201k Letter Sample With Notice Period

Description

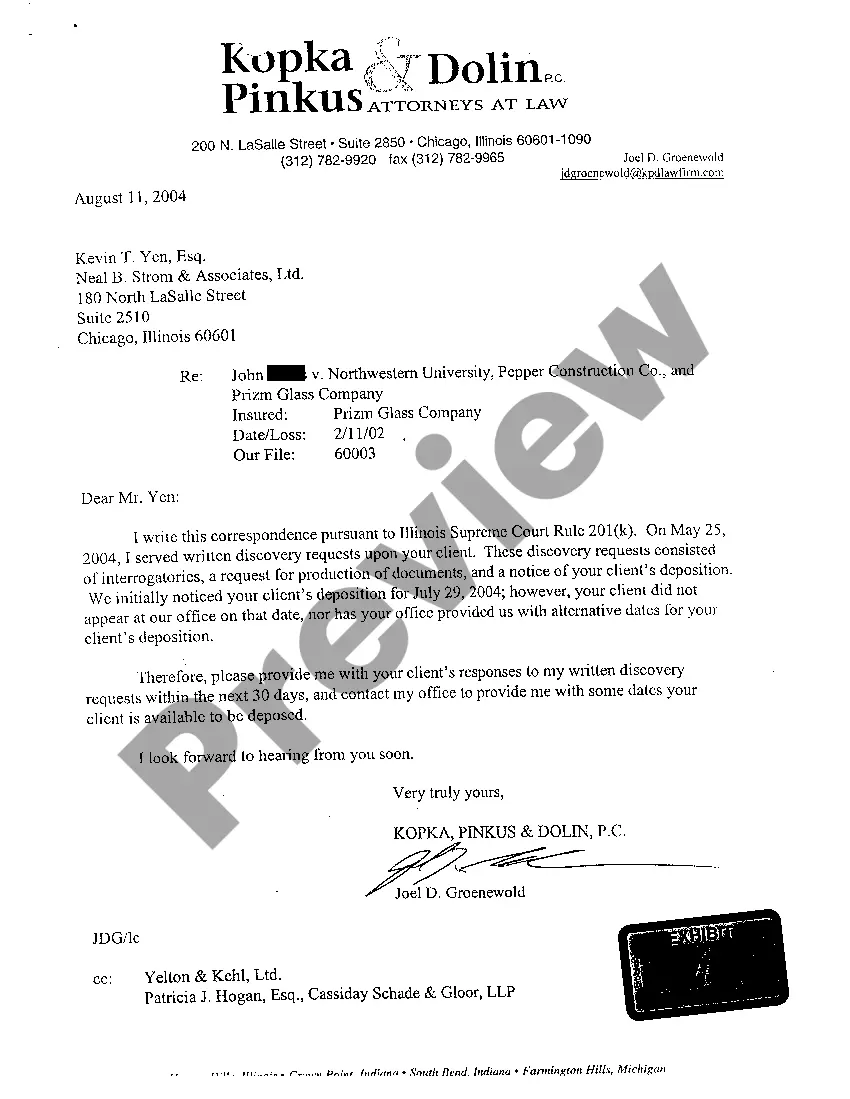

How to fill out Illinois Motion To Compel?

The 201k Letter Example With Notice Interval you observe on this page is a reusable formal model created by expert lawyers in compliance with federal and state regulations.

For over 25 years, US Legal Forms has offered individuals, businesses, and legal practitioners with more than 85,000 validated, state-specific documents for any commercial and personal circumstance. It’s the quickest, simplest, and most reliable way to secure the forms you require, as the service assures bank-grade data protection and anti-virus security.

Subscribe to US Legal Forms to have authenticated legal templates for all of life's situations readily available.

- Search for the document you require and verify it.

- Examine the sample you found and preview it or read the form description to confirm it meets your needs. If it doesn’t, utilize the search function to locate the correct one. Click Buy Now once you have identified the template you need.

- Subscribe and Log In.

- Select the payment plan that fits you and create an account. Use PayPal or a credit card for an immediate transaction. If you already have an account, Log In and review your subscription to proceed.

- Obtain the fillable template.

- Choose the format you desire for your 201k Letter Example With Notice Interval (PDF, DOCX, RTF) and download the sample to your device.

- Complete and sign the documents.

- Print the template to fill it out manually. Alternatively, use an online multi-functional PDF editor to quickly and accurately complete and sign your form with a valid signature.

- Download your documents once more.

- Access the same document again whenever required. Go to the My documents tab in your profile to redownload any previously purchased documents.

Form popularity

FAQ

Can a bill of sale be handwritten? If your state does not provide a bill of sale form, yes, you can handwrite one yourself. As long as the document includes all of the necessary parts of a bill of sale and is signed by both parties and a notary, it is valid.

How to write an effective ad to sell a business confidentially Be Concise and Informative About The Business For Sale. ... Focus on Your Business's Current Strengths. ... Growth Opportunities. ... Explain Why You Are Selling the Business. ... Include The Business Asking Price. ... Create an Attention-Grabbing Headline.

Legal Documents Needed to Sell a Business A Non-Disclosure Confidentiality Agreement. Offer-to-Purchase Agreement. Current Lease Agreement. Enterprise Insurance Policies. Business' Professional Certificates. Existing Vendor/Client Contracts. Employment Agreements. Letter of Intent.

Parts of a Business Sale Agreement Parties. The names and locations of the buyer and seller will be clearly stated in the first paragraph or two of the contract. ... Assets. The agreement will detail the specific assets being transferred. ... Liabilities. ... Terms. ... Disclosures. ... Disputes. ... Notifications. ... Signatures.

A Mississippi bill of sale needs to include details that clearly identify the seller, buyer, and property being transferred. It should also record the details of the transaction itself, such as the price and date. The bill of sale should indicate if the property is being accepted by the buyer in as-is condition.

If the ownership of my business changes, do I need to let you know? Yes. Whenever you buy, sell, or discontinue a business, you will need to contact the California Department of Tax and Fee Administration (CDTFA).

The 6-Step Process of Selling a Business Reverse Due Diligence. ... Information for the Buyer. ... Asking Price & Negotiation. ... Buyer's Letter of Intent. ... Buyer's Due Diligence. ... Agreement of Sale & Closing.

Buyers typically ask for the following: Three to five years of profit & loss (P&L) statements. Balance sheets. Bank statements. Federal income tax returns.