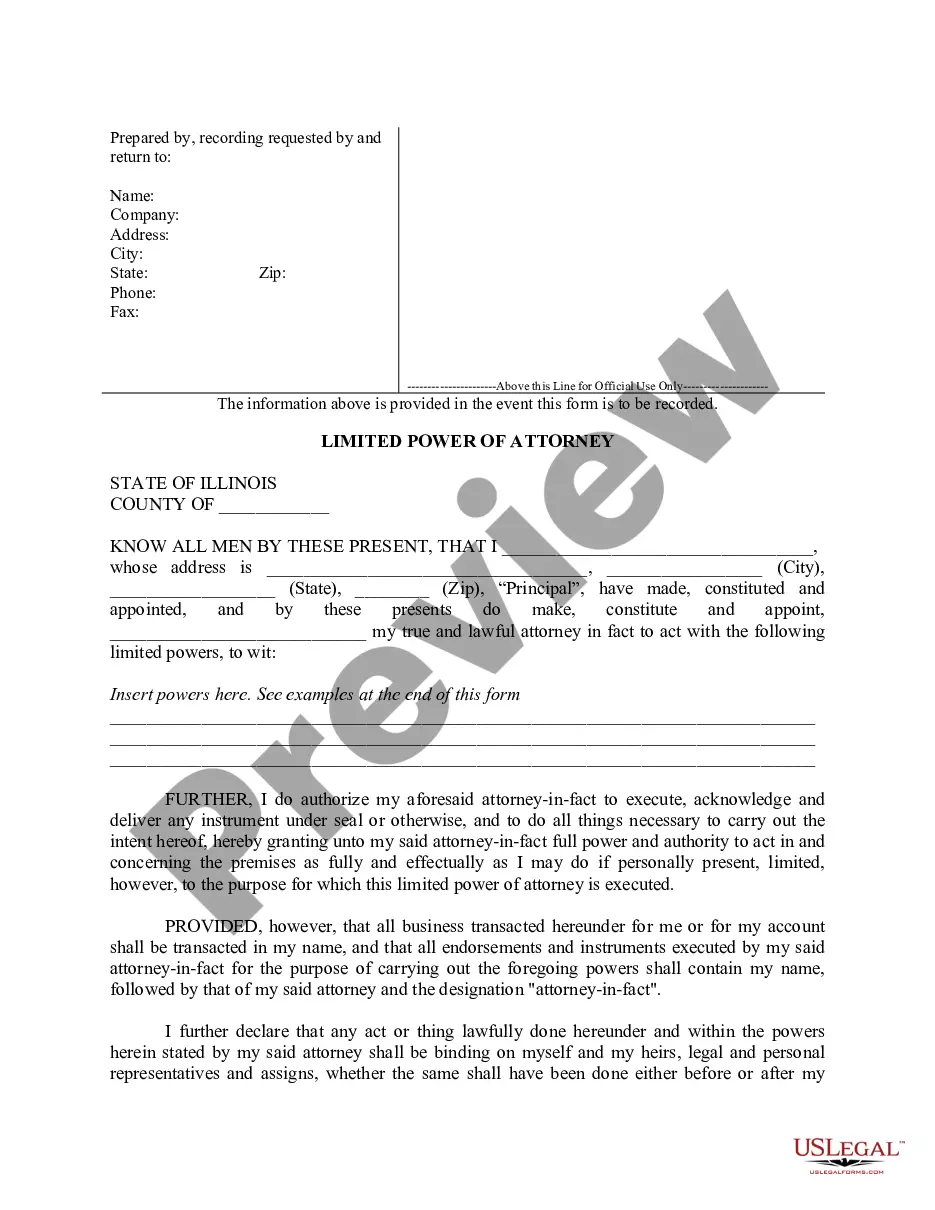

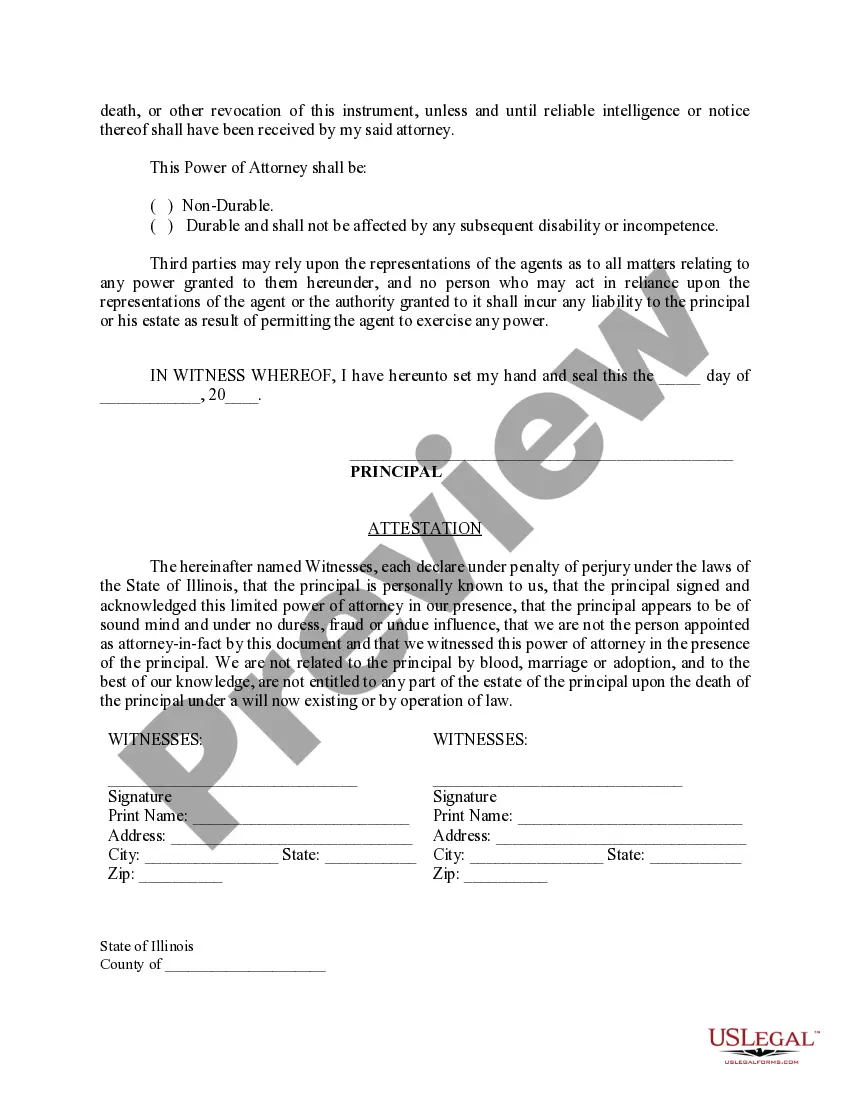

Power Attorney For Property

Description

How to fill out Illinois Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

- If you are an existing user, log in to your account and navigate to the form you need. Ensure that your subscription is active; if not, renew it as per your plan.

- For new users, start by reviewing the Preview mode and form descriptions to find the appropriate power of attorney template relevant to your jurisdiction.

- If necessary, utilize the Search tab to explore additional templates until you find the correct one.

- Once satisfied with your choice, select the Buy Now button and choose your desired subscription plan while creating an account for full access.

- Complete your purchase by entering your payment details, either through credit card or PayPal.

- Lastly, download the selected form onto your device for immediate use, and access it anytime through the My Forms section.

With US Legal Forms, you benefit not only from a vast collection of legal documents but also from expert assistance to ensure everything is completed accurately. Their simple platform empowers users to handle legal paperwork swiftly.

Start your journey with US Legal Forms today, and experience the ease and security in creating your power attorney for property!

Form popularity

FAQ

The best person for power of attorney for property is someone you trust to manage your financial matters responsibly. This could be a family member, a close friend, or a financial advisor. Consider their ability to handle complex transactions and their understanding of your wishes. Having a reliable individual in this role ensures your property is in good hands.

To establish a power attorney for property in Pennsylvania, you need to be at least 18 years old and mentally competent. The document must be signed by you and witnessed by two individuals or acknowledged by a notary public. Ensuring these requirements are met is crucial for the validity of the power of attorney. If you're uncertain, US Legal Forms can help you navigate these regulations with ease.

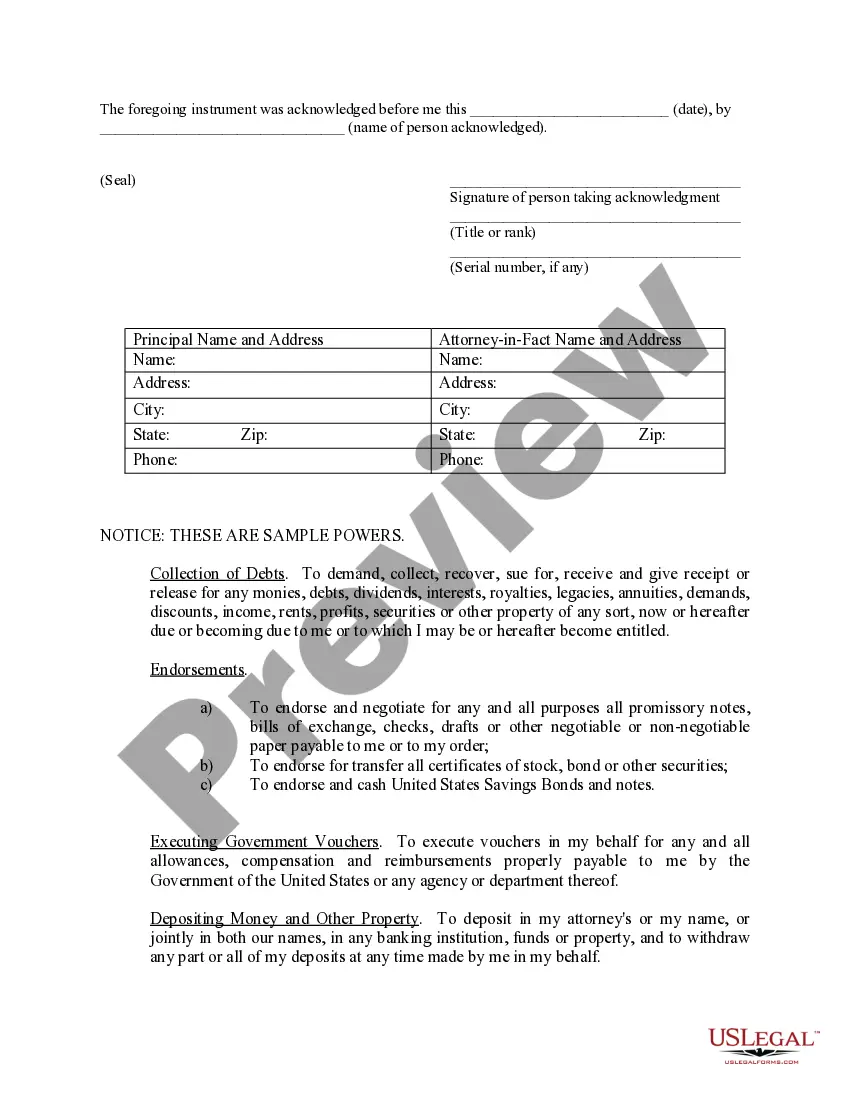

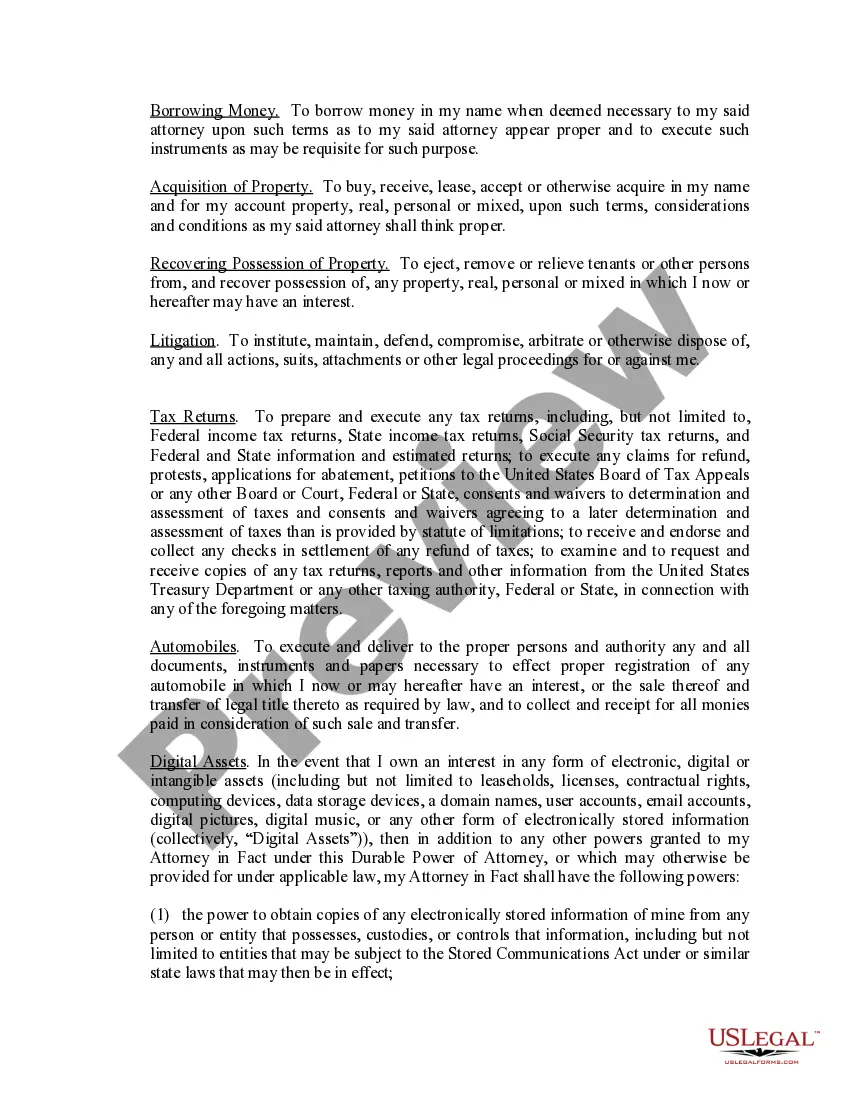

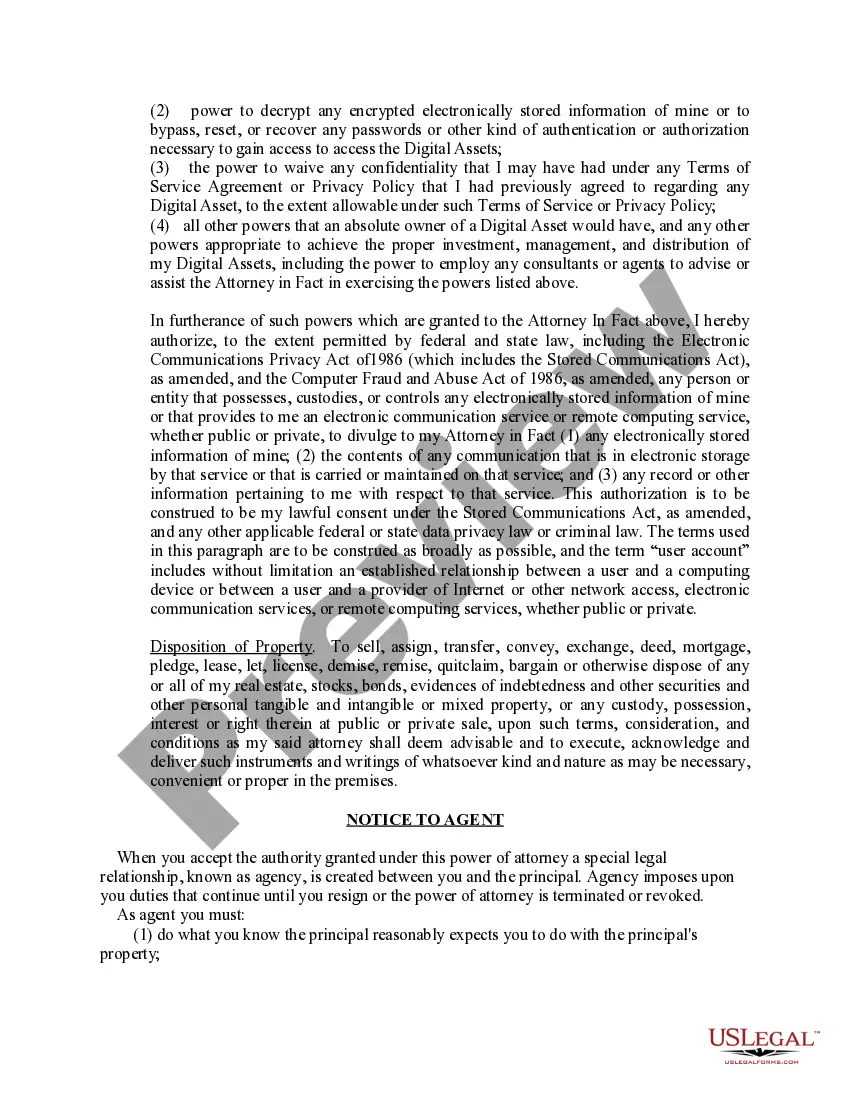

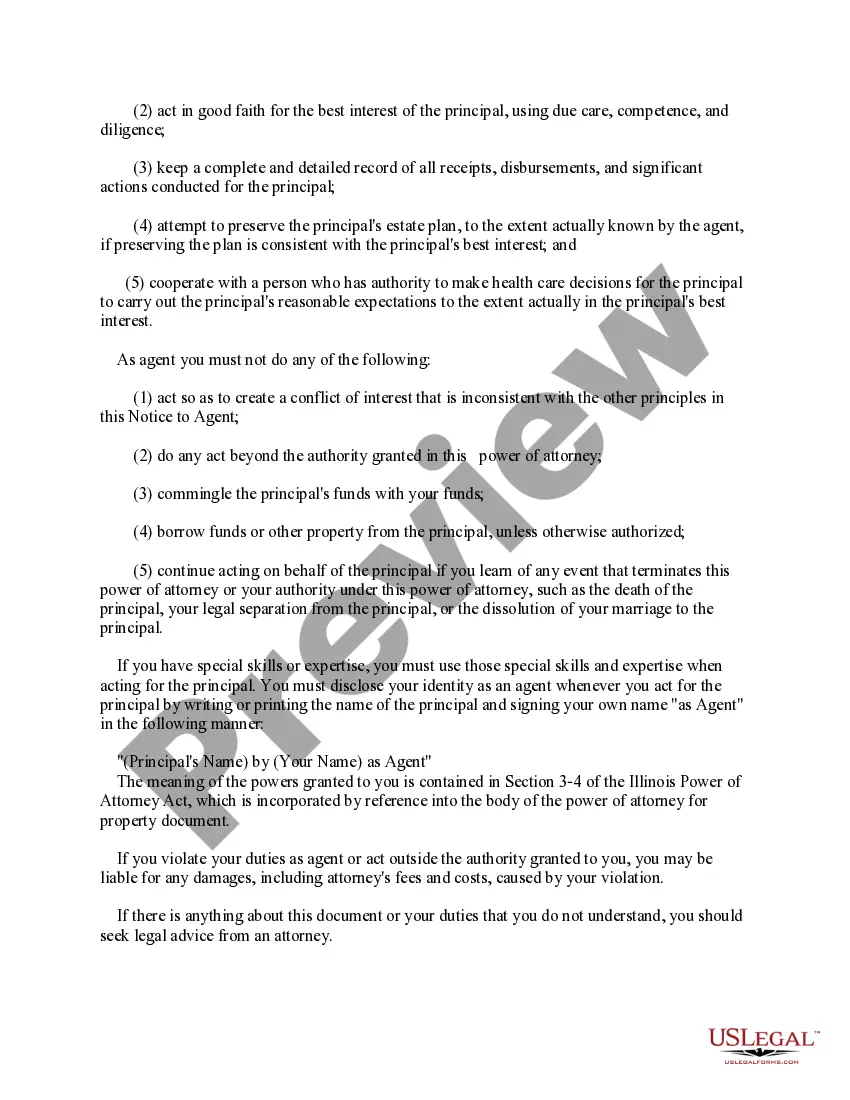

A power of attorney for property grants you the authority to manage another person's property and financial affairs. This includes handling transactions, paying bills, and making investment decisions on their behalf. It's essential to know what’s included in the document, as it defines your scope of authority and responsibilities. For a seamless experience, consider platforms like USLegalForms that help facilitate clear and effective power of attorney arrangements.

A power of attorney for property has limitations in terms of actions you can take. You cannot make decisions regarding the principal’s health care unless specifically granted that authority. Similarly, you cannot engage in self-dealing, meaning you cannot use the principal’s property for personal gain. Understanding these boundaries is crucial to fulfilling your role responsibly.

Choosing to be a power of attorney for property carries significant responsibilities. You take on the legal obligation to act in the best interest of the principal. If you fail to do so, you may face legal consequences. Additionally, the role may strain personal relationships, especially if disagreements occur over property management.

Choosing the best person to be your power of attorney involves considering someone who knows your values and wishes regarding property. Many people select trustworthy family members or friends who can act decisively during important moments. Ultimately, the right choice should be someone who feels comfortable managing your assets and executing your wishes.

The best person to be a power of attorney should possess strong moral character and financial responsibility. They should also be able to communicate effectively and make decisions that align with your wishes regarding property management. Trust is essential, as this person will handle significant responsibilities on your behalf.

In South Carolina, the rules for power of attorney require the document to be in writing and signed by the principal. It must clearly specify the powers granted, especially concerning property management. To ensure compliance with state laws, using platforms like USLegalForms can provide the necessary templates tailored to your needs.

The best choice for power of attorney is someone you trust implicitly with your property and financial affairs. This person should be organized, responsible, and have your best interests at heart. Often, family members or close friends are good candidates, but ensure they understand the implications of the role.

Writing a power of attorney letter for property requires a clear expression of intent and specific details about the property involved. Begin by identifying yourself and the person you designate as your agent. Describe the powers you grant them regarding your property, ensuring that the letter is signed and notarized to be legally binding.