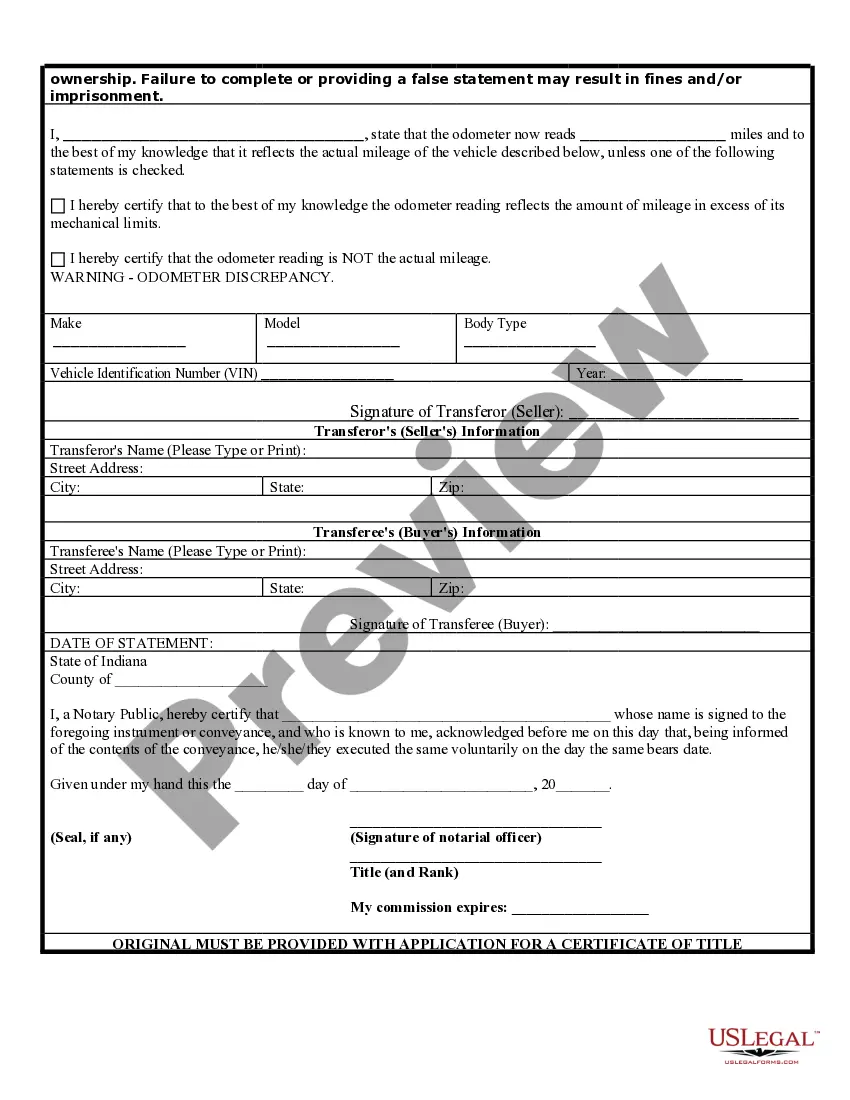

Indiana Odometer Statement With Lien

Description

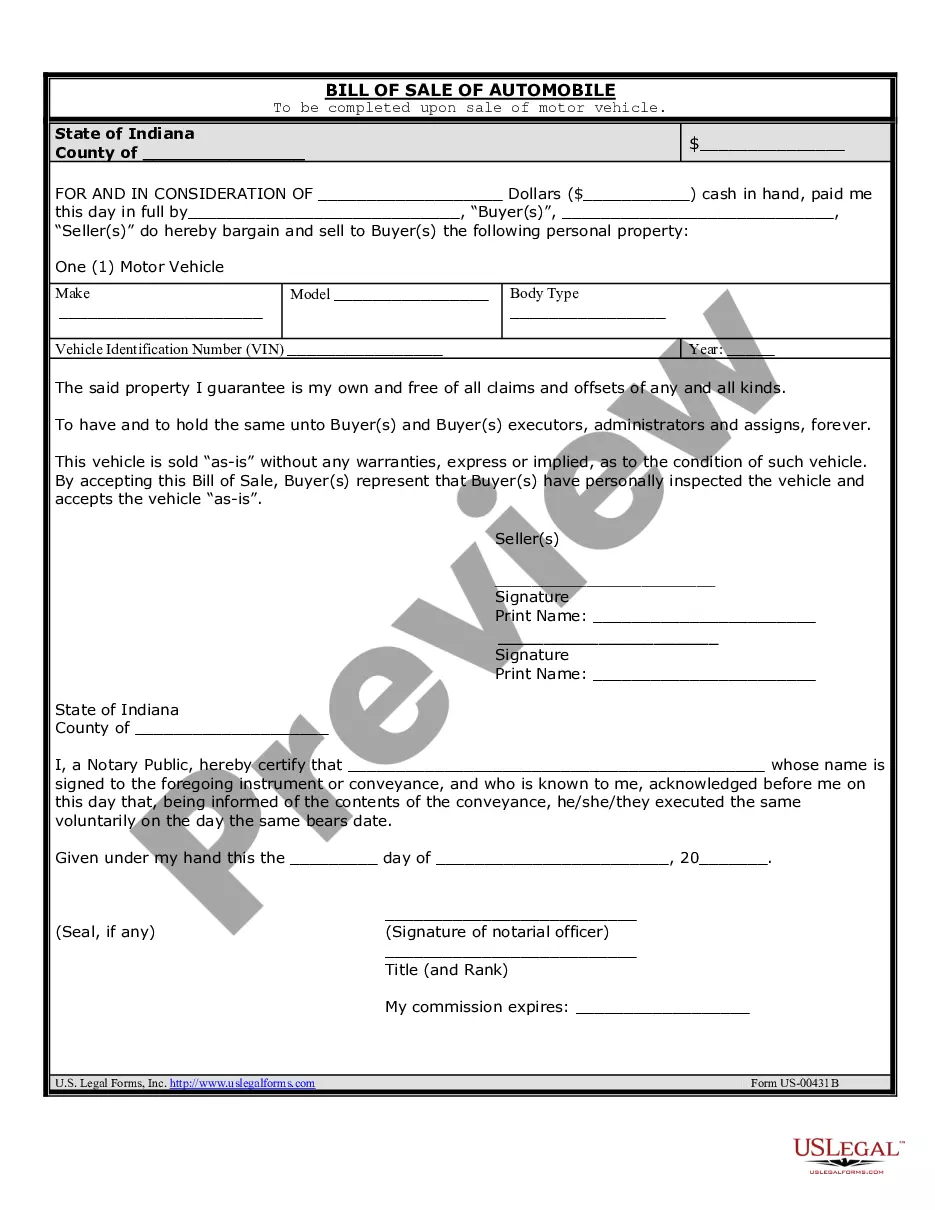

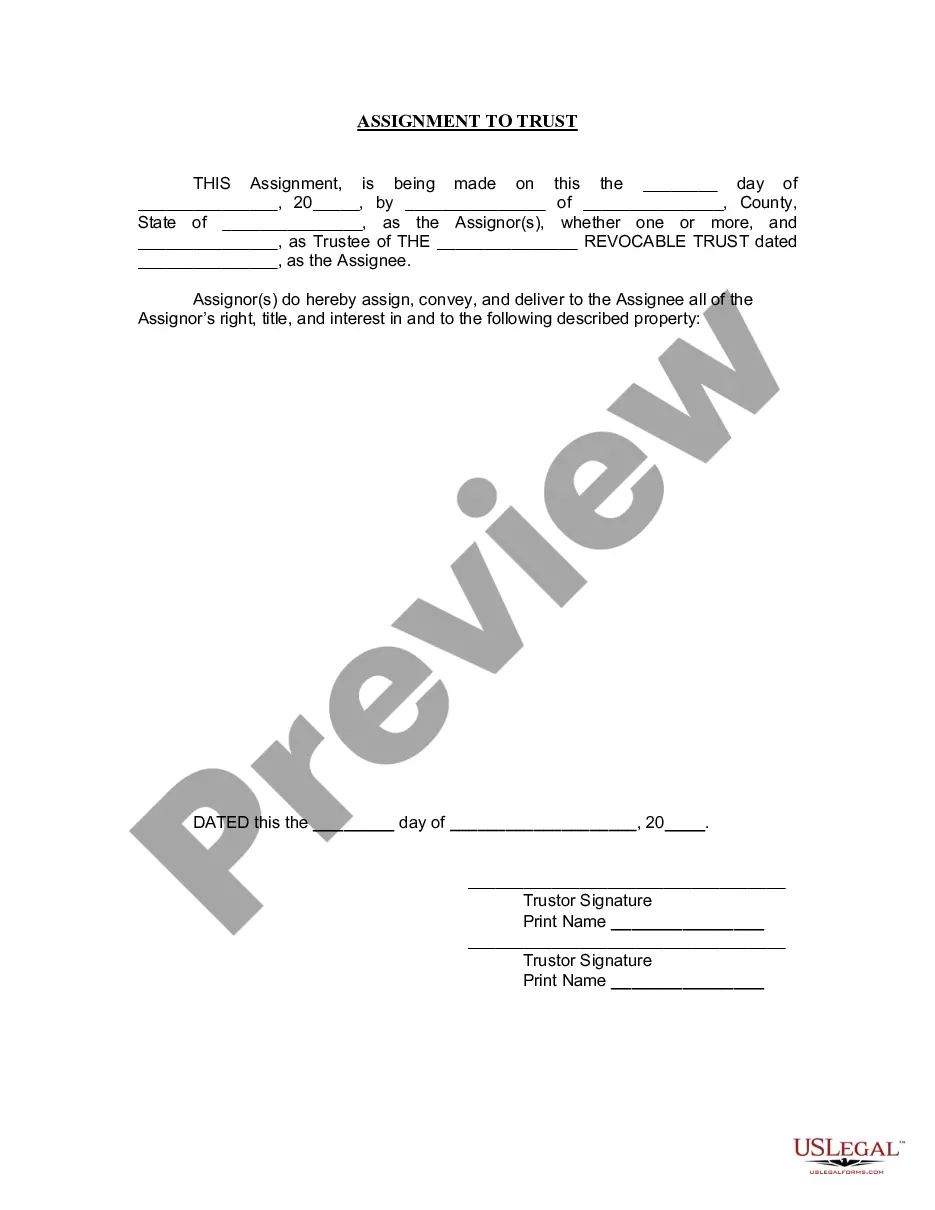

How to fill out Indiana Bill Of Sale Of Automobile And Odometer Statement For As-Is Sale?

Whether for commercial reasons or personal issues, everyone must confront legal matters sooner or later in their lives.

Completing legal documents demands meticulous focus, starting from selecting the right form template.

Once it is saved, you have the ability to complete the form using editing software or print it out and finish it by hand.

- For example, if you select an incorrect version of an Indiana Odometer Statement With Lien, it will be rejected when submitted.

- Thus, it is crucial to secure a trustworthy source for legal documents like US Legal Forms.

- Should you need an Indiana Odometer Statement With Lien template, adhere to these straightforward procedures.

- Locate the template you require by utilizing the search bar or catalog navigation.

- Review the form’s description to confirm it corresponds with your circumstances, state, and county.

- Click on the form’s preview to examine it.

- If it is the wrong document, return to the search function to find the Indiana Odometer Statement With Lien sample you require.

- Download the template if it aligns with your needs.

- If you already possess a US Legal Forms account, simply click Log in to retrieve previously saved templates in My documents.

- If you lack an account, you can obtain the form by clicking Buy now.

- Select the suitable pricing option.

- Fill out the account registration form.

- Choose your payment method: either a credit card or PayPal account.

- Select the file format you prefer and download the Indiana Odometer Statement With Lien.

Form popularity

FAQ

How Does Owner Financing Work? With owner financing (also called seller financing), the seller doesn't give money to the buyer as a mortgage lender would. Instead, the seller extends enough credit to the buyer to cover the purchase price of the home, less any down payment.

Louisiana does not provide a statutory form of deed. There are customary general warranty deeds, special or limited warranty deeds, and quit claim deeds. Forms for a deed, referred to as "an act of sale" in Louisiana, must contain the true sales price.

Louisiana Laws - Louisiana State Legislature. A transfer of immovable property must be made by authentic act or by act under private signature. Nevertheless, an oral transfer is valid between the parties when the property has been actually delivered and the transferor recognizes the transfer when interrogated on oath.

Draft up a deed, including the names of the property grantor, and include the signatures of the new owner, and include two witnesses and a notary. Include the price and property description. The land records office in Louisiana can assist with property description. There is a cost to file a deed.

Any property transfers in Louisiana are done voluntarily with a contract, including a Bond for Deed. A person must be of legal age of majority in the State of Louisiana in order to purchase a property.

Louisiana Laws - Louisiana State Legislature. A bond for deed is a contract to sell real property, in which the purchase price is to be paid by the buyer to the seller in installments and in which the seller after payment of a stipulated sum agrees to deliver title to the buyer.

It contains the names of the current owner (the grantor) and the new owner (the grantee), the legal description of the property, and is signed by the grantor. Transfers of real property must be in writing and notarized. Deeds should be recorded in the county where the property is located.

About Rent to Own (Lease Purchase) Agreements In Louisiana, options to buy have a 10 year limit. If the lessee (tenant) elects to exercise the option (chooses to buy the property), their past rental payments are applied to the purchase price of the property.