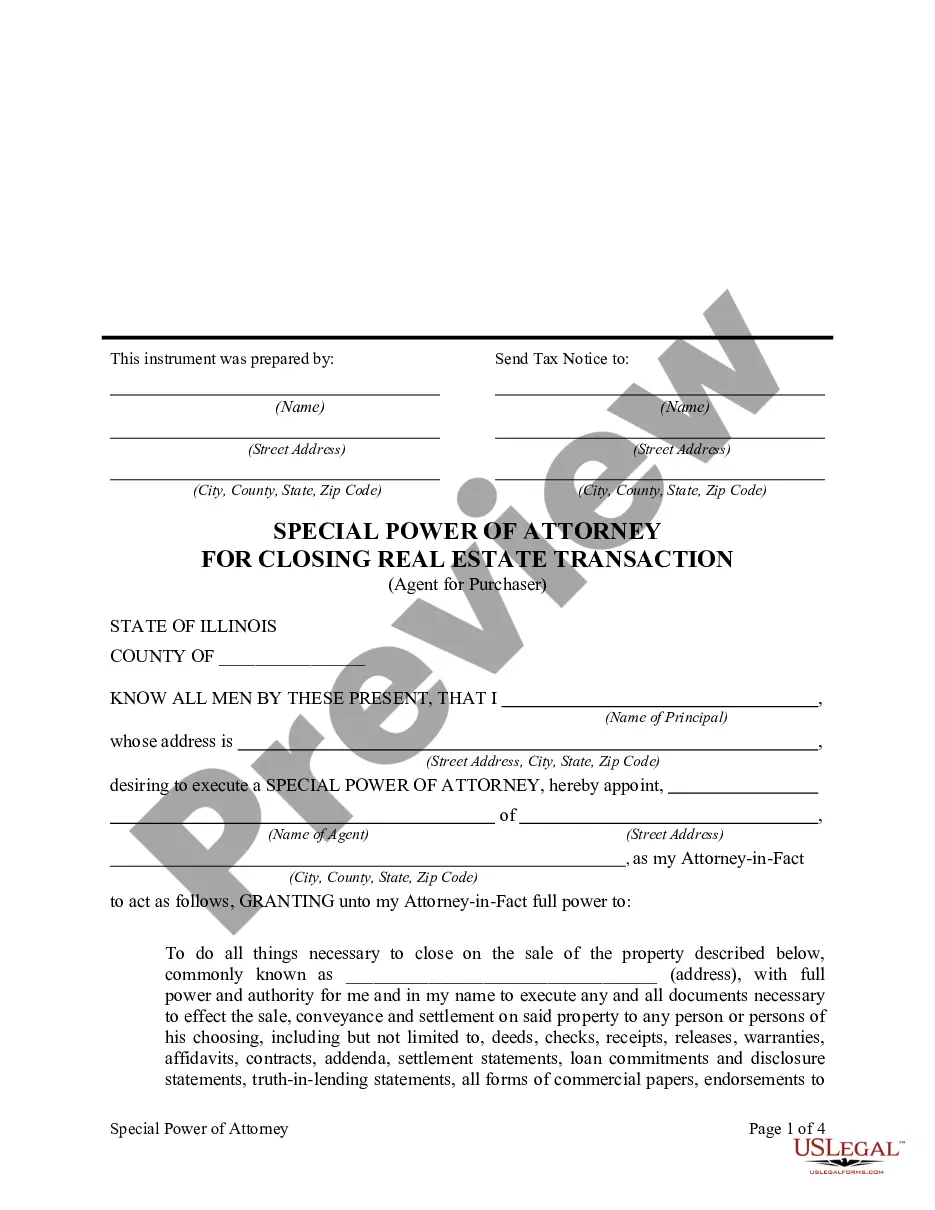

Special Power Of Attorney With Signature

Description

How to fill out Illinois Special Or Limited Power Of Attorney For Real Estate Purchase Transaction By Purchaser?

- If you're a returning user, log in to your account and click the Download button to access your needed form template. Verify your subscription status and renew if necessary.

- For first-time users, start by exploring the Preview mode and form description to ensure you select a template that fits your needs.

- If there are inconsistencies, utilize the Search tab to find a suitable alternative form.

- Once you find the right document, click the Buy Now button and select your preferred subscription plan. You will need to create an account for full access.

- Proceed with your payment by entering your credit card information or using PayPal for ease of purchase.

- Finally, download the completed form to your device and access it later via the My Forms menu in your profile.

By utilizing US Legal Forms, you benefit from a vast library of over 85,000 editable forms, surpassing competitors while delivering ease of use and expert assistance. This empowers both individuals and attorneys to complete legal documentation confidently and accurately.

Start your legal journey with US Legal Forms now and gain access to the resources you need to make informed legal decisions.

Form popularity

FAQ

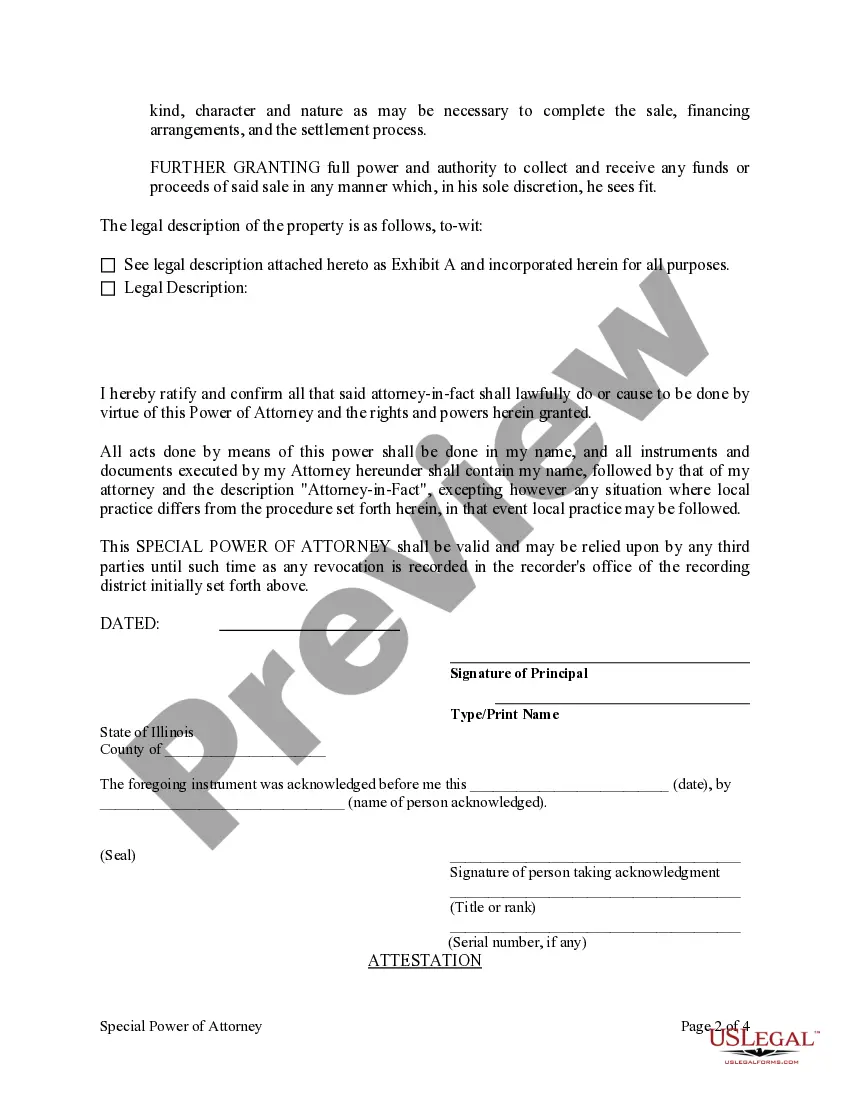

A specimen signature is an example of the principal's signature often included with a special power of attorney with signature. It serves to verify the identity of the principal and provides a reference for authenticity during any legal transactions. Including a specimen signature helps establish trust in the power of attorney document, ensuring that it is executed properly. You can find resources and templates on US Legal Forms to guide you through this process.

Yes, a special power of attorney with signature can be signed by the principal or someone authorized to sign on their behalf. However, this person must have legal capacity and the authority to act for the principal. In cases where the principal cannot sign themselves, the authorized individual must also provide proper documentation. For ease in drafting a power of attorney, US Legal Forms offers templates that clarify signing requirements.

You cannot obtain a valid special power of attorney without the person's signature. The signature ensures the principal's consent to grant authority to the agent, making it a crucial part of the document. Without this signature, the power of attorney lacks legitimacy and may not hold up in legal situations. If you need guidance on drafting a power of attorney, consider using US Legal Forms to create a legally sound document.

Filling out a POA check involves signing the principal's name on the front, followed by your own signature on the back as the power of attorney. Ensure that you clearly indicate you are signing on behalf of the principal. Additionally, retain a copy of the special power of attorney with signature to verify your authority when processing the check.

To fill out a power of attorney document, start by downloading a template that specifically outlines a special power of attorney with signature. Then, gather the required information about the principal and the agent, ensuring clarity in the permissions granted. It's advisable to review the document carefully and seek legal advice if needed before signing.

To endorse a check as a power of attorney, first sign the principal's name on the back of the check. Following that, write 'by' or 'as' and then your name as the agent. This process clearly shows that you are endorsing the check on behalf of the principal, making it important to keep a copy of the special power of attorney with signature for reference.

An example of signing as power of attorney occurs when the designated agent signs a document, such as a real estate transaction. The agent would write the principal's name first, followed by their own name, indicating their role as the power of attorney. This demonstrates that the agent is acting within the authority granted by the special power of attorney with signature.

The best person to be a power of attorney is someone you trust completely, as they will make important decisions on your behalf. This could be a close family member, a trusted friend, or a legal professional. It's essential that they understand your wishes and can act in your best interest when necessary.

When signing under a special power of attorney with signature, include the name of the person granting the authority, followed by the words 'by' or 'as' and then the agent's name. Make sure to clearly indicate that the agent is acting on behalf of the principal. This clarity ensures that all parties understand the authority being conveyed.

Currently, the IRS does not allow you to upload a power of attorney document directly. Instead, you must submit your signed Form 2848 via mail or fax. By using a special power of attorney with signature, you can efficiently manage tax representations while ensuring that you comply with IRS regulations.