Any Exempt Property Form Nc

Description

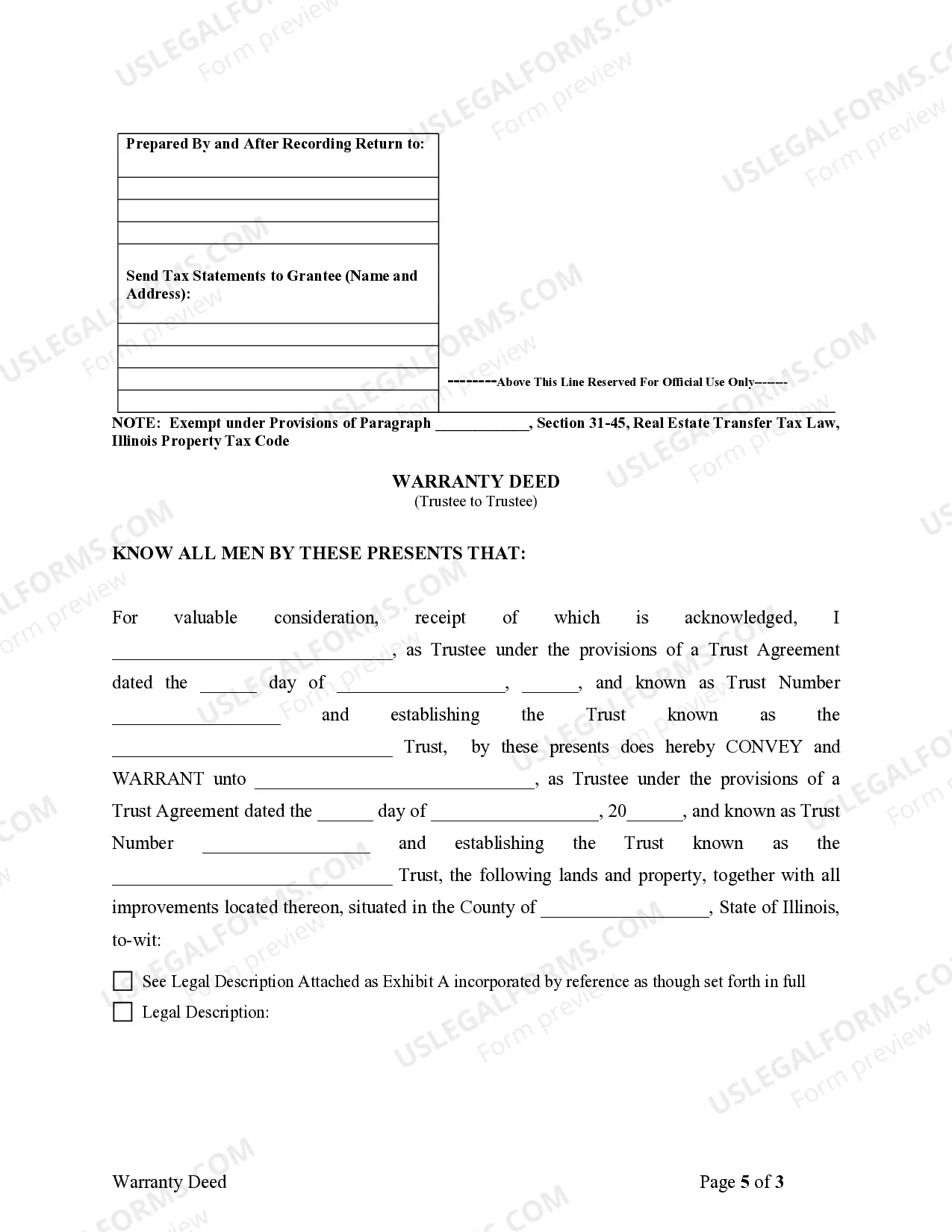

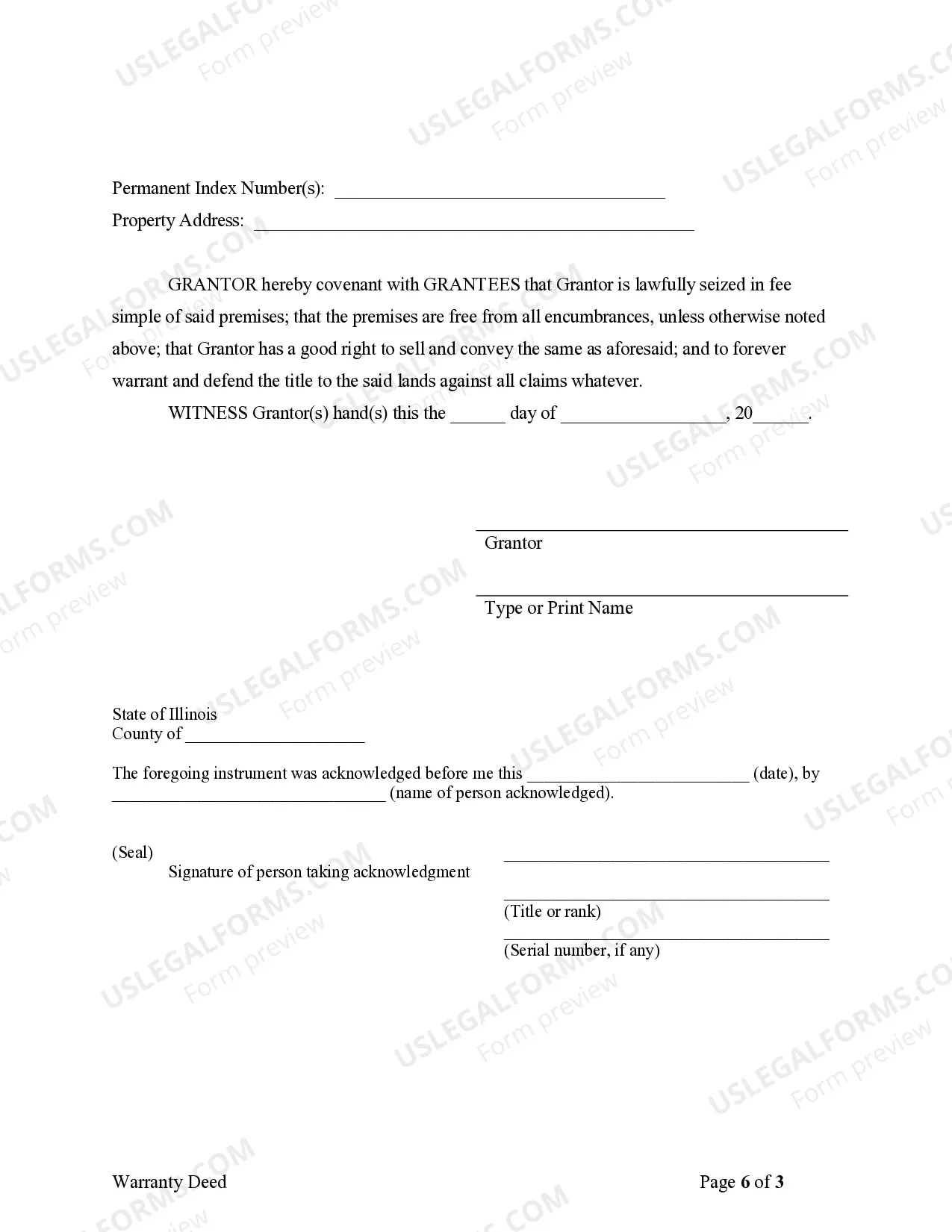

How to fill out Illinois Warranty Deed From Trustee To Trustee?

Dealing with legal documents and protocols can be an arduous addition to your whole day.

Any Exempt Property Form Nc and similar forms generally necessitate that you look for them and figure out how to fill them out accurately.

As a result, if you are managing financial, legal, or personal issues, utilizing a thorough and user-friendly online directory of forms at your fingertips will greatly assist.

US Legal Forms is the premier online resource for legal templates, providing over 85,000 state-specific forms and various tools to help you complete your documents effortlessly.

Is it your first experience with US Legal Forms? Sign up and establish your account in a few moments, and you’ll gain access to the form directory and Any Exempt Property Form Nc. After that, follow the steps below to fill out your form: Ensure you have the correct form using the Preview feature and reviewing the form details. Click Buy Now when ready, and select the subscription plan that suits your requirements. Click Download then fill out, eSign, and print the form. US Legal Forms has 25 years of expertise helping clients manage their legal documents. Find the form you need today and simplify any procedure without hassle.

- Explore the directory of pertinent documents accessible to you with a single click.

- US Legal Forms offers you state- and county-specific forms available at any time for downloading.

- Protect your document management processes with a high-quality service that enables you to create any form within minutes without any extra or concealed charges.

- Simply Log In to your account, find Any Exempt Property Form Nc and obtain it immediately in the My documents section.

- You can also reach previously downloaded forms.

Form popularity

FAQ

The most effective way to stop a writ of execution is to ask the Judgment Creditor to stop it. The sheriff will often back off if the parties are working to resolve the judgment. We have plenty of experience in settling judgments. Another sure fire way to stop a writ of execution is to file for Bankruptcy.

A ?notice of right to have exemptions designated? in North Carolina is a legal document from a creditor who has obtained a judgment against you. This notice of right to have exemptions designated form is sent to you by the judgment creditor requiring you to list all property that you own.

North Carolina's property exemptions usually cover most property owned by someone facing a judgment. North Carolina allows you to exempt: Up to $35,000 in equity in your primary residence. Up to $3,500 in equity in a vehicle.

The judgment and the lien are valid for ten years following the rendition of the judgment. After a judgment becomes a lien upon the debtor's real property, any subsequent change in ownership is subject to the lien.

Executions shall be dated as of the day on which they were issued and are returnable to the court from which they were Page 3 NC General Statutes - Chapter 1 Article 28 3 issued not more than 90 days from that date.