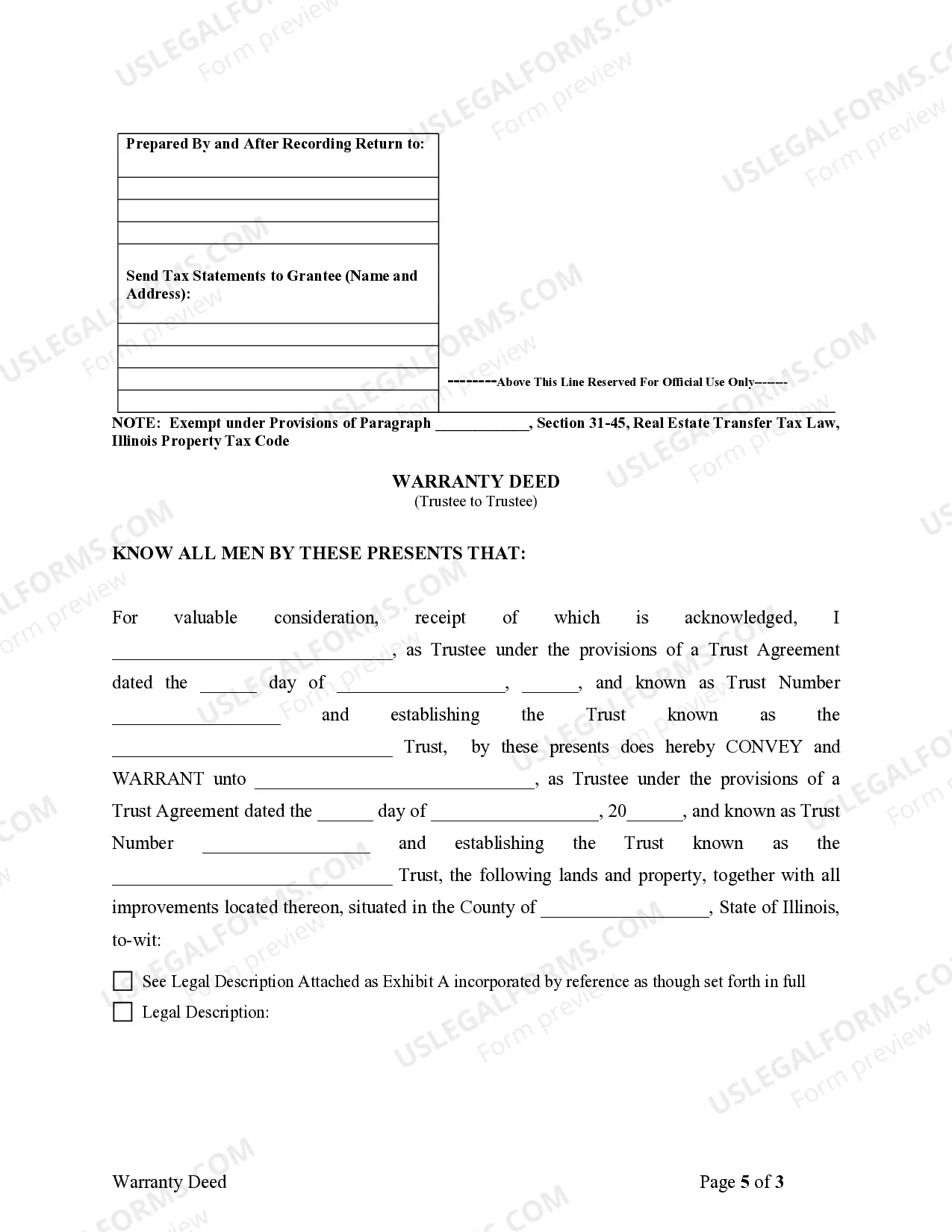

Any Exempt Property For Sale

Description

How to fill out Illinois Warranty Deed From Trustee To Trustee?

Drafting legal paperwork from scratch can sometimes be intimidating. Some cases might involve hours of research and hundreds of dollars spent. If you’re searching for an easier and more cost-effective way of creating Any Exempt Property For Sale or any other documents without jumping through hoops, US Legal Forms is always at your fingertips.

Our virtual catalog of more than 85,000 up-to-date legal documents addresses almost every element of your financial, legal, and personal matters. With just a few clicks, you can quickly access state- and county-compliant forms carefully put together for you by our legal professionals.

Use our platform whenever you need a trustworthy and reliable services through which you can quickly locate and download the Any Exempt Property For Sale. If you’re not new to our services and have previously created an account with us, simply log in to your account, locate the form and download it away or re-download it anytime later in the My Forms tab.

Don’t have an account? No worries. It takes minutes to set it up and navigate the catalog. But before jumping straight to downloading Any Exempt Property For Sale, follow these tips:

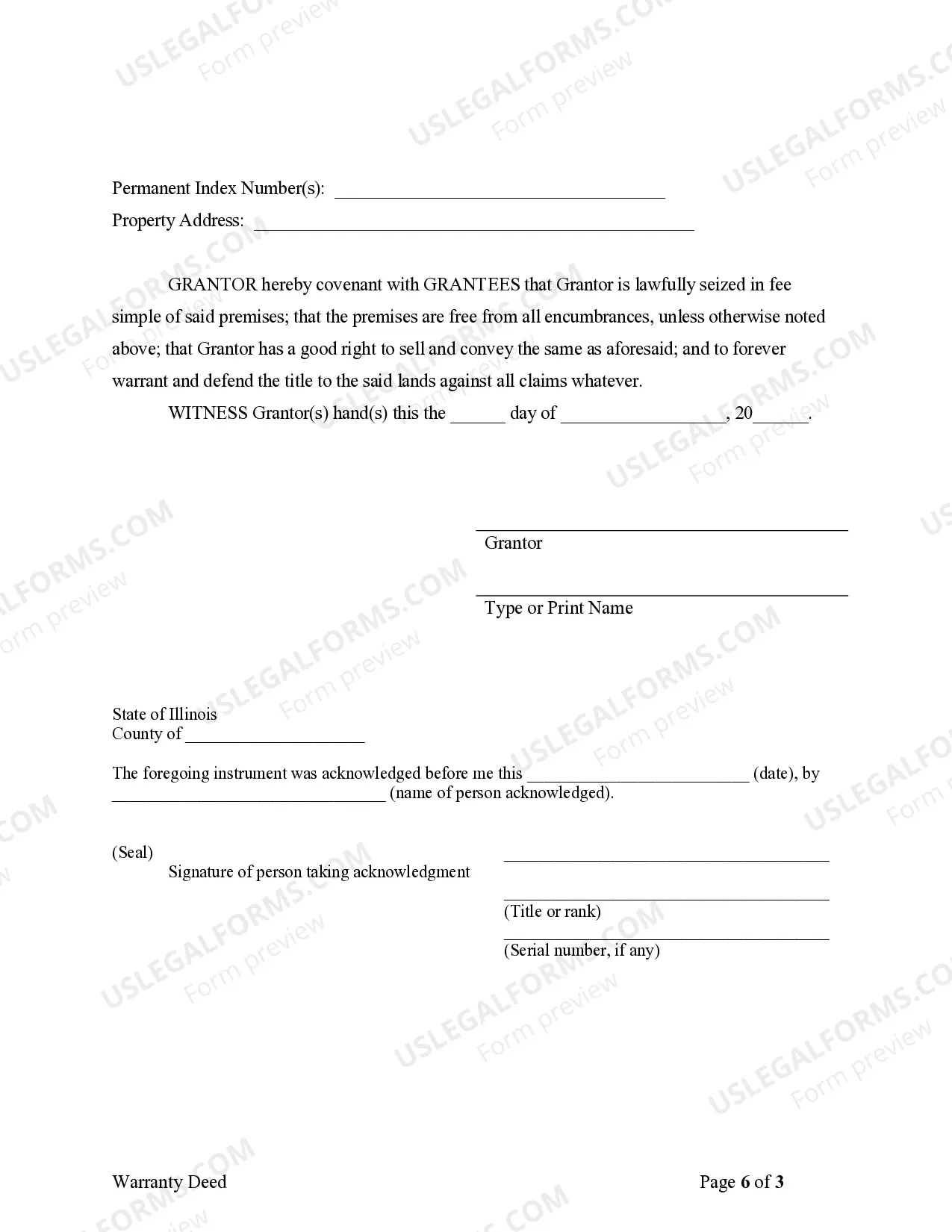

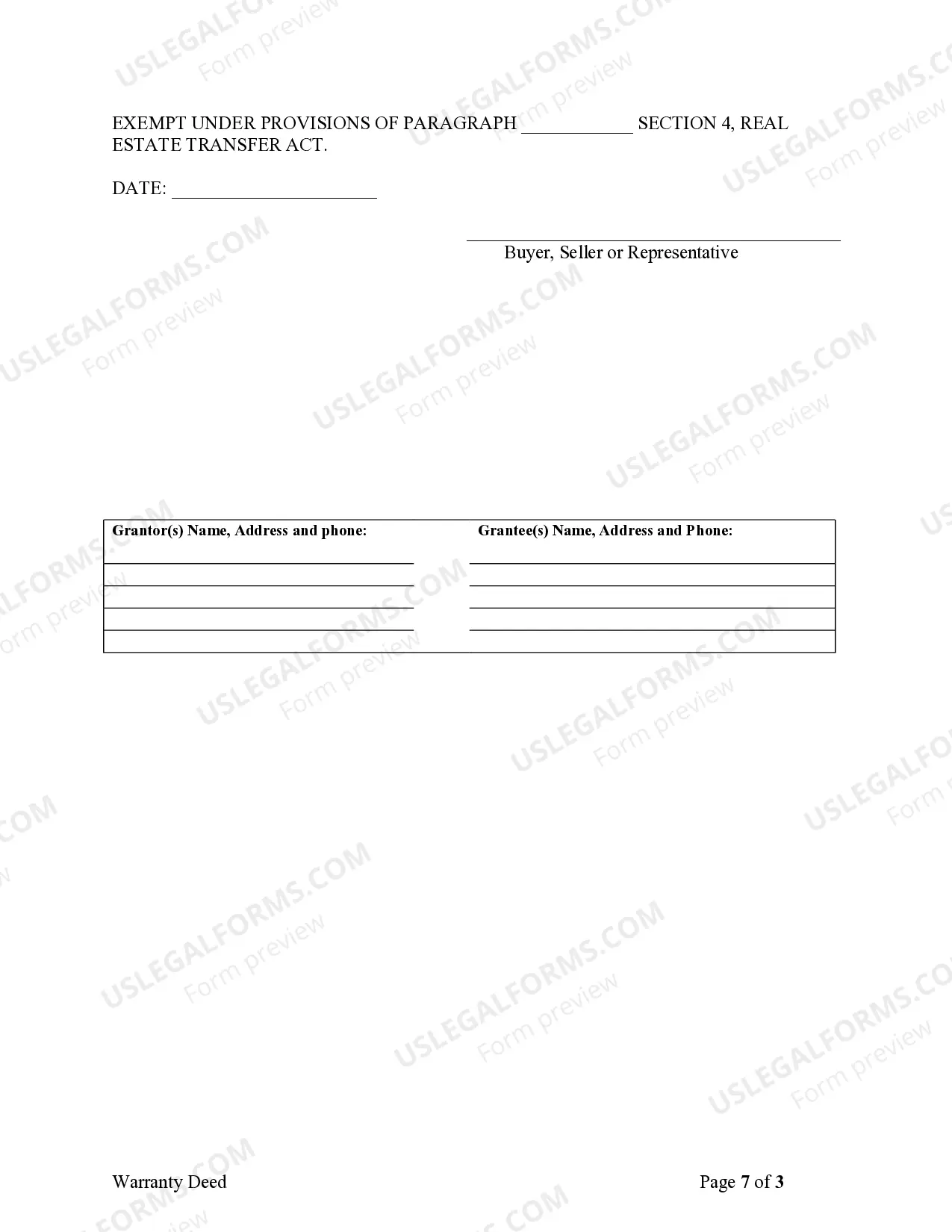

- Review the form preview and descriptions to ensure that you are on the the document you are looking for.

- Check if template you choose conforms with the regulations and laws of your state and county.

- Choose the right subscription option to purchase the Any Exempt Property For Sale.

- Download the form. Then complete, sign, and print it out.

US Legal Forms has a spotless reputation and over 25 years of experience. Join us now and transform form completion into something simple and streamlined!

Form popularity

FAQ

Property that is exempt Principal residence: Some types of property are exempt from being taxed for capital gains. The most common capital gain exemption is the sale of your principal residence. A principal residence is the home where you ordinarily live or where your spouse, former spouse, or child ordinarily lives.

To claim this tax exemption, you must complete form TP-274-V, Designation of Property as a Principal Residence, and include it with your income tax return for the year of sale. If you do not send us this form, you are liable to a penalty of $100 per month, to a maximum of $5,000.

If you sold or if you were considered to have sold, more than one property in the same calendar year and each property was, at one time, your principal residence, you must show this by completing a separate Form T2091(IND) for each property to designate what years each was your principal residence and calculate the ...

Methods to Minimize Capital Gains Tax on Rental Properties Take Advantage of the Principal Residence Exemption. ... Make a Gifted or Inherited Property Your Principal Residence. ... Incorporate Your Rental Property Business. ... Move Your Earnings to a Tax Shelter. ... Utilize the Capital Gains Reserve. ... Offset Capital Losses.

How do I avoid capital gains tax in Canada? Use capital losses to offset your capital gains. ... Invest through a tax-advantaged account like a TFSA. ... Sell your assets when your income is low to minimize the tax you pay.