Name Change Ordered With Irs

Description

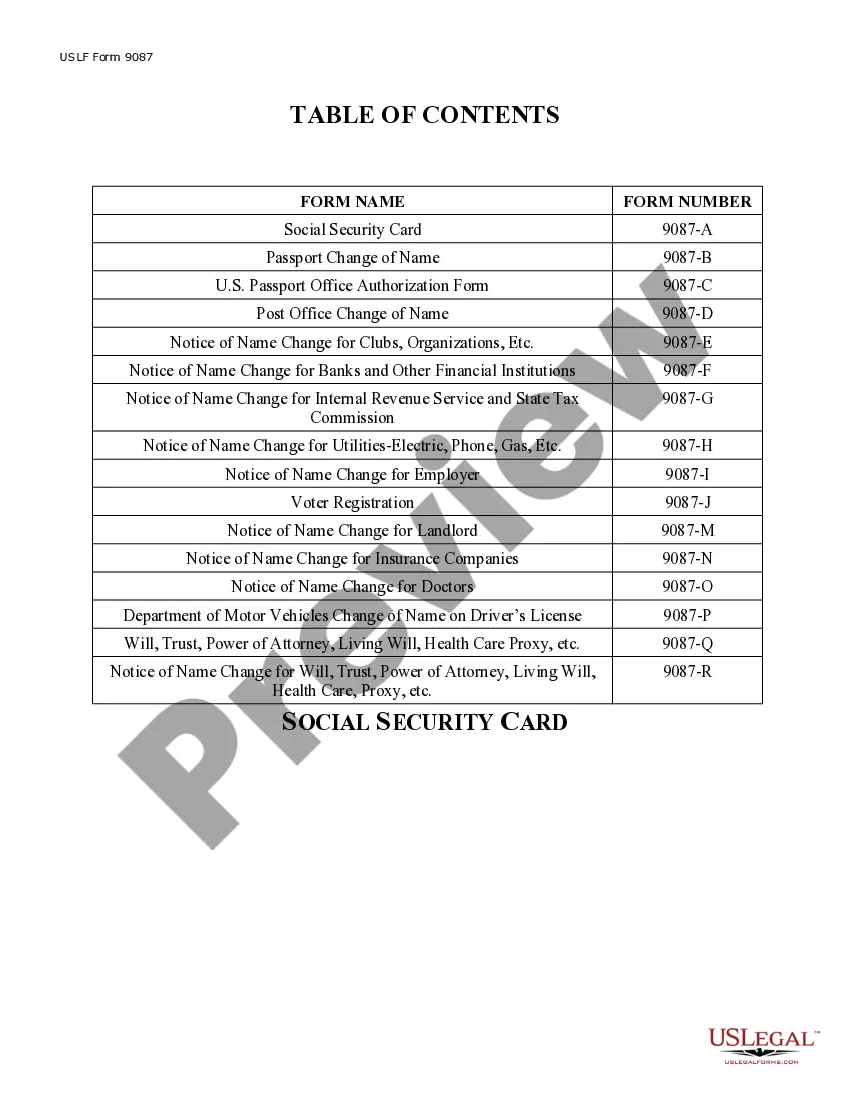

How to fill out Illinois Name Change Notification Package For Brides, Court Ordered Name Change, Divorced, Marriage?

Legal management can be daunting, even for experienced experts.

When searching for a Name Change Ordered With IRS and lacking the time to invest in finding the correct and current version, the procedures can be taxing.

Access a valuable resource center of articles, guidelines, manuals, and materials pertinent to your situation and requirements.

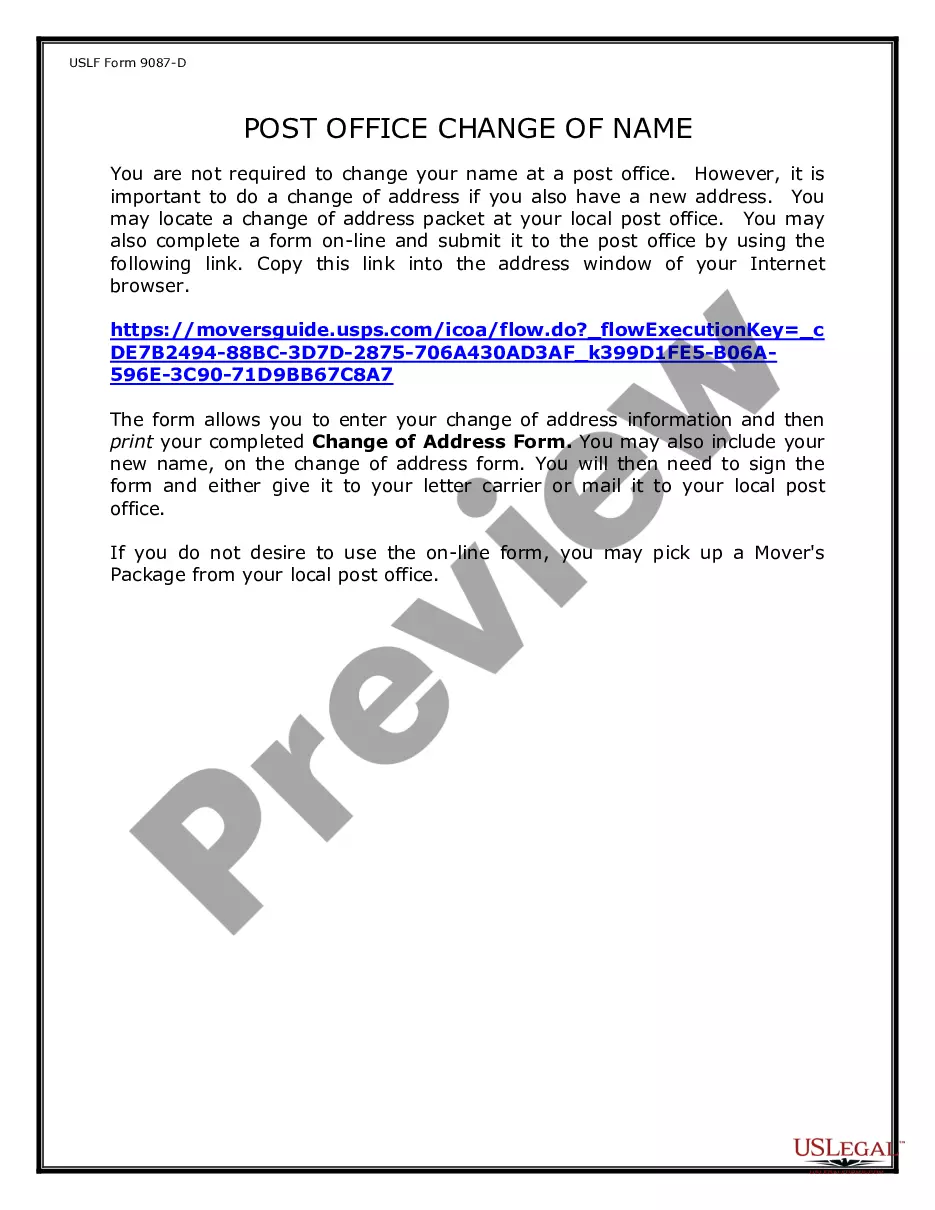

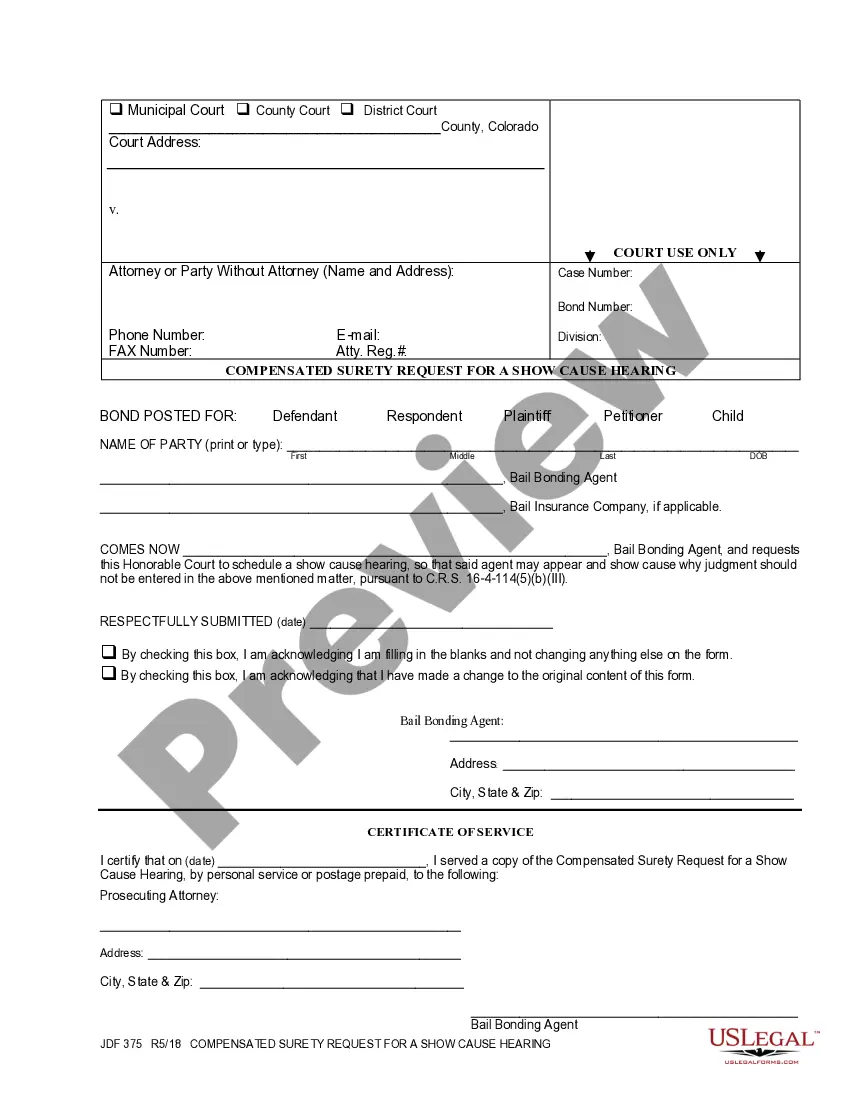

Save time and effort locating the necessary documents, and utilize US Legal Forms' advanced search and Preview feature to find Name Change Ordered With IRS and download it.

Enjoy the US Legal Forms online library, supported by 25 years of expertise and reliability. Transform your daily document management into a seamless and user-friendly process today.

- If you possess a subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check your My documents section to view the documents you have previously saved and manage your folders as needed.

- If this is your initial experience with US Legal Forms, create an account to gain unlimited access to all the benefits of the library.

- Here are the steps to follow after locating the necessary form.

- Confirm that it is the correct form by previewing it and reviewing its details.

- Ensure that the template is certified in your state or region.

- Click Buy Now when you are prepared.

- Choose a monthly subscription plan.

- Select the file format you require, and Download, complete, sign, print, and send your paperwork.

- Access state- or local-specific legal and business documents.

- US Legal Forms meets all your requirements, ranging from personal to business paperwork, all centralized in one platform.

- Take advantage of sophisticated tools to complete and manage your Name Change Ordered With IRS.

Form popularity

FAQ

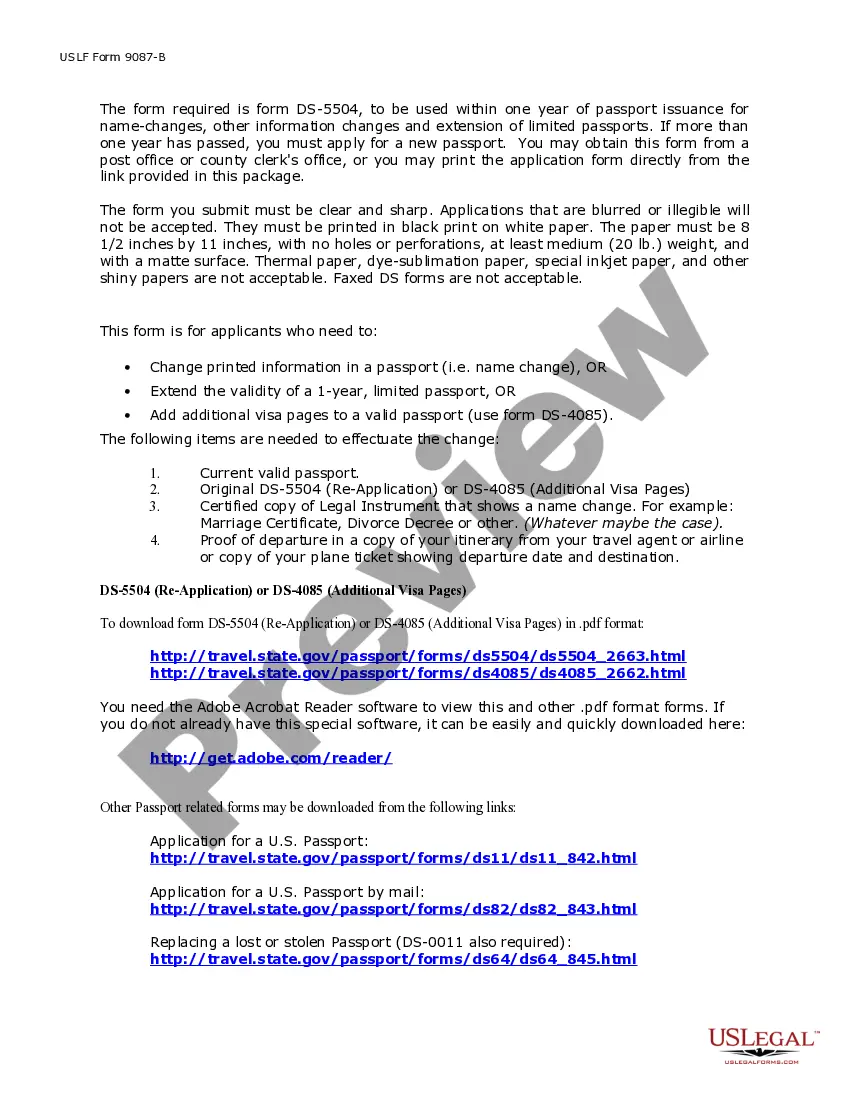

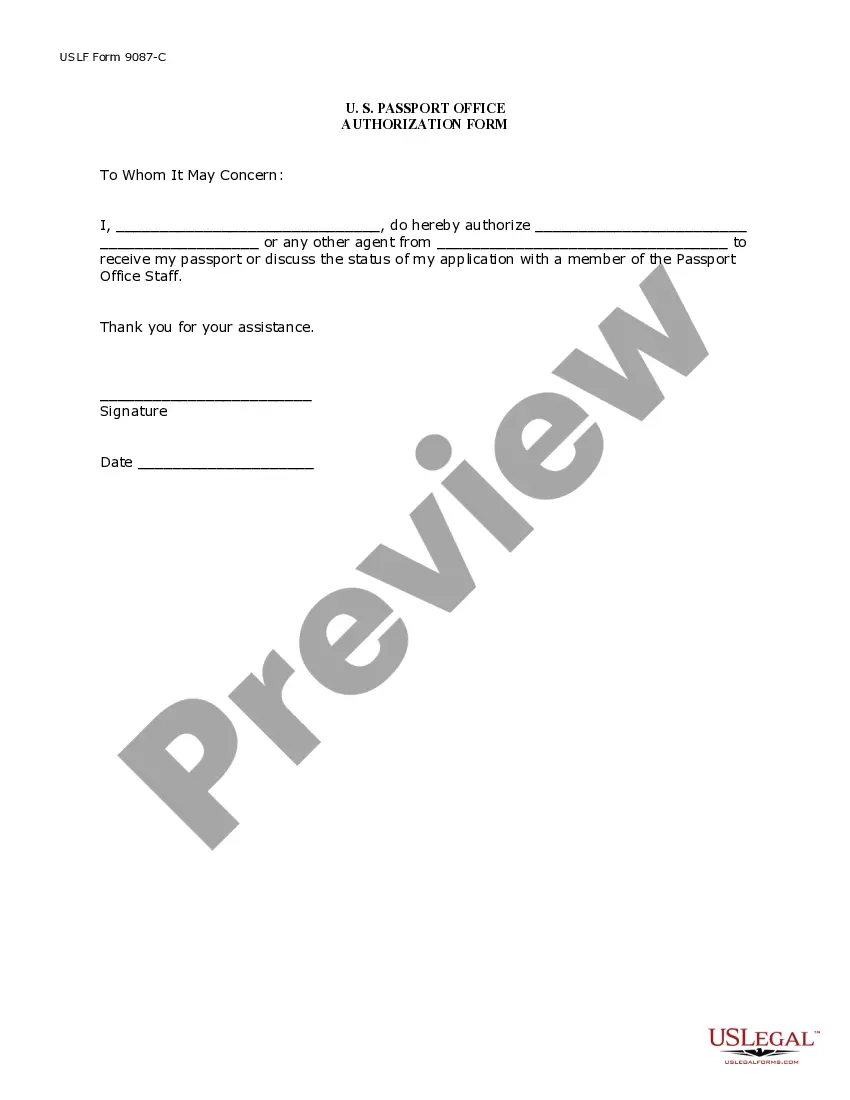

Ladies and Gentlemen: Please be advised that the name of the company has been changed to [NEW CORPORATE NAME]. Enclosed is a copy of the [Articles of Amendment] evidencing the name change. Once records have been updated, please send us confirmation.

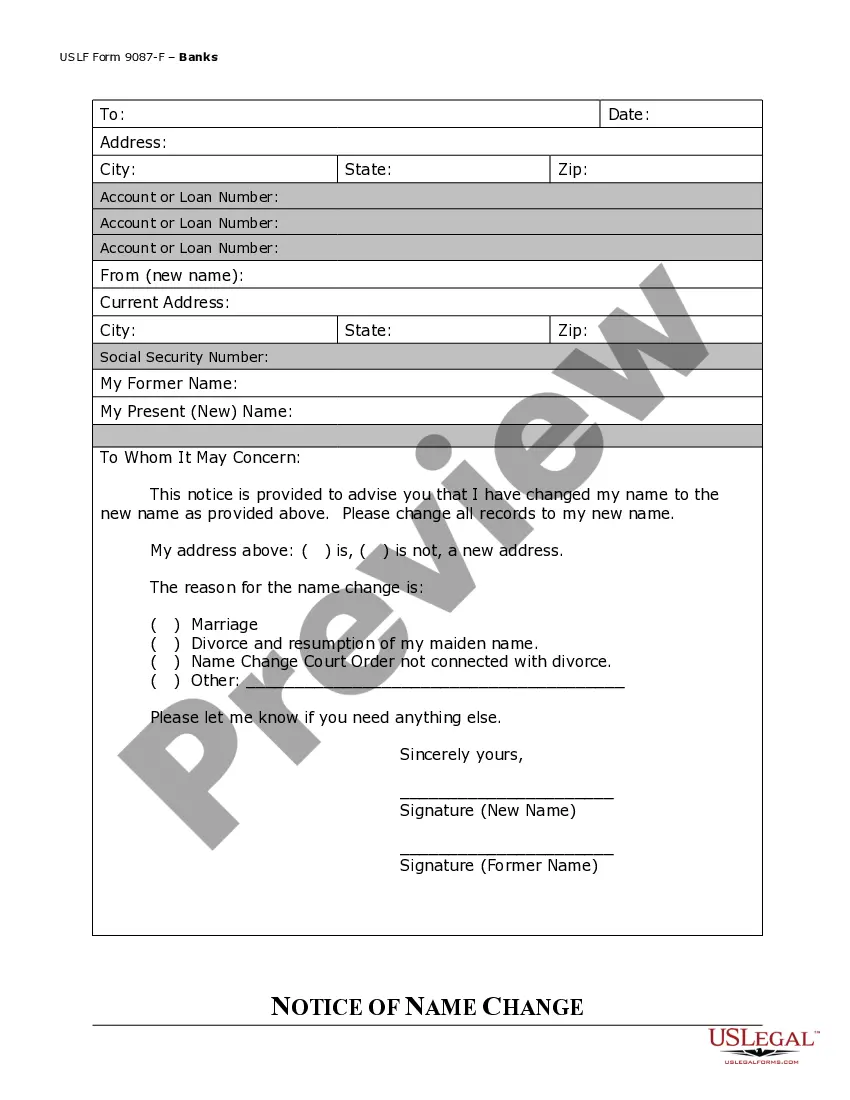

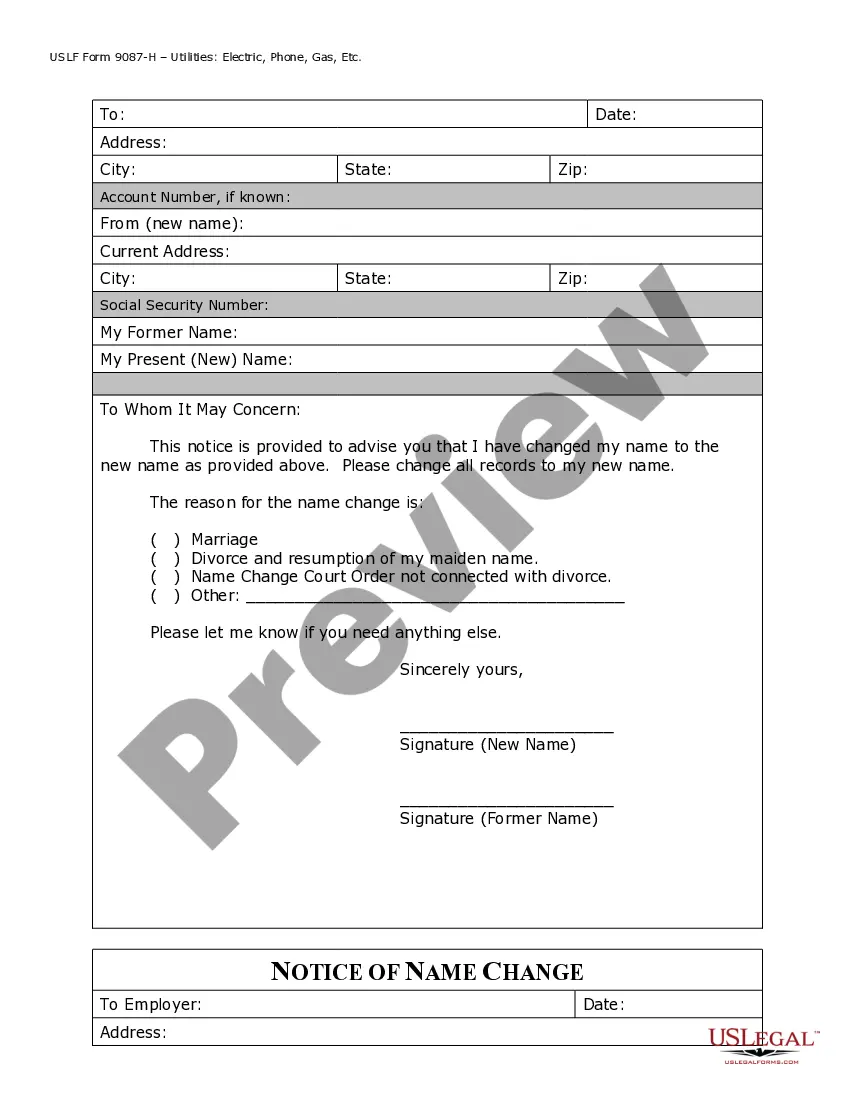

It should include information like your name, address, date, bank or organisation, address of the organisation, your previous name and the changed name or surname. Also, see to that you attach a copy of the proof of name change and other supporting documents.

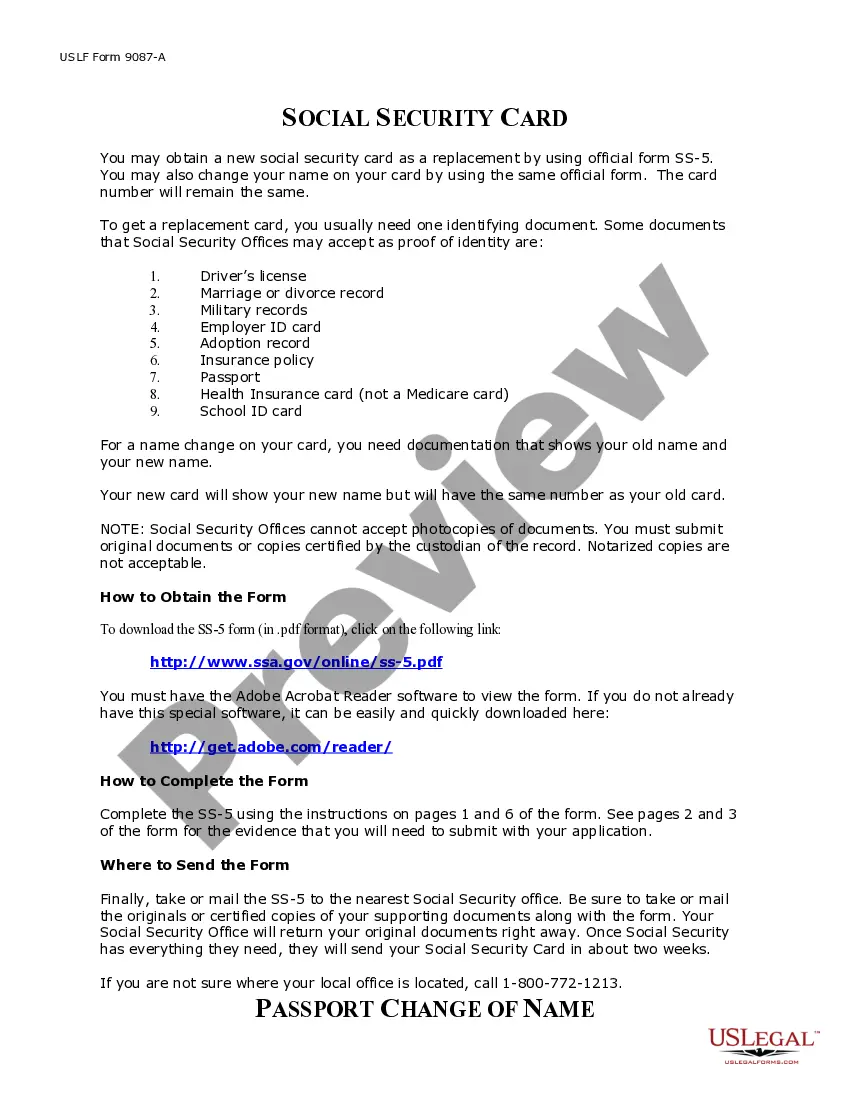

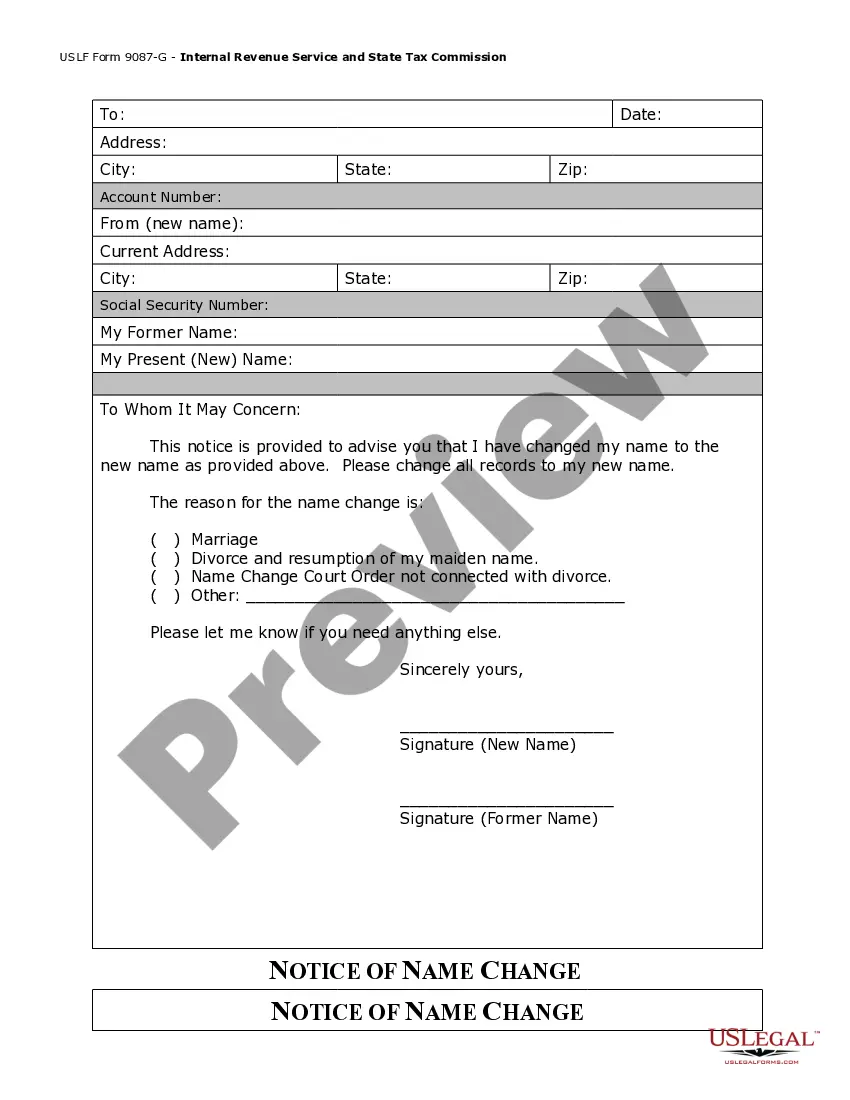

If you change your name soon after you file your annual tax return, then you can inform the IRS of the EIN number change name through a signed notification, similar to a sole proprietorship.

On Form 1040-X, enter your income, deductions, and credits from your return as originally filed or as previously adjusted by either you or the IRS, the changes you are making, and the corrected amounts. Then, figure the tax on the corrected amount of taxable income and the amount you owe or your refund.

By Form. To change your address with the IRS, you may complete a Form 8822, Change of Address (For Individual, Gift, Estate, or Generation-Skipping Transfer Tax Returns) and/or a Form 8822-B, Change of Address or Responsible Party ? Business and send them to the address shown on the forms.