Illinois Lead Based Paint Disclosure With Ct

Description

How to fill out Illinois Lead Based Paint Disclosure For Sales Transaction?

Legal administration can be exasperating, even for the most adept professionals.

When you are searching for an Illinois Lead Based Paint Disclosure With Ct and don’t have the opportunity to invest time in finding the suitable and current version, the procedures can be overwhelming.

Access a library of articles, guides, and resources pertinent to your situation and requirements.

Save time and effort searching for the documents you require, and use US Legal Forms’ sophisticated search and Preview feature to obtain Illinois Lead Based Paint Disclosure With Ct.

Leverage the US Legal Forms online catalog, backed by 25 years of experience and dependability. Streamline your daily document management into a simple and user-friendly process today.

- If you have a monthly subscription, Log In to your US Legal Forms account, find the form, and acquire it.

- Check your My documents tab to review the documents you have saved and organize your folders as needed.

- If it's your first time with US Legal Forms, create a no-cost account and gain unlimited access to all advantages of the library.

- Here are the steps to follow after downloading the form you need.

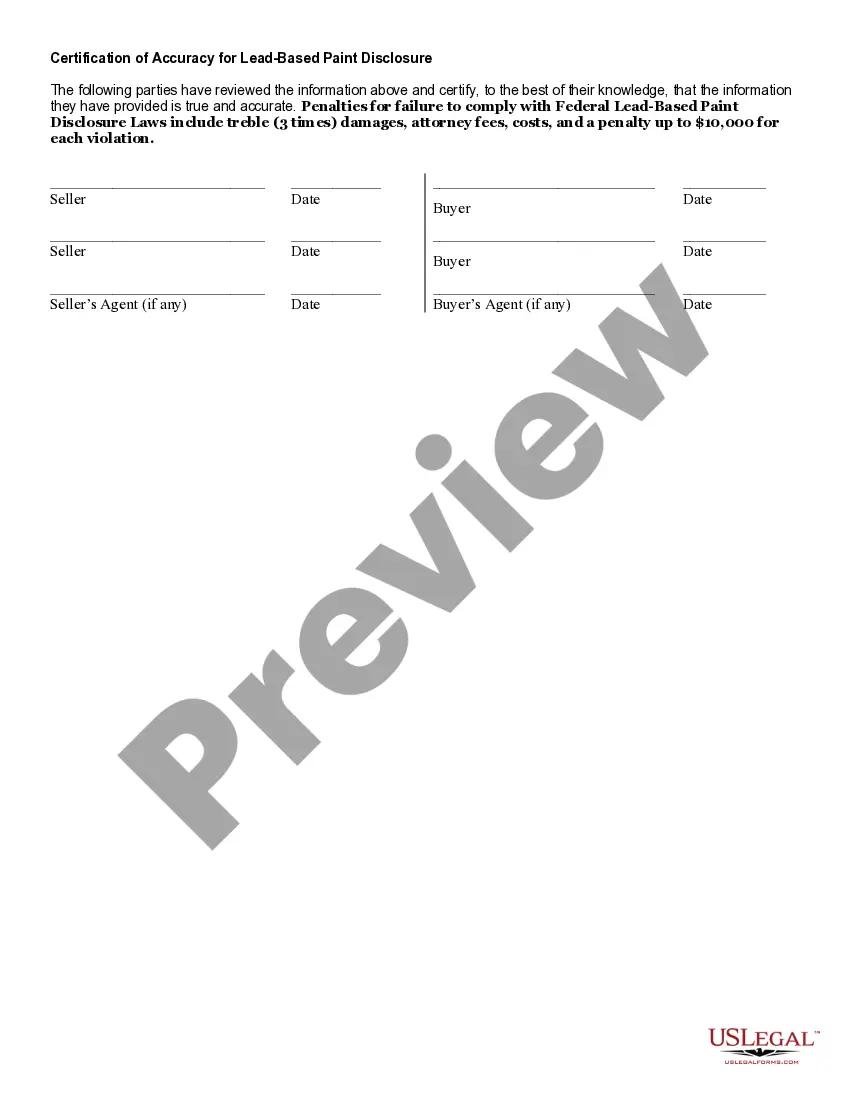

- Verify it is the correct form by previewing it and reviewing its description.

- Ensure that the template is valid in your state or county.

- Select Buy Now when you are prepared.

- Pick a subscription plan.

- Locate the format you need, and Download, complete, eSign, print, and dispatch your documents.

- Access state- or county-specific legal and business documents.

- US Legal Forms addresses all requirements you may have, from personal to corporate records, all in a single location.

- Utilize premium tools to fill out and manage your Illinois Lead Based Paint Disclosure With Ct.

Form popularity

FAQ

A secured transaction is an agreement between two parties in which one of the parties gives property (other than real estate) as collateral, or security, for a loan.

Article 9 is an article under the Uniform Commercial Code (UCC) that governs secured transactions, or those transactions that pair a debt with the creditor's interest in the secured property.

UCC-3 is an amendment or ?continuation statement? that the owner files to renew the UCC-1 for another 5-year period. Unless a continuation statement is filed before the expiration of the UCC-1's 5-year period, the owner must file a new UCC-1.

Security interests for most types of collateral are usually perfected by filing a document simply called a "financing statement." You'll usually file this form with the secretary of state or other public office.

Property Subject to the Security Interest Now we examine what property may be put up as security?collateral. Collateral is?again?property that is subject to the security interest. It can be divided into four broad categories: goods, intangible property, indispensable paper, and other types of collateral.

By Agreement with the Debtor Security obtained through agreement comes in three major types: (1) personal property security (the most common form of security); (2) suretyship?the willingness of a third party to pay if the primarily obligated party does not; and (3) mortgage of real estate.

Collateral ? property subject to a security interest. Laws vary regarding various types of collateral and the legal jurisdiction. Typical personal property involved in a security interest includes inventory, fixtures, equipment, vehicles, accounts receivable, and stocks/bonds/ negotiable instruments.

The law of secured transactions consists of five principal components: (1) the nature of property that can be the subject of a security interest; (2) the methods of creating the security interest; (3) the perfection of the security interest against claims of others; (4) priorities among secured and unsecured creditors? ...