Quit Claim Deed From Trust To Limited Liability Company With Example

Description

How to fill out Indiana Quitclaim Deed From A Trust To A Limited Liability Company?

Precisely composed official documentation is one of the essential assurances for preventing problems and legal disputes, but acquiring it without the assistance of an attorney may require some time.

Whether you must swiftly locate an up-to-date Quit Claim Deed From Trust To Limited Liability Company With Example or any other forms for employment, family, or business situations, US Legal Forms is always ready to assist.

The process is even more straightforward for existing users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button next to the chosen document. Additionally, you can access the Quit Claim Deed From Trust To Limited Liability Company With Example at any time later, as all documents ever acquired on the platform are available in the My documents section of your profile. Save time and money on preparing official paperwork. Try US Legal Forms now!

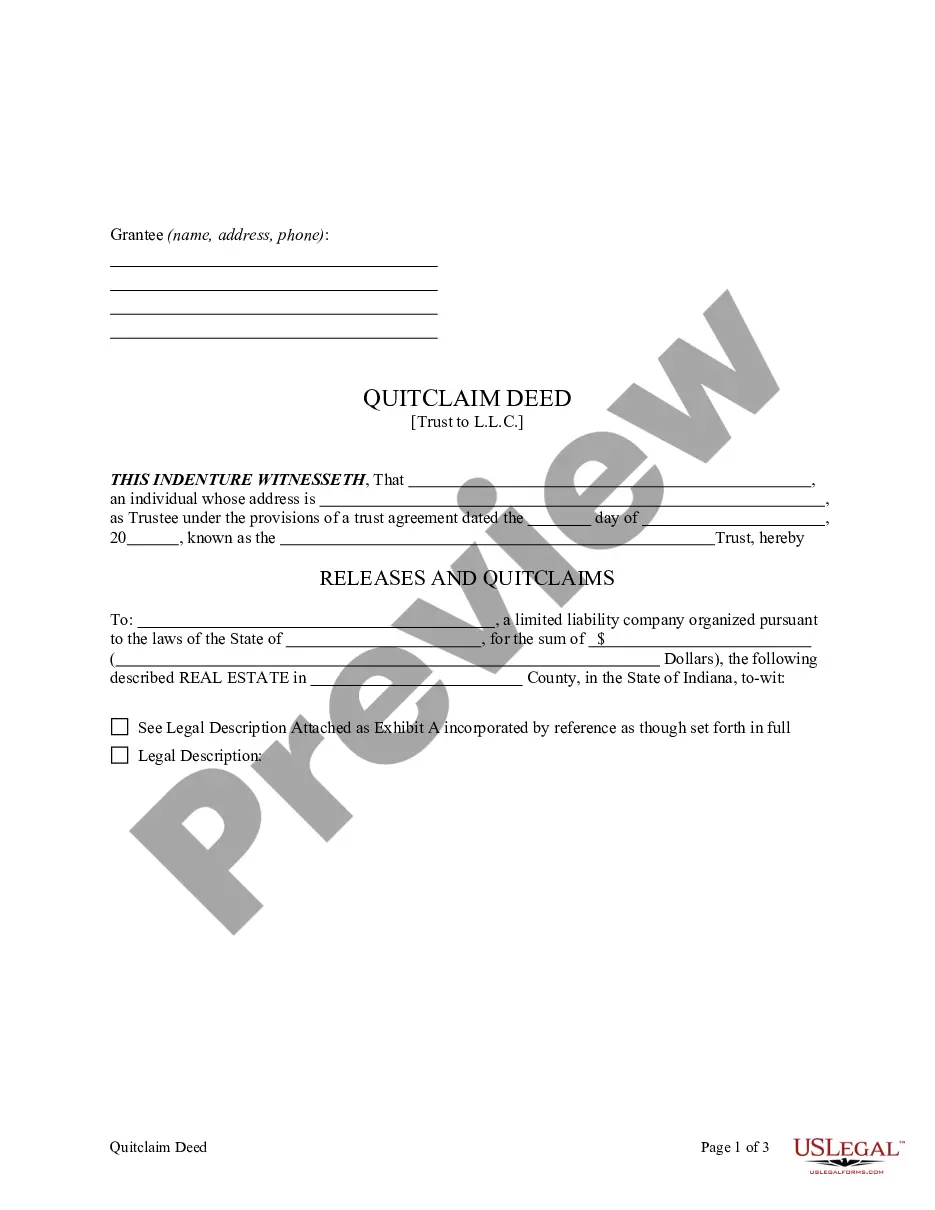

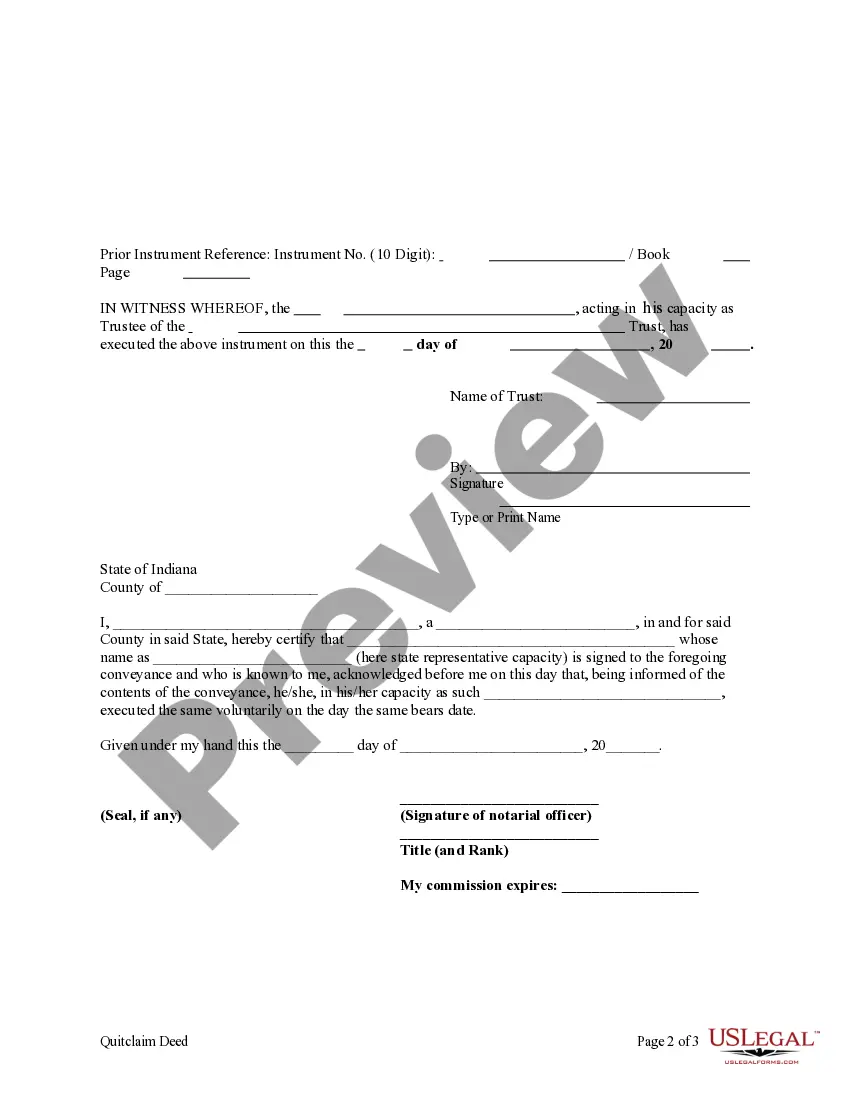

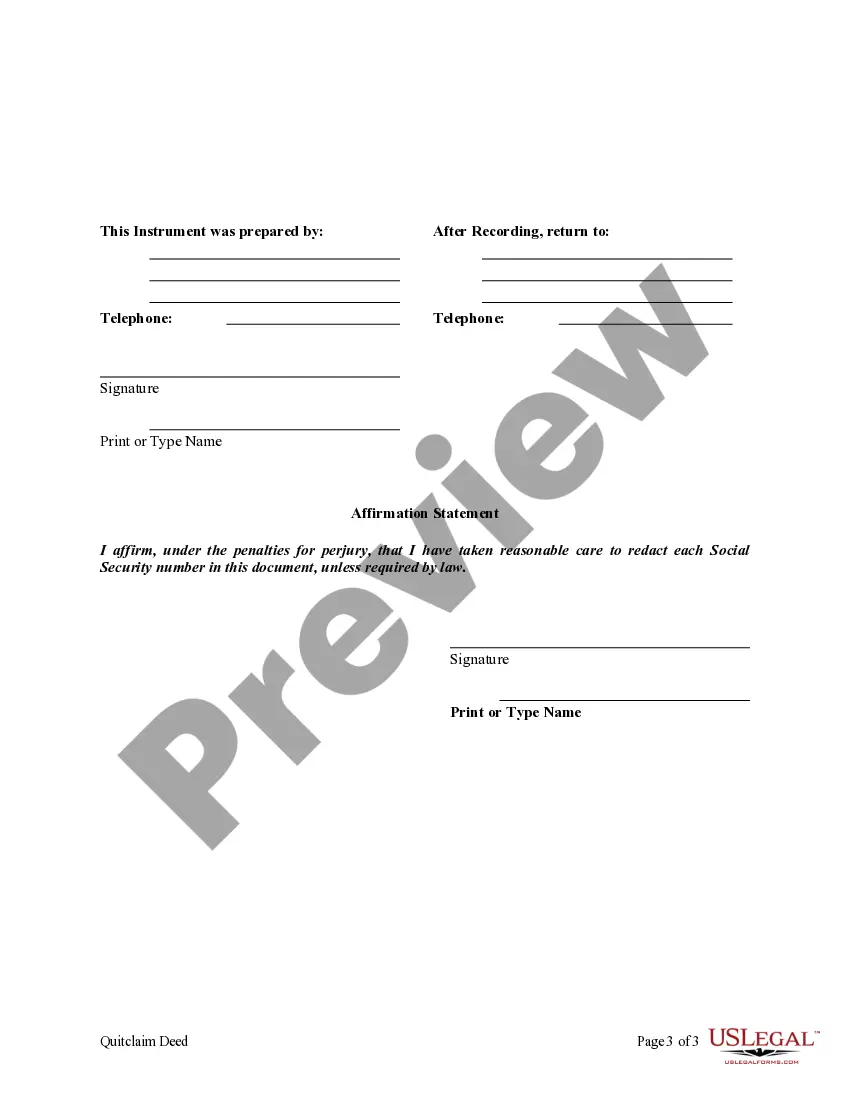

- Verify that the form is applicable to your situation and area by reviewing the description and preview.

- Seek another example (if necessary) using the Search bar in the page header.

- Click Buy Now when you identify the appropriate template.

- Choose the pricing plan, Log In to your account, or create a new one.

- Select your preferred payment method to acquire the subscription plan (via credit card or PayPal).

- Opt for PDF or DOCX file format for your Quit Claim Deed From Trust To Limited Liability Company With Example.

- Click Download, then print the document to complete it or add it to an online editor.

Form popularity

FAQ

When you transfer property to an LLC in Florida using a quit claim deed from trust to limited liability company with example, you may encounter specific tax implications. Generally, the transfer may not trigger a sales tax, but it could affect property taxes. It's important to reevaluate the property’s assessed value post-transfer, as the county may reassess it. Consult a tax professional to understand potential impacts on your overall tax liability.

Filling out a quitclaim deed in Florida requires careful attention to detail. Begin by entering the grantor’s and grantee’s names and the property description. Ensure you include the proper legal wording, and then sign the document in front of a notary. If you need a practical example, using a quit claim deed from trust to limited liability company with example can guide your process effectively.

To transfer your property to an LLC in Ohio, you’ll start by drafting a quit claim deed. This document should include the property's legal description and the LLC's details. After signing the deed in front of a notary, you’ll need to file it with the county recorder’s office. If you’re looking for assistance, consider exploring uslegalforms for comprehensive resources on a quit claim deed from trust to limited liability company with example.

The time it takes to transfer a deed in Ohio can vary, but the process generally takes a few days to a couple of weeks. After you complete the necessary paperwork and have it notarized, the next step is to file it with the county recorder’s office. Once filed, the deed becomes part of the public record. If you’re uncertain, using a quit claim deed from trust to limited liability company with example may simplify the procedure.

Individuals who are transferring property among family members or friends often benefit the most from a quitclaim deed. This type of deed allows for a simple and quick transfer without warranty of title, making it ideal for informal transactions. Additionally, using a quit claim deed from trust to limited liability company with example can provide both clarity and support in such transfers.

Transferring a deed to an LLC in Ohio starts with completing a quit claim deed. You will need to fill out the deed form, include the LLC's information, and have it notarized. Afterward, you must file the deed with the county recorder’s office. For detailed steps, you might find a quit claim deed from trust to limited liability company with example useful on platforms like uslegalforms.

To add an owner, or member, to an LLC in Ohio, you typically need to follow the procedures outlined in your operating agreement. This process often involves obtaining consent from existing members and amending the agreement. Once finalized, you can file the necessary documentation with the state. If you need guidance, check out resources like uslegalforms for help with forms like a quit claim deed from trust to limited liability company with example.

When you transfer property to an LLC in California, you may face certain tax consequences. Generally, the transfer may be subject to property tax reassessment, which could increase your tax burden. Additionally, income generated by the LLC could be taxed differently compared to individual ownership. For a clearer understanding, consider using a quit claim deed from trust to limited liability company with example.

In California, to avoid property tax reassessment when transferring property to an LLC, proper structuring is crucial. You can utilize a quit claim deed from trust to limited liability company with example, but ensure the ownership remains unchanged. Additionally, specific exclusions under Proposition 13 may allow you to prevent reassessment. Consulting an experienced attorney can help you navigate these regulations effectively.

Transferring a property title to an LLC in California typically involves drafting a quit claim deed from trust to limited liability company with example. You'll need to fill out the quit claim deed form with the property details and the LLC's information. After signing, you must file the deed with the county recorder's office to finalize the transfer. Always ensure that you comply with California's legal requirements during this process.