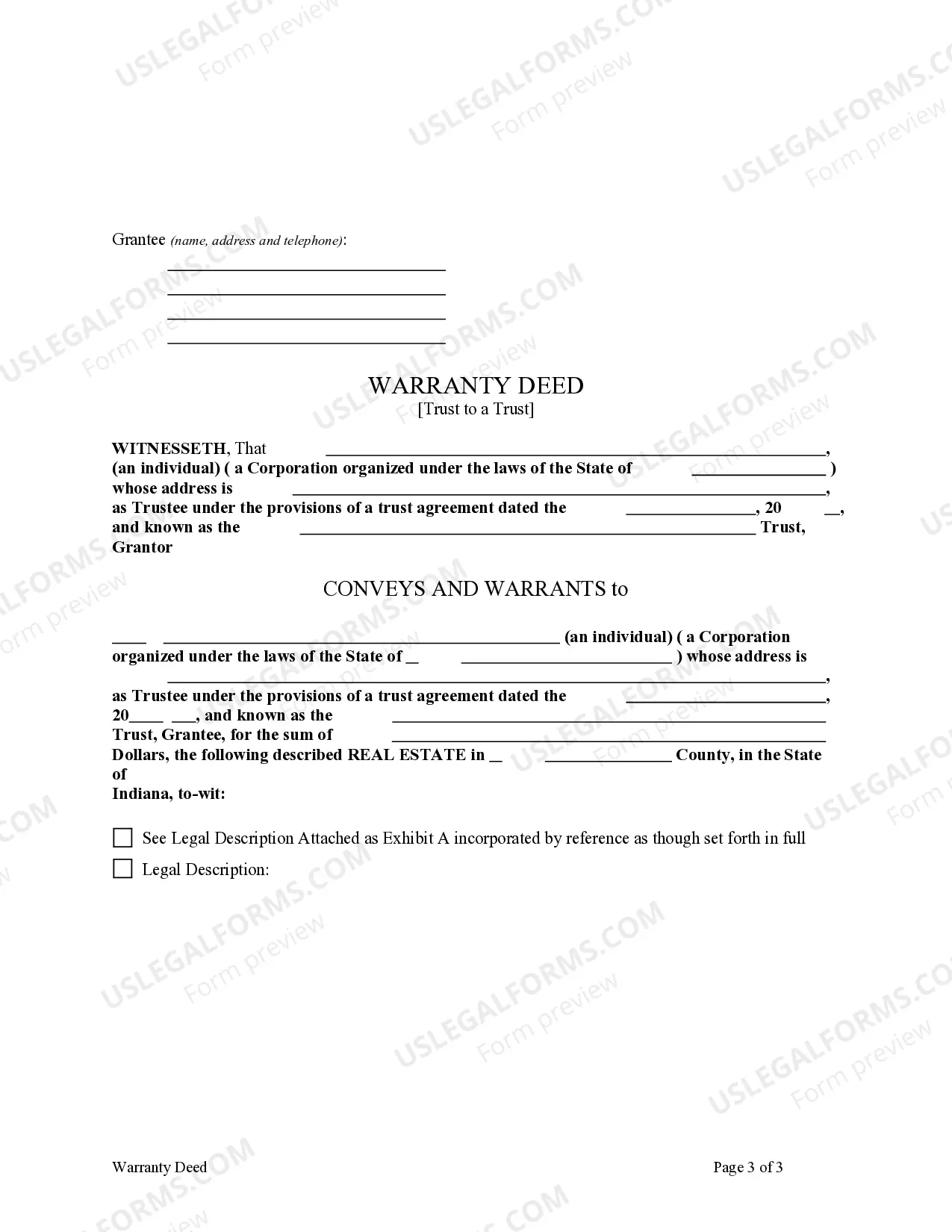

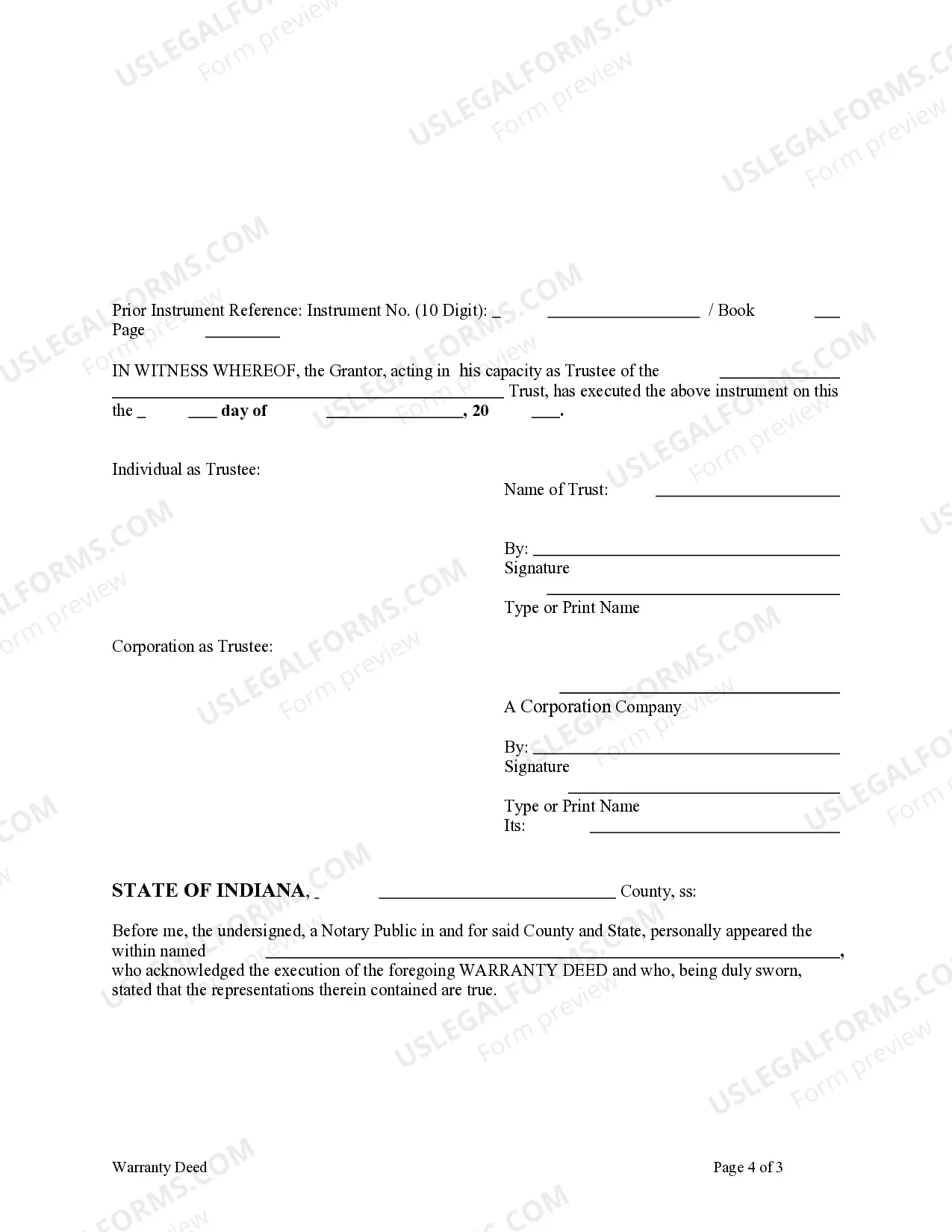

This form is a Warranty Deed where the Grantor is a Trust and the Grantee is also a Trust. Grantor conveys and warrants the described property to Trustee of the Grantee. This deed complies with all state statutory laws.

Trust Grantor Form Without Adequate Security

Description

Form popularity

FAQ

Whether you need an EIN for a grantor trust depends on its structure. Often, a grantor trust operates under the grantor's SSN if it remains revocable. However, once the grantor passes or if the trust becomes irrevocable, obtaining an EIN may be necessary for tax reporting. Our user-friendly platform can assist you with information on obtaining the trust grantor form without adequate security.

The power to borrow without adequate security allows a trust or individual to take out loans without providing collateral. This power could create risks, making creditors more reliant on the borrower's ability to repay. It's crucial to evaluate the implications of such a power when drafting trust documents. You may want to consider how the trust grantor form without adequate security may impact these decisions.

A trust is considered a defective grantor trust when the grantor retains certain powers that result in the income being taxed to them instead of the trust itself. Common powers include the ability to revoke the trust or control its assets. This structure can provide benefits like avoiding gift taxes while allowing the grantor to maintain some control. To navigate this complex area, the trust grantor form without adequate security can be very helpful.

A revocable trust does not need a new EIN upon the grantor's death; it typically becomes irrevocable at that point. This means the trust may continue to use the original EIN, or it may need to apply for a new one depending on how the assets are structured. Understanding these details can streamline the estate settlement process. For guidance, you can refer to resources on the trust grantor form without adequate security.

Trusts can have an Employer Identification Number (EIN) or use the Social Security Number (SSN) of the grantor. If the trust is revocable and the grantor is alive, it often uses the grantor's SSN. However, once the trust becomes irrevocable, it typically needs its own EIN. This distinction is essential for tax purposes and managing the trust's financial activities.

An intentionally defective grantor trust is designed to maintain control over assets while still offering tax advantages. This type of trust allows the grantor to be treated as the owner for income tax purposes, which means income generated within the trust is taxed to the grantor. You should consider using a Trust grantor form without adequate security to help facilitate the establishment of this kind of trust. By utilizing U.S. Legal Forms, you can easily create and manage the necessary documents to set up an intentionally defective grantor trust.

A Form 1041 is typically not required for a grantor trust, as the grantor's income is reported on their personal tax return. However, if the trust becomes irrevocable or meets certain criteria, then filing a 1041 may be necessary. Thus, it’s essential to evaluate your specific situation to comply with IRS regulations accurately. To streamline this process, consider using our Trust grantor form without adequate security for clear guidance.

While a trust generally requires a grantor to establish and fund it, there can be situations where a trust exists without a living grantor. For example, a trust may become irrevocable upon the grantor’s death, transferring rights to the beneficiary automatically. Understanding these conditions can help you form a more robust estate plan. If you need assistance in navigating these complexities, our Trust grantor form without adequate security is a great resource.

Recent IRS guidelines focus on transparency in trust taxation and mandates more thorough reporting on trust activities. One key element encourages grantors to disclose their direct involvement, highlighting the importance of understanding how trust structures affect tax obligations. Staying informed about these changes is crucial for effective trust management. You can utilize our Trust grantor form without adequate security to ensure compliance with new IRS rules.

Generally, an Employer Identification Number (EIN) is not required for a grantor trust if you, as the grantor, report the trust's income on your personal tax return. However, if the trust becomes irrevocable or holds specific types of accounts, obtaining an EIN may be necessary. It's important to evaluate your situation to determine the best course of action. Our resources, including the Trust grantor form without adequate security, can help clarify these requirements.