Llc Operating Agreement Indiana With Multiple Classes

Description

How to fill out Indiana Limited Liability Company LLC Operating Agreement?

Utilizing legal templates that comply with federal and regional regulations is crucial, and the web provides many choices to select from.

However, what is the benefit of spending time searching for the suitable Llc Operating Agreement Indiana With Multiple Classes model online if the US Legal Forms digital library already possesses those templates gathered in one location.

US Legal Forms is the largest online legal repository with more than 85,000 customizable templates created by attorneys for any professional or personal scenario. They are simple to navigate, with all documents categorized by state and intended use. Our specialists remain updated with legislative modifications, so you can always trust that your documents are current and compliant when obtaining a Llc Operating Agreement Indiana With Multiple Classes from our site.

Every document you locate via US Legal Forms is reusable. To re-download and complete previously purchased forms, access the My documents section in your account. Take advantage of the most comprehensive and user-friendly legal paperwork service!

- Obtaining a Llc Operating Agreement Indiana With Multiple Classes is swift and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document sample you need in the appropriate format.

- If you are a new visitor to our site, follow these steps.

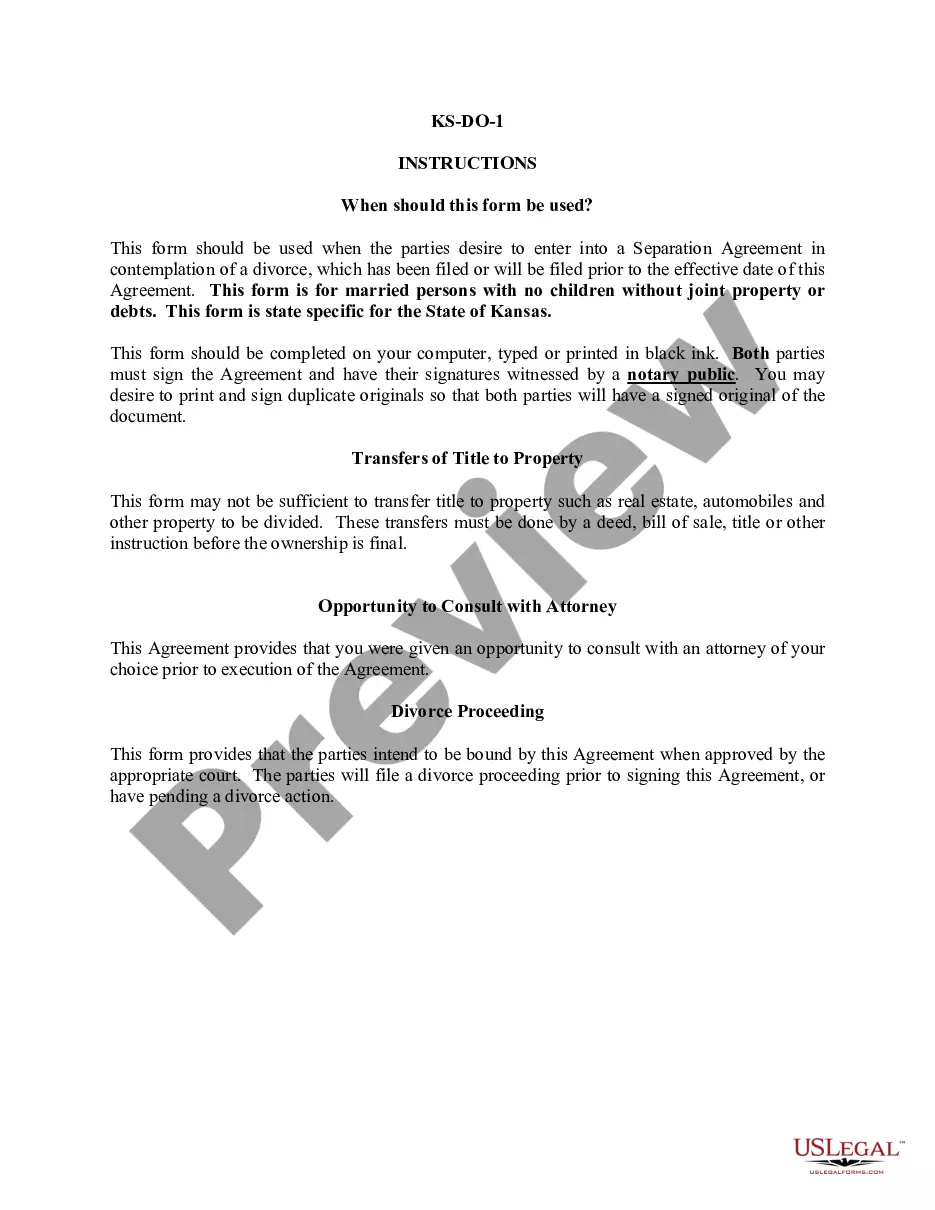

- Review the template using the Preview option or through the text outline to ensure it meets your requirements.

- Search for another sample using the search feature at the top of the page if necessary.

- Click Buy Now once you’ve discovered the correct form and choose a subscription plan.

- Create an account or Log In and complete the payment using PayPal or a credit card.

- Choose the ideal format for your Llc Operating Agreement Indiana With Multiple Classes and download it.

Form popularity

FAQ

Indeed, an LLC can have different classes of members. Different classes can help you manage varying levels of ownership and control among members. When creating your LLC operating agreement in Indiana with multiple classes, specify the roles and responsibilities of each class to maintain clarity and structure. Platforms like US Legal Forms provide templates that can assist you in crafting a well-defined agreement tailored to your needs.

Yes, LLCs can have multiple share classes. This flexibility allows you to define different rights and privileges for each class, such as voting rights and profit distributions. When drafting your LLC operating agreement in Indiana with multiple classes, it's essential to clearly outline these distinctions to avoid future disputes. Utilizing platforms like US Legal Forms can simplify this process, ensuring your agreements comply with Indiana laws.

Yes, an LLC can have multiple classes of stock, depending on the provisions outlined in the LLC operating agreement in Indiana with multiple classes. This flexibility allows members to define different rights and privileges for each class, such as voting rights or profit distributions. By structuring your LLC in this way, you can attract various investors and accommodate different needs within your business. To ensure compliance and proper setup, consider using a reputable platform like US Legal Forms to draft your operating agreement.

The difference between Class A shares and Class B shares of a company's stock usually comes down to the number of voting rights assigned to the shareholder. Class A shareholders generally have more clout. Despite Class A shareholders almost always having more voting rights, this isn't actually a legal requirement.

It is possible to have multiple classes of equity in an LLC. In a real estate LLC, for example, you may have an actively managing member and other passive participants.

Here, Class A would be business-founding members with complete voting rights. Class B would also be founders, but perhaps they played a minor role and are thus given less voting power. Class C would be investors, which aren't given any voting power.

In order to complete your Operating Agreement, you will need some basic information. The formation date of your LLC. The name and address of the Registered Office and Registered Agent. The general business purpose of the LLC. Member(s) percentages of ownership. Names of the Members and their addresses.

An operating agreement should include the following: Percentage of members' ownership. Meeting provisions and voting rights. Powers and duties of members and management. Distribution of profits and losses. Tax treatment preference. A liability statement. Management structure. Operating procedures.