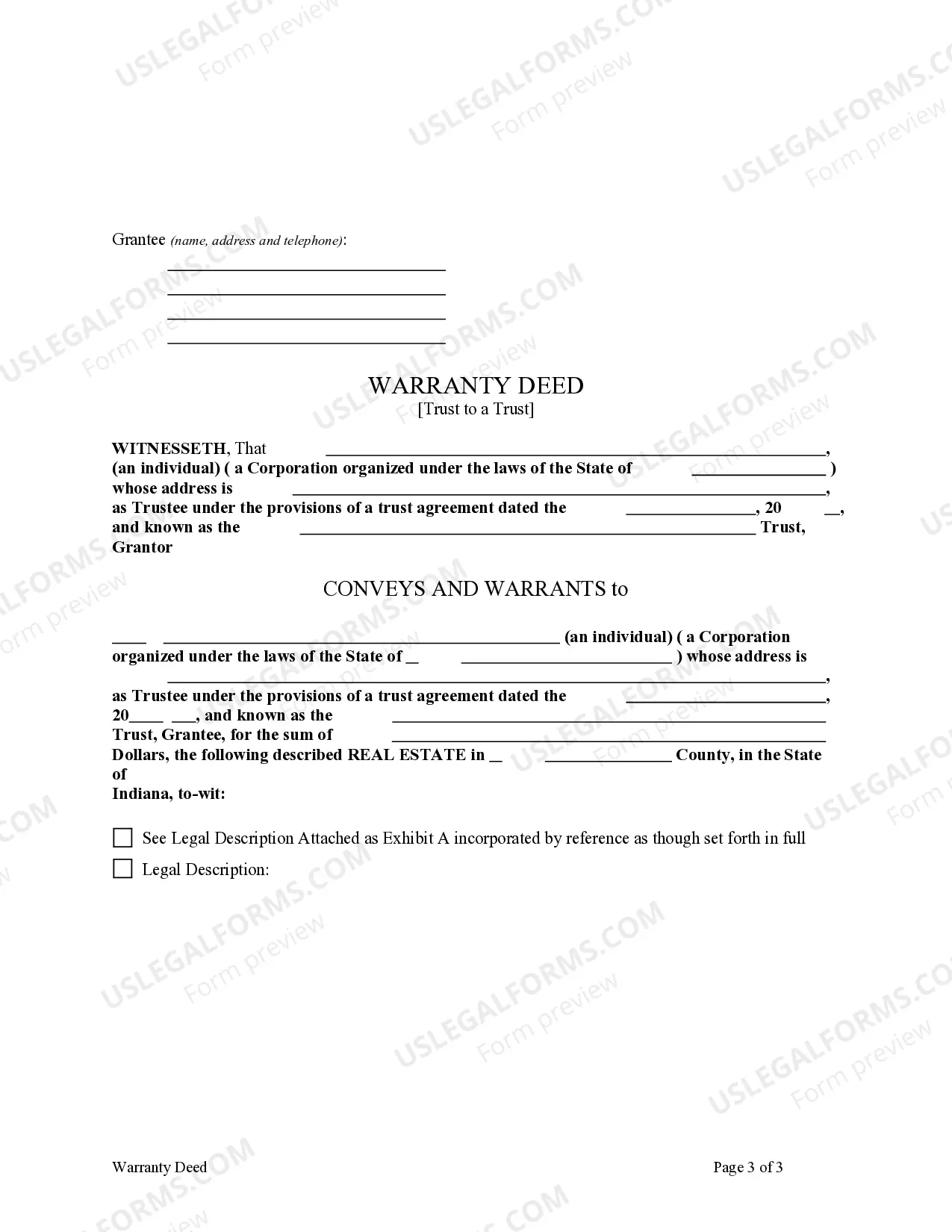

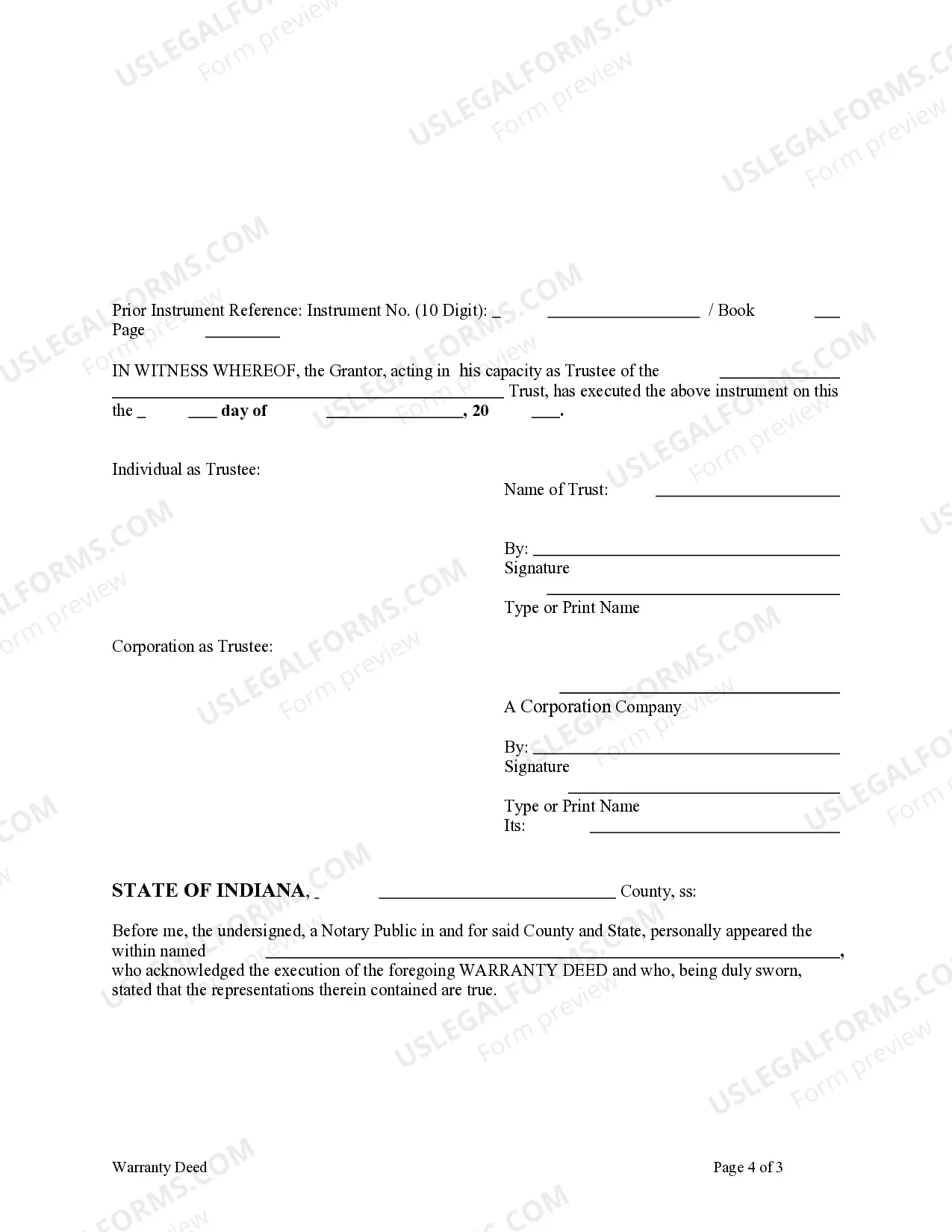

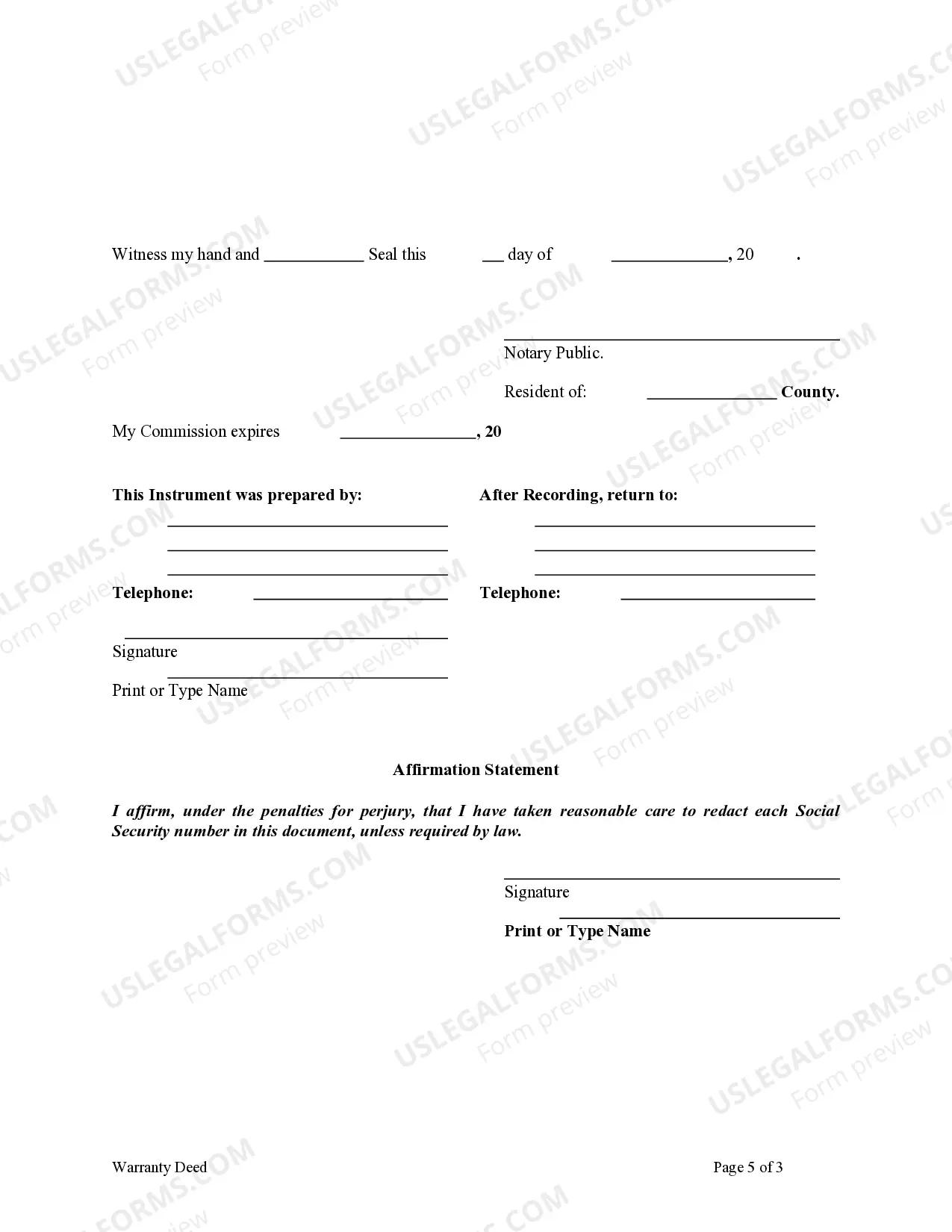

This form is a Warranty Deed where the Grantor is a Trust and the Grantee is also a Trust. Grantor conveys and warrants the described property to Trustee of the Grantee. This deed complies with all state statutory laws.

Trust Grantor Form Withholding

Description

Form popularity

FAQ

The grantor of a trust is the individual who creates the trust and contributes assets to it. This person lays the foundation for how the trust will operate and designates beneficiaries. Understanding the role of the grantor is essential, especially when navigating the Trust grantor form withholding and related tax implications. To clarify your responsibilities, US Legal Forms has resources specifically tailored to guide you.

Yes, a trust can pass out withholding tax to its beneficiaries, allowing for a fair distribution of tax responsibilities. This process often requires completing the Trust grantor form withholding to document the amounts accurately. Understanding how withholding works within the context of a trust is crucial for compliance with tax regulations. You can find useful information and forms on the US Legal Forms platform to assist you.

To avoid inheritance tax with a trust, you should structure the trust in a manner that aligns with tax laws and regulations. One effective strategy involves using the Trust grantor form withholding to manage distributions properly. Establishing the trust early and ensuring proper funding can also help in minimizing tax liabilities. US Legal Forms provides valuable resources to help you set up your trust effectively.

Filling out a withholding exemption form involves providing accurate information about your trust and its beneficiaries. You need to complete each section carefully and ensure that you use the correct Trust grantor form withholding. This form helps ensure the proper handling of exemptions. If you need guidance, US Legal Forms offers templates and clear instructions that can aid you in this process.

Yes, withholding can be distributed from a trust, which means that a trust may allocate tax liabilities among its beneficiaries. This is particularly important for maintaining transparency and fairness in distributing income. Utilizing the Trust grantor form withholding can guide you through the necessary steps and help you understand your obligations. Consider the resources available on the US Legal Forms platform for further assistance.

Yes, a trust can allow its personal exemption to be passed to its beneficiaries. This process can help reduce the overall tax liability of the trust. However, it is essential to complete the Trust grantor form withholding accurately to ensure compliance with tax laws. Consulting a tax professional or using a reliable platform like US Legal Forms can simplify this process.

California Form 541 must be filed by estates or trusts that have gross income of $600 or more, or if one or more beneficiaries are non-residents. Additionally, if there's any trust grantor form withholding, it's essential to comply with this filing requirement. Understanding these regulations will help ensure you fulfill your tax obligations.

Filing Form 593 involves accurately reporting all withholdings that have taken place during the tax year. You can complete the form online or via paper submission, depending on your preference. Make sure to keep records of trust grantor form withholding as this will help you accurately fill out Form 593.

You may not need to file an estate tax return if there is no income, but specific thresholds may apply. It’s important to assess whether the estate exceeds certain value limits. Consulting with a tax professional will help ensure you adhere to any trust grantor form withholding obligations.

Even if there is no income, you generally still need to file a final Form 1041. The IRS requires this to formally close the trust's tax obligations. This ensures that trust grantor form withholding and other matters are resolved, preventing possible future tax complications.