Il Form Ui-28

Description

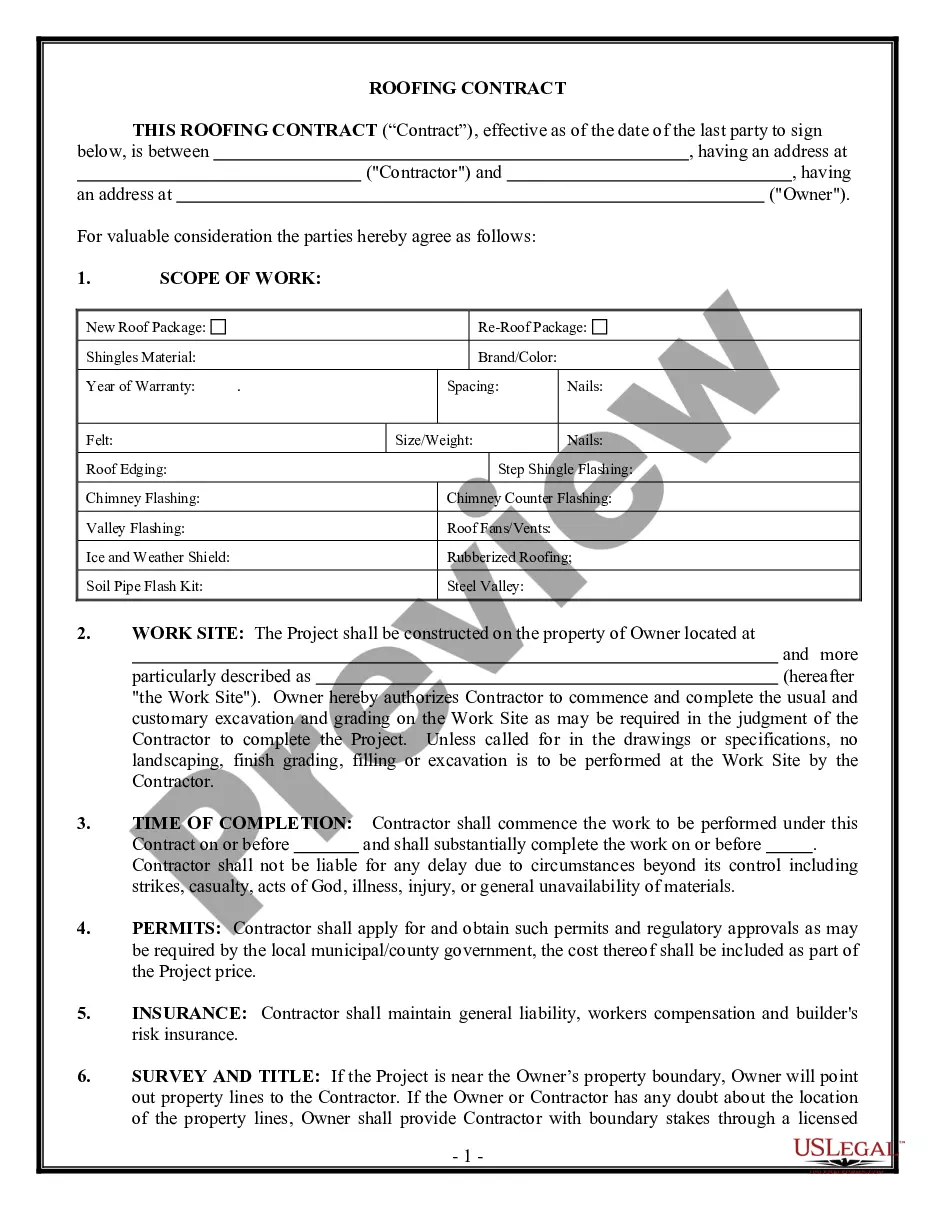

How to fill out Illinois Unemployment Insurance Registration Package?

It’s clear that you cannot transform into a legal expert immediately, nor is it possible to quickly understand how to efficiently prepare the Il Form Ui-28 without possessing a specialized knowledge base.

Drafting legal documents is an elaborate procedure that necessitates specific education and abilities.

Therefore, why not entrust the preparation of the Il Form Ui-28 to the professionals.

You can regain access to your files from the My documents section anytime. If you are a current client, you can simply Log In, and locate and download the template from the same section.

Regardless of the nature of your paperwork—whether it involves financial, legal, or personal matters—our platform has everything you need. Experience US Legal Forms today!

- Locate the form you require by utilizing the search function at the top of the website.

- Examine it (if this feature is available) and review the accompanying description to assess whether the Il Form Ui-28 meets your needs.

- Begin a new search if another form is necessary.

- Sign up for a complimentary account and select a subscription option to purchase the form.

- Click Buy now. Once the payment is completed, you can download the Il Form Ui-28, fill it out, print it, and submit it by mail to the appropriate individuals or organizations.

Form popularity

FAQ

A promissory note cannot be valid unless it contains details about the nature of credit, the means to repay it along with the duration given for the repayment, the signatures of all parties, the conditions agreed in the sanction of the loan, the rate of interest and all related terms.

Commonly Includes (5) The Parties ? Full names and addresses of the borrower and lender. Principal Amount ($) ? The original amount of money owed. Interest Rate (%) ? Percentage of the principal amount paid for the loan. Maturity Date ? Final date when the principal + interest must be paid.

For e.g. Ram is considered a drawer if he promises to pay Shyam Rs.5000 (Shyam is the drawee). However, if the same promissory note is transferred in favour of Rohan, then Rohan becomes the payee. Payee: A payee is someone to whom the payment is made.

What is a Promissory Note? A Promissory Note documents the legally binding promise that a borrower makes to pay back a loan under certain terms and conditions. However, unlike an IOU that simply acknowledges a debt amount, a Promissory Note goes into detail about the consequences of failing to repay a loan.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

The promissory note form should include: The names and addresses of the lender and borrower. The amount of money being borrowed and what, if any, collateral is being used. How often payments will be made in and in what amount.

Detailed Information ? The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

I promise to pay Rs. 5000/- three months from this day to Mr. Modi or bearer or order for value received. This is the correct form of Promissory note as it clearly express the Promise to pay.