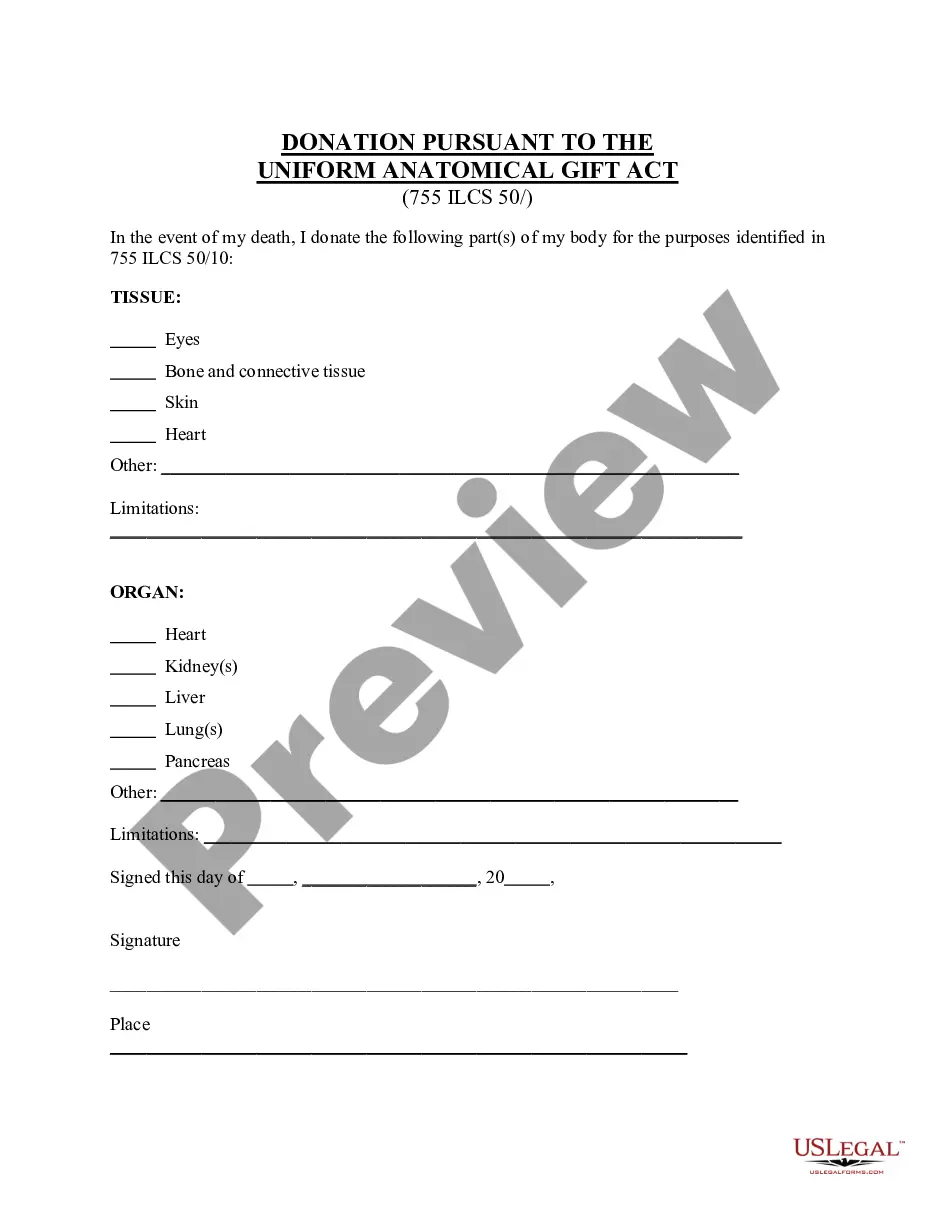

Il Anatomical Gift Form Illinois

Description

How to fill out Illinois Uniform Anatomical Gift Act Donation?

Regardless of whether for professional needs or personal matters, everyone must handle legal scenarios at some stage in their lives.

Filling out legal documents requires meticulous care, starting from selecting the correct template format.

Once saved, you can fill out the form using editing software or print it and complete it by hand. With a comprehensive US Legal Forms library available, you don’t need to waste time searching for the right template online. Take advantage of the library’s user-friendly navigation to find the suitable form for any circumstance.

- Obtain the template you require by utilizing the search bar or browsing the catalog.

- Review the form’s details to guarantee it aligns with your situation, jurisdiction, and county.

- Press on the form’s preview to examine it.

- If it is not the correct form, return to the search tool to locate the Il Anatomical Gift Form Illinois sample you seek.

- Acquire the template if it fulfills your criteria.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Choose the correct payment option.

- Complete the account registration form.

- Choose your payment method: you can use a credit card or PayPal account.

- Select the document format you prefer and download the Il Anatomical Gift Form Illinois.

Form popularity

FAQ

Tennessee requires LLCs to file an annual report every year. You can submit your report online or print and mail your report to the Secretary of State. To complete the annual report, you'll need to provide some basic information, such as: Thanks !

Does a bill of sale have to be notarized in Tennessee? No. A vehicle bill of sale for a private party transfer does not need to be notarized.

Tennessee Annual Registration Filing Fees & Instructions. The cost to file an annual report in Tennessee depends on how your business is registered. For example, profit corporations, both foreign and domestic, must pay $20 to file an annual report. Nonprofit corporations, however, pay a mere $5 to file a report.

Tennessee LLC Taxes The franchise tax imposed on LLCs is 0.25 percent of the real and tangible worth or net worth of a property in the state of Tennessee (whichever is greater). The minimum payment for the state franchise tax is $100.

A Tennessee bill of sale is a form that records a sale or trade of personal property between a buyer and a seller. Like a receipt, a bill of sale verifies the transfer of ownership of an item from one person to another and proves that the transfer was legal and agreed upon.

Tennessee requires LLCs to file an annual report and pay a franchise tax. The annual report is due on or before the first day of the fourth month following the close of the LLC's fiscal year. The filing fee is $50 per member, with a minimum fee of $300 and a maximum fee of $3000.

The annual report fee for LLCs is $300 minimum up to a maximum of $3000. The fee increases by an additional $50 per member for every member over 6 members up to a maximum of $3,000. An officer is not listed.

Anyone can draft a bill of sale in Tennessee. As long as the document has been signed by all involved parties, it can be legally binding.