Illinois Name Change Form Foreign Corporation

Description

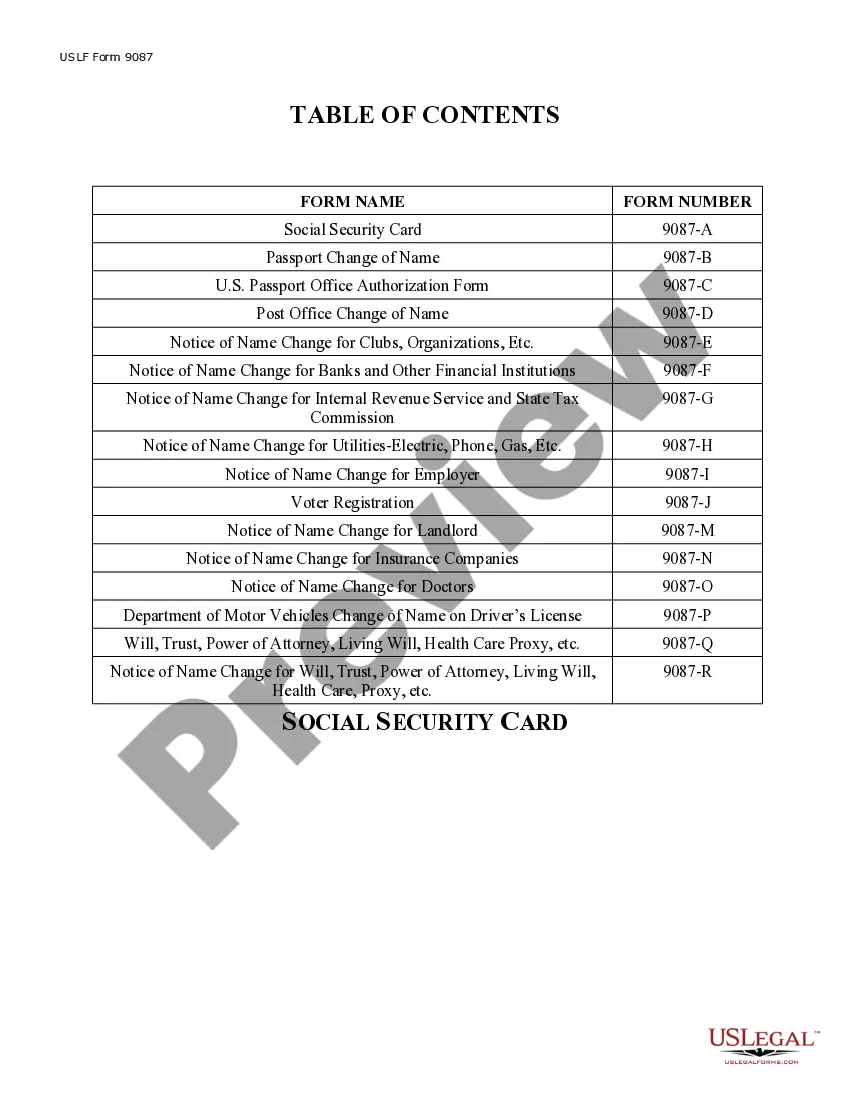

How to fill out Illinois Name Change Notification Package For Brides, Court Ordered Name Change, Divorced, Marriage?

Locating a reliable site to obtain the latest and pertinent legal templates is half the battle when navigating bureaucracy.

Selecting the appropriate legal documents requires accuracy and meticulousness, which is why it is crucial to obtain samples of Illinois Name Change Form Foreign Corporation solely from trustworthy sources, such as US Legal Forms.

Once you have the document on your device, you can edit it using the editor or print it out and fill it in by hand. Eliminate the difficulties associated with your legal documentation. Explore the extensive US Legal Forms library to find legal templates, verify their applicability to your circumstances, and download them right away.

- Use the library navigation or search bar to find your template.

- View the form’s description to ensure it aligns with the requirements of your state and locality.

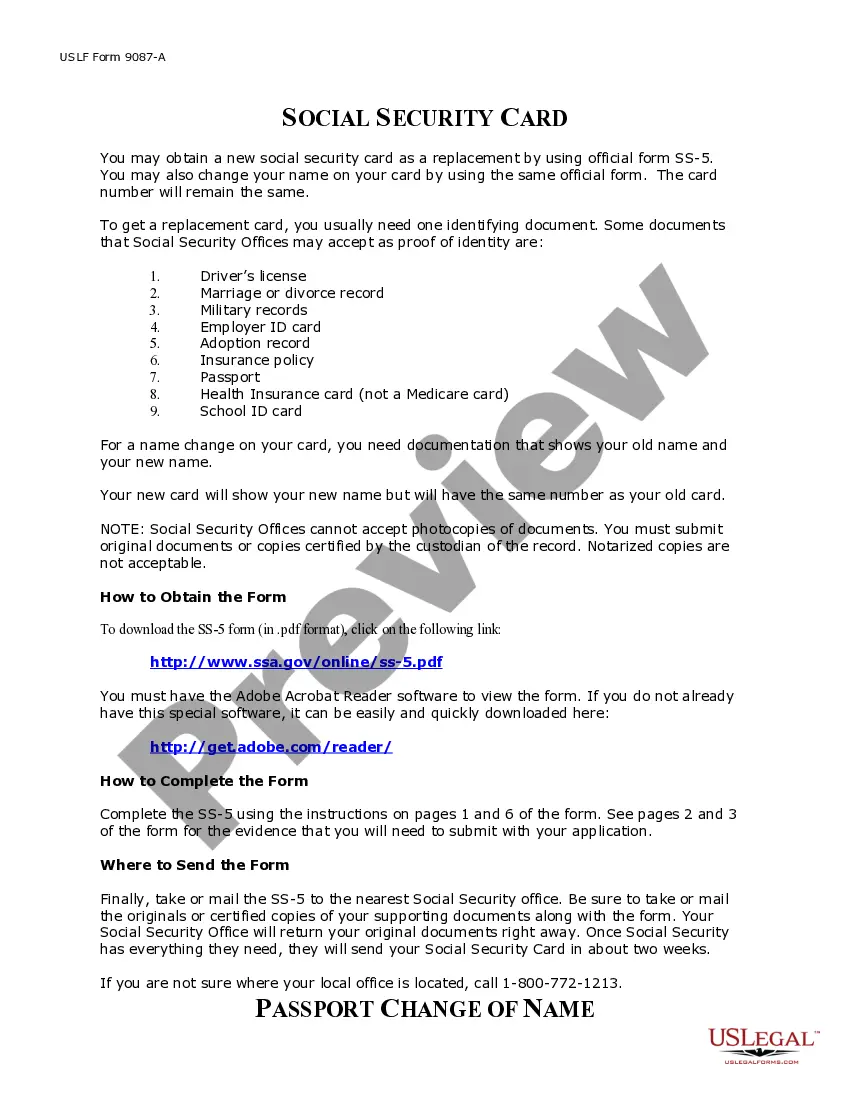

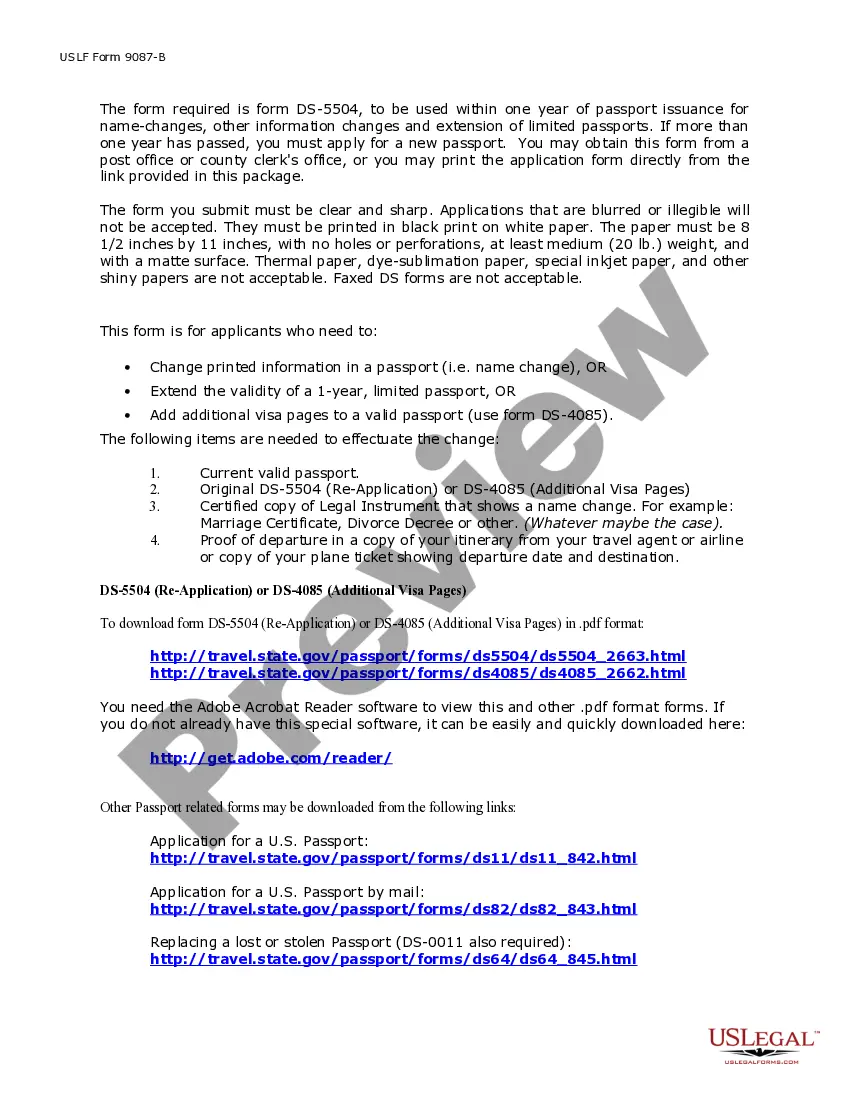

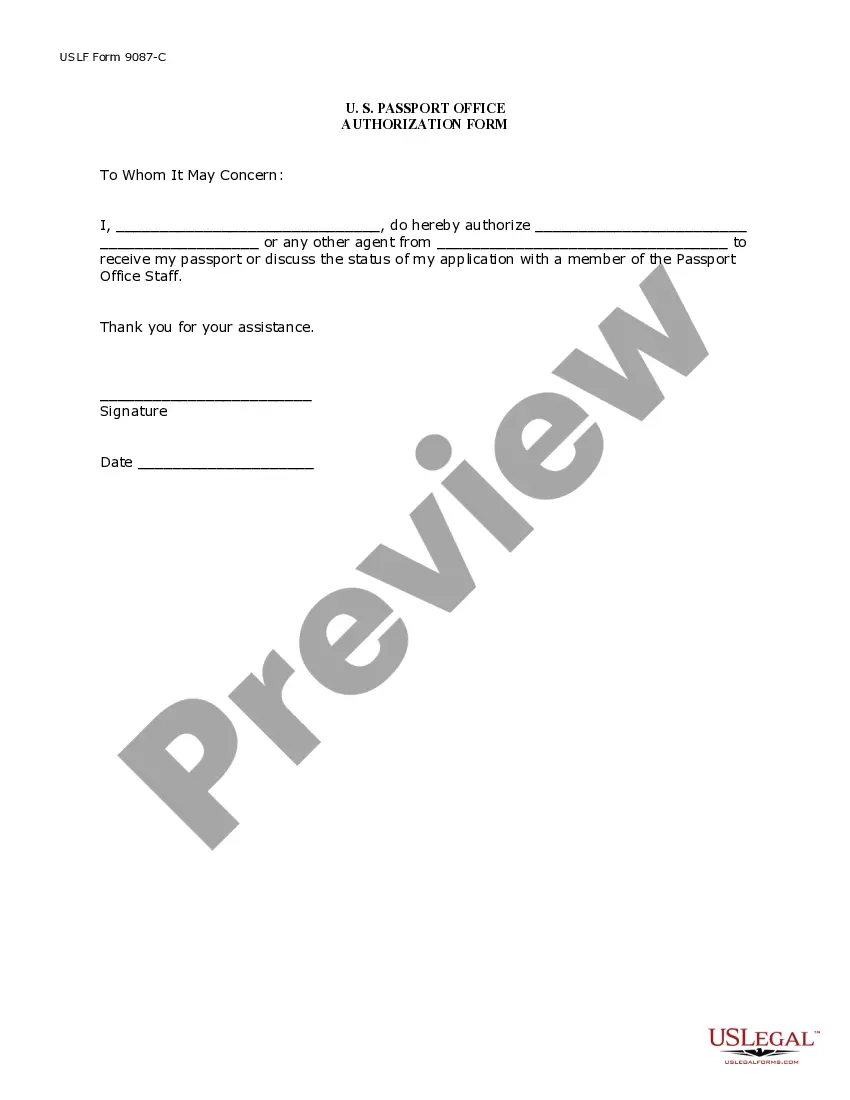

- Access the form preview, if available, to confirm the template is indeed what you are seeking.

- Continue your search and find the correct template if the Illinois Name Change Form Foreign Corporation does not fulfill your needs.

- If you are confident about the form’s applicability, download it.

- If you are a registered user, click Log in to verify your identity and access your selected forms in My documents.

- If you do not yet have an account, click Buy now to purchase the form.

- Choose the pricing option that best meets your needs.

- Proceed to the registration to finalize your transaction.

- Complete your payment by selecting a method (credit card or PayPal).

- Choose the file format for downloading the Illinois Name Change Form Foreign Corporation.

Form popularity

FAQ

To change the name of your LLC or corporation, you will need to file ?Articles of Amendment? with your state. Once approved, you can start operating under the new name.

REGISTERED AGENT/OFFICE: Every foreign corporation must maintain a regis- tered agent and registered office in Illinois upon whom service of process on the corporation may be served and to whom official correspondence from the Secretary of State may be sent.

To register a foreign corporation in Illinois, you must file an Illinois Application for Authority to Transact Business in Illinois with the Illinois Secretary of State, Department of Business Services. You can submit this document by mail or in person.

Illinois LLCs have to file 2 copies of the completed Articles of Amendment form with the Secretary of State. You can do this by mail or in person. If the amendment that your company plans to do is a name change, you can opt to file online. The amendment comes with a $50 filing fee.

You may change your corporate name, your corporate purpose, reclassify your shares or change the paid-in capital of your corporation in Articles of Amendment. If your amendment increases the paid-in capital of your corporation, you will be required to pay all franchise tax before the amendment is accepted for filing.