Assumption Agreement With The Lender

Description

How to fill out Illinois Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

There's no further justification to squander hours searching for legal documents to satisfy your local state regulations. US Legal Forms has assembled all of them in a single location and simplified their accessibility.

Our platform provides over 85k templates for any business and personal legal situations categorized by state and area of use. All forms are appropriately drafted and verified for accuracy, so you can be assured in acquiring an up-to-date Assumption Agreement With The Lender.

If you are acquainted with our service and already possess an account, you need to verify your subscription is active before acquiring any templates. Log In to your account, select the document, and click Download. You can also revisit all saved documents at any moment by opening the My documents tab in your profile.

Print out your form to fill it out by hand or upload the sample if you prefer to edit it in an online editor. Preparing official paperwork under federal and state laws is quick and simple with our platform. Try US Legal Forms now to keep your documentation organized!

- If you've never interacted with our service before, the process will require a few more steps to complete.

- Here's how new users can find the Assumption Agreement With The Lender in our library.

- Examine the page content carefully to confirm it contains the sample you need.

- To do this, use the form description and preview options if available.

- Utilize the Search field above to look for another sample if the previous one did not fit your needs.

- Click Buy Now next to the template name once you locate the suitable one.

- Select the preferred pricing plan and create an account or Log In.

- Make payment for your subscription with a credit card or via PayPal to proceed.

- Select the file format for your Assumption Agreement With The Lender and download it to your device.

Form popularity

FAQ

A refinance typically takes about 30 days, but a loan assumption can take anywhere from three to six months, depending on the lender.

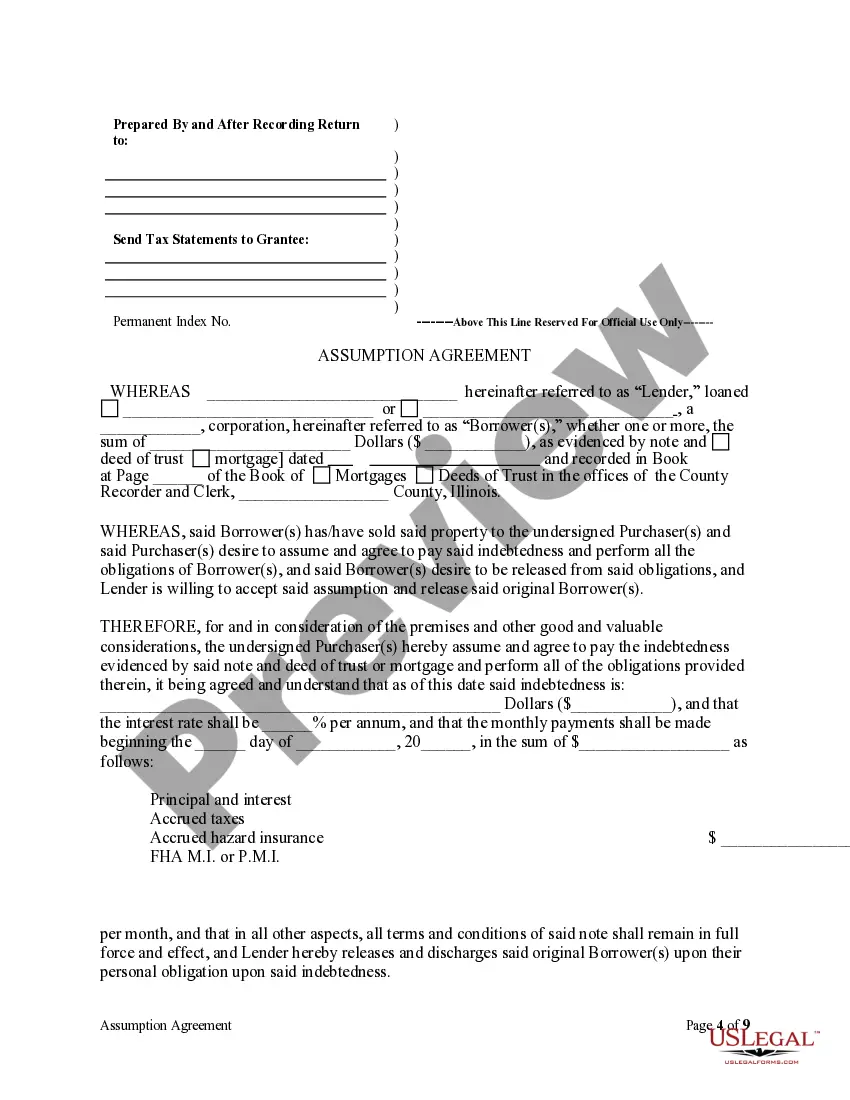

An assumption clause is a provision in a mortgage contract that allows the seller of a home to pass responsibility for the existing mortgage to the buyer of the property. In other words, the new homeowner assumes the existing mortgage andalong with itownership of the property that secures the loan.

An assumable mortgage allows a buyer to take over the seller's mortgage. Once the assumption is complete, you take over the payments on a monthly basis, and the person you assume the loan from is released from further liability. If you assume someone's mortgage, you're agreeing to take on their debt.

Keep in mind that the average loan assumption takes anywhere from 45-90 days to complete. The more issues there are with underwriting, the longer you'll have to wait to finalize your agreement. Do yourself a favor and get the necessary criteria organized in advance.

When a buyer assumes a loan it is with the lender's knowledge and approval. An assumption agreement is prepared by the existing lender of record and signed by the buyer as part of the escrow process.