Security Power Of Attorney Withdraw Money From Bank

Description

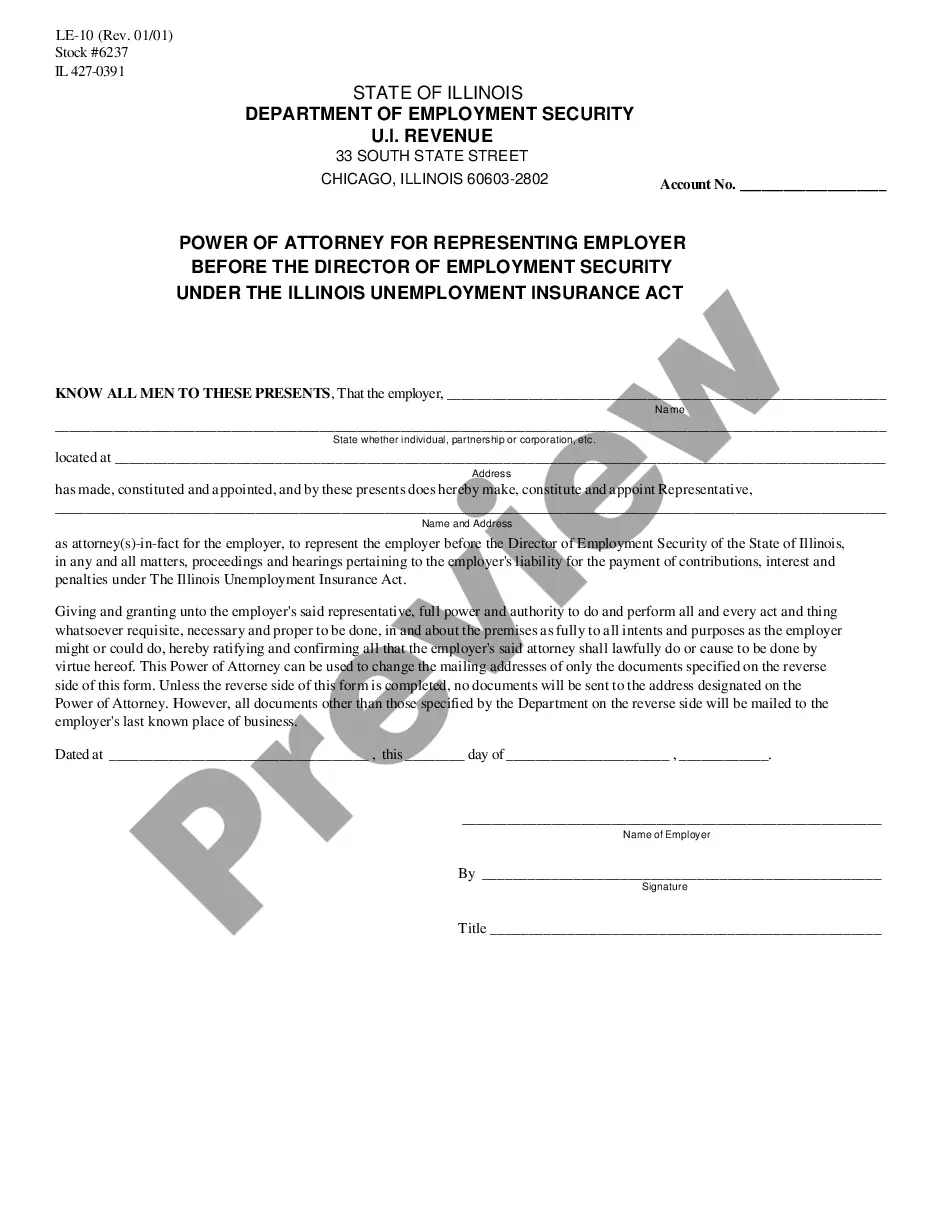

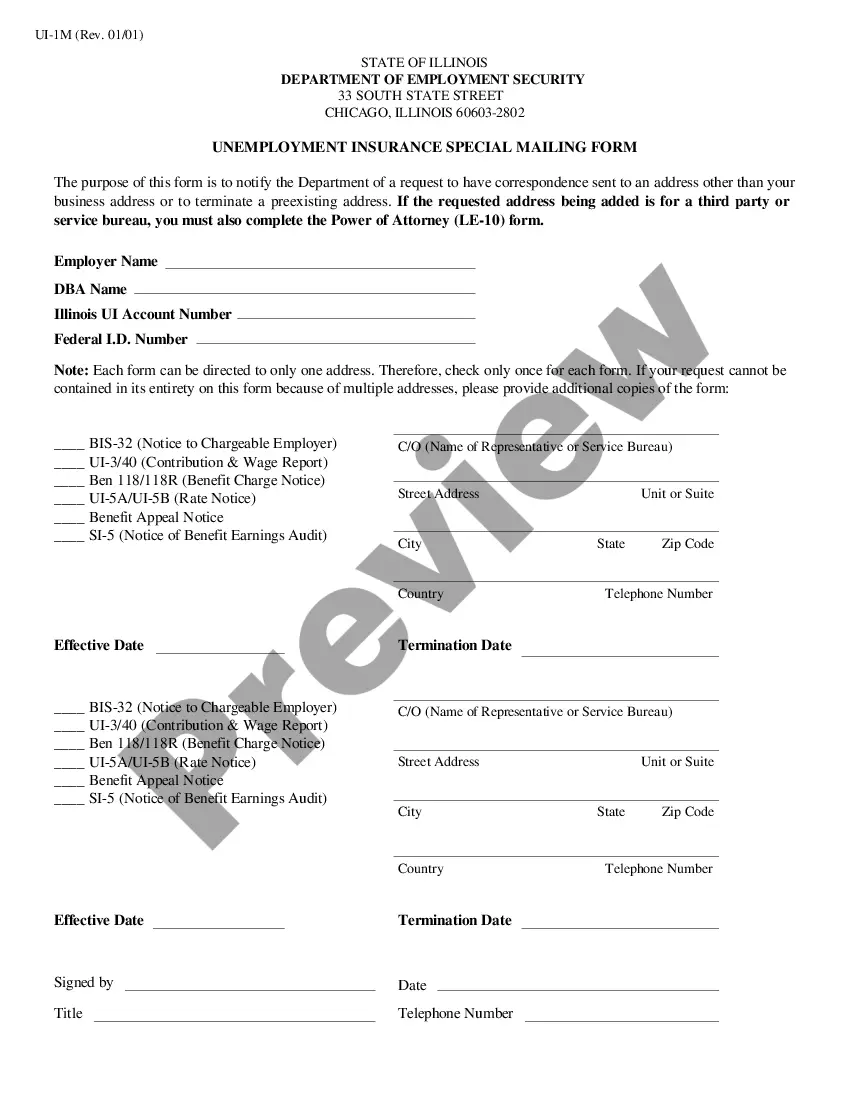

How to fill out Power Of Attorney For Representing Employer Before The Director Of Employment Security Under The Illinois?

Individuals frequently link legal documentation with something intricate that only an expert can manage.

In a sense, it's accurate, as preparing Security Power Of Attorney Withdraw Money From Bank requires considerable understanding of relevant criteria, encompassing state and local laws.

However, with US Legal Forms, matters have become simpler: ready-to-use legal documents for any personal and business situation tailored to state regulations are compiled in one online repository and are now accessible to all.

Pay for your subscription using PayPal or with your credit card. Choose the file format and click Download. Print your document or upload it to an online editor for quicker completion. All templates in our collection are reusable: once obtained, they remain saved in your profile and can be accessed anytime via the My documents tab. Explore all benefits of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 current documents organized by state and category of use, so searching for Security Power Of Attorney Withdraw Money From Bank or any other specific template only takes a few minutes.

- Previously registered users with an active subscription must Log In to their account and click Download to retrieve the document.

- New users on the platform will first have to create an account and subscribe before they can download any paperwork.

- Here is the step-by-step guide on how to access the Security Power Of Attorney Withdraw Money From Bank.

- Examine the page content carefully to ensure it meets your requirements.

- Review the form description or check it through the Preview option.

- If the previous one doesn’t fit your needs, use the Search field in the header to find another sample.

- Once you locate the correct Security Power Of Attorney Withdraw Money From Bank, click Buy Now.

- Select a subscription plan that suits your preferences and financial plan.

- Log In to your account or create one to move on to the payment screen.

Form popularity

FAQ

As a general rule, a power of attorney cannot transfer money, personal property, real estate or any other assets from the grantee to himself.

The Act stipulates that a gift or loan to a friend or relative, or a charitable gift, not be made if the incapable individual expresses a wish to the contrary. Give this some thought before executing your Power of Attorney.

Contact the bank before having a financial power of attorney drafted by a lawyer.Send or deliver your previously drafted financial power of attorney document to the bank.Provide identification and a copy of the financial power of attorney to the bank teller when you ready to complete a transaction.

A power of attorney for banking transactions is a POA that allows a trusted agent to deal with your bank account(s) on your behalf. If you want to set up a power of attorney in a way that allows someone to make bank transactions in your stead, your POA has to specifically state that.

Attorneys can even make payments to themselves. However, as with all other payments they must be in the best interests of the donor. This can be difficult to determine and may cause a conflict of interests between the interests of an Attorney and the best interests of their donor.