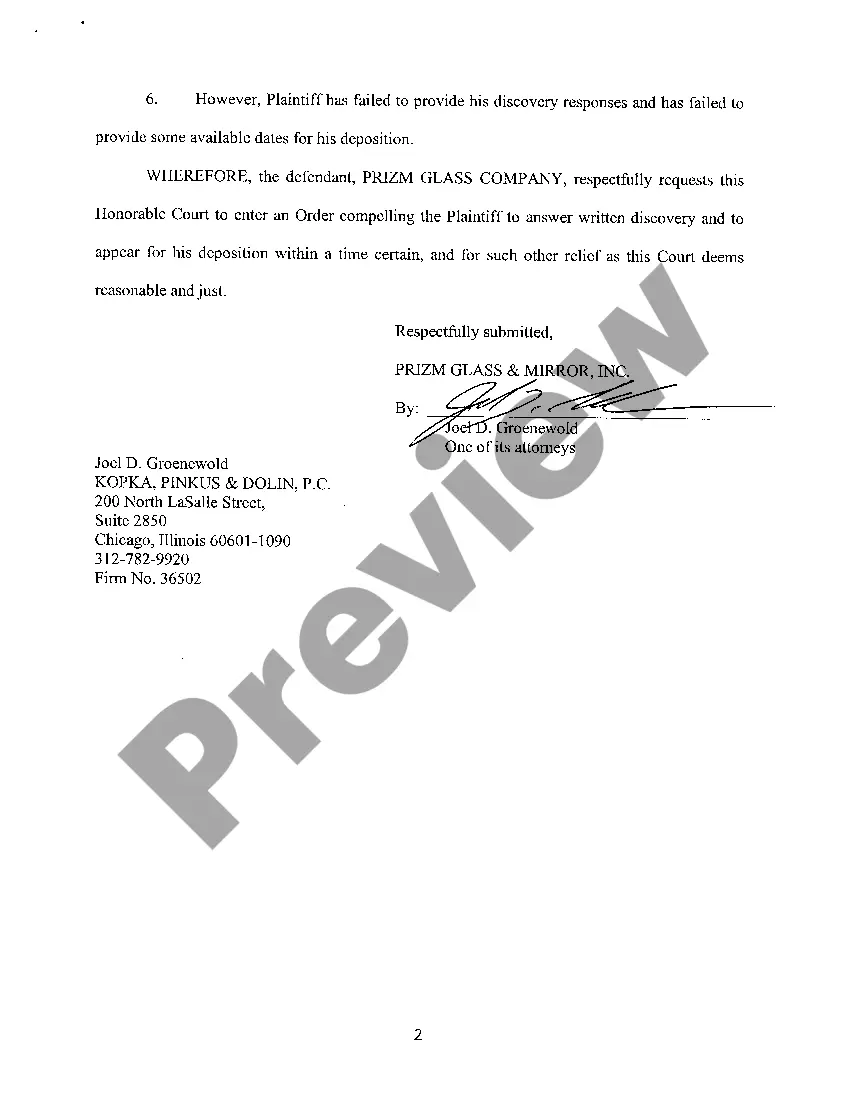

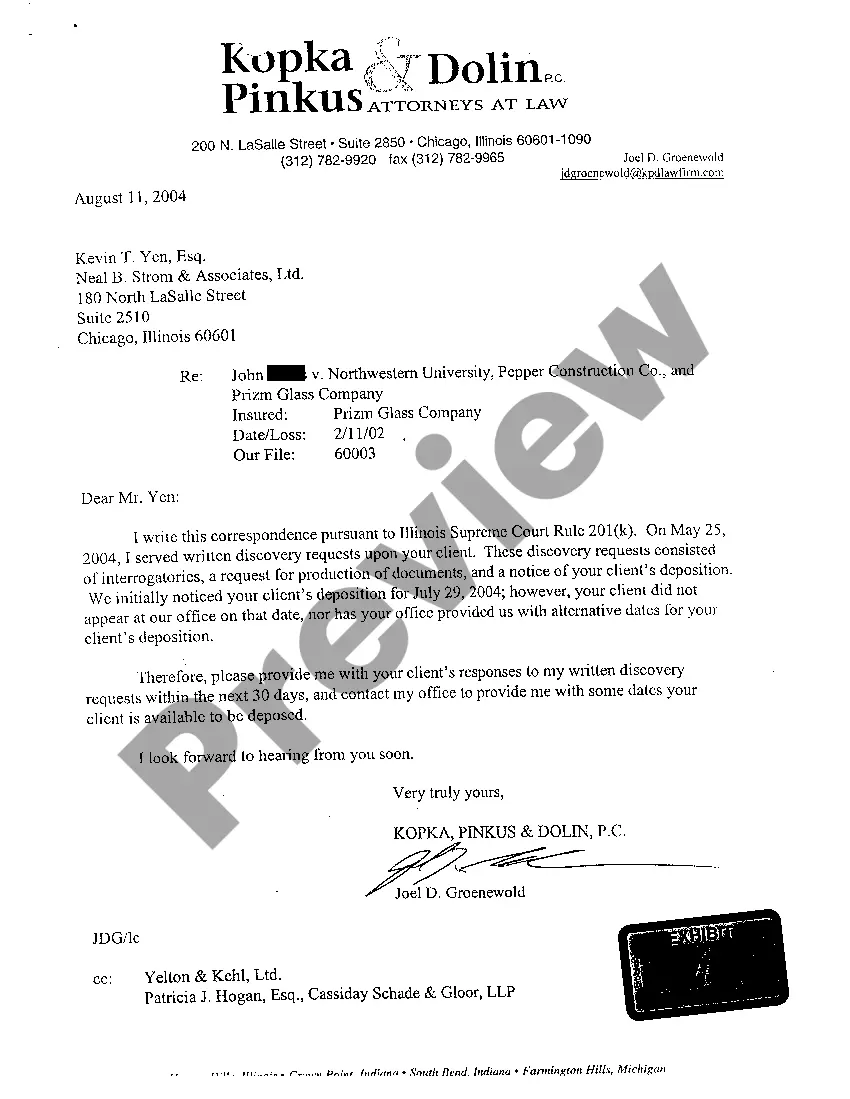

201k Letter Illinois Withdrawal

Description

How to fill out Illinois Motion To Compel?

Whether for commercial reasons or for personal matters, everyone must deal with legal issues at some point in their life.

Filling out legal documents requires careful consideration, starting with selecting the appropriate form template.

Once saved, you can fill out the form using editing software or print it and complete it by hand. With an extensive US Legal Forms collection available, you no longer have to waste time searching for the right template online. Utilize the library’s straightforward navigation to find the suitable template for any scenario.

- For instance, if you choose an incorrect version of the 201k Letter Illinois Withdrawal, it will be rejected once you submit it.

- Thus, it is crucial to have a reliable source for legal documents like US Legal Forms.

- If you wish to obtain a 201k Letter Illinois Withdrawal template, follow these straightforward steps.

- Retrieve the template you require by using the search bar or browsing the catalog.

- Check the form’s description to ensure it aligns with your case, state, and locality.

- Click on the form’s preview to view it.

- If it is the inappropriate document, return to the search function to find the 201k Letter Illinois Withdrawal template you need.

- Obtain the template once it meets your requirements.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Select the appropriate pricing option.

- Fill out the profile registration form.

- Choose your payment method: use a credit card or PayPal account.

- Pick the file format you prefer and download the 201k Letter Illinois Withdrawal.

Form popularity

FAQ

You can find Uniform Commercial Code information on any person or corporation in Georgia or other states by performing a search on the UCC website of the state or territory where the person resides or the corporation is registered.

Georgia has adopted the following Articles of the UCC: Article1: General Provisions: UCC Article 1 gives deals with definitions and also the rules of interpretation of the provisions.

The proper place to file in order to perfect a security interest under Georgia Uniform Commercial Code is with the clerk of the superior court of any county in the state of Georgia (hereinafter referred to as the "filing officer").

The filing fee is $25. make checks payable to the Georgia Superior Court Clerks' Cooperative Authority.

The UCC's general rule is that a financing statement remains valid for a period of five years from the date of filing. Unless a continuation statement is properly filed before expiration of the five year period, the effectiveness of the financing statement will lapse.

A UCC filing is the official notice lenders use to indicate that they have a security interest in a borrower's assets or property. The UCC filing establishes a lien against the collateral the borrower uses to secure the loan ? giving the lender the right to claim that collateral as repayment in the case of default.

By filing the UCC financing statement, the lender is giving notice that it has an interest in the property listed in the filing. This means that if the debtor defaults on the loan, the creditor can potentially receive the personal property of the debtor that was put up as collateral.

UCC1 and UCC2 statements are used to show that there is a lien on property. The UCC3 statement is used when there is a change in the UCC1, such as a release (cancellation), partial or complete assignment of lien, amendment or termination of the loan.