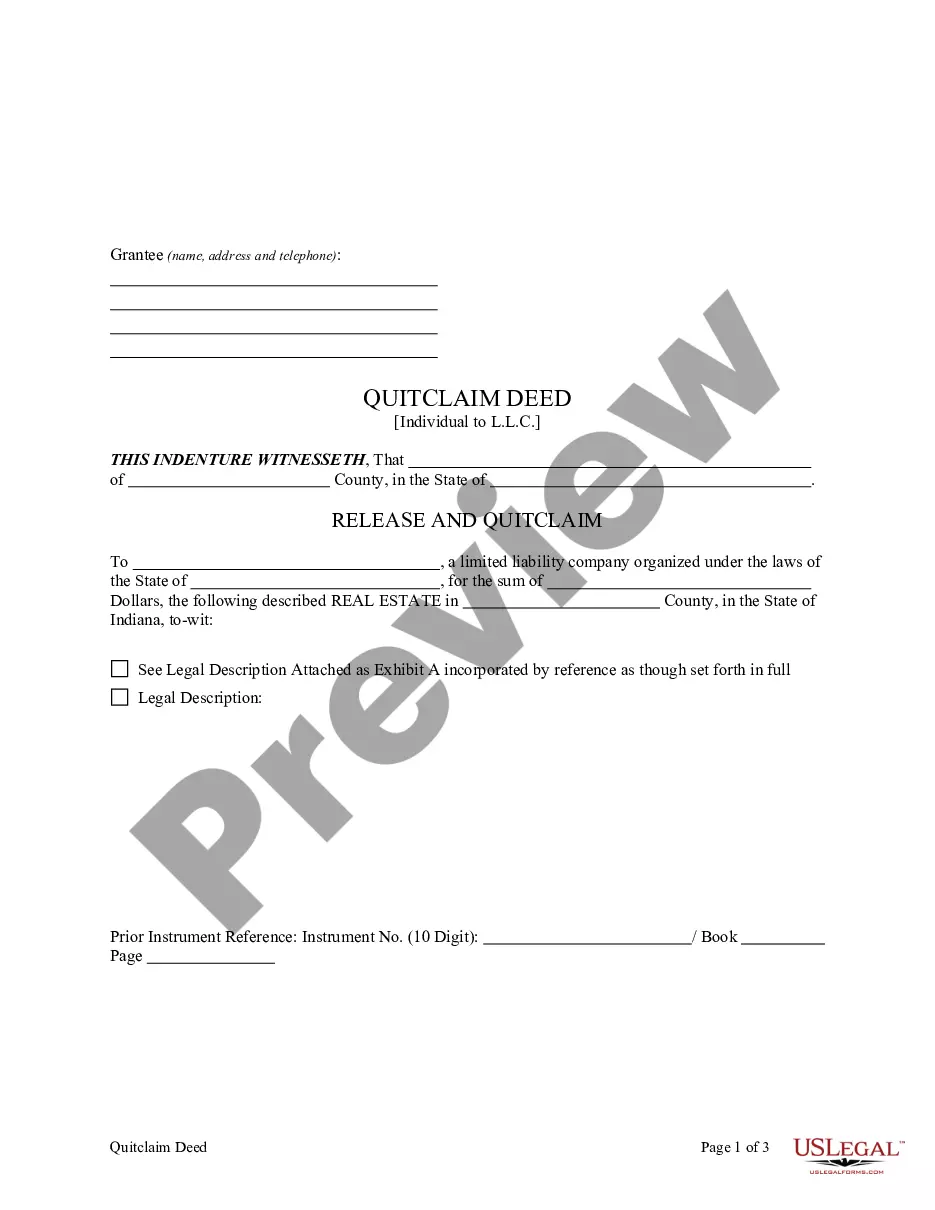

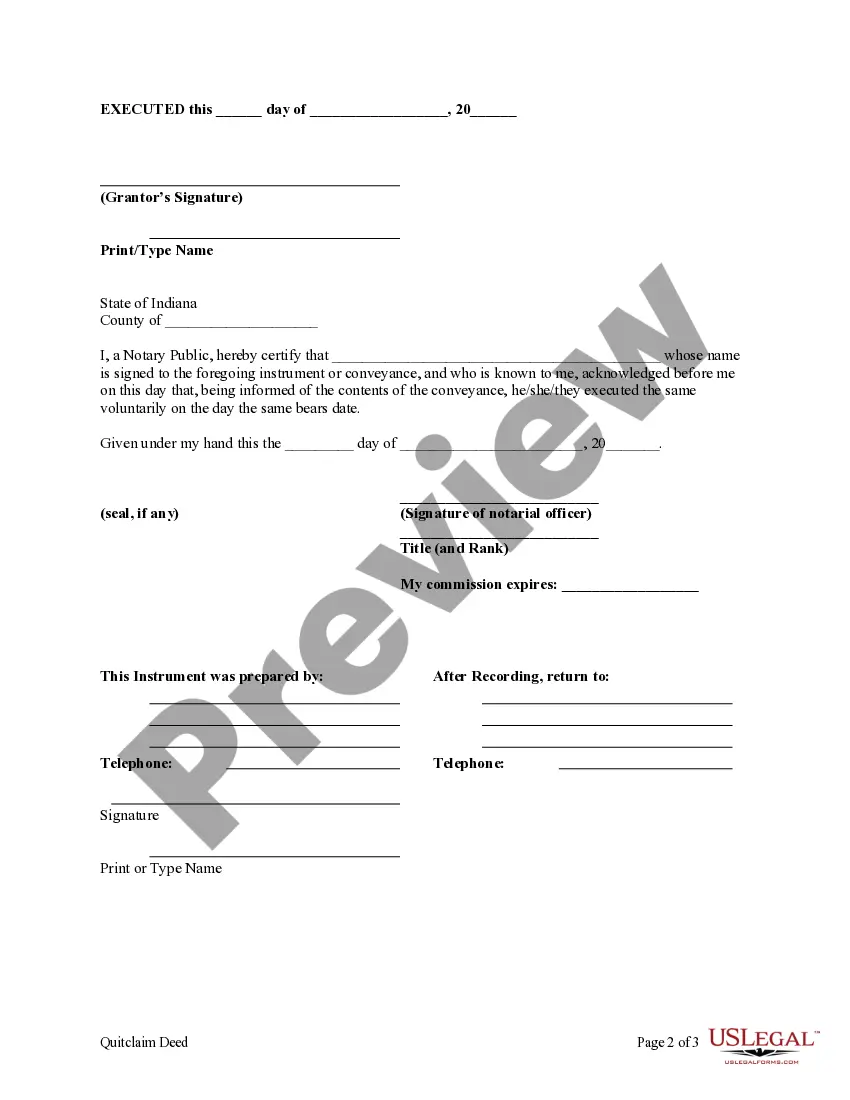

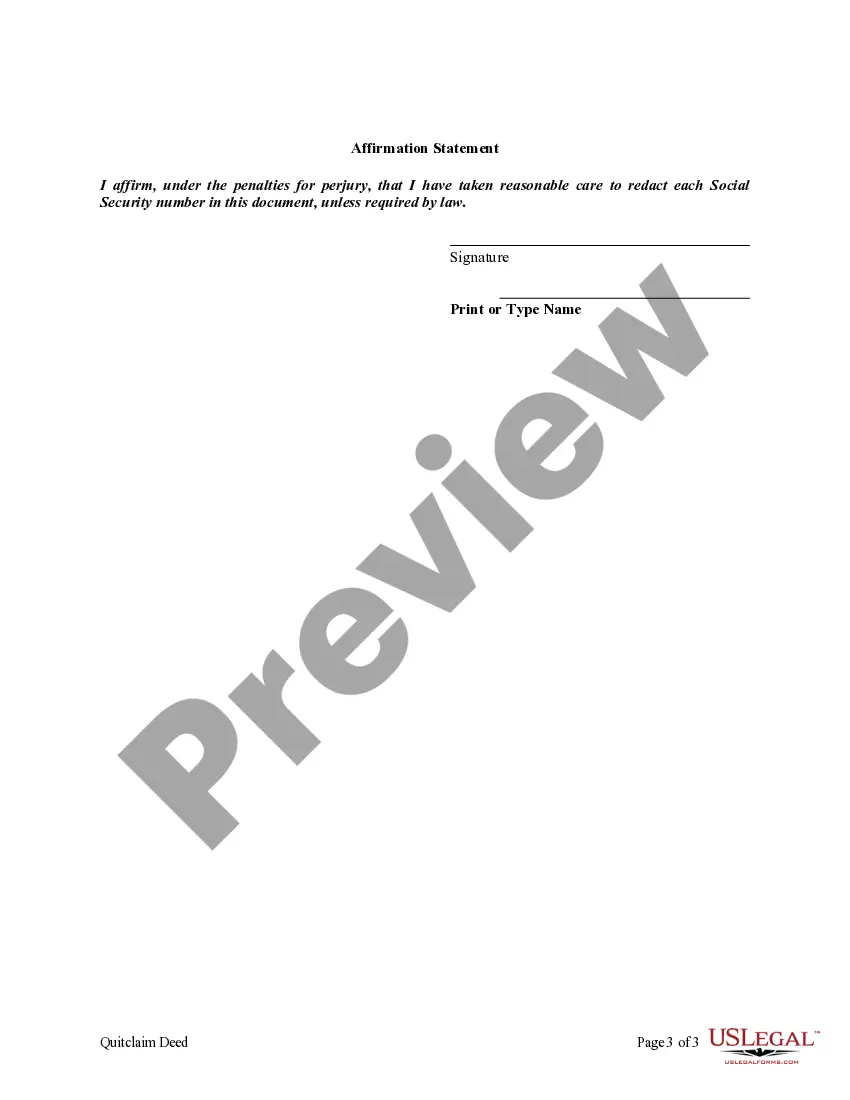

This form is a Quitclaim Deed where the grantor is an unmarried individual and the grantee is a limited liability company. Upon ordering, you may download the form in Word, Rich Text or Wordperfect formats.

In Llc Company Form

Description

Form popularity

FAQ

The easiest LLC to create is often a single-member LLC. This option allows you to maintain complete control and simplifies various filing requirements. Many users find that using online services like USLegalForms helps them navigate the formation process effectively. In llc company form, you can set up your business structure quickly and efficiently.

The easiest way to form an LLC typically involves utilizing an online formation service. By choosing a reliable platform like USLegalForms, you can access straightforward instructions and readily available templates. This guided approach eliminates confusion, allowing you to complete the necessary paperwork without stress. In llc company form gives you the tools you need to move forward with confidence.

The quickest way to get an LLC is by using an online service that specializes in forming LLCs. Platforms like USLegalForms streamline the process by providing forms and filing options that save you time. Fill out the necessary information, submit the application, and you can often receive your documents faster than traditional methods. In llc company form simplifies the process and helps you focus on starting your business.

The best classification for an LLC often depends on the specific business goals and structure. Many LLCs opt for classification as a partnership or corporation to enjoy tax benefits. In LLC company form, this classification can impact how profits are distributed and taxed. It's beneficial to consult with a tax professional to determine the optimal classification for your unique circumstances.

An LLC is ideal for small businesses that want liability protection without extensive formal requirements. This structure is particularly suitable for startups, professional practices, and independent contractors. In LLC company form, businesses that anticipate growth and seek to separate personal assets from business liabilities often choose this route. It allows owners to operate with peace of mind.

The most common type of LLC is the standard LLC, often called the domestic LLC. This formation allows for flexibility in management and tax treatment. In LLC company form, businesses can benefit from personal liability protection while enjoying adaptable management structures. This makes it a favorable option for many small to medium-sized enterprises.

The best tax form for an LLC depends on how it is classified for tax purposes. Most LLCs choose to be taxed as a sole proprietorship, partnership, or corporation. In LLC company form, the default is to file taxes as a pass-through entity, meaning profits and losses pass directly to the owners' personal tax returns. This can help simplify tax filings and reduce overall tax burden.

The most common form of LLC is the single-member LLC. This structure allows one individual to own and operate the business, providing flexibility and simplicity. In LLC company form, the owner benefits from limited liability protection without the complexities of a corporation. This structure is often preferred by freelancers, consultants, and small business owners.

The biggest benefit of forming an LLC is the protection it offers to personal assets from business liabilities. This means that, in most cases, your personal finances are secured if your business faces legal issues. Additionally, LLCs can enjoy various tax advantages, such as flexible profit distribution and pass-through taxation, making them an attractive option for many entrepreneurs.

Common issues over LLCs often involve state regulations that can vary significantly, leading to confusion. Another concern is the limited lifespan; in some states, LLCs may dissolve upon a member's departure. Furthermore, establishing credibility can be more challenging for new LLCs compared to established corporations.