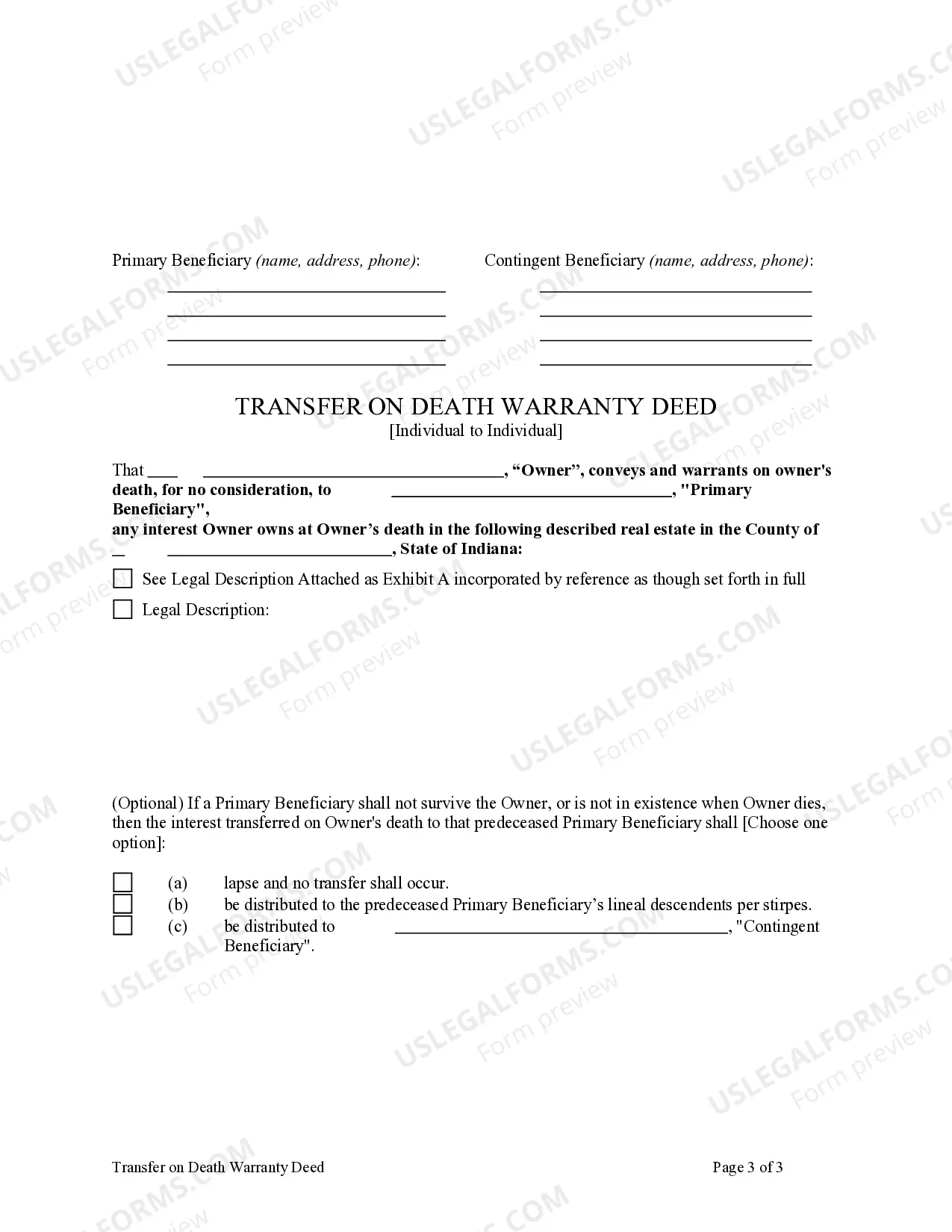

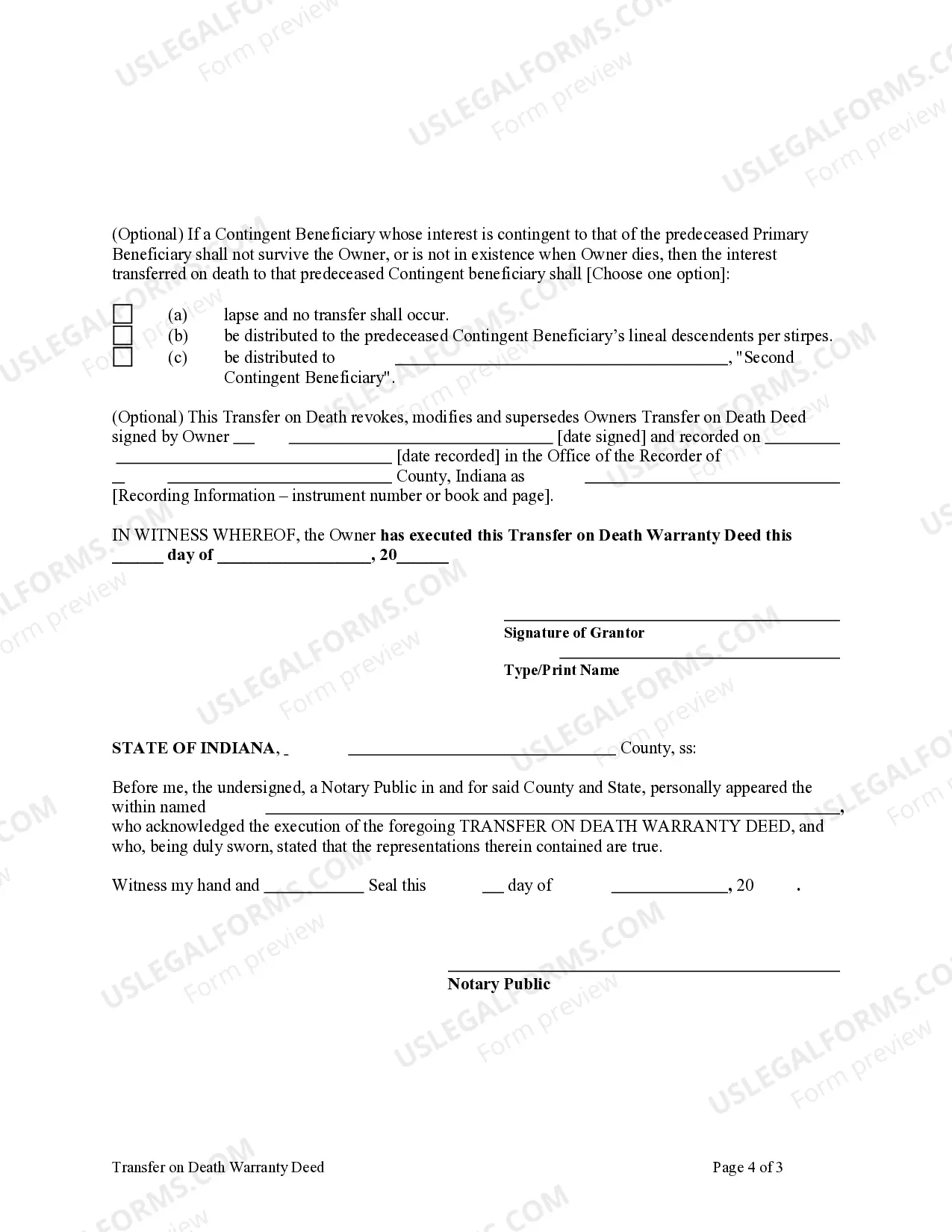

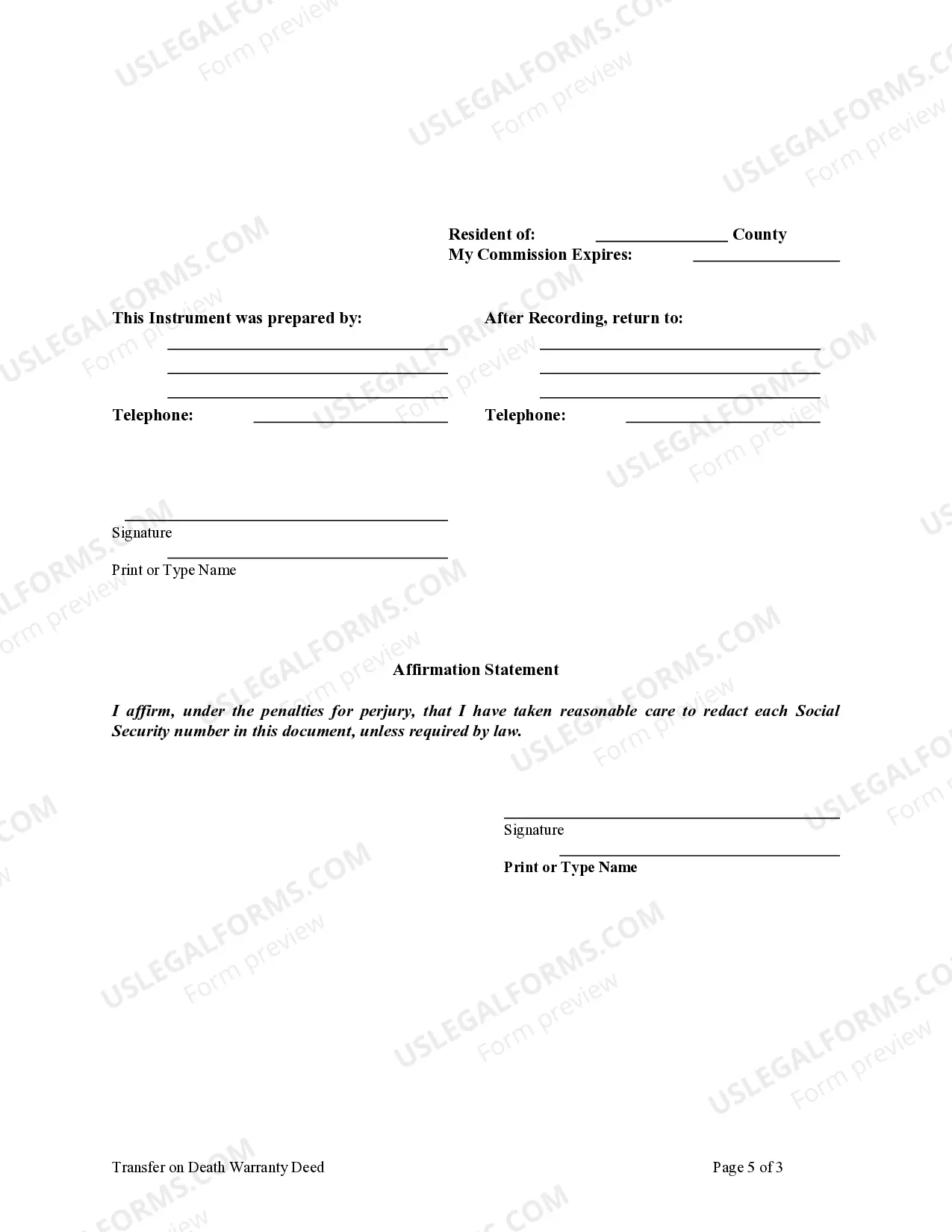

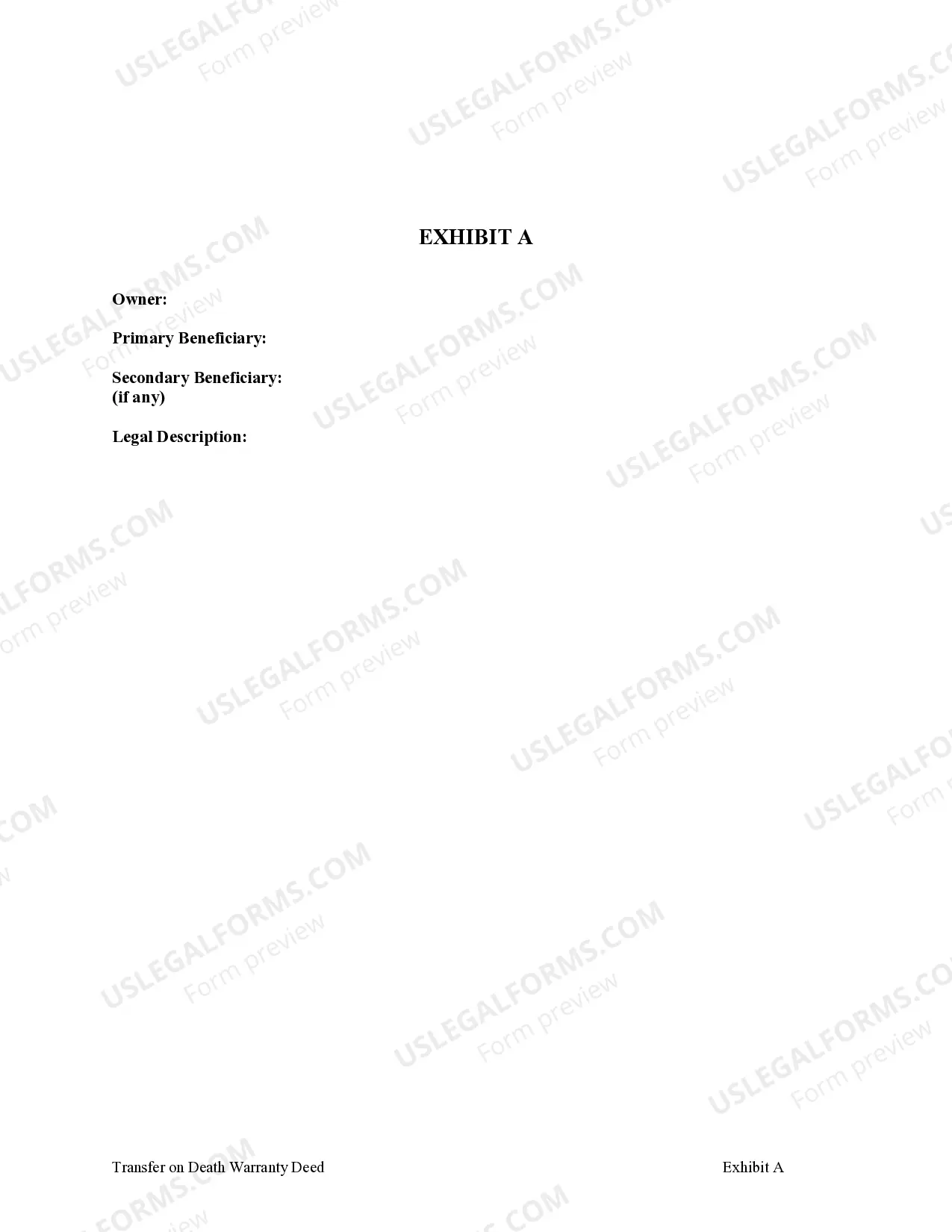

This form is a Beneficiary or Transfer on Death Warranty Deed where the Grantor is an individual and the Grantee is an individual. This transfer is revocable by Grantor until his or her death and effective only upon the death of the Grantor. The Deed has provisions for a contingent and a secondary contingent beneficiary. This deed complies with all state statutory laws.

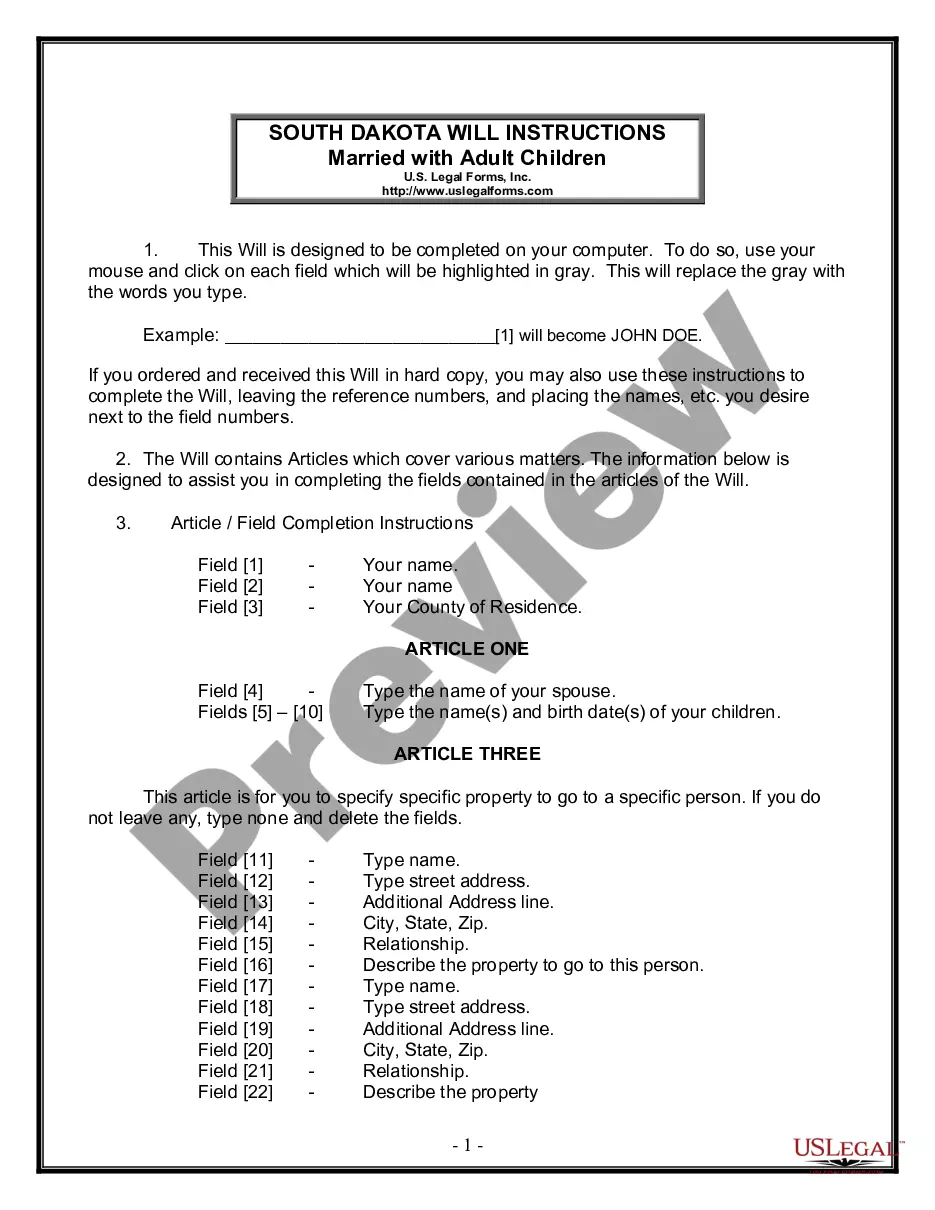

Title: Understanding the Indiana Transfer on Death Deed Form with Florida: A Detailed Overview Introduction: The Indiana Transfer on Death Deed (TODD) form provides an opportunity for property owners in Indiana to transfer real estate, located in Florida, to designated beneficiaries upon their death without the need for probate. This comprehensive guide will unravel the process, benefits, and different types of Indiana Transfer on Death Deed forms with relevance to Florida. Why Choose an Indiana Transfer on Death Deed Form? The Indiana TODD form allows individuals to retain full control and ownership of their real estate during their lifetime while ensuring a simple and efficient transfer of the property upon death. By avoiding probate, beneficiaries can directly inherit the property in Florida as specified in the deed, minimizing complications and expenses. Types of Indiana Transfer on Death Deed Forms with Florida: 1. Revocable Transfer on Death Deed: — This form permits property owners to modify or revoke the transfer at any time during their lifetime without seeking prior consent from the designated beneficiary. It offers flexibility and control, frequently chosen for its revocability. 2. Irrevocable Transfer on Death Deed: — Alternatively, an irrevocable Indiana TODD form provides a level of permanency, limiting the property owner's ability to revoke or modify the transfer without the beneficiary's consent. This type of transfer is often preferred for its assurance and security. Process to Create and Implement: To create an Indiana Transfer on Death Deed form with relevance to Florida, follow these steps: 1. Research State Requirements: Understand the specific guidelines and requirements of Indiana and Florida concerning TODD forms to ensure compliance. 2. Gather Essential Information: Collect necessary details about the property, beneficiaries' names, addresses, and other relevant data required for completing the form accurately. 3. Obtain a Legal Form: Acquire the Indiana TODD form from a reliable legal source, such as an attorney, online service, or the Indiana State Legislature website. 4. Fill out the Form: Carefully complete the form, ensuring accuracy in every section and adhering to the specific instructions provided. 5. Execute the Form: Sign the completed TODD form in the presence of a notary public or another authorized witness, following the legal requirements of both Indiana and Florida. 6. Record the Deed: File the executed deed in the county's corresponding recorder's office in Florida, where the property is located. Pay any applicable filing fees. 7. Provide Beneficiary with a Copy: Share a certified copy of the executed Indiana TODD form with the designated beneficiary to ensure they are aware of their future ownership rights. Conclusion: The Indiana Transfer on Death Deed form provides a straightforward and efficient method for Indiana property owners to transfer real estate in Florida to their chosen beneficiaries. By selecting either the revocable or irrevocable form, individuals can customize their planning according to their preferences. Understanding the process and complying with the necessary steps will enable property owners to successfully execute their desired transfer, ensuring a seamless inheritance process for their beneficiaries.