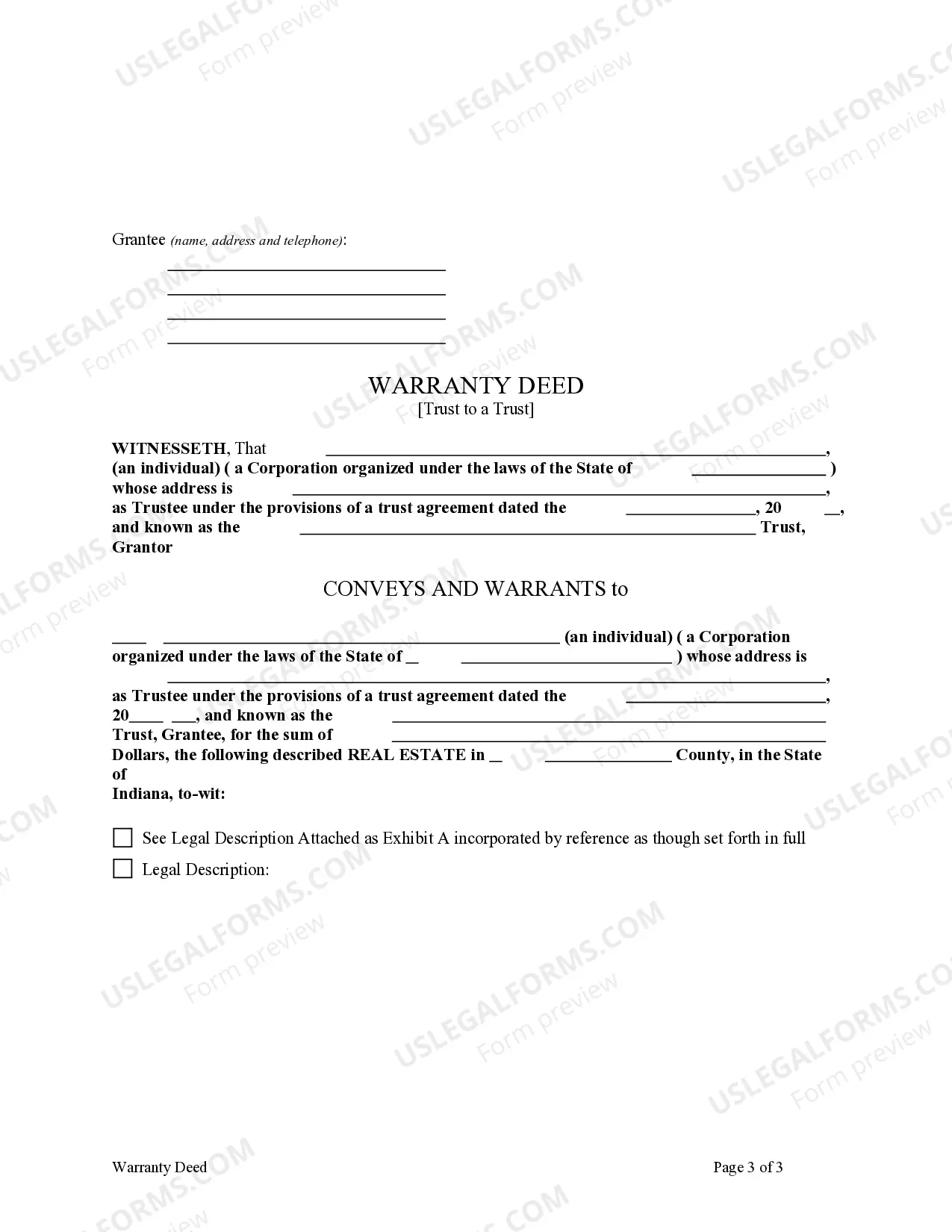

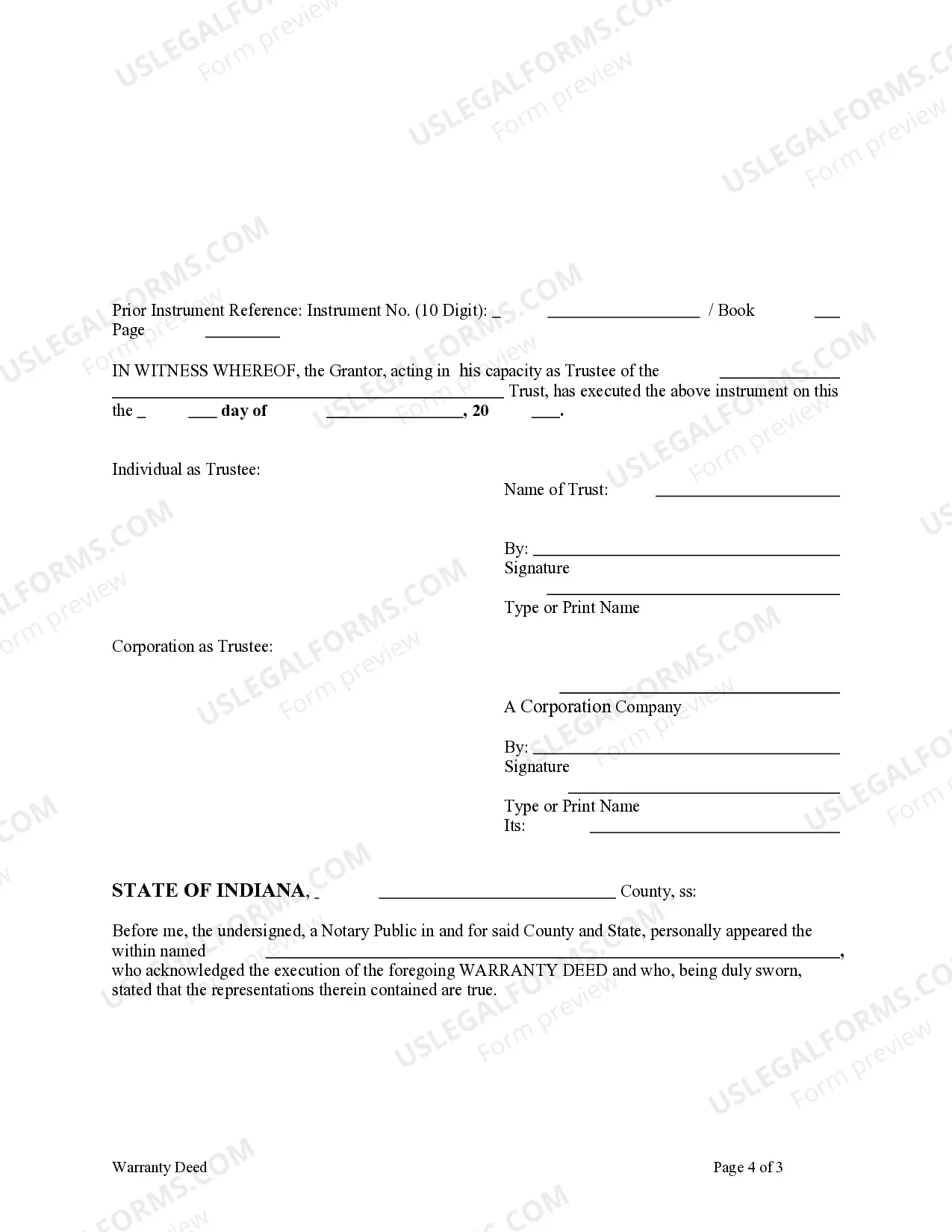

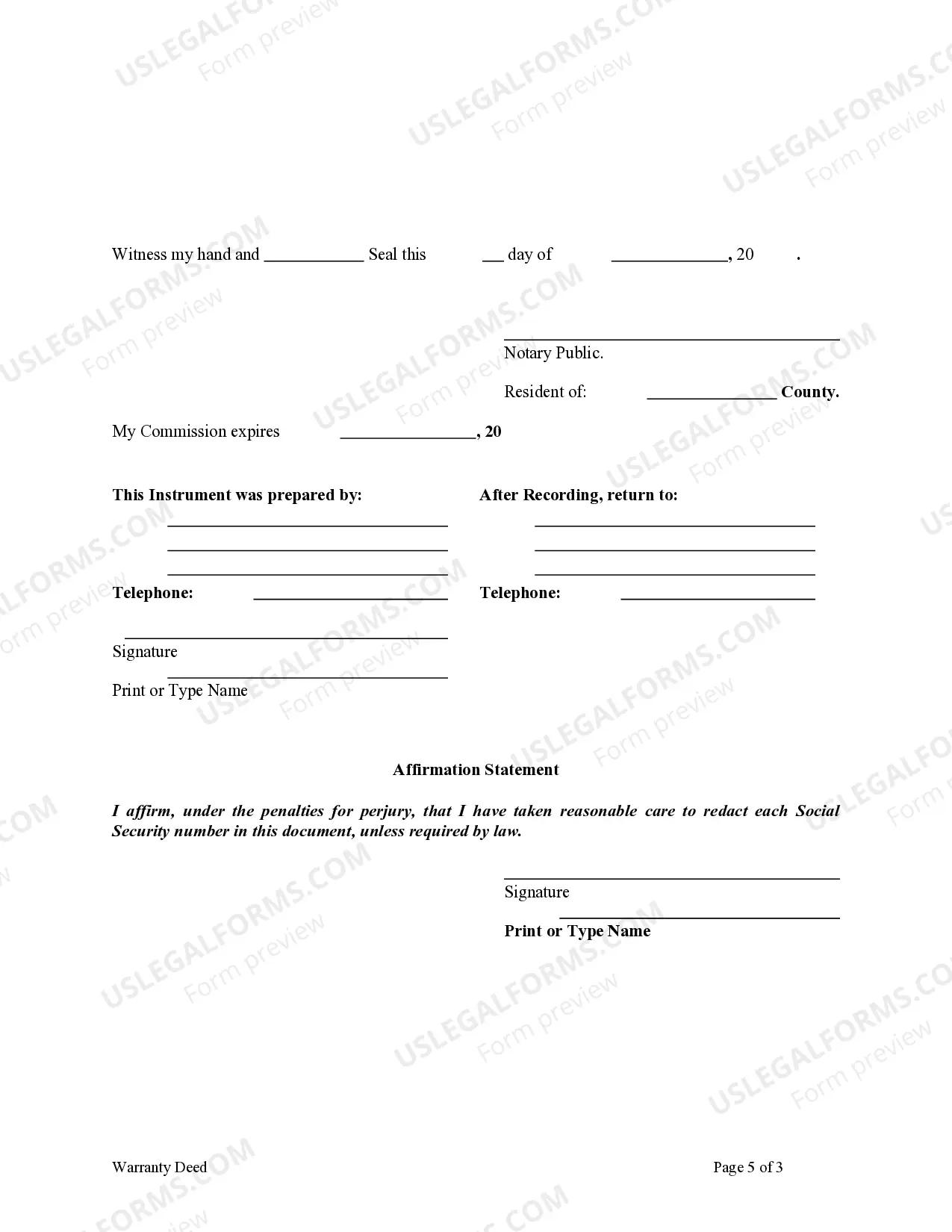

This form is a Warranty Deed where the Grantor is a Trust and the Grantee is also a Trust. Grantor conveys and warrants the described property to Trustee of the Grantee. This deed complies with all state statutory laws.

Trust Grantor Form With Ein

Description

Form popularity

FAQ

The application for an EIN for a trust is generally submitted by the responsible party, typically the grantor or the individual managing the trust. This person fills out the necessary forms and provides the required information to the IRS. The Trust grantor form with EIN can assist in streamlining this application process.

In many cases, the responsible party may be the same as the owner, particularly in grantor trusts. However, if another individual manages the trust, their role can differ. It is important to clarify these roles, especially when dealing with the Trust grantor form with EIN, to ensure accurate filing and compliance.

Typically, a grantor trust does not need a new EIN when the grantor dies, as the trust may continue under the original EIN. However, if the trust changes to a non-grantor trust, a new EIN might be required for tax purposes. Ensure you consult relevant tax guidelines, and consider using the Trust grantor form with EIN for smoother transitions.

The responsible party for a trust EIN is usually the grantor, unless another individual is designated to oversee the trust. This person handles tax obligations and reports income generated by the trust. Utilizing the Trust grantor form with EIN helps clarify this responsibility during the application process.

Yes, a grantor trust can use an EIN, especially for tax purposes or when opening bank accounts. The EIN helps in identifying the trust for federal tax reporting. Be sure to obtain an EIN through a simple application process, and effectively manage your finances with the Trust grantor form with EIN.

When applying for an EIN for a trust, the responsible party is generally the grantor or the individual managing the trust. This person will provide their personal information on the application. They play a critical role in ensuring the Trust grantor form with EIN is filled out correctly and submitted on time.

No, the responsible party and the registered agent are not the same. The responsible party is the individual who controls, manages, or directs the trust's operations and has a significant role in filings like the Trust grantor form with EIN. Whereas, the registered agent serves as the official contact for legal correspondence with the state.

Filing a tax return for a grantor trust involves reporting income, deductions, and other relevant details on your personal tax return, typically using Form 1040. Since the trust does not exist as a separate tax entity, you will also need to include the income generated by the trust on your return. Remember to keep records of any transactions and utilize the Trust grantor form with EIN for efficiently managing trust-related income.

An example of an EIN number would be 12-3456789. This nine-digit number format helps identify the trust for taxation purposes. Remember, when you complete your Trust grantor form with ein, you must use the proper EIN assigned by the IRS to avoid any delays or issues with tax reporting.

To look up a trust EIN number, you can consult any official documents related to the trust, such as tax returns. Alternatively, contacting the IRS directly may provide assistance if needed. Having your Trust grantor form with ein at hand can also facilitate this search, ensuring you have all pertinent information ready.