In Amendment Agreement For Fy 2018-19 Last Date

Description

How to fill out Indiana Amendment To Postnuptial Property Agreement?

Regardless of whether you handle documentation frequently or need to present a legal paper occasionally, it is essential to find a valuable resource that includes all relevant and current samples.

The first step with an In Amendment Agreement For Fy 2018-19 Last Date is to ensure it is the most recent version, as this determines if it can be submitted.

If you wish to simplify your search for the most up-to-date document samples, look for them on US Legal Forms.

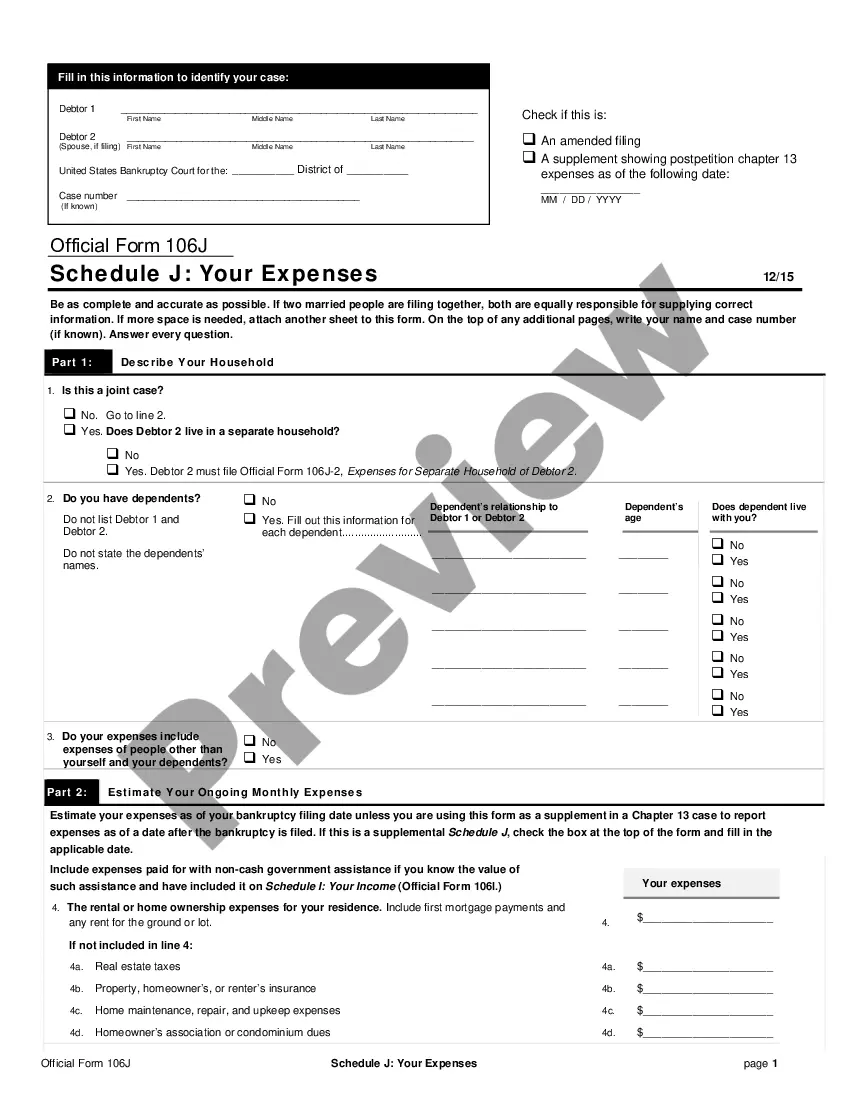

To obtain a form without an account, follow these steps: Use the search menu to locate the desired form, view the In Amendment Agreement For Fy 2018-19 Last Date preview and details to ensure it is the correct one, double-check the form, click Buy Now, choose a subscription plan that suits you, register an account or Log In to your existing one, provide your credit card or PayPal information to finalize the purchase, select the file format for download, and confirm it. Experience clarity in handling legal documents; all your templates will be organized and validated with a US Legal Forms account.

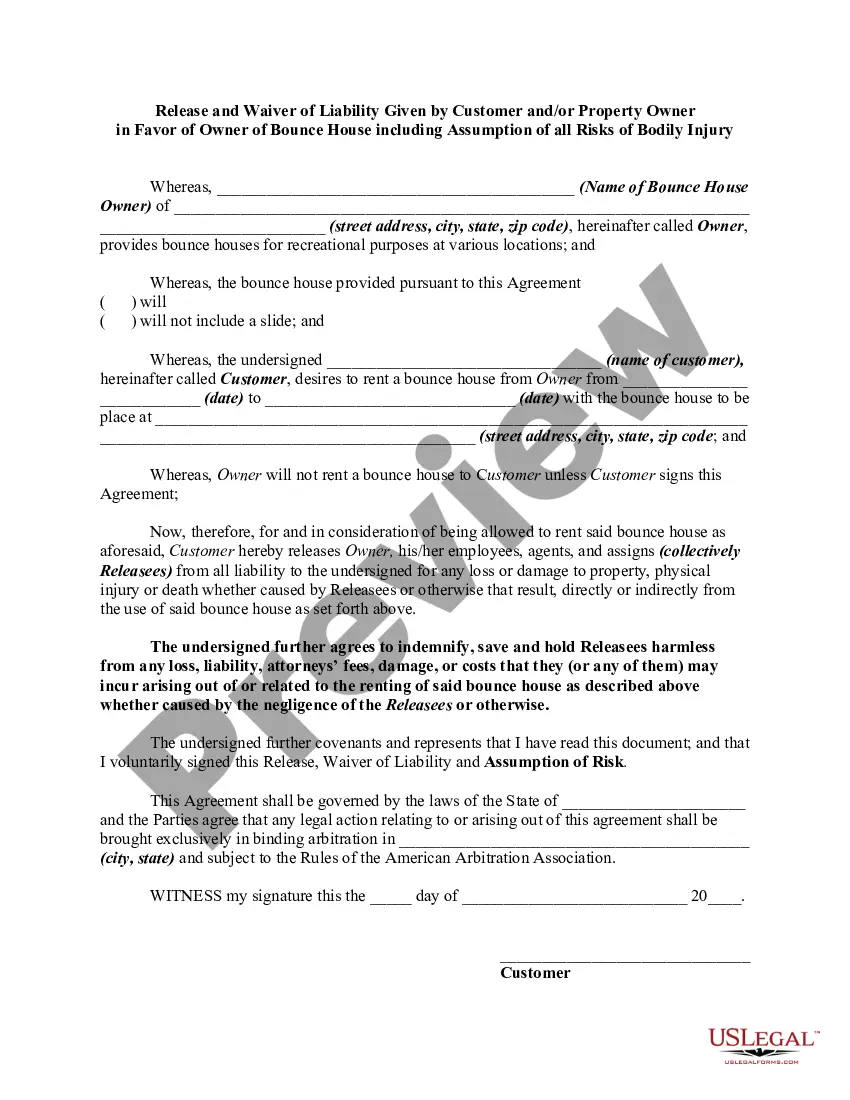

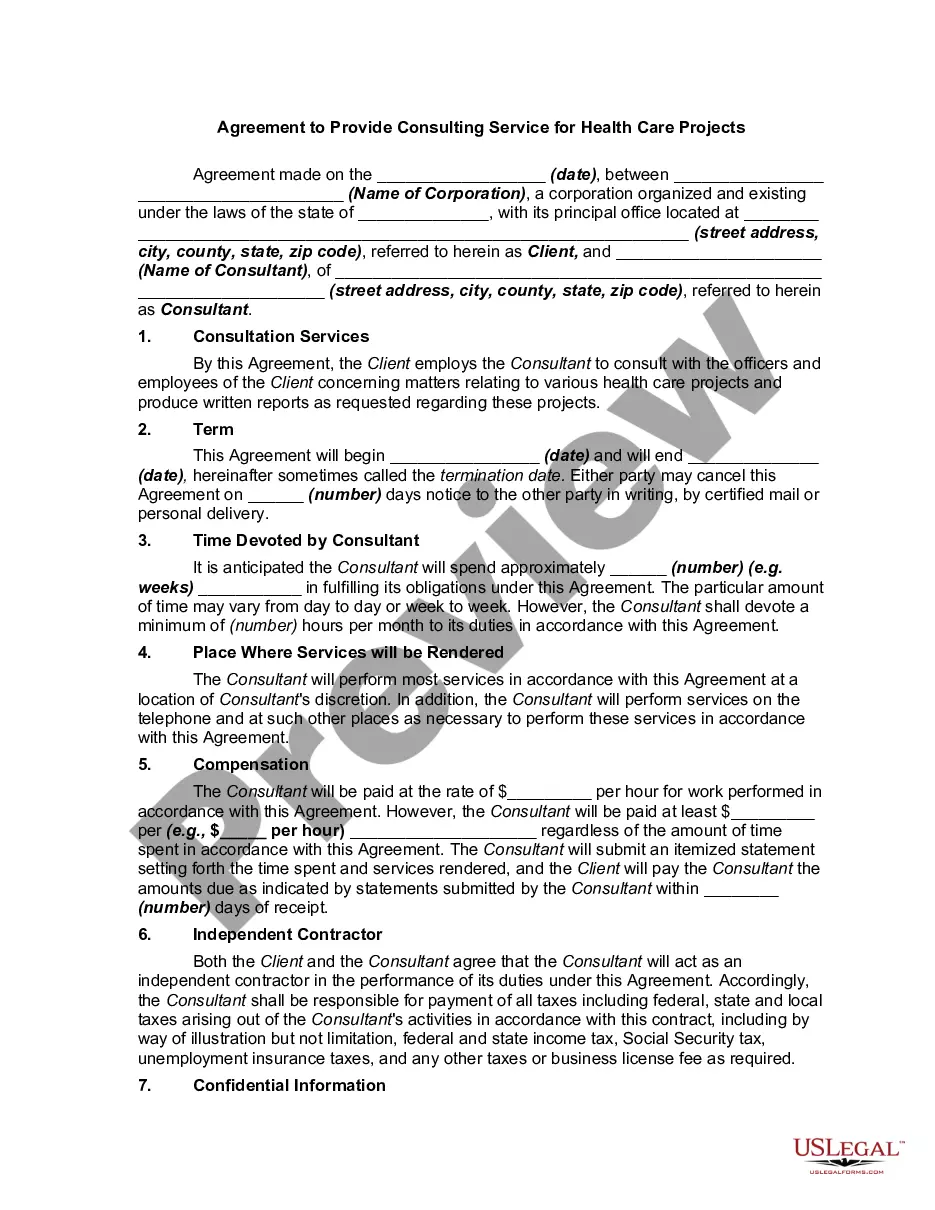

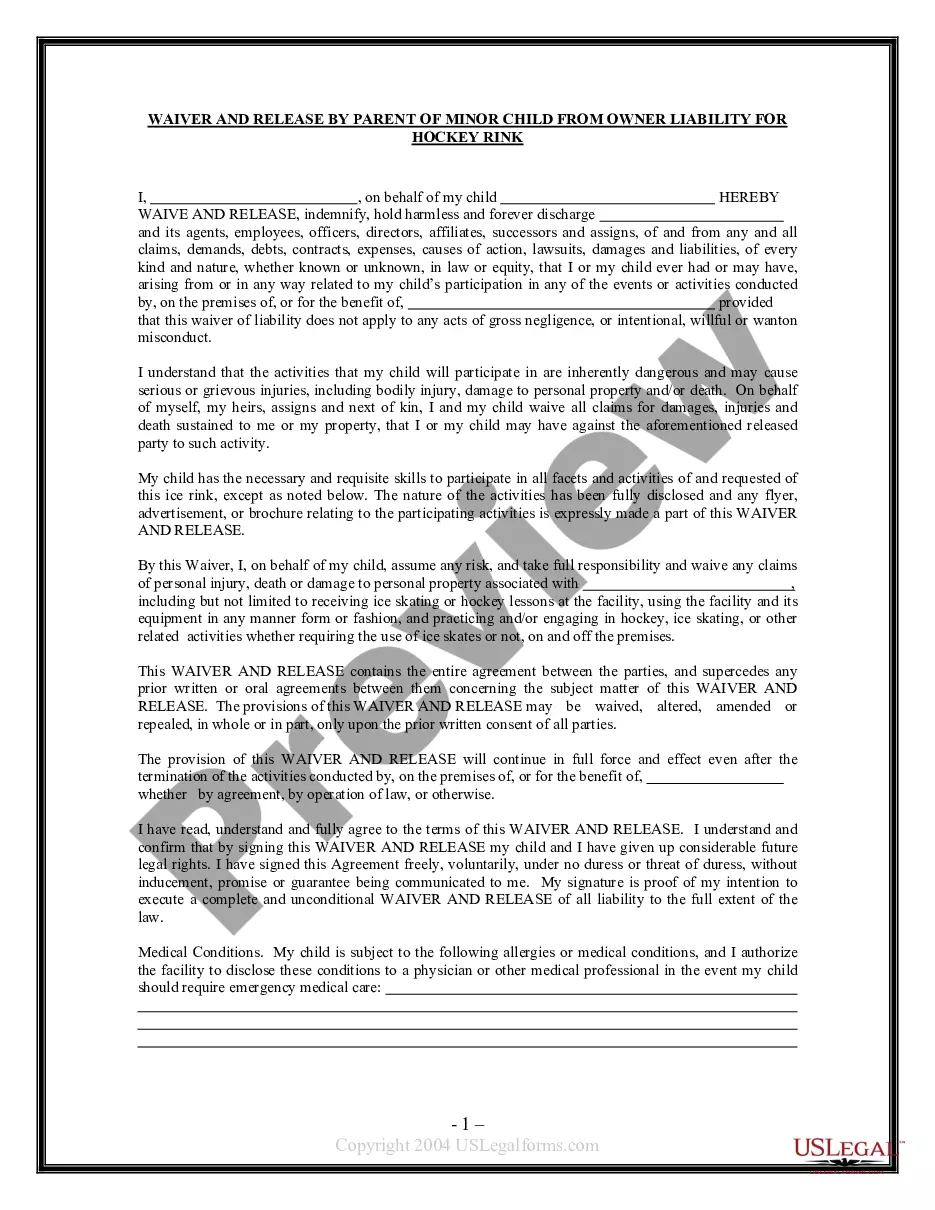

- US Legal Forms is a repository of legal documents that features almost every sample you might seek.

- Search for the templates you require, review their relevance instantly, and learn more about their application.

- With US Legal Forms, you gain access to approximately 85,000 form templates across various fields.

- Acquire the In Amendment Agreement For Fy 2018-19 Last Date samples in just a few clicks and save them anytime in your profile.

- A US Legal Forms profile enables you to access all necessary samples with greater ease and reduced effort.

- Simply click Log In at the top of the website and navigate to the My documents section to have all the forms you need at your fingertips.

- You won't have to spend time searching for the right template or verifying its validity.

Form popularity

FAQ

Is there a time limit for amending a return? The IRS advises that you generally must file Form 1040X to amend a return within three years from the date you filed your original tax return, or within two years of the date you paid the tax, whichever is later.

Can I file my Amended Return electronically? If you need to amend your 2019, 2020 and 2021 Forms 1040 or 1040-SR you can now file the Form 1040-X, Amended U.S. Individual Income Tax Return electronically using available tax software products.

Don't automatically assume you have to pay a penalty. If you amend your return before it is due (before April 15), then your amendment is timely, and no interest or penalty will accrue. Also, the IRS can be quite reasonable, especially for a first-time mistake.

If you need to make a change or adjustment on a return already filed, you can file an amended return. Use Form 1040-X, Amended U.S. Individual Income Tax Return, and follow the instructions.

Generally, you must file an amended return within three years from the date you filed your original return or within two years from the date you paid any tax due, whichever is later.